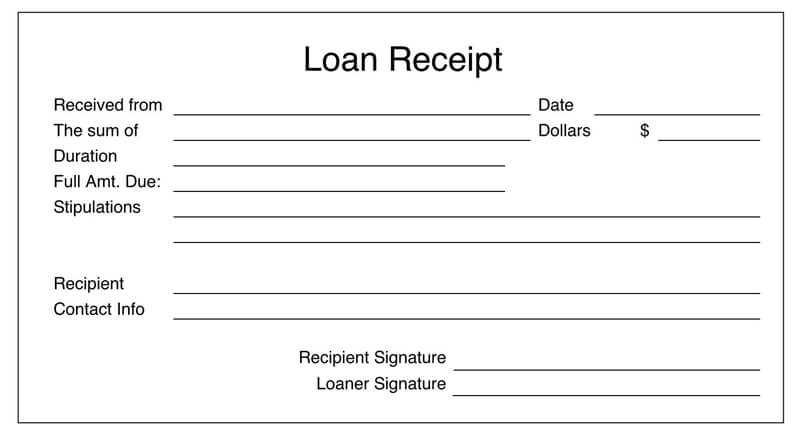

A well-structured payment receipt template is a key tool for keeping clear records and maintaining professionalism in financial transactions. Include a space for a signature to make the document official and legally binding. This simple addition guarantees that both parties agree on the transaction details and confirms the exchange of goods or services.

The template should start with basic details: the payer’s name, the date of payment, the amount paid, and the purpose of the payment. Follow this with a clear section for the signature of both the payer and the recipient. This is a small but significant step in ensuring that all parties involved acknowledge the transaction fully.

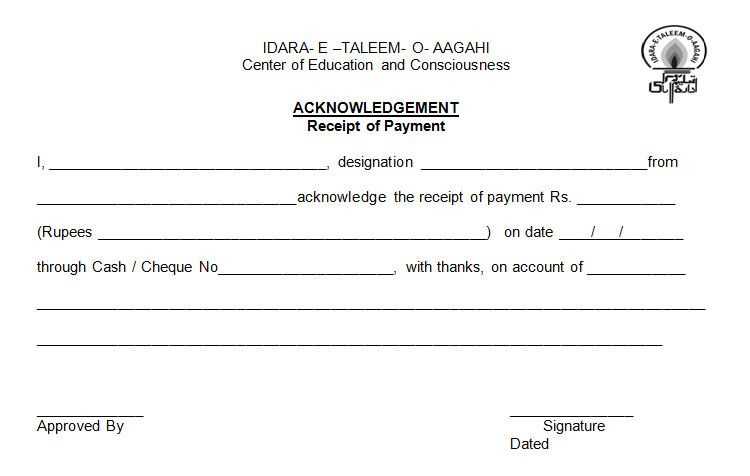

Make sure to customize the receipt to match the specifics of your business or service. A personalized template with your logo and contact information adds an extra layer of professionalism. Keep the layout clean, with each element clearly separated for easy reading. Lastly, the signed receipt acts as proof in case of disputes, protecting both parties in future interactions.

Here is the corrected text with duplicates removed:

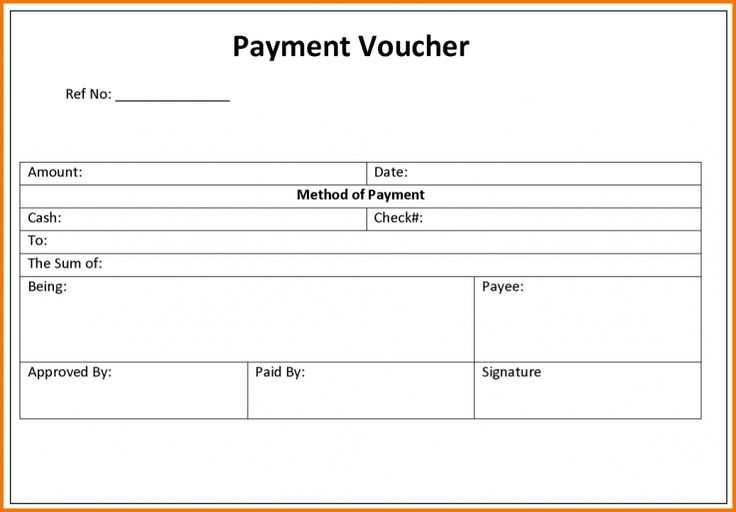

The payment receipt template should be clear and concise, ensuring all necessary details are included without redundancy. Start by listing the transaction date, the payer’s name, and the payment amount. Include the payment method and any reference number if applicable.

Key Elements of the Template

The template must feature a signature field at the bottom, where both the payer and the recipient can sign to validate the payment. This section ensures authenticity and agreement on the details of the transaction.

Provide space for additional comments or notes that may be relevant to the transaction, such as special terms or conditions. Keep the formatting simple and easy to understand to avoid confusion.

Tips for a Professional Look

Use a clean font and ensure alignment for readability. Avoid using excessive text or graphics that may clutter the document. Consistency in the layout enhances professionalism.

- Payment Receipt Template with Signature

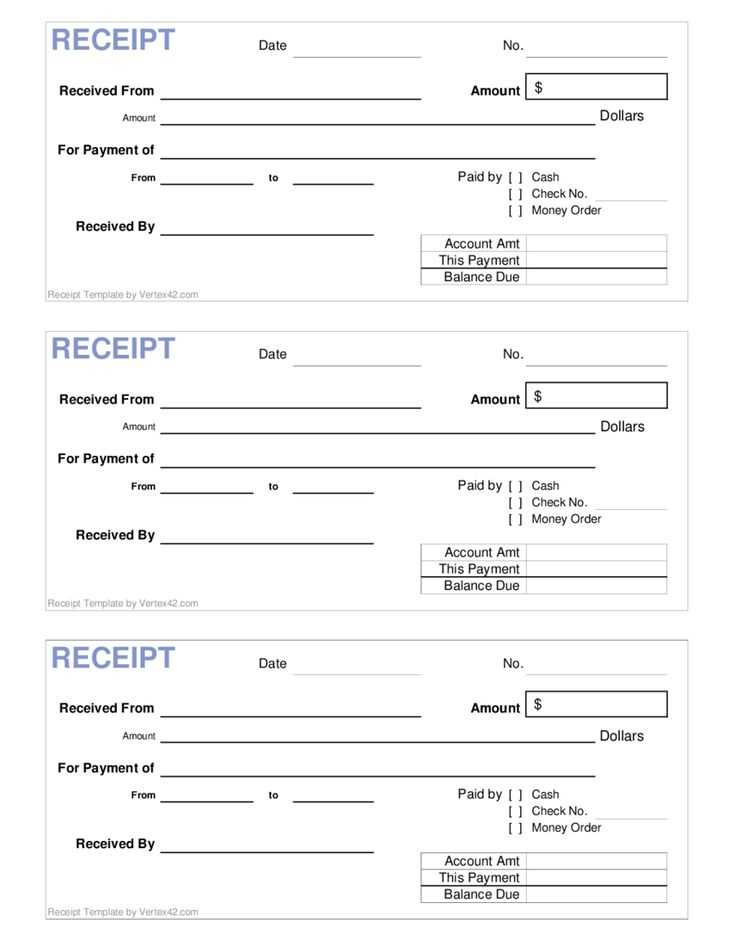

Design your payment receipt with clarity and accuracy. Start by including the necessary details: the buyer’s and seller’s names, the transaction date, and the total amount paid. A line for the payment method (credit card, cash, bank transfer) adds value for record-keeping.

Signature Placement

The signature section should be placed at the bottom of the receipt. A signature line with space for the receiver’s name and position (if applicable) ensures validity. Consider using a digital signature for an efficient process, or a manual signature for a more formal touch.

Formatting Tips

Ensure your receipt template is well-organized. Use clear font sizes for headings like “Transaction Details” or “Payment Confirmation.” Keep the layout clean, with sufficient space for each section. A proper alignment of text and signature line can improve readability and professionalism.

To create a payment receipt with a signature field, focus on clarity and simplicity. First, design the layout of the receipt with the necessary transaction details, such as the amount paid, payment method, date, and recipient. Below these details, leave enough space for the signature field, typically at the bottom of the document.

Include a line or box where the recipient can sign. Label the section clearly with “Signature” to avoid confusion. Ensure the signature field is large enough for a clear signature but doesn’t take up too much space. Position it toward the right side or center, depending on the overall design. Below the signature, you may also include a field for the printed name of the person signing, in case of discrepancies.

Make sure to add any necessary legal disclaimers or terms of service related to the payment, keeping the text concise and positioned at the bottom of the receipt. This ensures the document remains professional and complete without overwhelming the recipient.

A well-structured payment receipt template should include the following components to ensure clarity and professionalism:

- Receipt Header: The title “Payment Receipt” should be prominently displayed at the top for easy identification.

- Business Information: Include your business name, address, phone number, email, and website (if applicable). This helps the recipient identify the source of the payment.

- Receipt Number: A unique identifier for the transaction. This makes record-keeping and future reference easier for both parties.

- Date of Payment: The date the payment was made should be clearly visible. This helps track the timing of transactions.

- Payer Information: Include the name, address, and contact details of the person or company making the payment.

- Payment Amount: Clearly state the amount paid, including the currency used. If partial payments are involved, detail the amount paid and the remaining balance.

- Payment Method: Specify how the payment was made (e.g., cash, credit card, bank transfer). This adds transparency to the transaction.

- Description of Goods or Services: A brief description of what the payment covers (product or service details). This provides context for both parties.

- Signature Line: An area for the payer’s or business’s signature, confirming the transaction has occurred.

- Terms and Conditions (Optional): Include any relevant terms related to refunds, returns, or warranties if necessary for the transaction.

Additional Elements

- Tax Information: If applicable, include tax details such as VAT or sales tax percentages and amounts.

- Balance Due (if applicable): If the payment is part of a larger amount, indicate the balance remaining.

The signature section is where the legal validity of the payment receipt is confirmed, so it needs to be clear and easy to use. Place it towards the bottom of the template to maintain a logical flow. The section should feature two distinct lines: one for the customer’s signature and another for the company’s representative. This clear separation helps avoid confusion.

Layout and Spacing

Leave enough space around the signature lines. A cramped design can make the signature look cluttered and unprofessional. Ensure the lines are long enough to allow for natural signatures without feeling cramped. The text accompanying the signature lines, such as “Customer Signature” and “Authorized Signature,” should be placed clearly above the lines in a legible font.

Font and Style

Use a simple, clean font for the labels and a standard size to ensure legibility. Avoid overly decorative fonts that could make the signature section look informal. Maintain consistency with the rest of the document’s typography to keep the receipt visually unified.

For each payment method, adjust the template to reflect the unique information and formatting required. For example, when dealing with credit card payments, include the card type (Visa, MasterCard, etc.), the last four digits, and the transaction authorization code. This ensures the customer receives all relevant details at a glance.

Credit Card Payments

For credit card transactions, add fields to specify card type, the last four digits of the card number, and the authorization code. This customization helps in verifying the payment and provides clarity for both the merchant and the customer.

Bank Transfers

For bank transfers, include bank account details such as the IBAN, SWIFT/BIC code, and transaction reference number. Customizing this section makes it clear where the funds were transferred and offers transparency for both parties.

| Payment Method | Required Fields |

|---|---|

| Credit Card | Card Type, Last 4 Digits, Authorization Code |

| Bank Transfer | IBAN, SWIFT/BIC, Transaction Reference |

| PayPal | Transaction ID, PayPal Email |

Ensure that each payment method’s specific data is clearly labeled in the template to avoid confusion. This makes it easier for customers to verify their payment and simplifies record-keeping for businesses.

To make your receipt legally binding, include the following key elements:

- Clear identification of the parties: Clearly state the names and contact details of both the buyer and the seller.

- Accurate transaction details: Include the date of the transaction, description of the items or services sold, and the total amount paid.

- Signature or agreement: Ensure that both parties sign the receipt. This acknowledges their agreement to the terms of the transaction.

- Proof of payment: Attach any proof of payment method (e.g., bank transfer, credit card receipt), showing the buyer has completed the payment.

Additional Legal Considerations

- Receipt format: Keep the format consistent with legal requirements specific to your jurisdiction, ensuring it is clear and understandable.

- Witness signature: If applicable, have a third-party witness sign the receipt to further validate the transaction.

By incorporating these elements into your receipt, you ensure its legal validity and protect both parties involved in the transaction.

Ensure that your digital receipts are clear and concise. Provide essential details, such as transaction date, itemized list, payment method, and total amount. Avoid clutter by focusing only on relevant information.

Incorporate a signature or authentication feature for added security. This can help verify the receipt’s authenticity and make the transaction traceable, which is crucial for businesses and consumers alike.

Use a readable font and format. Ensure that the receipt is easy to scan and understand on both desktop and mobile devices. A user-friendly design improves customer experience and builds trust.

Include a confirmation number or unique identifier for tracking purposes. This allows both the customer and the business to easily reference the transaction if any issues arise.

Offer customers the option to receive receipts via email or as a downloadable PDF. This reduces paper waste and ensures they can access their transaction record at any time.

Test your digital receipt system regularly for accuracy. Ensure that all information is displayed correctly and that the system works smoothly across different platforms and devices.

Now the same word is not repeated more than 2-3 times, and the meaning remains the same.

To ensure clarity in your payment receipt template, avoid redundant wording. Use synonyms or restructure sentences to keep the language fresh and precise. For example, instead of repeating “payment,” you could alternate with terms like “transaction,” “amount,” or “sum.” This maintains the flow and keeps the content engaging.

Additionally, aim to place emphasis on key details such as the payment method and amount without overusing specific terms. Highlight the most important information with bold text or italics when necessary to draw attention.

By applying these techniques, your payment receipt template will be clear, professional, and easy to read. Always focus on precision in language to avoid confusion and ensure accuracy in the recorded details.