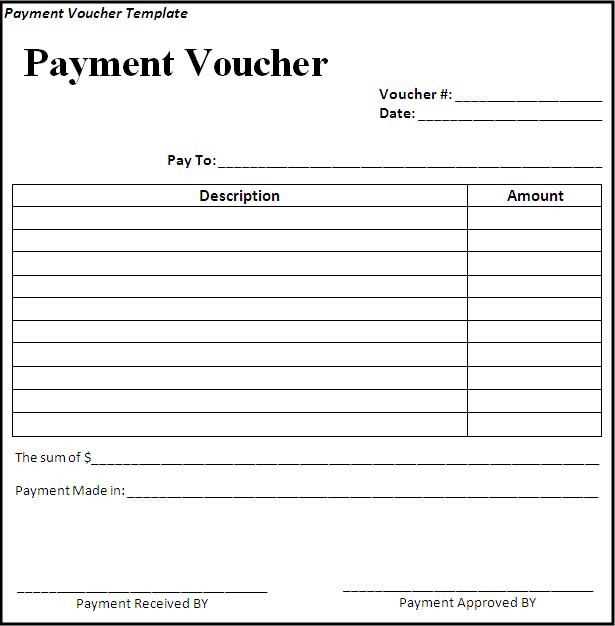

To create a seamless payment process, using a payment receipt voucher template is highly recommended. This template ensures all necessary details are captured in a structured format, making it easier for both the payer and payee to keep track of transactions. Include key information such as the transaction date, amount paid, and payment method to guarantee transparency and accuracy.

Make sure to customize the template to match your business’s branding and the specific nature of the transaction. Fields for customer information, a breakdown of products or services purchased, and applicable taxes can help provide clarity. Including a unique receipt number for each transaction will also facilitate easier record-keeping and tracking for future reference.

By utilizing this template, you streamline the process for both parties, reducing errors and miscommunication. It also adds a level of professionalism, ensuring that each payment is properly documented and can be easily retrieved in the future if needed.

Here’s the revised version:

Ensure the payment receipt voucher contains the following key details:

- Receipt Number – Assign a unique identifier to each receipt.

- Date of Payment – Clearly specify the exact date the payment was made.

- Payee Information – Include the full name or company name of the recipient.

- Amount Paid – State the total amount received in both numbers and words.

- Payment Method – Mention the method of payment (e.g., cash, check, bank transfer).

- Description of Goods/Services – Provide a brief summary of what the payment covers.

- Authorized Signature – Include a space for the signatory’s signature to validate the receipt.

By including these elements, you can ensure that the voucher provides a clear record for both parties involved.

- Payment Receipt Voucher Template

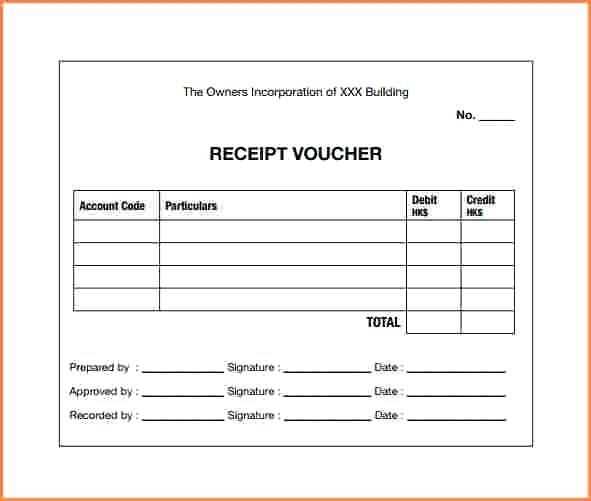

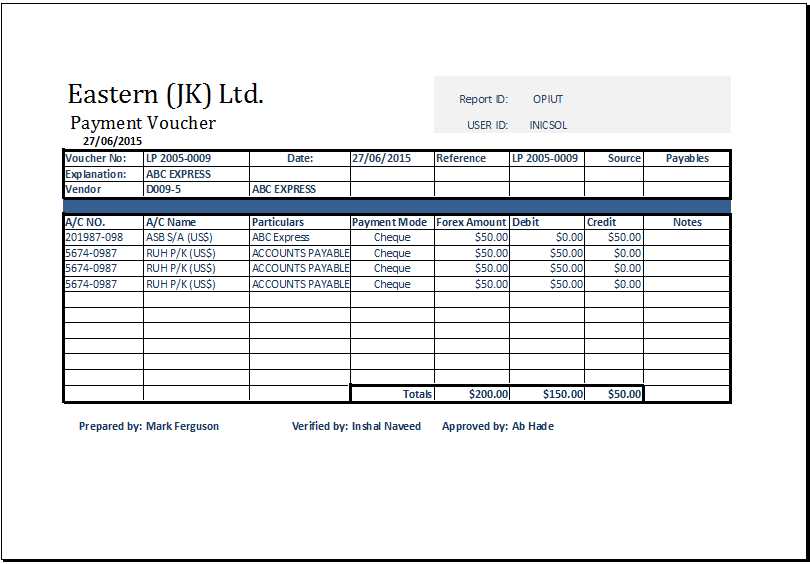

A Payment Receipt Voucher template is crucial for recording the payment transactions between a payer and payee. It serves as a legal document to acknowledge the receipt of funds for a service or product. Here’s how to structure it efficiently for clear documentation:

Key Components

| Section | Description |

|---|---|

| Voucher Number | A unique reference number for tracking and organizing receipts. |

| Date | The date the payment was received, ensuring a record of the transaction timeline. |

| Payee Details | Name, address, and contact information of the entity receiving the payment. |

| Payer Details | Name and contact details of the individual or company making the payment. |

| Payment Amount | The exact sum of money paid, along with the currency for clarity. |

| Payment Method | Indicates how the payment was made (e.g., cash, bank transfer, credit card). |

| Purpose | A short description of the reason for the payment (e.g., product purchase, service fee). |

| Signatures | Spaces for both payer and payee signatures, confirming the agreement and transaction. |

Template Layout

Here’s a simple, clear layout for a Payment Receipt Voucher:

| Voucher Number: [Enter Number] |

| Date: [Enter Date] |

| Payee Name: [Enter Name] |

| Payer Name: [Enter Name] |

| Payment Amount: [Enter Amount] |

| Payment Method: [Enter Method] |

| Purpose: [Enter Purpose] |

| Signatures: ______________________ (Payee) | ______________________ (Payer) |

This layout ensures all necessary details are captured, making it easier to track payments and ensure transparency in financial dealings.

Include the date of the transaction at the top of the receipt. This helps both parties track payment details and ensures clarity in financial records.

Clearly list the amount paid. Specify the currency and the exact figure to avoid any confusion.

Provide a breakdown of what the payment is for. If it covers multiple services or products, itemize each one with corresponding costs.

Show the payment method used, whether it’s cash, credit card, bank transfer, or another method. This adds transparency to the transaction.

Incorporate the name and contact information of the business or individual receiving the payment. This makes it easier to reference the receipt in case of future queries or disputes.

Include the payer’s information, especially if required for tax or accounting purposes. This ensures accountability and traceability.

Provide a unique receipt number. This serves as a reference for both the payer and payee, aiding in future identification and record-keeping.

Lastly, make sure to include any relevant terms or notes. For example, indicate if the payment is part of an installment plan or if there are any conditions attached.

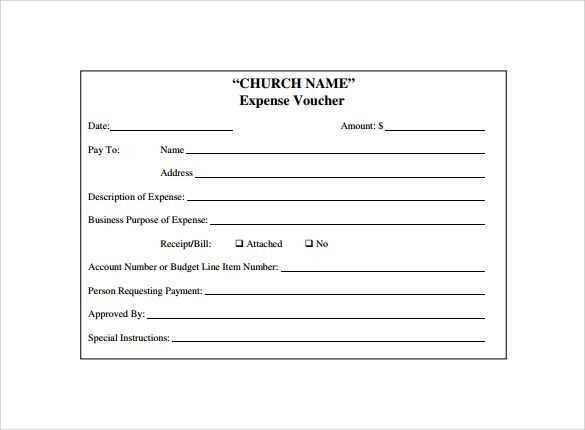

Tailor your receipt voucher by adjusting the layout and sections to match the specific requirements of your business. For retail businesses, emphasize the itemized list of purchased products or services, including quantity and price. For service-based businesses, highlight details such as service descriptions, duration, and hourly rates. Adding fields for taxes or discounts is also critical for transparency.

Include space for custom branding. This ensures that your company’s logo, colors, and contact information appear clearly on every receipt. If your business deals with multiple payment methods (like credit cards, cash, or digital wallets), provide options to specify the payment type used in the transaction.

For businesses that handle returns or exchanges, integrate a section for return/refund information, including policies and conditions. If applicable, add a tracking number or order ID for easy reference in customer service follow-ups.

Consider including a section for notes or special instructions, allowing customers to provide feedback or specific requests. This customization can enhance customer experience and improve communication. Ensure the design is clean and readable, with clear fonts and organized sections, so the voucher remains professional and practical for various business needs.

Ensure all details are accurate before finalizing the receipt voucher. Incorrect information, such as wrong dates or amounts, can lead to disputes. Double-check all fields for spelling and numeric errors.

- Skipping the Receipt Number: Always include a unique receipt number. This is necessary for proper tracking and record-keeping.

- Omitting the Method of Payment: Specify how the payment was made (cash, credit card, bank transfer, etc.). This provides clarity and helps avoid confusion in the future.

- Failing to Include Contact Information: Include your full contact details (name, phone number, email address). This allows the recipient to reach you easily if there are any issues with the transaction.

- Incorrect Tax Information: If applicable, mention tax rates and amounts separately. Failing to break down tax can create confusion, especially during audits.

- Inaccurate or Missing Signatures: Both the payer’s and the payee’s signatures (if required) should be present. Missing signatures make the voucher incomplete and legally questionable.

- Not Including the Transaction Details: Clearly mention what the payment is for. This helps both parties to track the reason behind the transaction later on.

- Not Using a Standardized Template: Use a consistent format for all receipts. A well-structured and uniform template helps prevent important details from being left out.

By avoiding these common mistakes, you’ll ensure that your receipt vouchers are clear, professional, and legally sound.

To design a clean and functional payment receipt voucher template, begin with including the payment details like the amount, date, and method of payment. Each section should be clearly labeled with enough space for the data. The template should have a field for the payer’s name, along with their contact details, to maintain clarity in communication.

Formatting Tips

Ensure the payment receipt is simple and structured. Use distinct fonts for headings and content to easily differentiate sections. Keep the total payment amount bolded and at the top of the receipt for quick visibility.

Additional Information

Include a section for any applicable taxes or fees, along with a description of the services rendered. This adds transparency and allows both parties to easily verify the details of the transaction.