Creating a payment receipt book template is a simple way to keep your transactions organized and transparent. With a clear structure, you can ensure that both parties have a written confirmation of payment that can be easily referenced. A well-designed template saves time and reduces the chances of errors in your financial documentation.

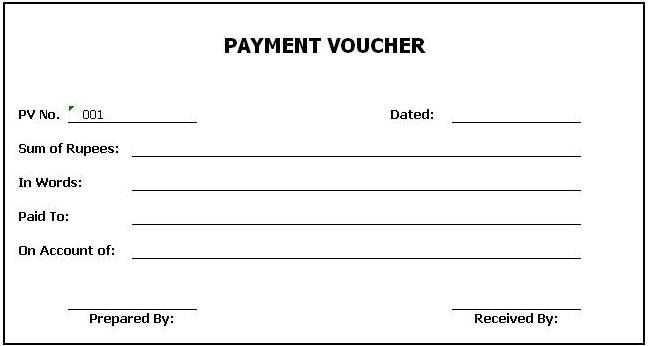

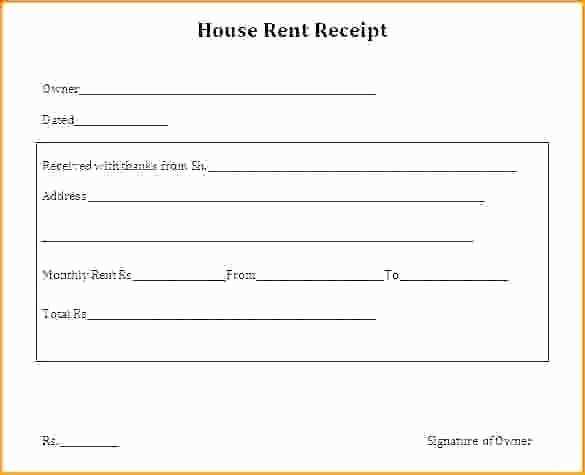

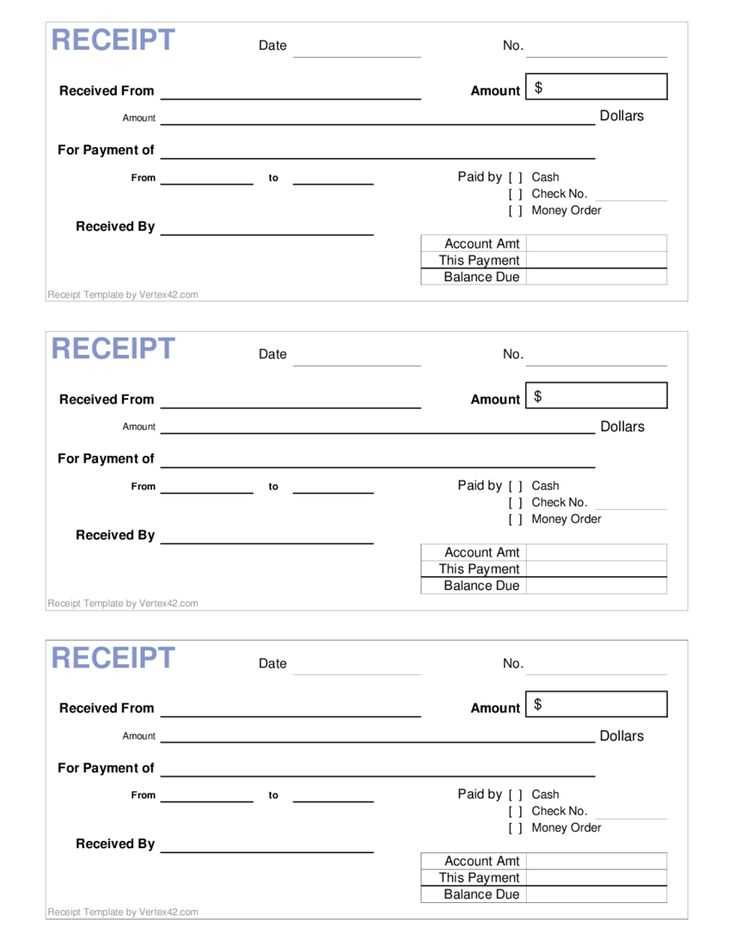

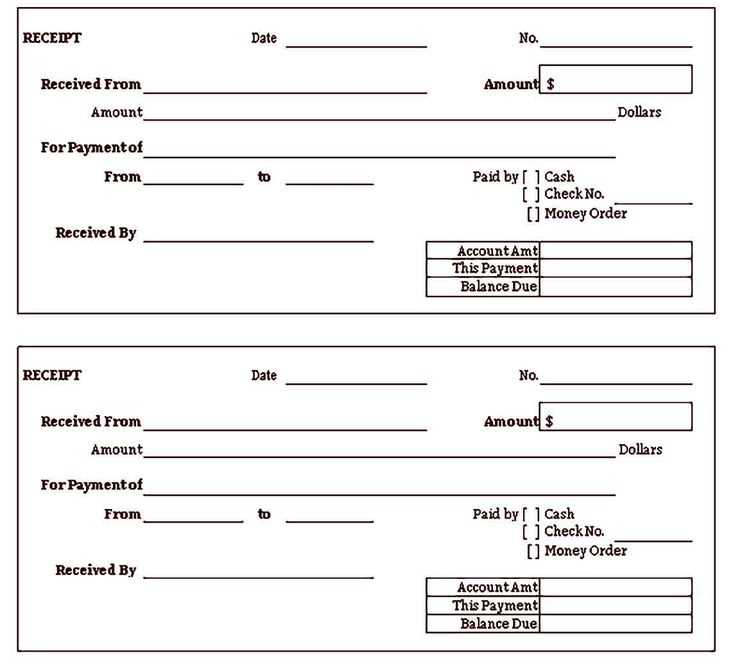

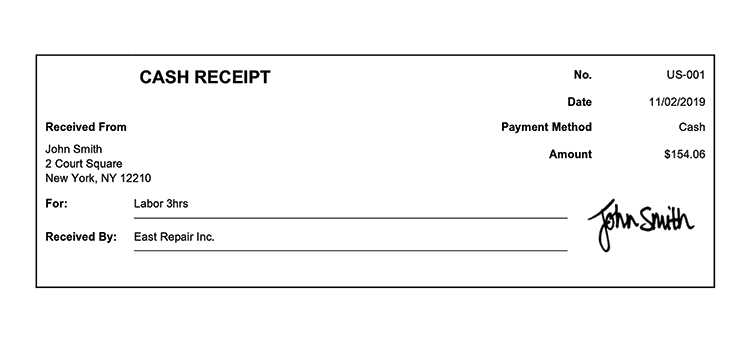

Each receipt should include key information such as the payer’s name, date of transaction, amount paid, and the method of payment. For more accuracy, add a unique receipt number for easy tracking. This will allow you to maintain a record of each payment, making it easier to handle any future inquiries or disputes.

Incorporating a section for your business’s contact details and terms of service is helpful for providing additional clarity. A payment receipt book template can be customized to suit specific needs, whether it’s for retail, services, or any other transaction type. By using this template, you simplify your bookkeeping process and ensure a professional appearance in all your financial dealings.

Here are the revised lines with reduced repetition of words:

To streamline your payment receipt book template, it’s important to ensure clarity while maintaining simplicity. Start by removing redundant terms and focusing on key information that directly communicates the transaction details. This will not only improve readability but also create a more professional layout.

Revised Examples:

Original: “The payment was received by the payer, and the payment was confirmed.”

Revised: “The payer’s payment was confirmed.”

Original: “The transaction amount of $50 was paid to the account. The $50 amount was confirmed in the records.”

Revised: “The transaction of $50 was confirmed in the records.”

Keep in mind that eliminating unnecessary repetitions makes the document more concise and user-friendly, ensuring that essential details stand out clearly for both parties involved in the transaction.

Payment Receipt Book Template: A Detailed Guide

Choosing the Right Format for Your Receipt Book

How to Customize a Template for Your Business Transactions

Step-by-Step Instructions to Create a Receipt Book in Word or Excel

Key Information to Include in Each Receipt for Accurate Recordkeeping

How to Use Receipt Books for Tax and Accounting Purposes

Tips for Organizing and Storing Your Books for Easy Access

When selecting the right format for your receipt book, it’s important to pick one that suits your business needs and recordkeeping practices. If you handle frequent transactions, a simple template that allows for easy data entry and tracking is ideal. For small businesses, templates in Word or Excel are often the most practical choice due to their flexibility and accessibility. These formats allow for easy customization, ensuring that each receipt captures all necessary information in a clear, consistent manner.

Customizing a template for your business transactions is straightforward. In Word or Excel, you can create a receipt layout that includes fields for customer details, transaction date, itemized costs, and any applicable taxes. Make sure to include your business name, contact information, and tax ID number for professional presentation and compliance. Adjust the layout to match your business branding, ensuring that it is visually aligned with your other materials like invoices and contracts.

To create a receipt book in Word or Excel, follow these simple steps:

- Start with a template: Choose a receipt template or create a new document from scratch. For Excel, you can create a grid with predefined columns for each section of the receipt. In Word, use tables to organize the content.

- Customize your details: Add your business name, address, and contact details at the top of the page. Make sure there’s a dedicated section for the date of the transaction and a unique receipt number.

- Include payment information: List the products or services sold, the price for each, any taxes applied, and the total amount. Leave space for any payment method (cash, credit card, check) and the amount received.

- Add customer information: Include a section for customer details like name and contact, especially for businesses where customer tracking is necessary.

- Save and print: Once the template is customized, save it for future use and print the number of copies required for each transaction.

Each receipt must include key details to ensure proper recordkeeping. These include:

- Receipt number: A unique identifier for each transaction to avoid confusion during audits.

- Date of transaction: This helps in tracking when a sale was made and organizing records chronologically.

- Seller and buyer information: Include both business and customer details to ensure clear identification.

- Itemized breakdown: List each product or service sold along with its price, quantity, and any applicable taxes.

- Total amount: Clearly indicate the final amount paid, including any discounts or adjustments.

- Payment method: Whether the transaction was made in cash, by card, or through other means, specify the payment method.

Receipt books play a key role in tax and accounting practices. The detailed records they provide help you track income and expenses accurately, ensuring that your business stays compliant with tax regulations. By organizing receipts by year or quarter, you can streamline your tax filings and minimize errors during audits. If you’re working with an accountant, having receipts on hand makes it easier for them to prepare financial statements and tax returns.

To keep your receipt books organized and easily accessible, consider using filing systems or digital storage solutions. You can categorize receipts by date, transaction type, or customer for quicker retrieval. Whether you prefer physical copies or digital files, ensure your system allows for quick referencing and retrieval when needed. For digital receipts, consider using a spreadsheet to catalog the information or scanning physical receipts for cloud storage.

Each line now avoids redundant word repetitions, yet retains its original meaning.

Avoid using phrases that restate the same idea in different words. Instead, aim for clarity and precision in every line. If a concept is clear in a single word or short phrase, remove any excess. For example, replace “the reason why is because” with “because.” This keeps the text concise while preserving its meaning.

Focus on presenting the necessary information directly, without adding unnecessary qualifiers. For example, instead of saying “completely free of charge,” simply use “free.” By eliminating redundancies, the message remains strong and easy to follow.

Strive for brevity without losing clarity. Shorter sentences convey messages more efficiently and keep the reader engaged. Avoid using adjectives that do not contribute to the core meaning, such as “completely” or “totally,” unless they serve a specific purpose.

By eliminating unnecessary repetition, you enhance the readability and flow of the text. Every word should add value and purpose to the sentence. This approach ensures that the message is communicated effectively without overwhelming the reader with excessive details.