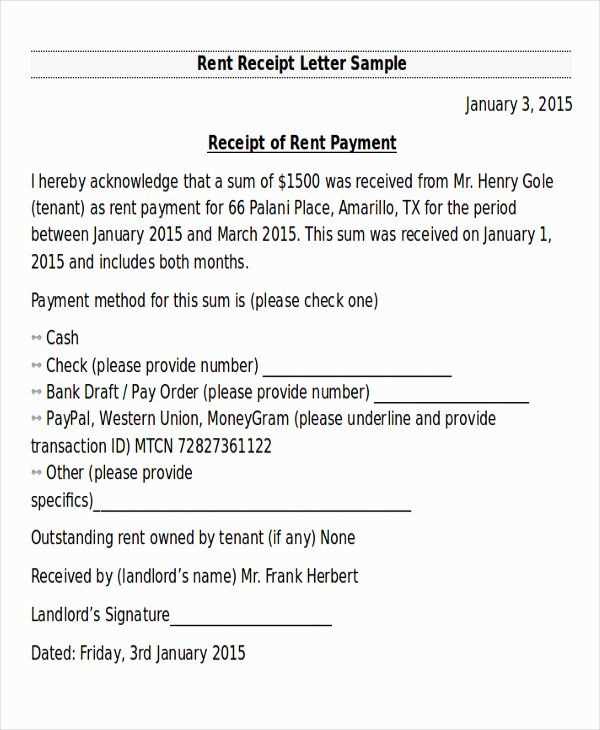

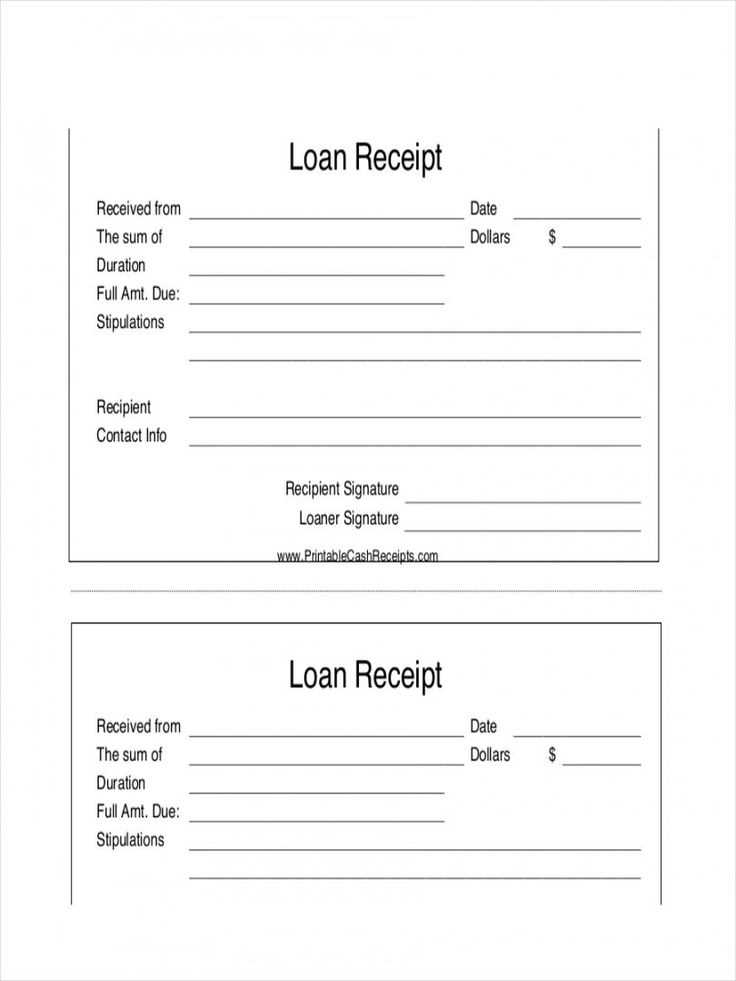

Always specify the amount, date, and payment method in a receipt letter. This ensures clarity and serves as proof of the transaction. Include the payer’s and recipient’s details, along with a unique reference number for easy tracking.

State the purpose of the payment clearly. Whether it’s for a product, service, or subscription, make sure to describe it concisely. If applicable, mention any taxes or fees included in the total amount.

Use a professional yet friendly tone. A brief note of appreciation enhances the recipient’s experience. Phrases like “Thank you for your payment” help maintain positive relationships.

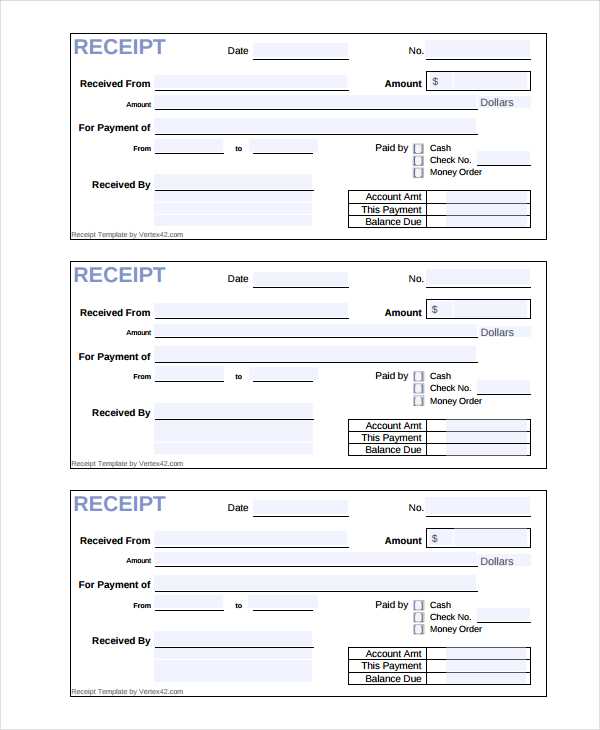

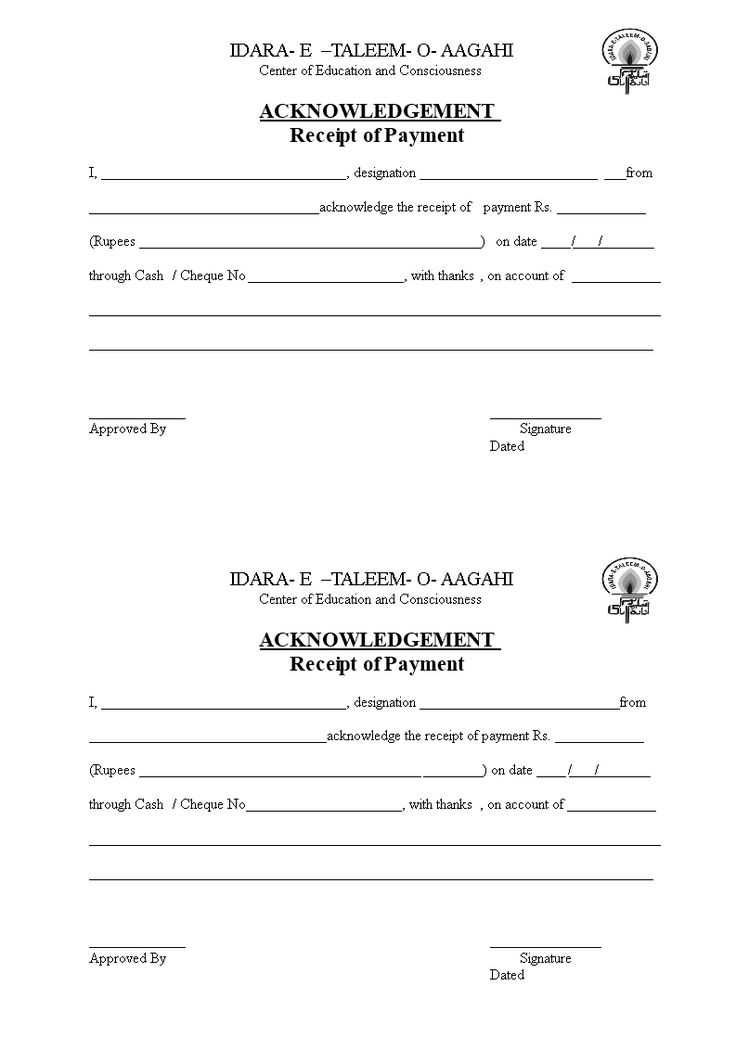

Ensure the document is structured properly. A well-formatted receipt includes a subject line, payment summary, and sender’s contact information. This makes it easy to reference in future communications.

Here’s a version with reduced repetition, maintaining meaning and correctness:

To create a concise and clear payment receipt, focus on including the essential details without redundancy. Start with the payment date and transaction number to ensure clarity. Then, specify the amount paid, the recipient’s name, and the method used for the transaction. Avoid repeating these details unnecessarily in different sections. Keep descriptions brief and direct, ensuring they are easy to understand. Use clear formatting to highlight key information like the total amount and date for quick reference.

Tips for Streamlining Payment Receipts

Ensure all critical details are easy to find by organizing the receipt logically. Use bullet points or separate lines to break up information into sections like payment details, recipient information, and transaction method. Keep the language straightforward and avoid using too many adjectives or filler phrases. This makes the receipt more efficient and professional.

Final Thoughts on Simplifying Receipts

Always prioritize clarity and relevance. By focusing on key information, you reduce the need for repetitive phrases while maintaining a professional tone. A clean, easy-to-read receipt provides a better experience for both parties involved in the transaction.

- Payment Receipt Template Letter

To create a clear and professional payment receipt, start by including key information. Begin with the date of the transaction and the payment method used. Ensure the payer’s details, such as name and address, are correctly noted. Be specific about the amount paid, including the currency and any taxes involved. Also, outline the purpose of the payment to avoid confusion.

The format of the letter should be simple, including sections for both parties’ details, a description of the transaction, and the signature line. Below is an example of how to structure your payment receipt template letter:

| Section | Details |

|---|---|

| Payer Information | Name, Address, Contact Details |

| Receiver Information | Name, Address, Contact Details |

| Date | Transaction Date |

| Amount Paid | Total Amount, Currency |

| Payment Method | Cash, Credit Card, Bank Transfer, etc. |

| Purpose | Description of the transaction (e.g., Service Payment, Product Purchase) |

| Signature | Both Parties’ Signatures |

This template ensures both clarity and professionalism, covering all necessary information without overcomplicating the document. Adjust the details according to the specific transaction, ensuring all relevant information is included for easy reference.

A transaction confirmation should be clear and detailed, ensuring both parties have the necessary information for reference. The following key elements should be included in any transaction confirmation letter:

1. Transaction Date and Time

Specify the exact date and time of the transaction. This helps in verifying the details in case of any disputes or inquiries later. Include both the transaction date and the time zone used for accurate timing.

2. Transaction Amount

Clearly state the total amount of the transaction. Include the currency used to avoid confusion in international transactions. This detail should be precise, with no room for ambiguity.

3. Transaction Reference Number

Provide a unique reference number for the transaction. This will serve as an identifier for both parties involved and can be used for tracking or resolving any issues that arise.

4. Payment Method

Describe the method used to complete the transaction. Whether it’s a credit card, bank transfer, or another method, detailing this can help track payment discrepancies or assist in accounting processes.

5. Purchaser and Vendor Information

List the names, addresses, and contact information of both the buyer and the seller. This ensures both parties can reach out if clarification is needed.

6. Description of Goods or Services

Include a brief description of the items or services involved in the transaction. This could include the quantity, specifications, or service details provided. Be clear to avoid confusion later.

7. Shipping or Delivery Details (if applicable)

If physical goods were part of the transaction, specify shipping or delivery details. Include tracking information or delivery dates for both parties to monitor progress.

8. Refund and Return Policy

Include any applicable refund and return policies, particularly for goods that could potentially be returned or exchanged. This ensures both parties understand their rights and responsibilities in the case of a dispute.

Transaction Breakdown Table

| Item | Description | Amount |

|---|---|---|

| Transaction Date | February 8, 2025 | – |

| Amount | Payment for Services | $500.00 |

| Reference Number | TX123456789 | – |

| Payment Method | Credit Card | – |

| Shipping Details | Standard Shipping | – |

Begin with a clear title that immediately reflects the purpose of the receipt. This should be prominently placed at the top, ideally in bold or a larger font size to grab attention. A concise heading such as “Payment Receipt” or “Receipt for Payment” works best. Follow this with the essential details–payment amount, transaction date, and the involved parties. Organize these details in a logical flow to avoid confusion.

Use Organized Sections

Break the document into clear sections. Start with a header section that includes the payee and payer’s information. Then, have a dedicated area for the transaction details, such as payment method, reference numbers, and any relevant notes. Each section should be distinct, either through spacing or headings, to guide the reader easily through the document.

Incorporate Readable Formatting

Utilize bullet points or numbered lists where applicable, especially for listing items, services, or amounts paid. Keep font choices simple and legible, using standard types such as Arial or Times New Roman. Avoid overly stylized fonts that may detract from the professional look. A balanced layout ensures the document is easily skimmed and understood at a glance.

Highlight Key Information by making important payment details, such as the total amount paid, bold or underlined. This draws the reader’s attention to what matters most, preventing any confusion in case of future reference.

Lastly, provide a clear space at the bottom for both parties to sign, if necessary. This adds an extra layer of formality and professionalism to the document.

Start with a clear, concise, and direct approach. Maintain a professional but friendly tone to ensure your message is both respectful and approachable.

- Formal tone: Use this when addressing clients, business partners, or institutions. Keep the language clear and precise, avoiding casual expressions. Phrases like “Thank you for your payment” or “We appreciate your promptness” are suitable.

- Informal tone: For regular customers or close business relationships, a lighter tone works best. You can express gratitude more casually, e.g., “Thanks for your payment” or “We really appreciate it!”

Consider the context and the recipient when choosing the level of formality. If you are unsure, it’s better to lean towards more formality, as it helps maintain professionalism.

Start by organizing the information clearly. Break down the total amount into separate line items, detailing individual costs, taxes, and any applicable fees. This prevents confusion and ensures transparency.

- Use precise figures: Avoid rounding numbers. Report totals exactly as they appear in the records.

- Clarify payment methods: Specify whether payments were made via bank transfer, credit card, or another method, including any transaction references or IDs.

- Provide due dates: Clearly mention any deadlines for payments or payment periods covered by the receipt.

- Incorporate all necessary contact details: Include the recipient’s address, phone number, and email to make it easier to reach for clarification.

- Ensure consistency: Use the same format for monetary values and dates throughout the document for a polished look.

Double-check your figures. Verify that all amounts match the receipts or invoices that are being referenced. A simple mistake can make a significant difference to the clarity and trustworthiness of the document.

Keep a detailed and organized record of all transactions. This includes accurate entries of payments, receipts, and related documentation. Ensure that the receipt clearly states the transaction’s purpose, date, and amount. For tax compliance, include your tax identification number (TIN) if applicable, as well as the applicable tax rate. Verify that all receipts reflect the correct tax calculations and follow local tax regulations.

Use a consistent format for your receipts, including clear references to your business’s legal name and contact details. If applicable, show any discounts, refunds, or adjustments made to the original payment. Make sure to retain copies of each payment for the required time period specified by local tax authorities. Consider using accounting software to generate receipts that comply with legal and tax requirements automatically.

Stay updated with any changes in local tax laws. Regularly consult with a tax advisor to ensure that your receipts meet all legal standards. Filing your records accurately will help avoid any potential penalties or fines during audits.

Inaccurate or Missing Information: Ensure all details, such as transaction amount, date, and buyer’s name, are correct. A small error can cause confusion or disputes. Always double-check every entry before finalizing the receipt.

Clarity and Readability

Write in clear, simple terms. Avoid abbreviations or unclear wording that might confuse the reader. The buyer should quickly understand the details without needing further explanation.

Neglecting Proper Formatting

Use a consistent layout with well-organized sections. Separate key information like transaction amount, taxes, and items purchased. A cluttered or unorganized format can make it harder to retrieve the necessary data in the future.

Overlooking Tax Details: If applicable, include tax amounts separately. Failing to list taxes can lead to misunderstandings, especially for business transactions that require proper accounting.

Ensure that your payment receipt template is clear and precise by following these steps:

- Include the date of the transaction for reference.

- Clearly state the amount paid, using both numbers and words to avoid confusion.

- Provide details about the goods or services exchanged, including descriptions, quantities, and prices.

- List the payment method used (e.g., credit card, cash, bank transfer).

- Include any applicable taxes or discounts to show transparency in the total amount.

- Ensure the recipient’s information is accurate, such as their name or business name.

- Use a professional but approachable tone, ensuring that the language is easy to understand.

By maintaining these guidelines, your payment receipts will be clear and serve as reliable documentation for both parties involved.