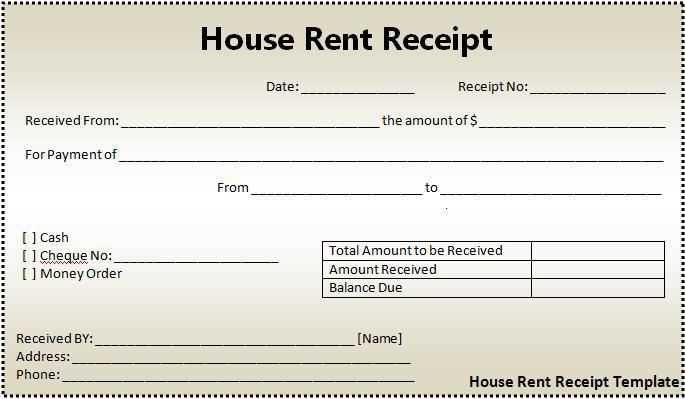

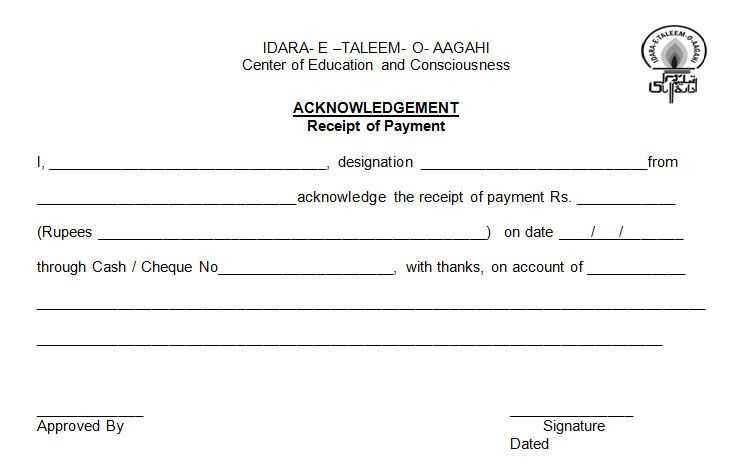

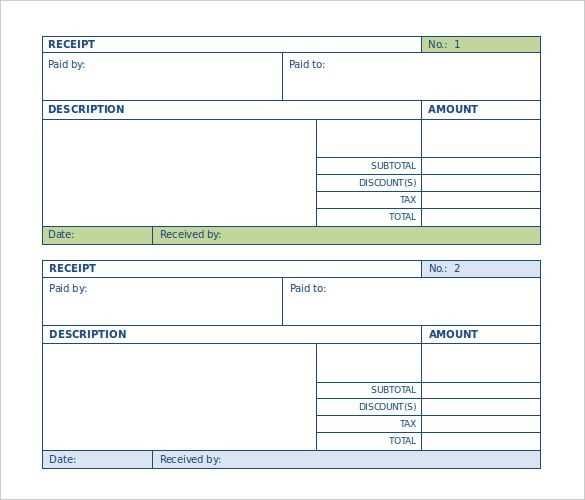

A payment received receipt template should clearly detail the transaction and offer transparency for both parties. Begin with the payer’s name, the date of payment, and the payment method used. Ensure that the receipt clearly states the amount received, along with the corresponding currency. Add a unique receipt number for reference, making it easier to track in case of disputes or future inquiries.

Include a section for itemization to break down what the payment covers, especially for services or products sold. This offers a clear record for the buyer, which is helpful for record-keeping or warranty claims. If applicable, make sure to note any taxes or additional charges included in the total amount.

Finally, add a thank you note or confirmation that the payment has been processed. This reassures the buyer that the transaction is complete and helps maintain a professional relationship. A clean, concise receipt template can make these steps smooth and error-free, providing peace of mind for all parties involved.

Here is the corrected version:

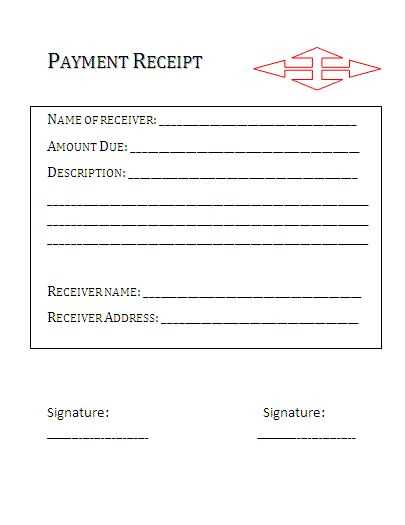

For a clear and professional payment receipt, include the following key elements:

- Receipt Number: Assign a unique number to each receipt for easy tracking.

- Date of Payment: Clearly state the payment date for reference.

- Payment Amount: Include the exact amount paid, in both words and numbers.

- Payment Method: Specify how the payment was made (e.g., cash, credit card, bank transfer).

- Payer Information: List the name or company of the payer, along with any relevant contact information.

- Receiver Information: Include the business or individual receiving the payment, along with contact details.

- Description of Goods/Services: Briefly outline the items or services the payment covers.

- Signatures: Both payer and receiver should sign the receipt for verification.

Example Format:

- Receipt Number: 00123

- Date: January 25, 2025

- Amount: $500.00 (Five hundred dollars)

- Payment Method: Credit Card

- Paid By: John Doe

- Paid To: XYZ Company

- Description: Payment for 5 hours of consulting services

- Signature: ____________________

Ensure that the format is consistent and professional for each transaction. Customizing the template with your logo or business details can also add a personal touch.

- Payment Received Receipt Template

A clear payment receipt template helps maintain accurate records of transactions. Below is an example of what a payment received receipt should include:

| Field | Details |

|---|---|

| Receipt Number | A unique identifier for each receipt. |

| Date | The exact date the payment was received. |

| Payee Name | The name of the person or business receiving the payment. |

| Payer Name | The person or entity making the payment. |

| Amount | The total amount paid. |

| Payment Method | Details of how the payment was made (e.g., cash, credit card, bank transfer). |

| Purpose | A brief description of the goods or services paid for. |

| Signature | Space for the payee to sign, confirming the receipt of payment. |

Adjust this template based on your specific needs. Ensure all the necessary fields are present for clear documentation of each transaction.

To create a straightforward payment receipt template, focus on the key details required for clear documentation. Include the following sections:

- Receipt Number: Assign a unique identifier to each receipt for easy tracking and reference.

- Payment Date: Clearly indicate the date the payment was received.

- Payee Information: List the name, address, and contact details of the party receiving the payment.

- Payer Information: Include the payer’s name and contact information if necessary.

- Payment Amount: Specify the exact amount paid, including the currency.

- Payment Method: Note the method used for payment (e.g., cash, check, bank transfer).

- Invoice Number (Optional): Link the receipt to any relevant invoice, if applicable.

- Signature: Include space for signatures of both the payee and payer for verification.

Arrange these components in a clean and readable layout, ensuring each section is distinct. Use consistent fonts and spacing for a professional look. This template will provide a clear and concise record of transactions for both parties.

Adapt your payment receipt template to match the specific details required for each payment method. For example, credit card payments typically include fields for the card number, expiration date, and authorization code. When customizing for PayPal, ensure the transaction ID and payer’s email are clearly displayed. For bank transfers, include the bank name, account number, and reference code.

Credit Card Payments

For credit card payments, the template should capture necessary card details while maintaining security. Include placeholders for the cardholder’s name, card number (obscured for privacy), transaction amount, and authorization code. These elements help provide a clear, organized record of the transaction.

PayPal Transactions

When the payment is processed through PayPal, your template should feature a transaction ID and a link to the PayPal transaction page. Display the payer’s email address to ensure identification, and clearly indicate the amount paid in the correct currency.

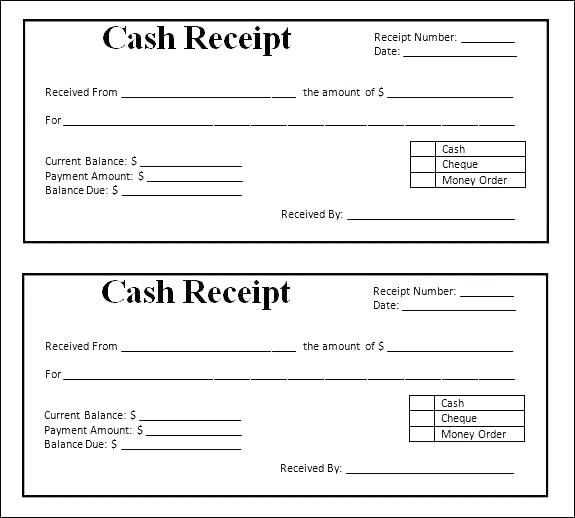

For cash payments, a simple receipt format suffices, noting the amount paid and the date of the transaction. Keep the layout minimal, highlighting the essential information: the amount, payment method, and transaction date.

By customizing these sections based on payment methods, you ensure that your receipt template remains functional and relevant for any type of payment. Make sure to maintain consistency in formatting for easy reading and understanding, regardless of the payment method used.

To ensure compliance with legal and business requirements, tailor your receipt template to include specific fields mandated by local laws. Include the transaction date, payment method, and itemized list of services or products. This provides transparency and aids in resolving disputes, should they arise. Always check your local jurisdiction’s requirements regarding tax information, as it may vary depending on the region or the type of business.

Maintain Organized Records

Keep a copy of each receipt generated, either digitally or in hard copy. Implement a system for easy access to these records, such as using a file storage solution or an accounting software that integrates with your template. Record-keeping ensures that both parties have a reference point in the case of future audits or questions. If the transaction is part of a larger agreement, ensure that this information is also reflected in your records.

Periodic Review of Your Template

Review your receipt template regularly to ensure it remains in line with any changes in compliance regulations. Adjust the template if necessary to include new information, such as updated tax rates or business registration details. This minimizes the risk of non-compliance and helps your business maintain a transparent record-keeping system.

Ensure that each payment received receipt is clear, concise, and includes all necessary details. Start by listing the basic transaction information.

- Date of Payment: Clearly specify the date when the payment was received.

- Amount: Include the exact amount of money received, in the correct currency.

- Payment Method: Indicate whether the payment was made via cash, card, cheque, or another method.

- Recipient’s Name: The person or business receiving the payment should be listed.

- Sender’s Name: If applicable, include the name of the person or company making the payment.

- Transaction Reference Number: If available, include a unique reference number for the payment.

Using this template, you ensure all parties have a record of the transaction details. This also helps avoid future disputes and confusion. Consider keeping a copy for your own records.

Example Template

Date of Payment: 12th February 2025 Amount Received: $250.00 Payment Method: Credit Card Recipient: John Doe Enterprises Sender: Sarah Smith Transaction Reference: 12345678