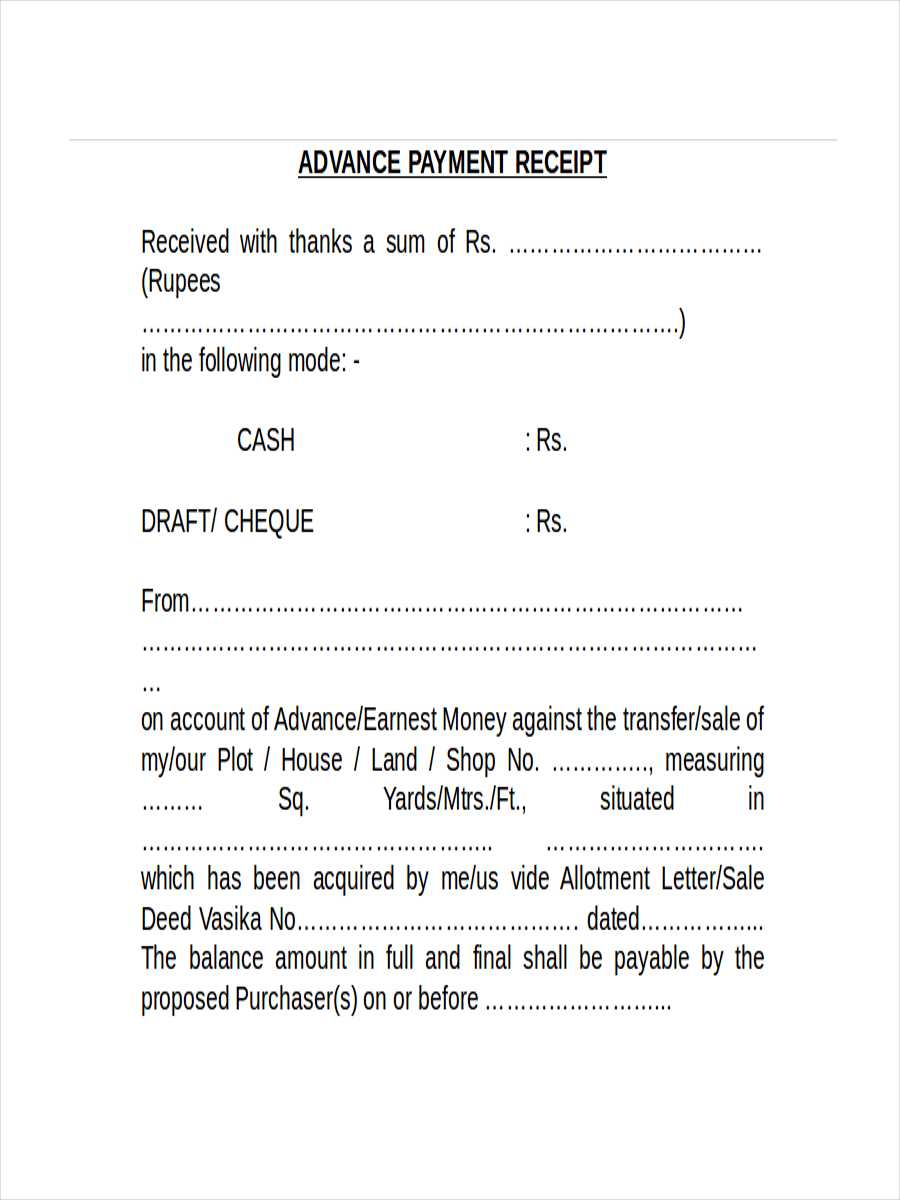

When you need to confirm that a payment has been received, a well-structured payment receipt letter is key. It ensures both the payer and the recipient have a clear record of the transaction. The letter should be concise, clear, and include the necessary details such as the payment amount, date of transaction, method of payment, and the purpose of the payment.

Start by including the name and contact details of the payer, along with the date of receipt. Clearly state the amount paid and the payment method, whether it’s via bank transfer, cash, credit card, or another method. It’s also helpful to reference the invoice or transaction number if applicable. A short note about the transaction’s purpose or the goods/services provided adds clarity.

Conclude with a brief statement confirming the payment has been received, expressing gratitude, and providing any further instructions or information, such as the next steps or contact details for follow-up. A simple and straightforward structure will help avoid confusion and serve as a reliable confirmation for both parties.

Here’s the corrected version:

Begin by clearly stating the payment details, including the amount, date, and method of payment. Ensure accuracy in these fields to avoid confusion later. Double-check the spelling of the payer’s name and the payment reference number if applicable. Provide a clear description of the goods or services received, including any pertinent transaction identifiers such as invoice or order numbers. It’s important to confirm that the terms of the transaction are correctly reflected in the receipt.

To enhance clarity, use bullet points or numbered lists for key information such as payment date, amount, and method. This makes the document easy to read. End the receipt with a statement confirming that the payment has been received in full, along with any additional terms if required. The recipient should feel confident in the completeness and accuracy of the document.

Always offer a contact point for further inquiries. This ensures the recipient knows where to reach out in case of discrepancies or issues. If the payment is part of a larger contract or agreement, reference the relevant clauses or terms to make the context of the payment clear. This helps avoid misunderstandings down the line.

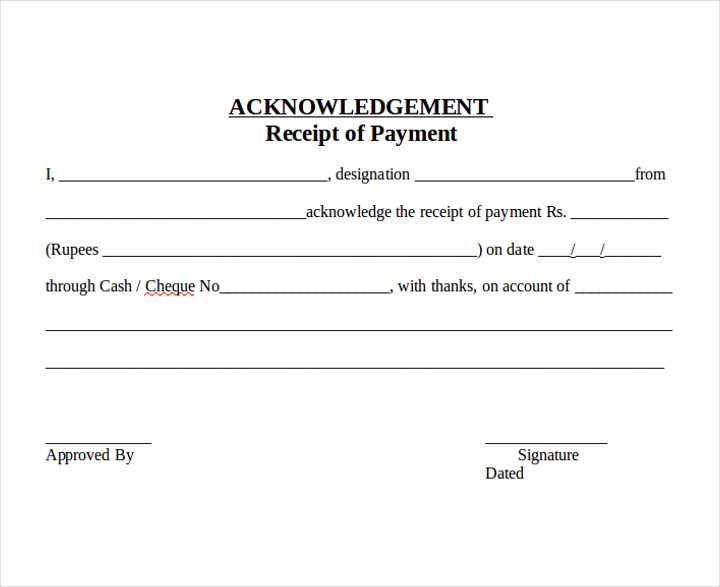

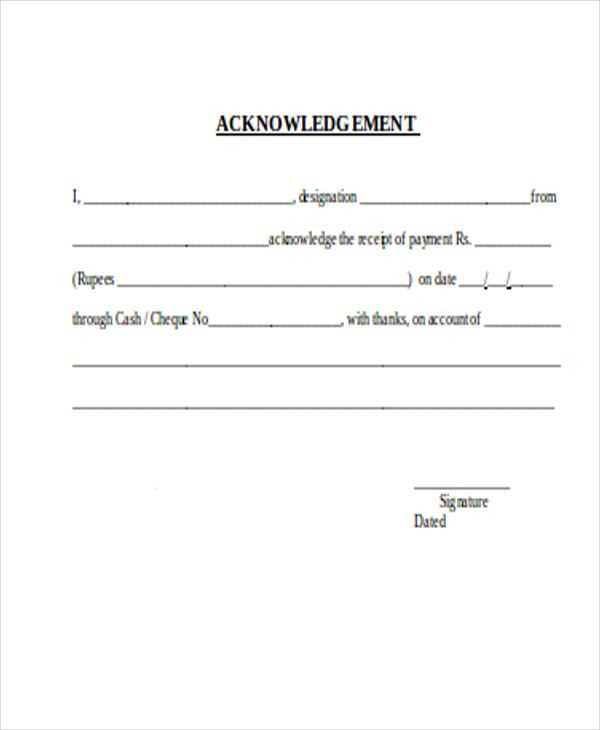

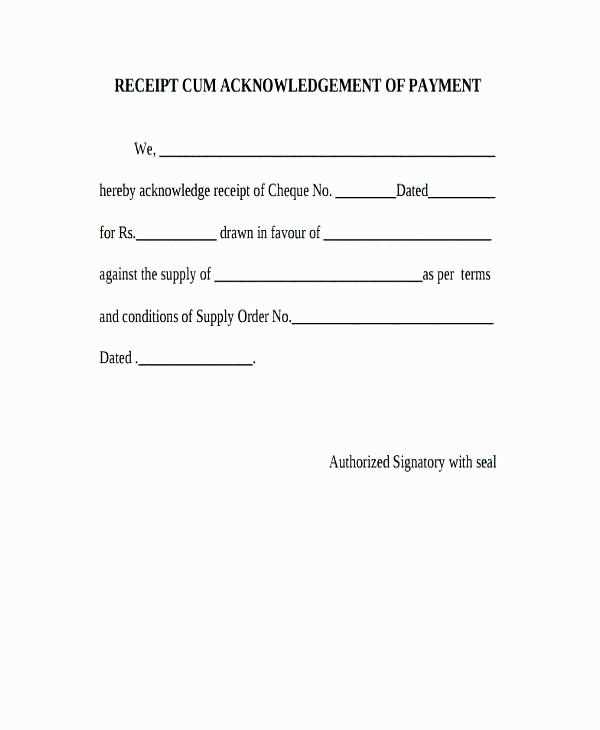

- Payment Receipt Letter Template

A payment receipt letter confirms the receipt of payment for goods or services. It should include the payment amount, date, payer details, and a description of what the payment covers. The letter serves as proof of the transaction and should be clear and concise.

Here’s a template you can use:

[Your Company Name] [Your Address] [City, State, ZIP Code] [Email Address] [Phone Number] [Date] [Customer Name] [Customer Address] [City, State, ZIP Code] Subject: Payment Receipt for [Invoice Number] Dear [Customer Name], This letter confirms that we have received your payment of [Amount] for [Goods/Services] provided. The payment was received on [Date], and covers the following: [Brief description of goods/services provided]. The details of the payment are as follows: - Payment Method: [Cash/Check/Credit Card/Other] - Payment Amount: [Amount] - Invoice Number: [Invoice Number] - Payment Date: [Date] Thank you for your prompt payment. If you have any questions, feel free to contact us at [Your Phone Number] or [Your Email Address]. Sincerely, [Your Name] [Your Position] [Company Name]

Ensure that the payment receipt includes all the necessary information to avoid any confusion. A clear and professional receipt will not only help maintain good relationships with customers but also ensure proper record keeping for both parties.

A payment receipt letter should follow a clear and logical structure. Begin with a professional header that includes your business name, address, and contact details. Add the recipient’s name, address, and date of the transaction. Keep this section concise and easy to locate for both parties.

Next, include a reference number for easy tracking. This can be especially helpful for future correspondence. Specify the amount paid, the date of payment, and the method used. Break this down clearly so the recipient understands the details of the transaction.

Ensure you describe the service or product received, including any relevant identifiers like invoice numbers or order details. This confirms the reason for the payment and reduces ambiguity.

Close the letter with a polite thank you, acknowledging the recipient’s payment. Offer additional information if needed, such as contact details for questions or clarification. Ensure the tone remains courteous and clear throughout.

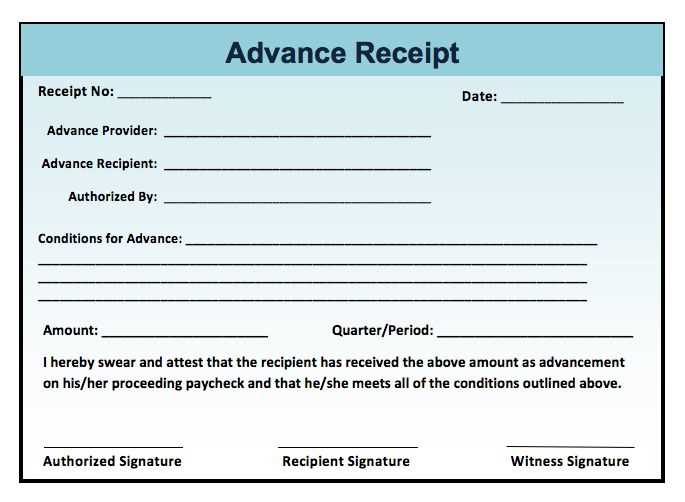

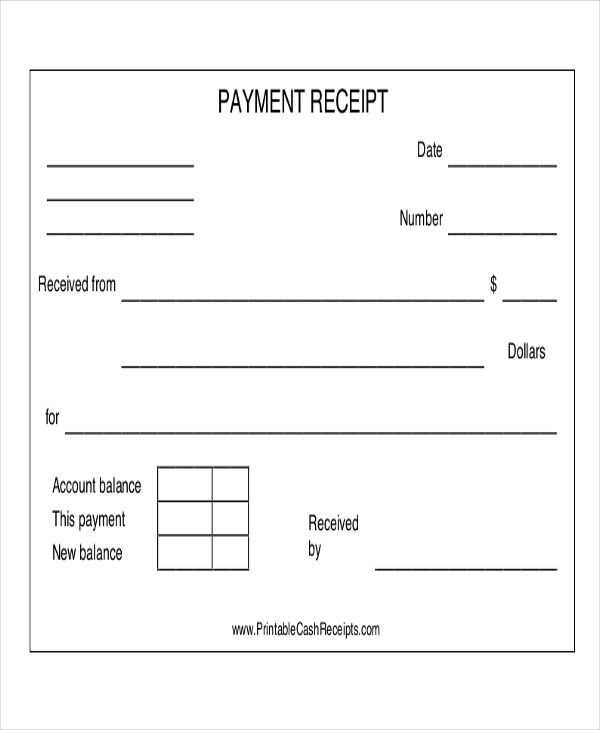

Include these key details in your payment receipt to ensure clarity and accuracy for both parties:

- Receipt Number: Assign a unique identifier for each receipt to avoid confusion and facilitate tracking.

- Payment Date: Clearly state the date the payment was made. This helps both the payer and payee keep accurate records.

- Payment Amount: Specify the exact amount paid, including the currency used. This ensures there’s no ambiguity.

- Payment Method: Indicate the method of payment, such as cash, credit card, or bank transfer, for accurate recordkeeping.

- Payee Information: Include the full name or business name, address, and contact details of the recipient.

- Payer Information: Include the full name or business name, address, and contact details of the payer, if applicable.

- Description of Goods/Services: Briefly describe the product or service that the payment covers. This adds context to the transaction.

- Invoice or Order Number: If relevant, reference the invoice or order number that corresponds with the payment.

- Balance Due (if applicable): If the payment is partial, indicate the remaining balance to be paid.

Including these details in your payment receipt helps prevent misunderstandings and ensures both parties have accurate documentation.

1. Incorrect Date Format

Ensure the date on the receipt matches the transaction date exactly. Using an incorrect or unclear date format can cause confusion. Stick to one standard, such as “DD/MM/YYYY” or “MM/DD/YYYY,” and be consistent throughout your documents.

2. Missing Payment Details

Provide a detailed breakdown of the payment. Failing to list the amount paid, the method of payment, or any associated fees could lead to misunderstandings or disputes later. Always specify the total sum, along with the payment method and any relevant invoice or order number.

3. Lack of Clear Identifiers

Always include unique identifiers, such as a transaction number, customer ID, or reference number. Omitting this crucial information can make it harder for both parties to track the payment, especially in case of disputes or refunds.

4. Vague or Inaccurate Descriptions

Be precise about the goods or services received. General descriptions like “goods” or “services” are insufficient. Instead, specify exactly what was purchased, including quantities and specifics of the items or services, to avoid any ambiguity.

5. No Signature or Authorized Confirmation

A receipt should include a signature or an authorized confirmation, especially for significant transactions. Leaving this out can make the document appear unprofessional and untrustworthy.

6. Typos and Grammatical Errors

Proofread the receipt before sending it. Typos, misspelled names, or incorrect figures can raise doubts about the accuracy of the document. A receipt should look professional and error-free to maintain credibility.

7. Absence of Contact Information

Always include your company’s or organization’s contact details–address, phone number, and email. Without this, the recipient might struggle to reach you in case of any follow-up questions or issues with the payment.

Focus on aligning the template with your business’s branding, tone, and specific needs. Start by incorporating your company logo, adjusting colors, and selecting fonts that reflect your identity. These visual changes will immediately give your template a professional and personalized touch.

- Customize Contact Information: Ensure all business contact details, including phone number, email, and website, are accurately updated. This is crucial for customers who may need to reach out after receiving the payment receipt.

- Add Payment Details: Include specific fields relevant to your transactions, such as payment method, transaction number, and the items or services purchased. Tailor these sections to reflect the products or services you offer, ensuring clarity and precision.

- Adjust Language and Tone: If you serve clients from various industries or locations, tweak the language to match their preferences. Use clear and direct wording that fits your brand’s voice–whether formal, casual, or something in between.

- Incorporate Additional Information: Depending on your business model, it might be helpful to add a brief note about return policies, warranty information, or customer support. This enhances the value of the receipt beyond just the transaction details.

- Ensure Legal Compliance: Double-check the template to include any necessary tax information, disclaimers, or other legally required details specific to your region or industry.

By making these adjustments, you create a document that is not only functional but also reinforces your brand identity while providing customers with all necessary information in a clear, accessible format.

Legal Considerations When Issuing Receipts

Receipts must include accurate information to avoid legal issues. Each receipt should clearly state the transaction details, including the date of payment, the amount received, and the method of payment. Failure to provide a properly documented receipt could lead to disputes or difficulty in proving payment in the event of a legal matter.

Required Information on Receipts

Depending on the jurisdiction, receipts may need to meet certain legal requirements. Common information includes:

| Information Required | Purpose |

|---|---|

| Business Name | Identification of the seller or service provider. |

| Transaction Date | Document the exact date of the payment. |

| Amount Received | Clear indication of the monetary exchange. |

| Payment Method | Clarify whether payment was made via cash, credit card, or other methods. |

| Tax Information (if applicable) | Document any taxes applied to the purchase to comply with tax laws. |

| Receipt Number | For record-keeping and future reference. |

Retention of Receipts for Legal Protection

Keep copies of all receipts issued. These serve as legal proof of the transaction and can protect both the business and the customer in case of disputes. Businesses should have a process in place to securely store receipts for a period specified by local laws, which is typically several years.

Maintain clarity in your communication. Make sure the purpose of your letter is evident from the beginning, so the recipient knows exactly what to expect. Avoid jargon and complex language; keep your sentences simple and straightforward.

Personalize Your Message

Address clients by their name and reference any specific details relevant to them. Personalization shows attentiveness and builds trust, making clients feel valued. This approach encourages positive responses and reinforces strong relationships.

Proofread Before Sending

Double-check your letter for any errors in grammar, spelling, or punctuation. Mistakes can damage your professionalism and affect the credibility of your business. A well-written, error-free letter demonstrates care and attention to detail.

Use a formal yet friendly tone that aligns with your company’s image. Avoid sounding too casual or too stiff. Your tone should mirror the client’s preferences, reflecting respect and professionalism without being too distant.

Finally, ensure timely delivery. Whether you send letters via email or traditional mail, make sure to meet the expected timeframe. Prompt communication helps maintain a positive relationship and ensures your message is relevant.

Structuring a Payment Receipt Letter

When writing a payment receipt letter, it’s important to follow a clear and concise structure to ensure both clarity and professionalism. Make sure to include the necessary details without overcomplicating the message. Here’s a breakdown of the key components:

Key Elements of a Payment Receipt Letter

The letter should begin with the company or individual’s name, address, and contact information at the top. Following that, include the recipient’s information. This helps maintain a formal tone while keeping the document organized. Right under the recipient’s details, mention the purpose of the letter–confirming that the payment has been received.

After the introduction, list the specifics of the transaction: the amount paid, the date of payment, and any reference or invoice number. This section should be straightforward and leave no room for confusion. You may also include the method of payment, such as cash, check, or electronic transfer.

Closing the Letter

Conclude the letter with a short paragraph expressing appreciation for the payment, and ensure the letter is signed with the appropriate signatory. Always include the company’s contact information at the end for any follow-up questions.

By following this format, you provide a professional, easy-to-read payment receipt letter that covers all essential details while maintaining clear communication.