Key Elements of a Payment Receipt

A well-structured payment receipt includes essential details to ensure clarity and accuracy. Every receipt should contain:

- Business Name and Contact Information: Include the legal name, phone number, email, and address.

- Client Details: Full name, company (if applicable), and contact information.

- Receipt Number: A unique identifier for tracking payments.

- Payment Date: The date when the transaction was processed.

- Description of Services: Clearly outline the services provided.

- Amount Paid: Specify the total payment received.

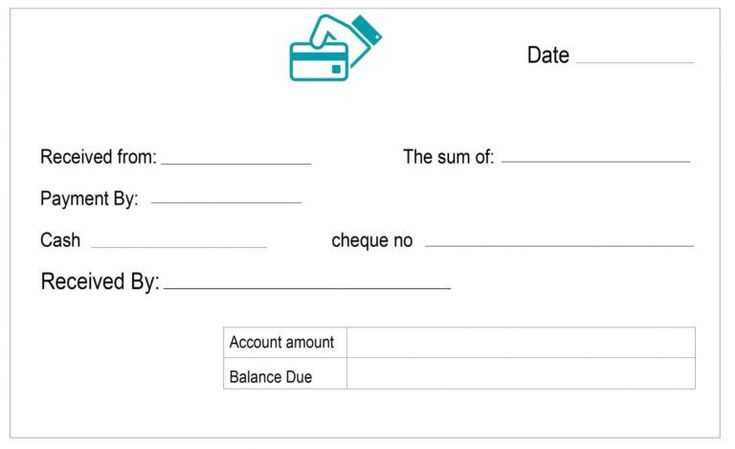

- Payment Method: Indicate whether the payment was made via cash, credit card, bank transfer, or another method.

- Authorized Signature: A signature or digital stamp confirming receipt.

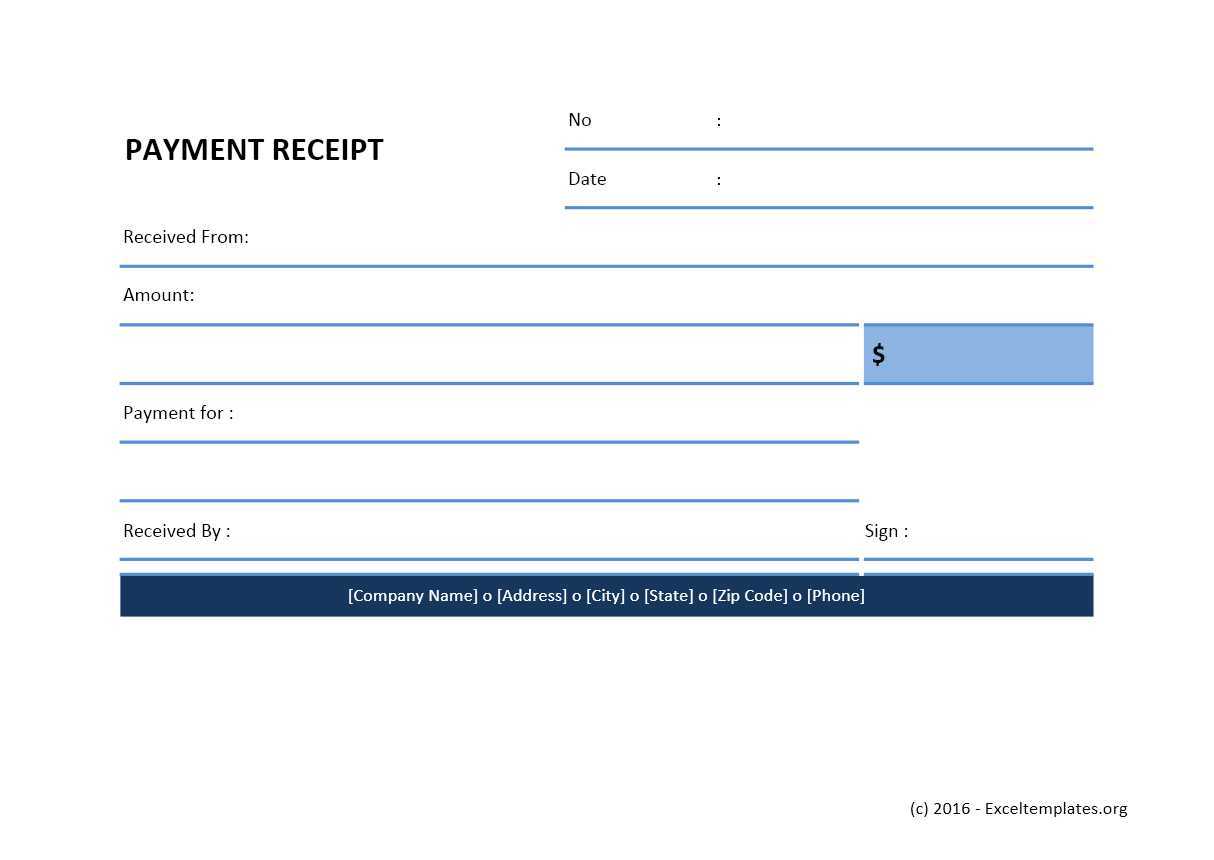

Simple Template for a Payment Receipt

Use this template to create a professional receipt:

Receipt for Services Rendered Business Name: [Your Business Name] Business Contact: [Phone Number, Email, Address] Receipt Number: [Unique ID] Date: [MM/DD/YYYY] Client Name: [Client’s Name] Client Contact: [Client’s Email/Phone] Services Provided: [Description of Services] Amount Paid: $[Total Amount] Payment Method: [Cash/Credit/Bank Transfer] Authorized By: [Your Name or Business Representative] Signature: _____________________

Best Practices for Issuing Receipts

- Use sequential receipt numbers for easy record-keeping.

- Provide a digital copy via email for convenience.

- Retain copies for tax and accounting purposes.

A clear and professional receipt not only confirms payment but also strengthens trust between service providers and clients.

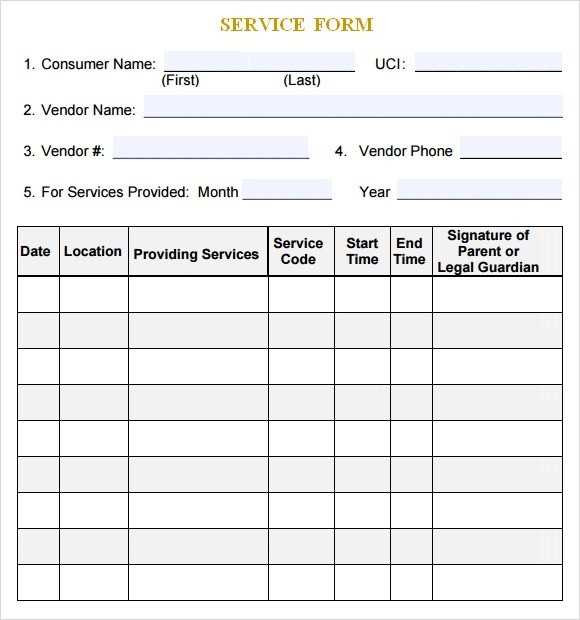

Payment Receipt for Services Provided Template

Essential Elements to Include in Documentation

Formatting Tips for Clear Records

Legal Aspects of a Valid Receipt

Digital vs. Paper: Advantages and Drawbacks

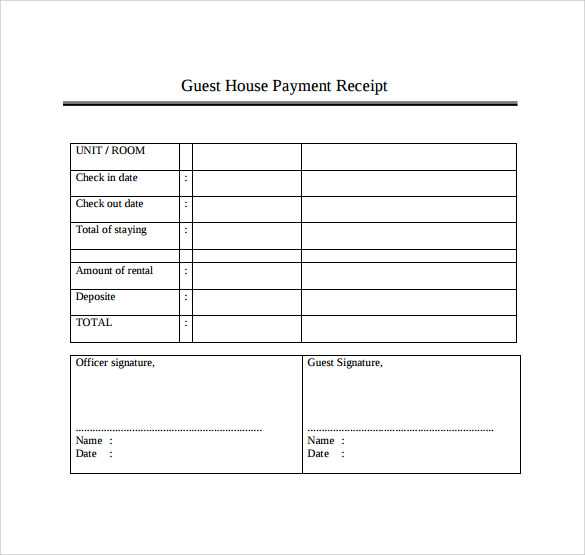

Adapting Templates for Various Sectors

Frequent Errors to Avoid in Issuing

Essential Elements to Include in Documentation

Include the provider’s full name, business details, and contact information. List the recipient’s details, ensuring accuracy. Specify the service date, description, and total amount paid. Break down costs if necessary, indicating taxes and discounts separately. Assign a unique receipt number to streamline record-keeping and prevent duplication.

Formatting Tips for Clear Records

Use a structured layout with bold headers for key sections. Ensure consistent font size and spacing to enhance readability. Highlight critical figures, such as total paid and outstanding balances, to prevent misinterpretation. Digital receipts should include hyperlinks for additional information or payment verification.

Legal compliance requires including applicable tax identifiers, such as VAT or EIN, based on jurisdiction. Ensure the document states whether payment was full or partial. For digital receipts, a secure signature or certification adds authenticity. Adapt formats to industry needs–freelancers may require simple templates, while corporate providers need detailed breakdowns.

Issuing errors often stem from missing signatures, unclear descriptions, or incorrect dates. Verify details before finalizing. Store copies securely to maintain a reliable transaction history, whether using cloud-based solutions or physical archives.