A well-structured payment receipt is key to maintaining clear financial records. For consultants, a payment receipt template should capture essential details, ensuring both the service provider and the client have accurate documentation of transactions. The template should include the consultant’s name, business name (if applicable), client’s name, payment date, service description, amount paid, and payment method.

The template should also feature a unique invoice or receipt number, which helps in tracking payments, especially for tax reporting purposes. Always include a brief description of the services provided. This transparency ensures there is no ambiguity about what the client is being billed for. If applicable, state whether the payment is for a one-time consultation or part of an ongoing project, and include any terms regarding future payments or deposits.

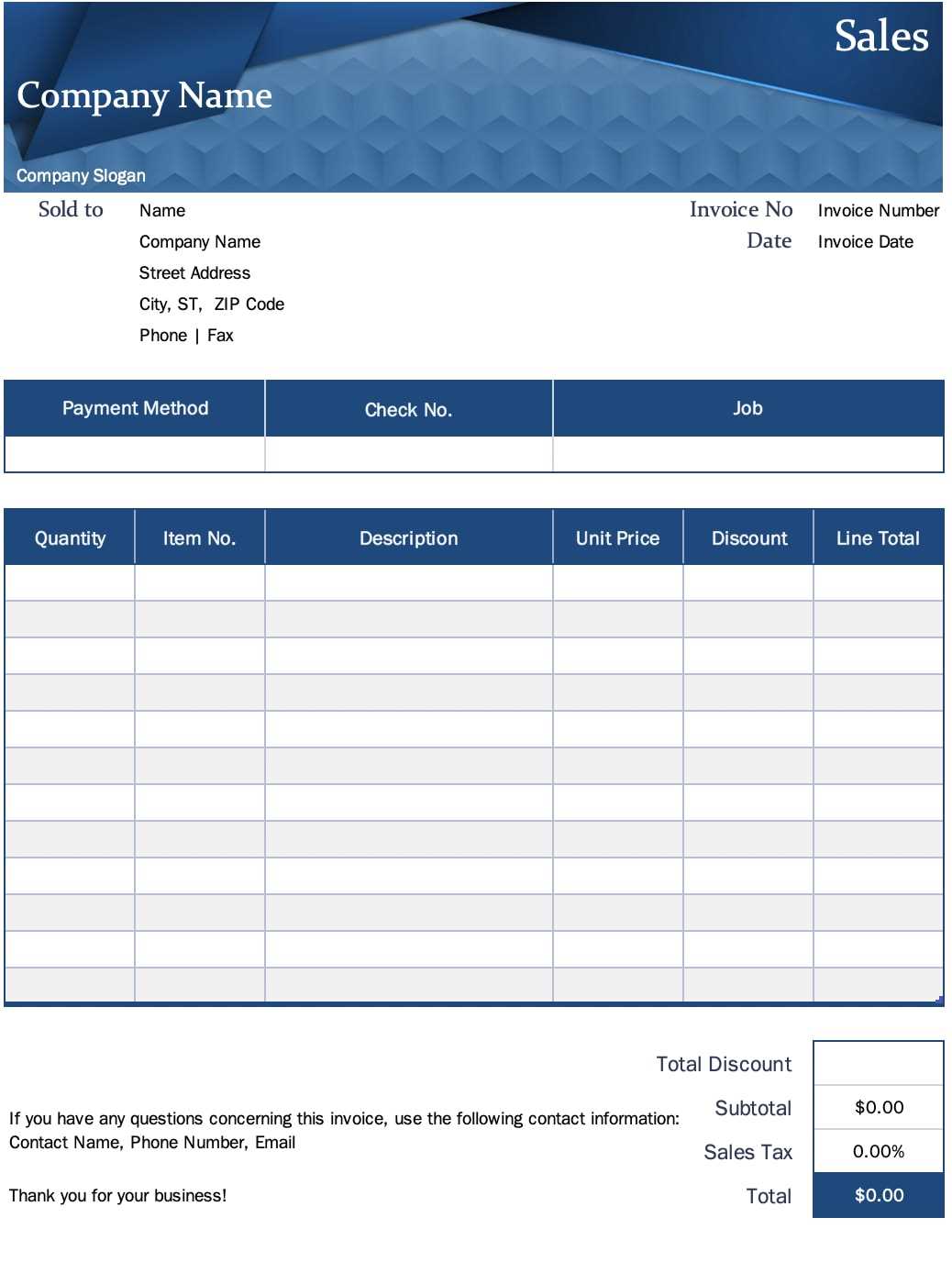

Design the receipt with clear headings and sections for easy reading. A clean layout minimizes confusion and speeds up the process of documentation. Ensure that all relevant details are easy to locate and that there is no room for misinterpretation. The receipt can be generated digitally or printed, but it should always be delivered to the client promptly, reinforcing professionalism and good business practices.

Here are the updated lines based on your request:

Make sure the consultant’s full name appears at the top of the receipt for clarity. Include the company name if relevant.

Details of the Service

Specify the service provided, breaking it down into clearly defined tasks. For example, “Consultation on market analysis for Q1 2025” or “Hourly advice on project management strategy.” This helps both the consultant and client track specific deliverables.

Payment Terms

State the payment terms explicitly. For example, “Full payment is due within 15 days of receipt date” or “A 50% deposit is required upfront, with the balance due upon completion.” Adjust terms based on prior agreements with the client.

Be sure to include the method of payment (e.g., bank transfer, PayPal) and any relevant transaction details (e.g., transaction ID or bank account number). This ensures the payment process is straightforward and transparent.

End the receipt with a thank-you note or a brief acknowledgment of the client’s trust in your services, ensuring a positive tone for future business.

- Payment Receipt Template for Consultant

A payment receipt for a consultant should clearly outline the transaction details. It needs to include specific elements to ensure both parties have a clear record. Below is a template to help you craft an effective payment receipt.

1. Receipt Title: Use a clear and concise title, such as “Payment Receipt” or “Consultant Payment Receipt.” It should be prominently displayed at the top.

2. Consultant’s Information: Include the consultant’s full name or business name, address, and contact information (email and phone number). This makes it easy to identify the service provider.

3. Client’s Information: Similarly, include the client’s name, address, and contact details. This helps to clarify who made the payment.

4. Date of Payment: Specify the exact date when the payment was received. This will serve as a reference for both the consultant and client.

5. Description of Services: Provide a brief description of the services rendered, including the hours worked, rate, and any specific deliverables. This ensures that both parties are on the same page regarding the nature of the work performed.

6. Total Amount Paid: Clearly state the total amount paid. Break it down into the hourly or flat rate, as well as any applicable taxes or additional fees.

7. Payment Method: Indicate the method of payment used–whether it’s via bank transfer, credit card, cash, or another method. This provides a clear record of the transaction.

8. Payment Reference Number: If applicable, include a reference number or transaction ID for the payment. This is useful for both accounting and future reference.

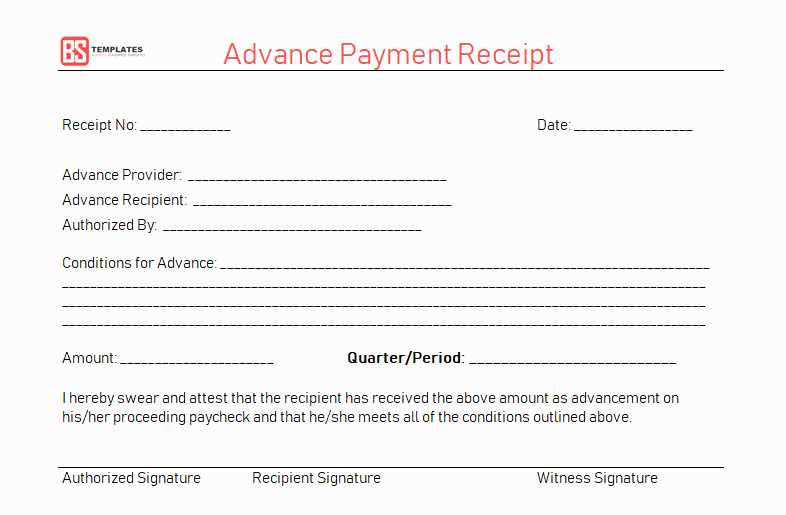

9. Signature: While not always necessary, you may choose to include a space for the consultant’s signature. This can help formalize the document.

Using this template ensures clarity and transparency for both the consultant and the client. It helps maintain accurate records and can serve as proof of payment in case of any disputes.

Begin by clearly identifying the consulting service provided and the date it was completed. This provides transparency and helps both parties track the transaction details. List the name of the consultant and the client, and include any relevant contract or project numbers that link the receipt to a specific agreement.

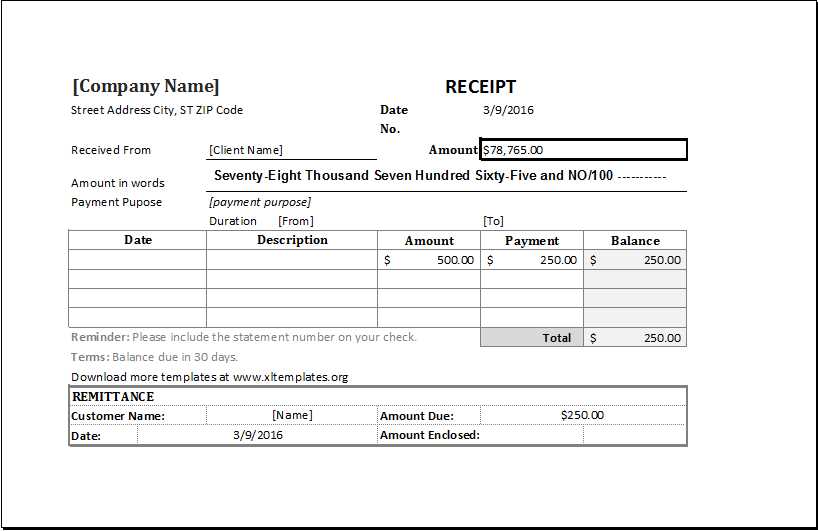

Next, provide a detailed breakdown of the fees. If multiple services were provided, separate them into individual line items, showing the price for each. Include the hours worked and the hourly rate, if applicable, or provide a flat fee, depending on the agreement. Ensure the total amount to be paid is highlighted at the bottom.

| Description of Service | Hours Worked | Rate | Total Amount |

|---|---|---|---|

| Consulting on Marketing Strategy | 10 | $100/hr | $1,000 |

| Market Research | 5 | $100/hr | $500 |

| Total Amount Due | $1,500 |

Next, clearly state the payment terms. Specify the due date for the payment and include any late fees or penalties if applicable. If the payment has been made, mark it as “Paid” along with the payment date. Provide the payment method used, whether it’s bank transfer, check, or online payment platform.

Lastly, include any additional notes, such as a thank-you message, or offer contact information for any questions. This keeps the communication professional and accessible. End the receipt with a clear statement of the document’s purpose, like “This receipt acknowledges the payment made for consulting services provided.” This makes the document official and easily understandable.

Specify the full name of the consultant and the client or organization issuing the payment. Include the payment amount in both numerical and written formats, ensuring clarity. Mention the date of the transaction or the payment receipt to avoid any confusion. Indicate the payment method, such as bank transfer, check, or cash, and provide relevant transaction details, like bank reference numbers or check numbers, if applicable.

Clearly outline the services rendered with specific details, including any project milestones or deliverables that were met. If applicable, reference the contract or agreement under which the payment is made to clarify the terms. If a portion of the payment is made in advance or as a deposit, note the outstanding balance or future payments due.

Finally, include a confirmation statement that acknowledges receipt of the payment. A brief closing statement, such as “Thank you for your business” or “We appreciate your prompt payment,” adds a professional touch to the acknowledgment.

Pick a payment receipt format that suits both your business needs and the expectations of your clients. This will make sure your records are clear, and clients receive the necessary details to verify the transaction.

1. Standard or Custom Format

A standard receipt provides basic details, such as the amount, payment method, and date. This format works well for straightforward transactions. However, customizing the receipt to include specific terms or project details can help establish a professional image and ensure clarity.

2. Consider the Client’s Preference

Some clients may prefer a more formal or detailed receipt, while others may appreciate simplicity. If possible, ask your clients about their preferences, or choose a format that allows for easy modification based on the client’s needs.

3. Include Key Payment Details

- Transaction date

- Consultant’s name and contact information

- Client’s name

- Description of the service provided

- Total amount paid

- Payment method (e.g., credit card, bank transfer)

- Invoice number or reference (if applicable)

Be sure to provide all relevant payment information in a clear, organized layout. A receipt with missing details can cause confusion and may lead to disputes.

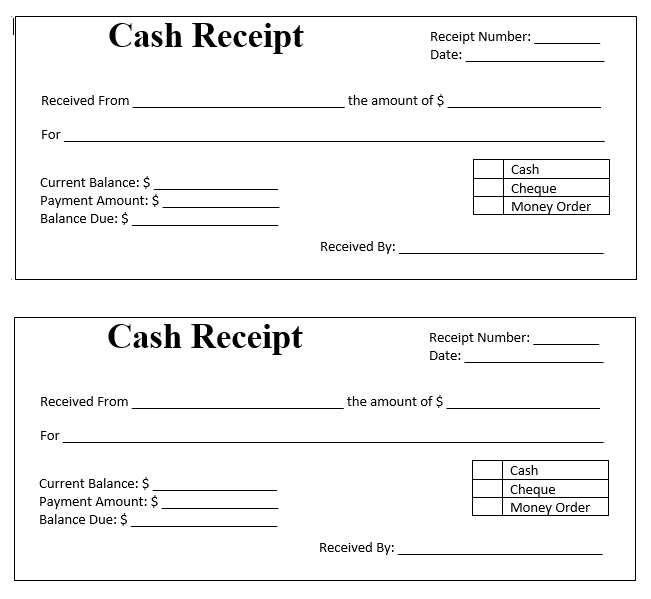

Include a clear breakdown of each payment method used. For each transaction, specify the method of payment, such as credit card, bank transfer, or check. This ensures transparency and clarity for both the consultant and the client.

- Credit Card Payments: List the card type (Visa, MasterCard, etc.), the last four digits of the card number, and the payment amount. If multiple cards are used, include details for each.

- Bank Transfers: Indicate the transfer date, sender’s account number (last 4 digits), and the amount transferred. If possible, include any reference number for the transaction.

- Checks: Note the check number, the issuing bank, and the payment amount. It’s helpful to specify if the check was cleared or pending.

- Cash Payments: Record the amount of cash received and note the currency. If a receipt for cash is issued, state this clearly.

- Online Payment Services: For services like PayPal, include the transaction ID, payment amount, and date. If there are any fees associated with the payment, mention those as well.

Ensure you clearly state the payment status (paid, pending, etc.) and any additional notes about partial payments or installment plans. This helps avoid confusion and confirms the consultant’s records are up-to-date.

Ensure the receipt includes the consultant’s full legal name or business name, as well as their contact details. This verifies their identity and provides clarity in case of disputes. Include the date of the transaction, as it may be necessary for tax reporting or for establishing the timeline of services rendered.

List the services provided with clear descriptions. This can prevent misunderstandings between the consultant and client about the scope of work. For services rendered, specify the rate charged (whether hourly, per project, or otherwise), including any applicable taxes. This transparency ensures that both parties understand the financial arrangement and helps avoid potential legal issues.

Ensure the receipt mentions the payment method used, whether by bank transfer, check, or other means. This provides a record of the transaction and is particularly important for reconciling accounts or resolving any payment disputes. Include the total amount paid and confirm if the payment covers any prior invoices or is for a new agreement.

It’s advisable to include a statement about the receipt’s status, such as whether the payment is full or partial. This prevents ambiguity, especially if multiple payments are involved. Some jurisdictions require specific language or disclosures in receipts for services, so it’s important to stay aware of local regulations regarding receipt documentation.

For tax purposes, provide an invoice number or reference that matches any prior communication, like contracts or quotes. This number acts as an identifier in case the receipt needs to be referenced for tax filings or audit purposes.

Make sure the receipt is signed, either electronically or by hand, to verify its authenticity. Some regions may require this level of formal acknowledgment for it to hold up in legal contexts.

Include clear and accurate details on the receipt. Ensure it has the client’s name, payment amount, date, and a description of services rendered. A concise breakdown of charges builds trust.

1. Use a Professional Template

A well-structured template makes your receipts appear organized and trustworthy. It should have your company logo, contact information, and any relevant legal disclaimers. Customize the template for a clean, easy-to-read format.

2. Provide a Receipt Number

Each receipt should have a unique identifier. This helps with tracking payments, managing records, and resolving potential disputes. It’s also helpful for the client’s future reference.

3. Send Receipts Promptly

Send receipts as soon as payment is processed. Avoid delays, as this might confuse the client or raise doubts about your business’s reliability.

4. Keep it Simple

Don’t overload the receipt with unnecessary details. Focus on the transaction, providing clear payment methods and relevant terms. Avoid clutter to maintain professionalism.

5. Offer Digital Receipts

For convenience, offer receipts in digital form. Email or PDF formats make it easy for clients to save and retrieve them later, and reduce paper waste.

6. Use Clear Payment Terms

Clarify payment terms on the receipt. Indicate whether the payment was full, partial, or if there’s an outstanding balance. If applicable, include payment due dates for future clarity.

7. Personalize the Receipt

A personal touch goes a long way. Include a short note of thanks or an acknowledgment of the work completed. This makes the transaction feel more client-focused and strengthens relationships.

8. Follow Up If Necessary

If a client has not received or acknowledged their receipt, follow up politely. Keep a record of all correspondence in case further action is required.

Payment Receipt Template for Consultant

Replace repetitive terms with synonyms while keeping the overall meaning and structure intact. This can improve readability and provide variety in communication.

For instance, instead of repeating “consulting services,” try “advisory assistance” or “expert guidance” in different sections of the document. This small change enhances flow while preserving clarity. Consistency in terminology remains important, so ensure synonyms align with the context of the document.

Make sure to include key elements in the receipt, such as the client’s name, the service provided, the date, and the total amount. Organize the details in a clear, easy-to-read format like the table below:

| Client Name | Service Provided | Date | Total Amount |

|---|---|---|---|

| John Doe | Consulting on Marketing Strategy | Feb 5, 2025 | $500.00 |

Such structured documents enhance transparency and ensure both parties are aligned on payment details. When editing, remember to maintain consistency in the overall tone and professionalism throughout the receipt.