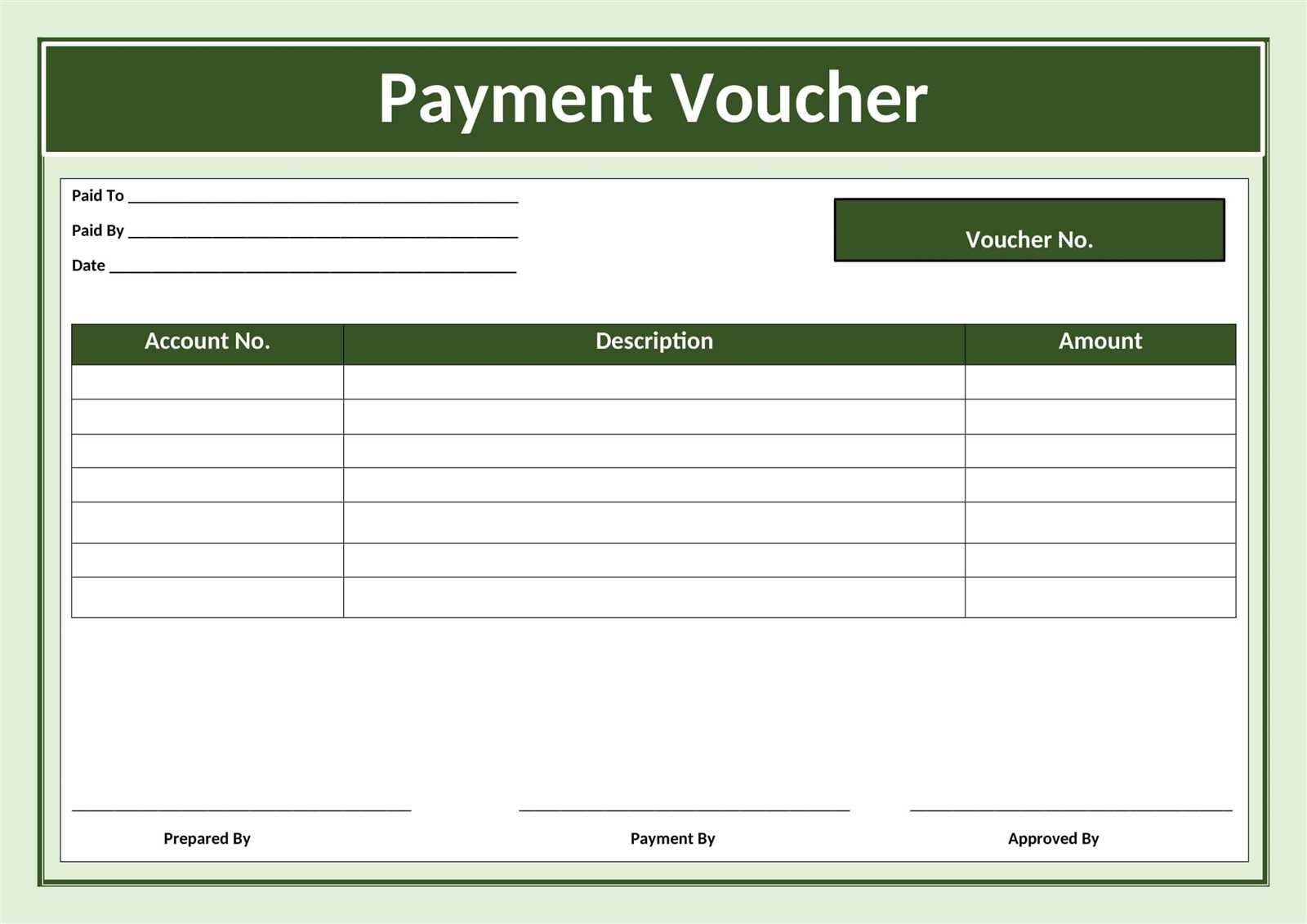

Design a clear and professional payment receipt template for subcontractors to streamline payment tracking and ensure transparency. A well-structured receipt includes crucial details such as the subcontractor’s name, project description, total amount paid, and payment date. This ensures both parties have a record that is easy to reference for accounting or any future disputes.

Focus on clarity in your template layout. Ensure there is a distinct section for the subcontractor’s details and another for the payment breakdown. Including fields for both the payment method and any outstanding balance gives the recipient a complete picture of the transaction.

Using simple and standardized language in the template helps to avoid confusion. Make sure to incorporate space for additional notes or terms if necessary, especially if partial payments or adjustments apply. A receipt is not only proof of payment but also a record that can be referenced for tax purposes or audits.

Once the template is set, regularly update it to reflect any changes in your contracting business or legal requirements. The more precise and professional the receipt looks, the more trust it will build with subcontractors and clients alike.

Here is the revised version with minimized repetitions:

Streamline your subcontractor payment receipt template by focusing on clarity and brevity. Remove unnecessary details that don’t add value to the transaction. Follow these guidelines for an optimized format:

- Header: Clearly state the document type at the top, such as “Subcontractor Payment Receipt.” Avoid redundant headings or descriptions.

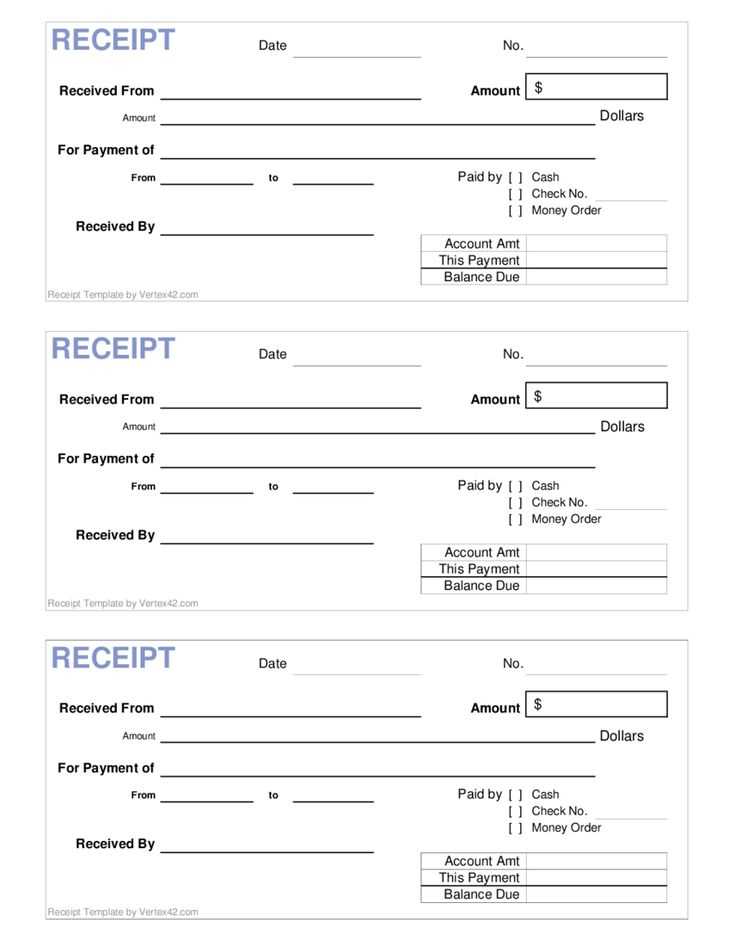

- Date: Include the exact payment date. If a payment schedule is involved, note the specific due dates.

- Amount Paid: Display the total amount, including any deductions, in both words and numbers to avoid confusion.

- Payment Method: Specify how the payment was made (e.g., bank transfer, check, or cash). Don’t repeat this information elsewhere.

- Services Rendered: Summarize the work performed with key details. Avoid lengthy descriptions; just note the primary tasks completed.

- Subcontractor Details: Include the subcontractor’s full name and business details in one line, with no unnecessary repetition of contact info.

- Reference Number: Always include a unique reference or invoice number for tracking purposes. Ensure no overlap with previous receipts.

- Signature: Include a space for both parties to sign. Only one signature per party is required to keep it concise.

By focusing on these core components and minimizing redundancy, your subcontractor payment receipt will be clear, concise, and professional.

- Payment Receipt Subcontractor Template

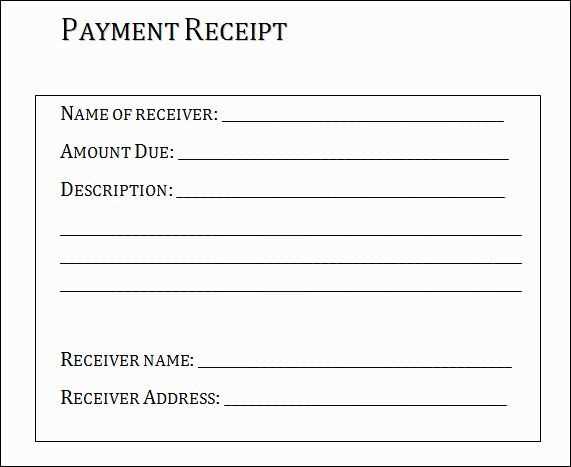

Start by including the full details of both the subcontractor and the contractor. Make sure to state their legal names, addresses, and contact information. This ensures the receipt is traceable to both parties.

Details to Include

Provide a breakdown of the total amount paid and the date the payment was processed. Include the method of payment, whether it was via bank transfer, check, or another method.

Be specific about the services provided. Include a description of the work completed, referencing the contract or invoice number. This adds clarity and links the payment to the corresponding project or service.

Final Steps

Conclude the receipt with the appropriate signatures from both the subcontractor and the contractor. This ensures the payment is acknowledged and agreed upon by both parties. Keep a copy for your records and provide one to the subcontractor as proof of payment.

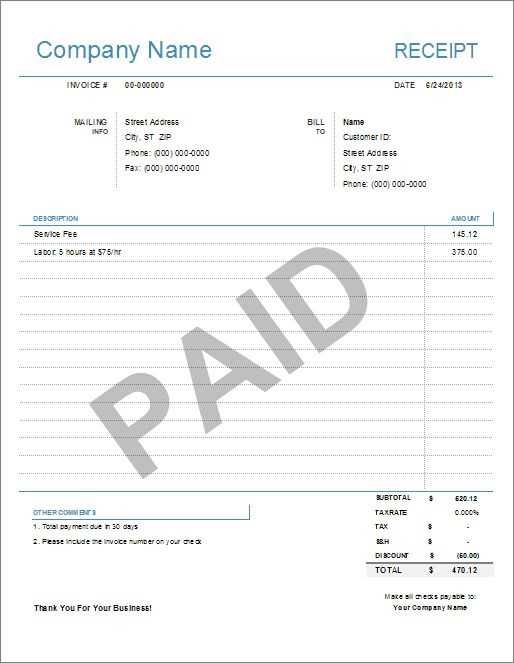

Creating a payment receipt for subcontractors involves capturing specific details about the transaction. Include the subcontractor’s name, address, and contact information, along with the business details of the hiring company. Ensure you list the payment date and the total amount paid, breaking down the work completed and any taxes involved.

Key Details to Include

Start by adding a unique receipt number for easy reference. Mention the job or project name the subcontractor worked on, and specify the payment terms. If the payment covers multiple invoices, list each invoice number with its amount. Include any deductions or credits, such as deposits or prior payments made.

Payment Methods and Notes

Indicate the method of payment (e.g., bank transfer, check, cash), and provide any relevant payment reference numbers if applicable. If the subcontractor has any notes about the payment, such as incomplete work or pending approvals, ensure they are included for clarity. End with a signature line, acknowledging that the payment has been received in full for the agreed services.

A subcontractor payment receipt should be clear, concise, and provide all necessary details to avoid misunderstandings. The following key elements will ensure that the receipt serves its purpose effectively.

1. Subcontractor Details

Include the subcontractor’s full name, business name (if applicable), and contact information. This helps identify the parties involved in the transaction.

2. Payment Information

Clearly state the amount paid, the payment method (e.g., cash, check, bank transfer), and the payment date. This establishes a clear record of the financial transaction.

3. Invoice Reference Number

If the payment relates to a specific invoice, reference the invoice number. This ties the payment to a particular job or contract.

4. Services Rendered

Describe the work or services performed, including the scope, dates of work, and any related details that clarify the purpose of the payment. This prevents any ambiguity regarding the work completed.

5. Total Amount Due vs. Payment Made

Indicate the total amount due for the work and show how much has been paid, if applicable. This helps track remaining balances.

6. Signature

Both parties should sign the receipt to confirm the transaction. A signature validates the receipt as an official document.

Example Payment Receipt

| Field | Details |

|---|---|

| Subcontractor Name | John Doe Construction |

| Payment Amount | $1,200 |

| Payment Method | Bank Transfer |

| Payment Date | February 14, 2025 |

| Invoice Number | #12345 |

| Services Rendered | Electrical Work – Phase 1 |

| Amount Due | $1,500 |

| Amount Paid | $1,200 |

| Signature | _________________ |

Start by ensuring the payment amount is correctly stated. A common mistake is entering incorrect figures, leading to confusion and potential disputes. Double-check the agreed payment terms and the actual amount received before finalizing the receipt.

1. Missing Payment Details

Always include specific details about the payment method, such as whether it was cash, check, bank transfer, or another method. Omitting this information can lead to misunderstandings later. Also, note the date of payment and any associated reference numbers or transaction IDs.

2. Incomplete or Vague Descriptions

Be clear about the work completed and the corresponding payment. Avoid vague terms like “work done” without specifying the tasks. Detailed descriptions help prevent future disagreements. Specify the service rendered, the project phase, or any milestone that the payment relates to.

3. Lack of Proper Signatures

Failing to include both parties’ signatures can invalidate a payment receipt. Ensure that the subcontractor signs the document, and if possible, the main contractor as well. This provides clear acknowledgment of the transaction and avoids ambiguity.

4. Failure to Record Tax Information

If applicable, record any tax amounts related to the payment. For subcontractors who are self-employed or business owners, tax documentation is critical for proper accounting and reporting purposes. Forgetting this step can result in penalties later.

5. Unclear Payment Terms

Clearly outline any payment terms on the receipt, including the payment due date, late fees (if any), and whether the payment is for full or partial completion. Lack of clarity can lead to disagreements about outstanding balances.

6. Incorrect Contact Information

Ensure that both parties’ contact details are correct, including names, addresses, phone numbers, and email addresses. Incorrect information can hinder communication in case there are questions or issues with the payment.

7. Not Updating the Receipt for Modifications

If there are changes to the original payment agreement, make sure to update the receipt accordingly. This includes any adjustments to the payment amount, timing, or work scope. Failing to reflect modifications can lead to confusion and disputes down the road.

8. Ignoring Currency and Country-Specific Details

If the payment involves foreign currency, specify the exchange rate used, the exact amount in both currencies, and the country of origin. This ensures both parties understand the value of the transaction and avoids misinterpretation of the amounts involved.

Payment Receipt Subcontractor Template

Maintain clarity and organization in your subcontractor payment receipt template. Start by including the subcontractor’s full name, contact details, and business identification number. This establishes clear identification of the parties involved. Ensure you provide accurate payment details, including the date, payment amount, and breakdown of services rendered. Clearly list any taxes applied, along with the total payment received. Add a reference number for easier tracking and future reference.

Key Information to Include

Include a unique invoice or reference number. This allows for straightforward identification and ensures accountability for both parties. Specify the project name or description of services, providing context for the payment. It’s also important to mention any discounts or adjustments made. The payment method should be outlined clearly, whether by bank transfer, cheque, or another means. Don’t forget to indicate the due date and any payment terms agreed upon.

Final Steps for Completion

Before closing the receipt, ensure both parties sign the document if required. This adds a level of security and ensures mutual agreement on the payment details. Make sure to keep a copy for record-keeping and auditing purposes. A well-organized payment receipt helps prevent confusion and improves transparency between subcontractors and contractors.