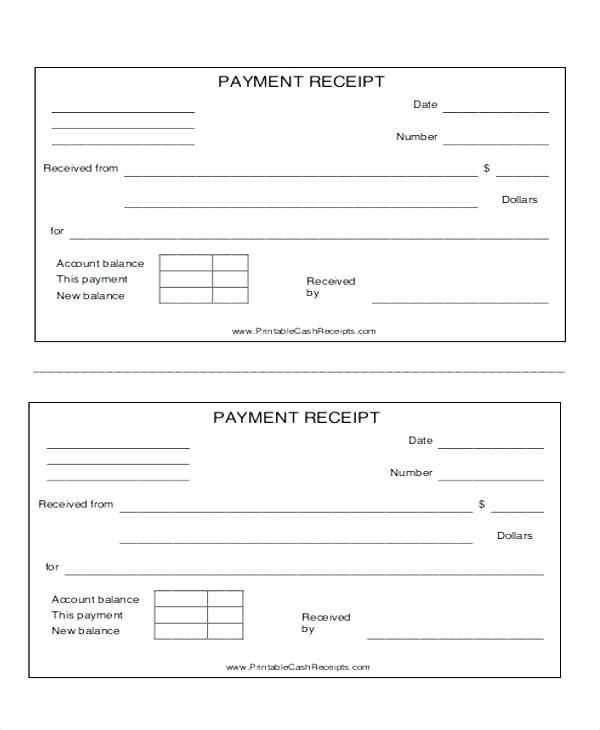

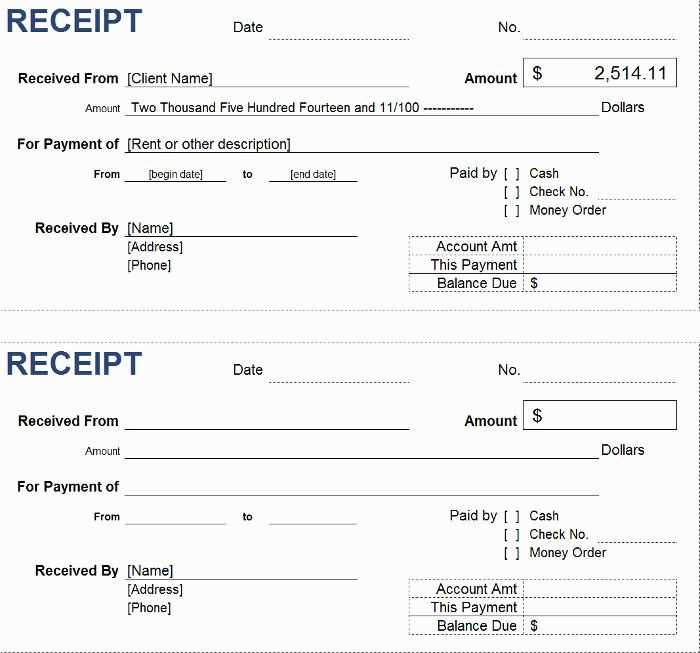

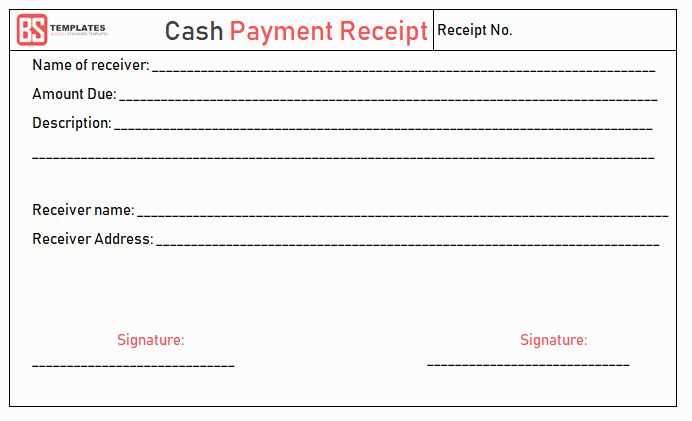

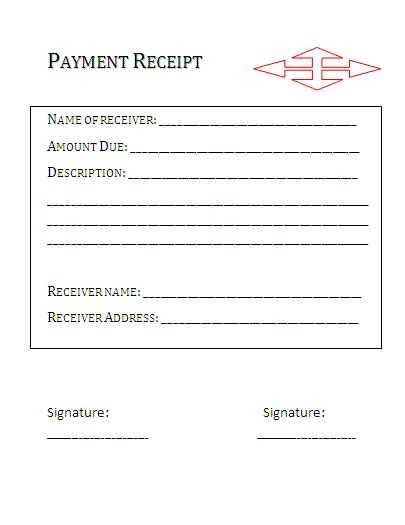

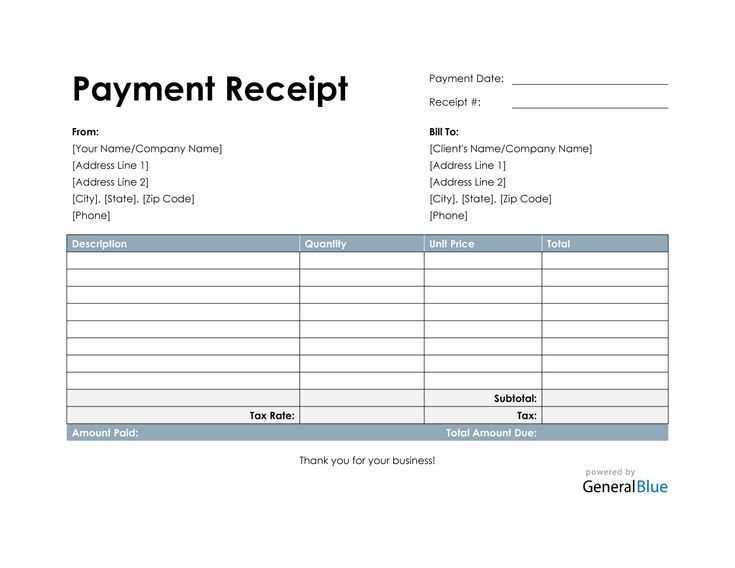

To create a payment receipt, use a template that covers all the essential details: payer and payee names, transaction amount, date, and payment method. A well-designed template helps avoid mistakes and provides a professional, easy-to-read record for both parties. Make sure the template fits your business needs, whether you’re handling small transactions or larger contracts.

When customizing a payment receipt template, include fields that are specific to your industry. For example, if you’re in real estate, consider adding a property address or a reference number to help track payments. For e-commerce businesses, include an order number and itemized list of purchased products. This information ensures clarity and helps with future record-keeping.

Ensure the layout is clean and user-friendly. Avoid clutter by sticking to a simple design that highlights key details. Use bold text for headings like “Payment Amount” and “Transaction Date”, so they stand out. Use a consistent font and spacing to make the receipt easy to read, whether printed or viewed digitally.

Lastly, make sure the payment receipt template is adaptable. You should be able to adjust it based on payment method (cash, credit card, or bank transfer) or transaction type (full or partial payment). This flexibility ensures you can use the template across various scenarios without needing to redesign it each time.

Here’s a version that removes redundancies while maintaining the meaning:

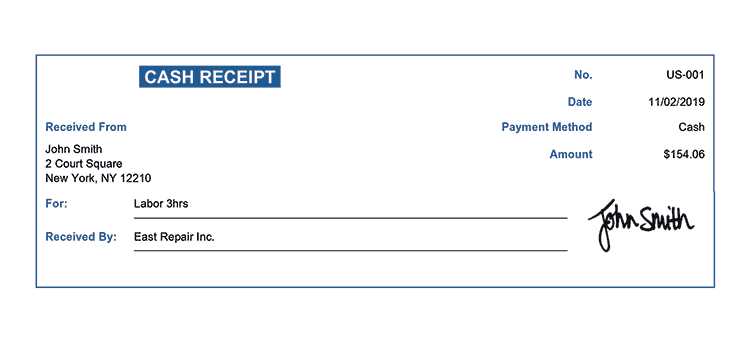

When creating payment receipt templates, it’s important to make sure the information is clear and concise. Start with the payment date, the amount, and a unique transaction reference. These details should be prominently displayed at the top.

Next, include the payer’s name and contact information, along with the recipient’s details. Avoid repeating these data points within the template; one mention is enough. If needed, include a brief description of the service or goods paid for, but keep it direct.

The payment method (e.g., credit card, bank transfer, cash) should be stated simply, along with any transaction or reference number tied to it. You don’t need to overcomplicate this section with unnecessary details like processing fees unless they’re relevant to the transaction.

Conclude with a thank-you message or a note that the transaction has been successfully processed. This adds a personal touch without overcrowding the template with unnecessary text.

By removing repetition, your template will be clear and efficient, ensuring both parties understand the key details without being overwhelmed by redundant information.

Payment Receipt Templates: A Practical Guide

How to Choose the Right Template for Your Business

Key Information to Include in a Payment Receipt

Customizing Receipt Templates for Different Industries

Top Free Tools for Creating Payment Receipts

How to Automate Receipt Generation with Templates

Legal and Tax Considerations When Using Templates

Choose a payment receipt template that fits your business needs and branding. Consider the type of transactions you handle–service or product-based businesses might require different layouts. Ensure the template is simple to customize and has space for all necessary information without clutter. A clean, professional look enhances trust and clarity.

Key details to include are the payment amount, date, method of payment, receipt number, business name and contact information, and a breakdown of purchased items or services. These elements provide transparency and help with bookkeeping. Adding the tax amount or VAT can also be helpful for clients and your financial records.

Different industries may require additional or fewer details. For example, a freelancer might need to include project descriptions or hourly rates, while a retail business could focus on product details and SKU numbers. Customize your template to reflect these nuances, while keeping it user-friendly.

For creating payment receipts without spending money, check out free tools like Invoice Generator, Canva, and Google Docs. They offer easy-to-use templates that you can personalize with your business information. Many platforms also allow you to save templates for future use, saving you time.

Automate receipt generation by integrating payment systems with invoicing software. This streamlines the process, ensuring that receipts are created instantly after a transaction. Platforms like QuickBooks or Zoho Books offer automation features that sync payments directly to receipt generation.

Finally, ensure your receipt template complies with legal and tax regulations. Include all necessary tax identification numbers or business registration details. If your receipts need to comply with specific local laws, such as VAT or sales tax, make sure your template accounts for this to avoid compliance issues down the road.