Creating a payment receipt is easy when you have the right template. A well-designed template not only saves time but also ensures consistency in your financial records. You don’t need to start from scratch every time a transaction occurs. With a payment receipt template in DOC format, you can quickly document any payment, whether it’s for goods, services, or any other transaction.

The DOC format is ideal for this purpose as it’s universally accessible and easily editable. Whether you’re using Microsoft Word or another word processor, a DOC template ensures that you can customize each receipt as needed, adding details like the payment amount, payer’s information, date, and transaction description. This allows you to maintain professional documentation for both personal and business purposes.

By utilizing a pre-made template, you eliminate the risk of missing key information that could lead to confusion later. Make sure the template includes placeholders for all relevant fields and is structured to match the needs of your business or personal use. If you’re looking for a straightforward, reusable tool, a payment receipt template in DOC format is an excellent choice to streamline your documentation process.

Here’s a Version Without Repetitions:

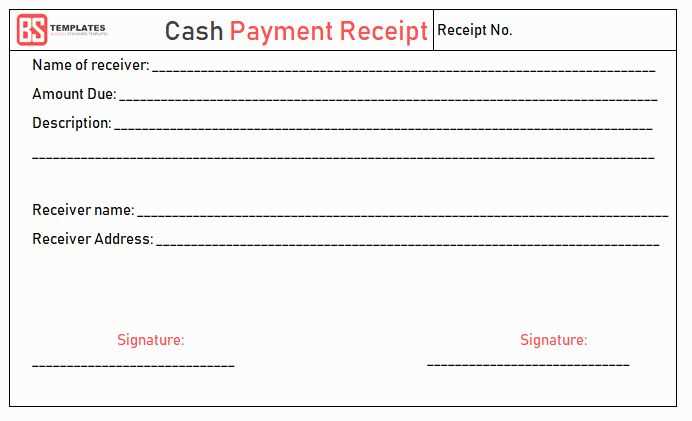

To create a clean and professional payment receipt, focus on including clear sections that help both parties understand the details of the transaction. Include the payer’s name, recipient’s name, and the date of the transaction upfront. You can follow with a breakdown of the payment amount, listing the specific goods or services provided, including any relevant tax amounts or discounts.

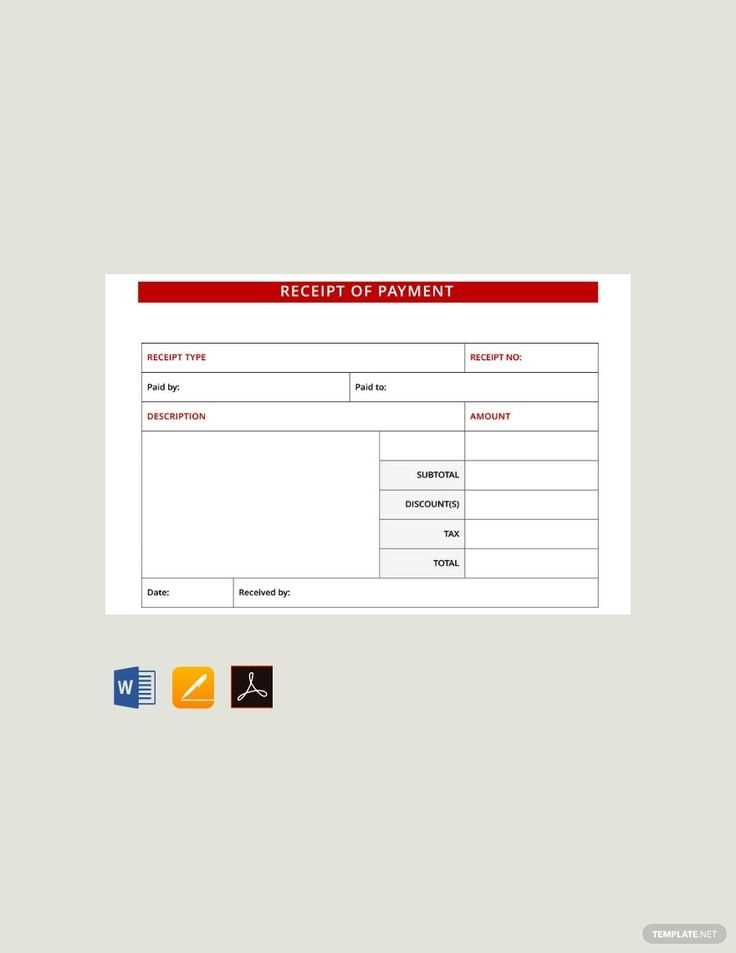

Payment Breakdown

Be sure to clearly list the itemized payment information: quantity, unit price, and total for each item. This helps clarify the charges and prevents misunderstandings. Use a table format for easy reading and structure. Keep the table simple but detailed enough to cover the transaction fully.

Additional Notes

Consider adding a “notes” section at the bottom. This can include payment terms, due dates, or any additional relevant information. A signature line is also useful for verifying the receipt if needed.

By following these suggestions, you can craft a payment receipt template that is both clear and professional, with no unnecessary duplication or confusion in the details.

- Payment Receipt Template DOC: A Practical Guide

To create a Payment Receipt template in DOC format, focus on the necessary elements for clarity and accuracy. A well-structured document helps both parties involved–payer and payee–stay organized.

- Header: Include your business name, logo, and contact details at the top. This ensures the receipt is easily traceable back to your company.

- Date: The payment date is a key detail. It indicates when the transaction occurred and may be needed for accounting or tax purposes.

- Receipt Number: Assign a unique number to each receipt. This helps organize payments, especially for businesses with a high transaction volume.

- Buyer Information: Include the name and contact information of the person or company making the payment. This provides clarity in case any follow-up is needed.

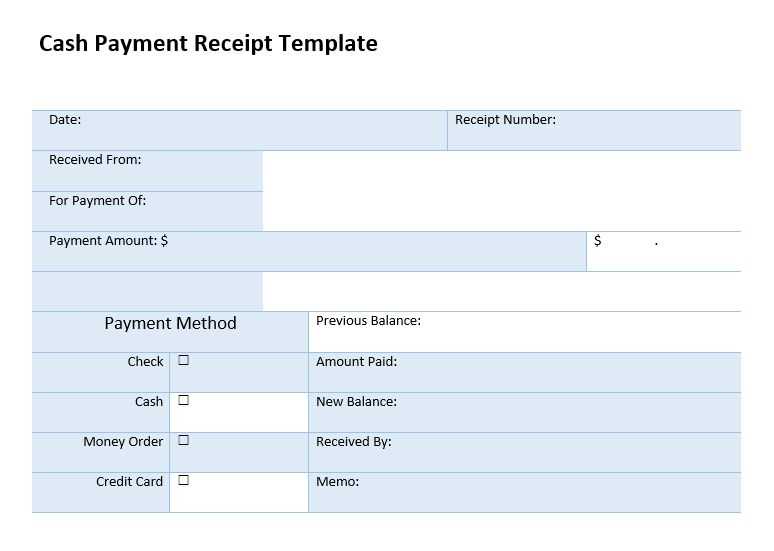

- Payment Details: Break down the payment into its components. For example, if it’s for services rendered, list the services with corresponding amounts. Clearly state the total payment amount.

- Payment Method: Specify how the payment was made–whether it’s through credit card, bank transfer, check, or another method. This is useful for both record-keeping and reconciliation.

- Notes or Additional Information: Include a section for any relevant notes, such as terms of service, discounts applied, or next steps if applicable.

When designing your receipt template, make sure it is professional yet easy to understand. Customize fields to match your specific business needs, ensuring both payer and payee are clear on the details of the transaction.

Lastly, save your template in DOC format for easy editing and sharing. This format also allows for future customization, ensuring that your receipts remain adaptable as business practices evolve.

Open a word processor, such as Microsoft Word or Google Docs, to create your payment receipt. Start by selecting a clean, professional template or create a custom layout with clear sections. Begin with the title of the receipt at the top, e.g., “Payment Receipt,” in a large, bold font.

Step 1: Add Payment Details

Include the transaction details such as the date of payment, the payer’s name, and a brief description of the service or product purchased. Make sure to mention the amount paid, including any tax if applicable, and the payment method (e.g., cash, credit card, bank transfer).

Step 2: Include Business Information

Provide your business name, address, phone number, and email. This adds professionalism and allows the payer to contact you easily in case of any issues. Be sure to include any relevant identification numbers such as a tax ID or registration number if required.

Once you have entered all the necessary details, save the document in DOC format. Ensure everything is clear and easy to read. You can also add a footer with a thank-you note or other business details for a personal touch.

A payment receipt should provide clear and detailed information. Here are the key elements that must be present:

- Receipt Title: Clearly label the document as a payment receipt for easy identification.

- Transaction Date: Include the exact date the payment was made. This helps track payment history.

- Payment Amount: State the total amount paid, along with the currency type. This ensures transparency in financial transactions.

- Payer’s Information: Include the name and contact details of the person or company making the payment. This allows for accurate record-keeping.

- Payee’s Information: Provide the name and contact details of the recipient. This makes it clear who received the payment.

- Payment Method: Specify how the payment was made (e.g., credit card, cash, bank transfer). This confirms the payment channel used.

- Invoice or Reference Number: Include any relevant invoice or transaction number to tie the payment to a specific order or service.

- Itemized List (if applicable): For purchases, include a breakdown of the items or services paid for, along with their costs. This provides full transparency.

- Tax Information: If taxes apply, clearly show the tax rate and amount paid. This ensures proper documentation of the financial details.

- Payment Confirmation: A brief statement confirming the payment has been received, which reassures the payer.

Including these elements ensures that both payer and payee have all the necessary details for their records, minimizing confusion and ensuring smooth financial tracking.

Tailor your receipt template to suit different needs by adjusting specific details. For instance, if you’re issuing receipts for services rendered, include a section that breaks down labor costs, hourly rates, or service descriptions. On the other hand, for product sales, incorporate a column for product names, quantities, and prices.

Consider adding customized fields such as order numbers, payment methods, or transaction IDs for better tracking. This can be especially useful in business environments where record-keeping is critical. Depending on your needs, integrate tax fields, discounts, or promotional codes to capture the full financial transaction.

| Field | Purpose |

|---|---|

| Product Name | Essential for product-based businesses to identify sold items. |

| Service Description | Provides clarity on the type of service offered, helping customers understand the charge. |

| Transaction ID | Facilitates easy reference and tracking of the payment. |

| Discounts/Promotions | Show any active discounts or special offers to give customers clarity on price changes. |

| Tax Rates | Ensure proper tax calculations are clear and accurate for both the business and the customer. |

For recurring clients, implement a template that reflects loyalty programs or subscription plans, including dates for renewal or next payments. A professional layout will help ensure that the template meets business or regulatory requirements while keeping it aligned with customer expectations.

Ensure clarity by using a clean, easy-to-read font like Arial or Times New Roman. Set the font size to 10 or 12 points to make the text legible without overcrowding the page. Keep the alignment of all text elements consistent throughout the document. Typically, left-aligned text works best for the details, while the header can be centered.

Organize Information with Clear Headings

Group receipt information under clear headings. Include sections such as “Transaction Date,” “Itemized List,” “Total Amount,” and “Payment Method.” This structure guides the reader’s eye and makes it easier to find key details. Bold or increase the font size of headings for better visibility.

Use Tables for Itemized Lists

For itemized purchases, use tables. This helps separate each item’s description, price, and quantity in a structured layout. Avoid cluttering the page with too much information in one row or column. Tables should have simple borders and enough space for readability, without distracting from the overall receipt design.

Ensure there is sufficient spacing between sections to avoid a cramped look. Don’t fill the entire page with text; leave margins and whitespace for a polished and user-friendly appearance. Additionally, consider adding a footer with contact information or a website link, keeping it subtle and not overpowering the receipt content.

Incorporate your company’s logo, color scheme, and font styles to maintain a consistent look across all documents. Start by adding your logo at the top or in the header section of the payment template, ensuring it’s visible but not overwhelming. Use your brand’s primary colors for headings, borders, or background elements. For text, choose fonts that match your branding guidelines, making sure they’re clear and readable.

Including your company’s contact information, such as phone number, email, and website, in the footer reinforces your branding while providing essential details. If your company has a tagline, consider placing it near the logo or at the bottom of the document.

Don’t forget to add any necessary legal disclaimers or terms and conditions related to payment, formatted in line with your brand’s style. By doing so, you create a cohesive payment experience that aligns with your company’s identity and enhances professionalism.

To save your payment receipt template, click the “Save” button in your document editor, and select a location on your computer or cloud storage. Choose a file format such as .docx or .pdf to ensure compatibility with most devices. Saving it as a PDF is often the best choice for easy sharing and printing.

Saving the Template

When saving, make sure to name your file clearly and include relevant details, like the date or transaction type, so you can easily find it later. If you plan to use this template for multiple transactions, consider creating a folder specifically for payment receipts to keep things organized.

Sharing Your Template

To share your saved receipt, attach the file to an email or share a link if you saved it in a cloud storage service. Make sure the recipient has access to the file, especially if you’re using cloud storage. If you need to share the document with a group or team, consider using shared folders for easy access and collaboration.

If you’re sharing the receipt template regularly, creating a reusable link or using a document management tool can streamline the process.

For quick sharing via messaging apps, PDF is a preferred format due to its universal compatibility and fixed formatting.

Printing the Template

To print the payment receipt template, open the file on your computer, click on the “Print” option in your document editor, and choose your printer. Before printing, review the template to ensure all fields are filled out correctly. Adjust the printer settings, such as paper size and orientation, based on your needs.

Make sure to double-check your print preview to confirm that the receipt appears as you intended before hitting the print button. If you plan to print many copies, consider saving a master template to avoid repetitive editing.

Each word or phrase is repeated no more than 2-3 times while maintaining the meaning and structure of the original.

When designing a payment receipt template, clarity is key. Ensure each section is straightforward and serves a clear purpose. Start with the payer’s details, followed by the payment information, and then confirm the receipt with a summary of the transaction. Avoid redundancy, making sure the key information stands out without overloading the document.

Payment Details

Provide exact details of the payment, including the amount, date, and method. This should be concise and easy to read. Use clear labels for each section and avoid unnecessary descriptors that could clutter the document.

Confirmation Statement

A confirmation statement is important for verifying the completion of the transaction. Keep it short and to the point, acknowledging the payment without repetition. This reassures the payer of the transaction’s success while maintaining simplicity in your receipt format.