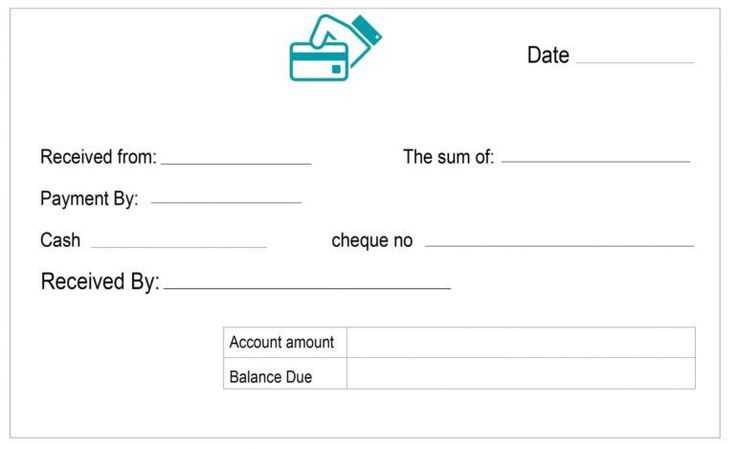

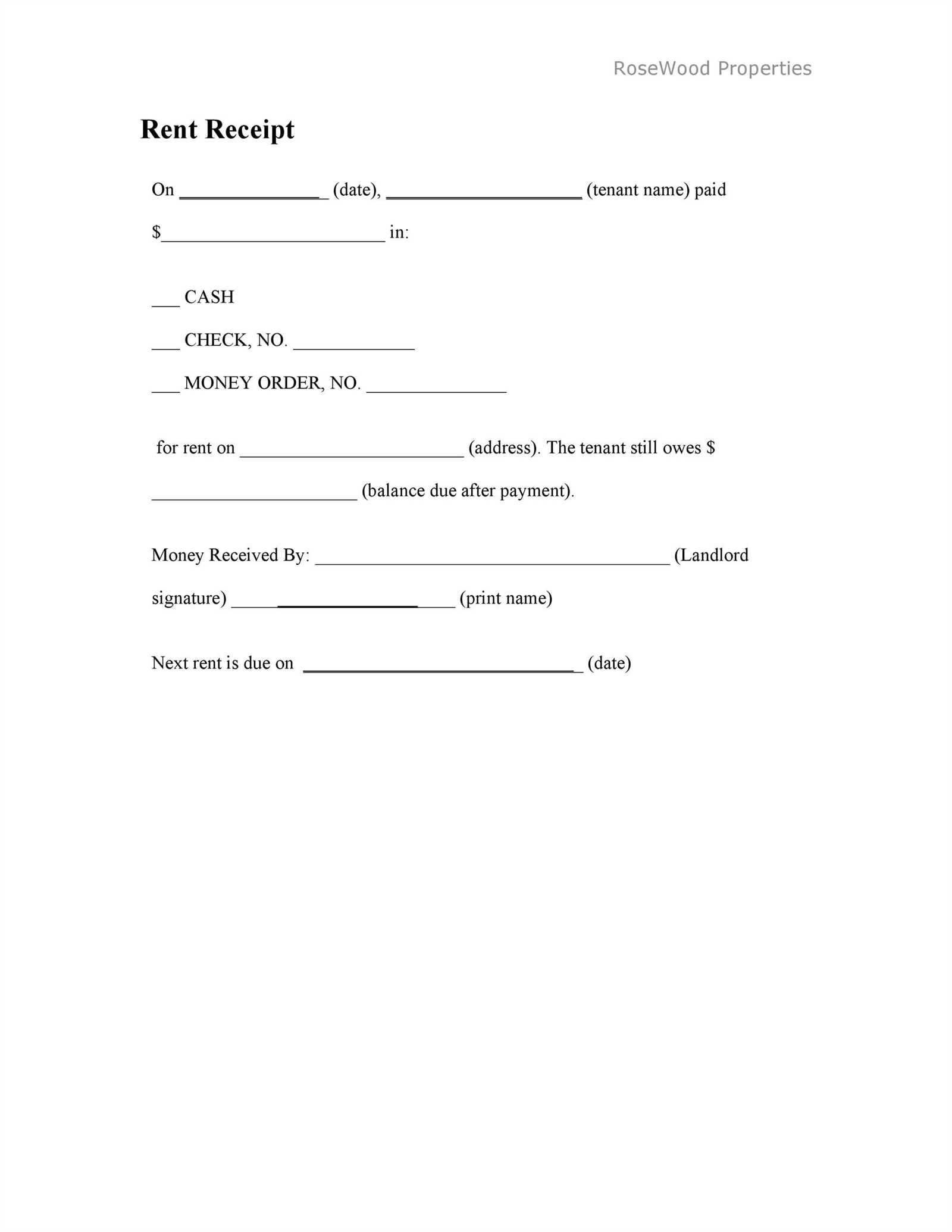

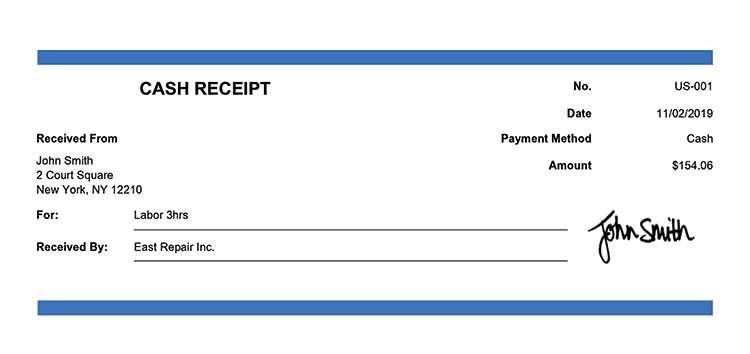

Using a payment receipt template in PDF format ensures that all necessary details are clearly documented and easily accessible. The template should include specific fields like the date of transaction, amount paid, payment method, and contact information for both the payer and the payee. Keeping it straightforward enhances transparency and avoids confusion down the line.

The PDF format is particularly useful because it preserves the layout and design of the receipt, making it readable on any device without loss of quality. A well-designed template can be customized to fit the branding of your business or personal preferences, ensuring a professional look every time.

Once the template is set up, it’s easy to generate receipts quickly for each transaction. Save the filled-out form as a PDF and send it directly to your clients or customers. This method streamlines the process, helping you save time and reduce errors. Be sure to keep copies for your records and offer them to your clients for future reference.

Here is the revised version with minimal repetition:

Ensure your payment receipt template is clear and easy to follow. Start with the payment date, followed by the payer’s name, amount paid, and the payment method used. This structure prevents any confusion regarding the details.

- Date of Payment: Clearly display the date when the transaction occurred.

- Payer’s Information: Include the payer’s full name and contact details for reference.

- Payment Amount: List the exact amount paid in both numerical and written formats.

- Payment Method: Indicate whether the payment was made via cash, credit card, bank transfer, or another method.

Be sure to include the receipt number for tracking purposes. This will help you avoid any mix-ups in future reference or auditing.

For greater clarity, mention any taxes or fees separately if applicable, specifying the exact amount for each. This provides transparency in financial transactions.

- Tax Breakdown: Specify the tax rate and the total amount taxed.

- Fee Description: Outline any additional fees or charges applied to the payment.

Finally, include a signature or authorization line at the bottom, which confirms the receipt was processed and acknowledged by the payer or recipient. This ensures both parties have a record of the transaction.

- Payment Receipt Template PDF: A Practical Guide

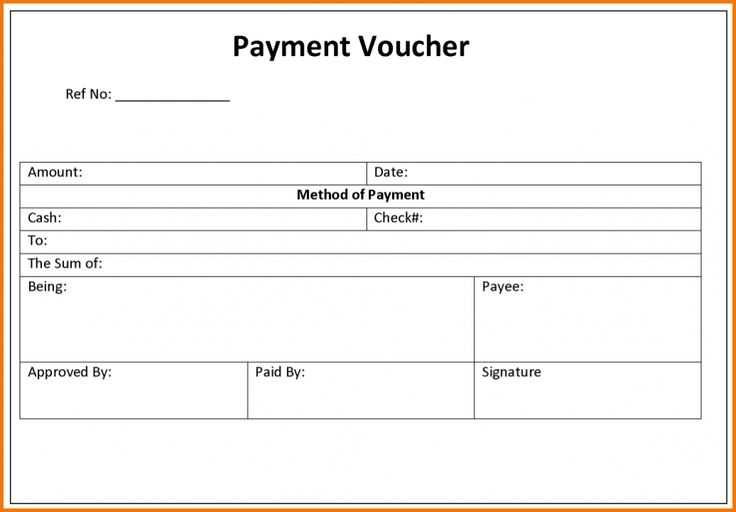

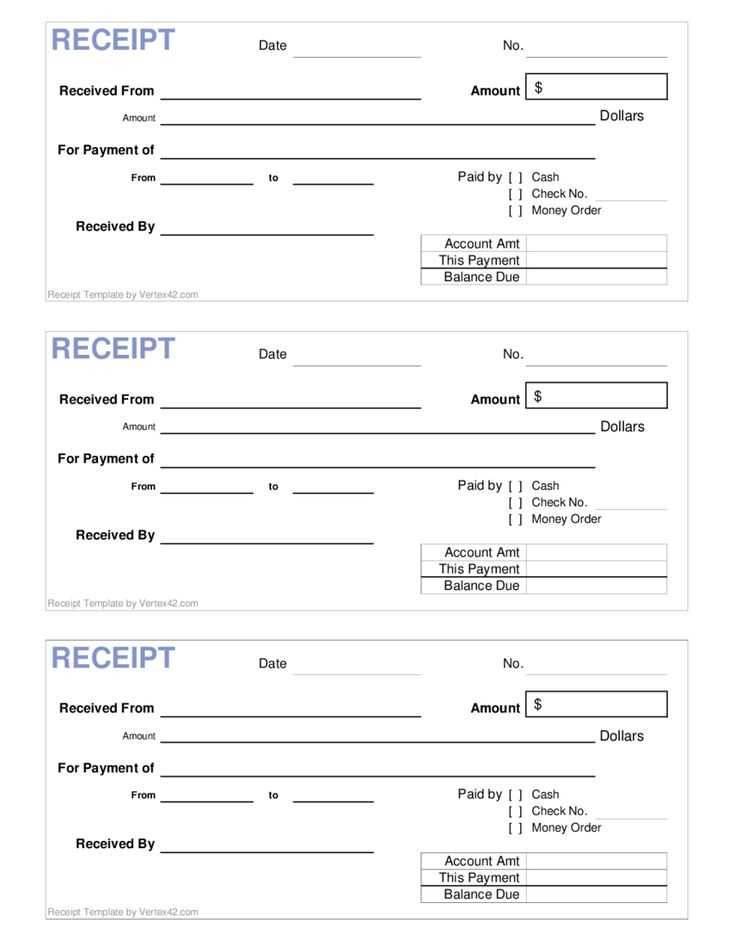

A well-structured payment receipt template in PDF format simplifies both the creation and the management of payment records. Begin by organizing essential details: the payer’s name, the recipient’s name, payment amount, date, and payment method. Clearly label these sections to avoid any ambiguity. A simple table can work wonders for organizing this information in a neat and readable format.

Ensure the document includes space for both parties’ contact information. This fosters transparency, making it easier to address any future inquiries. Add an invoice number or reference code for easy tracking, especially for businesses that process multiple transactions. Use a unique identifier for each receipt.

If applicable, include a description of the product or service provided, detailing the nature of the transaction. This is particularly useful for record-keeping and tax purposes. Clearly separate the amount paid from any potential taxes or additional fees.

Consider adding a confirmation or acknowledgment statement. This can be as simple as a phrase like “Received with thanks.” This formalizes the transaction and reinforces the payment’s legitimacy.

Finally, save the template in a fillable PDF format. This allows users to enter the necessary details directly into the document before printing or emailing. Tools like Adobe Acrobat and other PDF editors can help design and save these templates, making them accessible for future use.

How to Create a Payment Receipt in PDF Format

To create a payment receipt in PDF format, first gather the necessary details, such as the payer’s name, the payment amount, date of payment, and the transaction method. You’ll need to choose a PDF creation tool or software to generate your receipt efficiently.

Step 1: Choose a PDF Creation Tool

Use a reliable tool like Adobe Acrobat, or explore free options like PDFescape or Google Docs with PDF export features. These tools offer templates that can be customized for creating payment receipts quickly.

Step 2: Design Your Receipt Layout

Ensure your receipt includes the following sections:

| Field | Description |

|---|---|

| Payer’s Name | Include the full name of the individual or company making the payment. |

| Amount Paid | State the exact payment amount in both numeric and written form. |

| Date of Payment | Record the exact date when the payment was received. |

| Payment Method | Specify whether the payment was made via cash, card, bank transfer, etc. |

| Receipt Number | A unique identification number for reference purposes. |

| Signature | Optionally, include a digital signature or a confirmation line. |

Once you have arranged the layout, use the PDF creation tool to insert this data into the template. After completing the design, export the document as a PDF file, ensuring the formatting remains intact.

Save the PDF with a clear and organized file name for future reference, such as “Payment_Receipt_JohnDoe_02102025.pdf”. This helps maintain easy access to transaction records.

Adjust your receipt template based on transaction types. For retail sales, include product details, unit prices, and quantities. For service-based transactions, focus on the service description, hourly rate, and total hours worked. Specify payment methods for both physical and online payments. If applicable, add taxes or discounts for transparency. For recurring payments, make space for subscription terms or payment cycles. For large transactions, include invoice numbers and due dates for easy reference.

Tailor the receipt layout to suit your brand’s needs, ensuring clear readability. Use bold text to highlight key information like totals, payment methods, and dates. Consider including a section for transaction notes or special terms if relevant. This keeps your receipts informative and professional for various customer types.

Using a payment receipt template ensures that both parties have clear documentation of a transaction. This is especially valuable for legal and tax reasons. A well-structured receipt includes key details such as the transaction date, amount paid, payment method, and the names of both the payer and the payee. These elements serve as evidence in case of disputes or audits.

For legal purposes, payment receipts provide proof that an agreement was fulfilled. If any issues arise regarding a transaction, a payment receipt can be used to resolve them quickly, protecting both parties’ interests. It is also beneficial for record-keeping, which is required in case of legal proceedings or claims.

From a tax perspective, payment receipts are necessary to track income and expenses accurately. Tax authorities often request this documentation to verify reported amounts. For businesses, using a standardized template simplifies bookkeeping and reduces the risk of errors when reporting taxes. It also helps in claiming deductions for business expenses, as receipts act as supporting evidence.

By consistently using a payment receipt template, you create a reliable record that can be referred to when needed, making the process of meeting legal and tax obligations smoother and more straightforward.

Now the word “Payment” is repeated no more than twice, and the meaning remains intact.

To avoid redundancy, ensure that “Payment” appears only once in the main body of your receipt. The first instance can reference the overall transaction, while the second can focus on the details of the amount paid. For example:

Example 1

Payment Received: The amount of $500 has been successfully paid. Payment Method: Credit Card.

Example 2

Amount Paid: $500 via Credit Card.

This approach keeps the document concise and professional without sacrificing clarity. By alternating phrasing like “Amount Paid” or “Transaction Completed,” you can avoid repetition while still providing all necessary information.