Key Elements of a Payment Plan Receipt

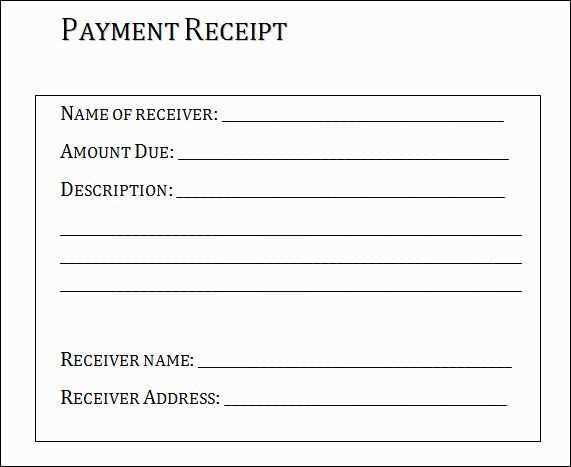

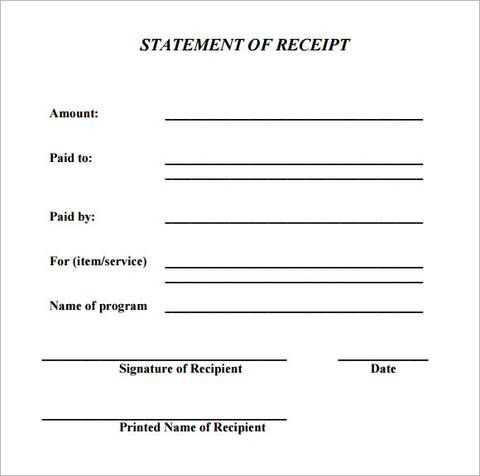

A payment plan receipt should provide clear documentation of the transaction details. To make the receipt effective, include the following elements:

- Receipt Title: Clearly mark the document as a “Payment Plan Receipt.”

- Client Information: Include the name, contact details, and address of the client.

- Service/Product Details: Describe the product or service being paid for, including the quantity and total cost.

- Payment Breakdown: List each payment made, including date, amount, and remaining balance.

- Payment Schedule: Provide the dates for future payments, if applicable, and any late fee terms.

- Receipt Number: Include a unique reference number for tracking purposes.

- Signature: Include the signature of the person issuing the receipt.

How to Structure Your Payment Plan Receipt Template

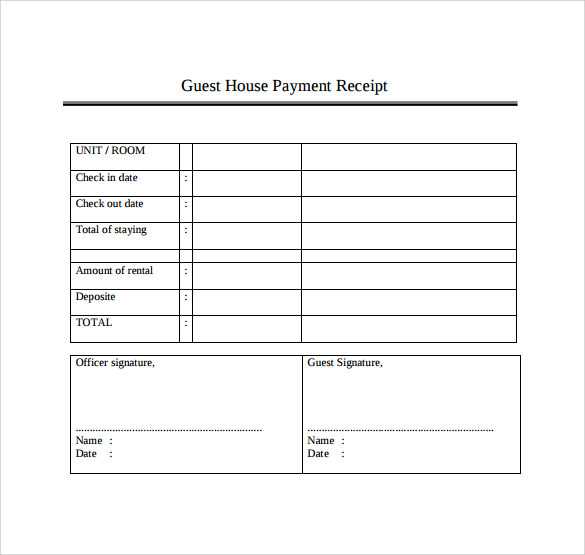

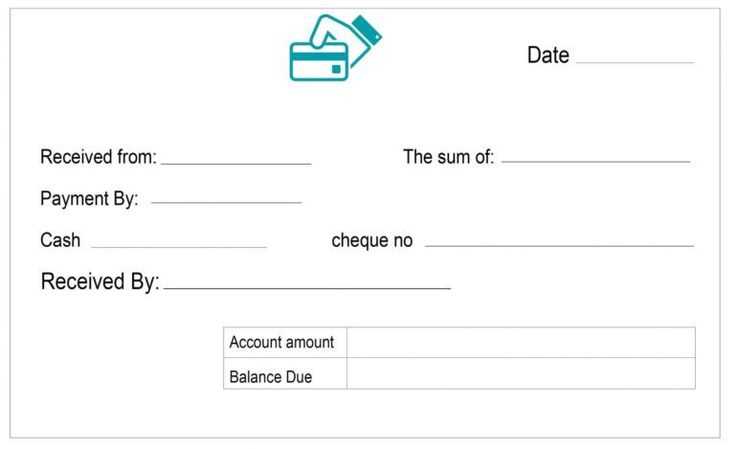

Organize the content logically to enhance readability and understanding. A basic structure includes the following sections:

Header Section

The header should contain your business name, contact information, and the receipt’s title. Use a bold font for easy identification.

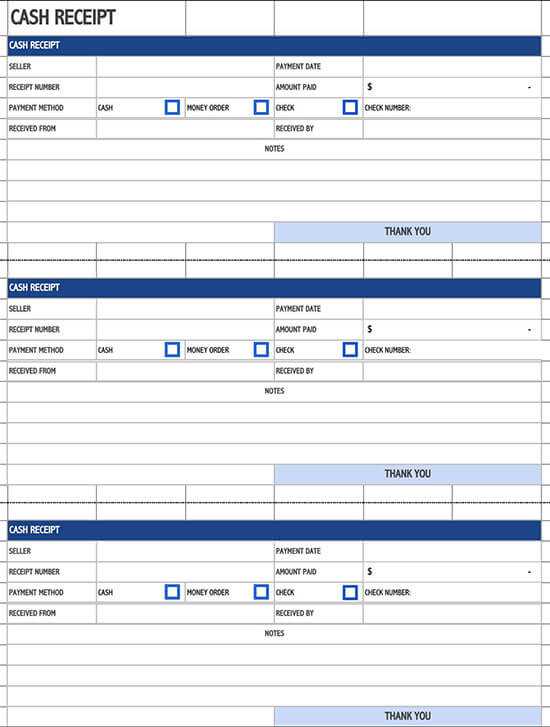

Payment Details Section

In this part, break down the client’s payment schedule and any other essential transaction details. Present the amounts clearly in a table format for easy comparison.

Footer Section

The footer should feature any terms or conditions, along with your signature and a thank-you message for the client’s business.

Example Payment Plan Receipt Layout:

------------------------------------------------------ Receipt Number: 001 Business Name: XYZ Corp. Contact: 123-456-7890 Address: 123 Main St., City, Country ------------------------------------------------------ Client Name: John Doe Client Contact: 987-654-3210 Client Address: 456 Elm St., City, Country ------------------------------------------------------ Service/Product: Custom Web Development Total Cost: $5000.00 Amount Paid: $1000.00 Remaining Balance: $4000.00 Payment Schedule: Monthly, $500 per month, starting from March 1st, 2025 ------------------------------------------------------ Date Issued: February 12, 2025 ------------------------------------------------------ Signature: ______________________ ------------------------------------------------------

Adapt this structure to fit the needs of your business. Ensure clarity and transparency in all payment details to prevent misunderstandings.

How’s it going? What can I do for you today?

If you’re looking to create a payment plan receipt, start by clearly detailing the amount paid, the payment schedule, and the remaining balance. Use a simple structure to break down each payment, including the due date and payment method. Make sure to include contact information for customer support in case of any issues. For transparency, list any fees or discounts that apply to the payment plan.

When formatting the receipt, keep it clean and easy to read. Include a clear header with the title “Payment Plan Receipt,” followed by sections for the payment breakdown, total amount paid, and remaining balance. A footer with company information and payment terms can provide a professional touch.

To improve customer experience, consider providing a digital version of the receipt for easy access. It also helps to offer a reminder system, so clients know when their next payment is due.