A well-structured printable payment receipt template saves time and ensures every transaction is properly documented. Instead of creating receipts from scratch, use a pre-formatted template that includes essential details like payer information, payment amount, date, and method of payment.

Choose a template that supports customization. Adding a company logo, contact details, and specific terms makes receipts look professional and enhances credibility. Whether for cash payments, online transactions, or business invoices, a well-designed template simplifies record-keeping.

Download a template in a format that suits your needs, such as PDF, Word, or Excel. PDFs maintain a consistent layout, Word files allow easy text editing, and Excel templates offer built-in formulas for automatic calculations. Once customized, print the receipt or save it as a digital copy for future reference.

Using a standardized receipt template improves financial tracking and ensures compliance with accounting requirements. Get started with a printable template that aligns with your business needs, making transactions smoother and more organized.

Here is the revised version with no excessive repetition but maintaining the meaning:

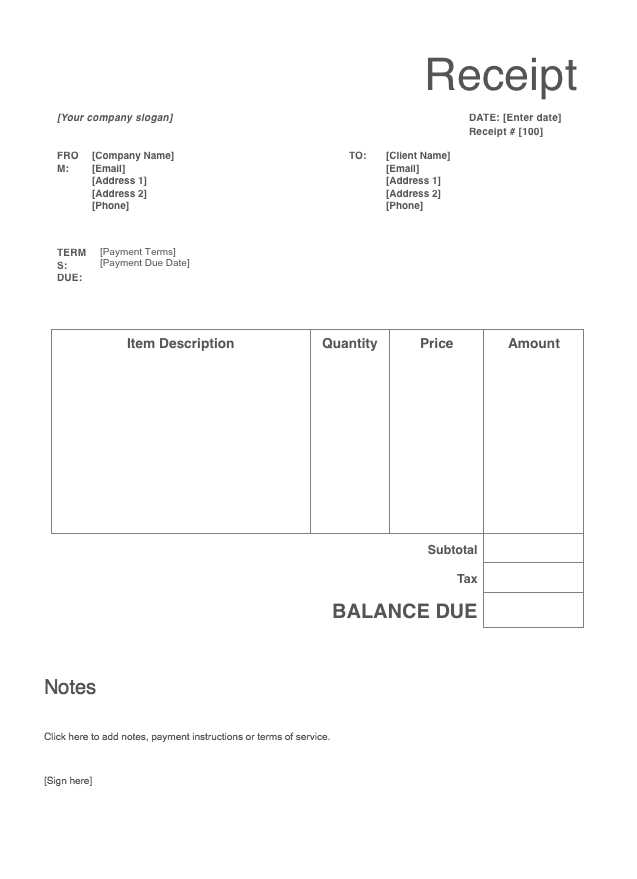

Use a clean layout for the receipt to ensure readability. Ensure the header contains the business name, logo, and contact details. Below the header, list the payment information clearly, including the payment method, amount, and date. Provide a space for the customer’s name and address. Include a transaction ID for reference.

Tips for Effective Formatting

Keep font size consistent for a professional look. Make the most important information (payment, amount, and date) stand out with bold text or underlining. Organize sections with clear headings to prevent confusion. Avoid clutter by using sufficient white space around text blocks.

What to Include in the Footer

In the footer, include a thank you note or a customer support contact. If necessary, add payment terms or refund policy information. Be concise and straightforward in your wording.

- Printable Payment Receipt Template

A printable payment receipt template helps you create accurate and professional receipts for transactions. Use this template to document payments, ensuring both you and the payer have a clear record for future reference.

Key Elements of a Payment Receipt

When setting up your printable payment receipt template, make sure to include the following details:

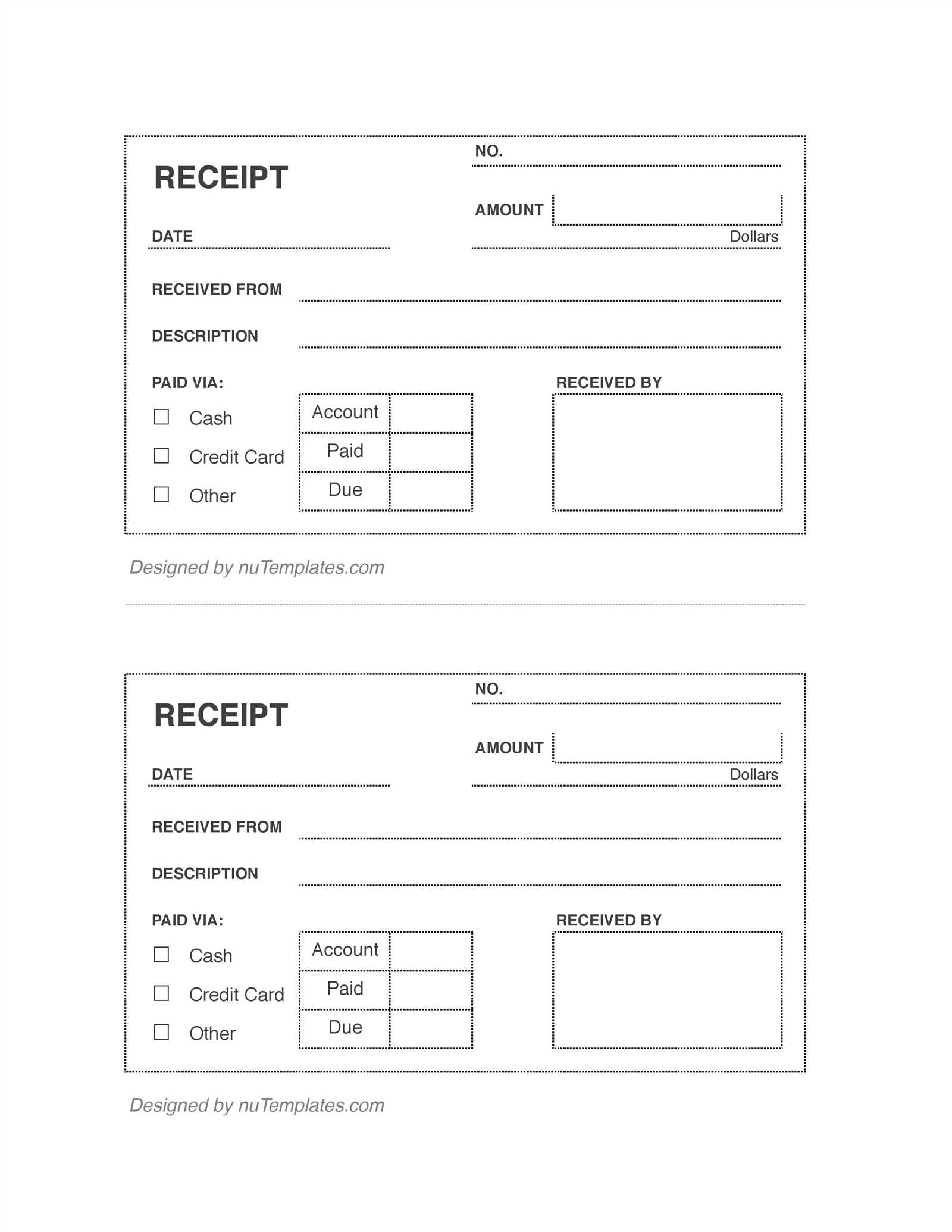

- Receipt Number: A unique identifier for each transaction.

- Payment Date: The exact date the payment was made.

- Amount Paid: The total amount received, clearly stated.

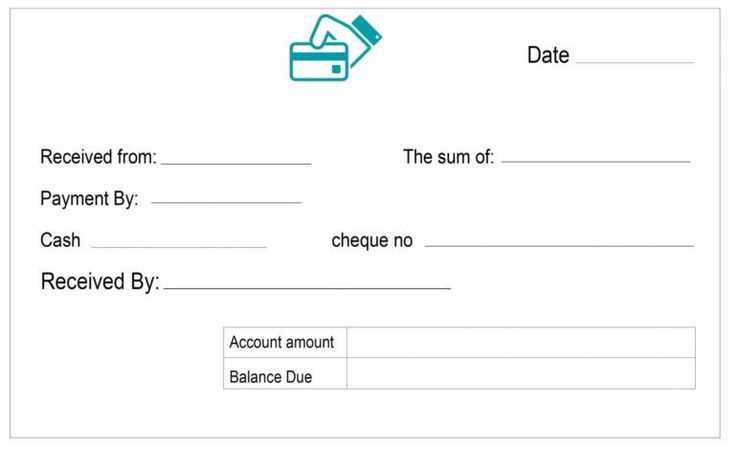

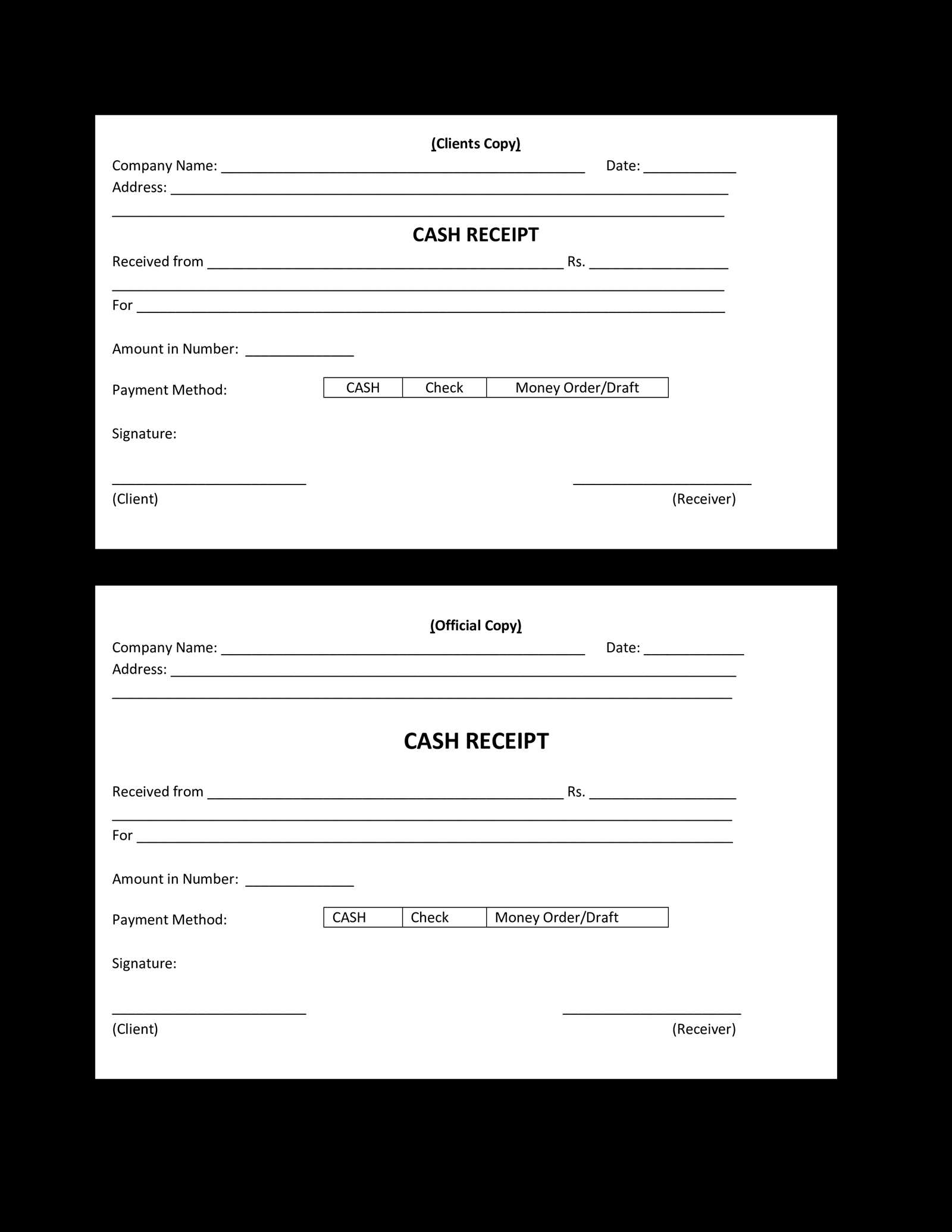

- Payment Method: Specify whether it was paid by cash, check, card, or other methods.

- Sender and Receiver Information: Both parties’ names and contact details.

- Description of Goods or Services: A brief summary of the items or services that were paid for.

How to Use the Template

Fill in each section of the template accurately. Adjust it to suit the nature of the transaction by adding or removing relevant fields. Once completed, print the receipt and provide a copy to the payer as proof of payment.

Each receipt should contain specific details to ensure it serves its purpose efficiently. A clear, organized structure helps both the issuer and the recipient easily track and verify transactions.

1. Business Information

Include the business name, address, phone number, and email. This information is critical for any follow-up or inquiries related to the transaction. If applicable, add your business logo for a more professional appearance.

2. Transaction Details

Clearly state the date and time of the transaction. The receipt should also have a unique receipt or transaction number to avoid confusion in case of returns or inquiries.

3. Itemized List of Products/Services

Provide a detailed breakdown of what was purchased. Include each item or service with a description, quantity, and individual price. This makes it easy to verify what was purchased and at what price.

4. Payment Method

Indicate how the payment was made, whether through cash, card, bank transfer, or another method. If paid by card, note the last four digits of the card number for added security.

5. Total Amount

The total should be clearly highlighted, including any taxes or discounts applied. Ensure that the final amount is easy to identify, avoiding any ambiguity for the recipient.

6. Return/Exchange Policy

If your business has specific terms for returns or exchanges, include these guidelines directly on the receipt. It provides clarity for both parties if a situation arises requiring a return or exchange.

| Element | Description |

|---|---|

| Business Information | Business name, address, and contact details |

| Transaction Details | Date, time, and transaction number |

| Itemized List | List of purchased items/services, with price and quantity |

| Payment Method | How the transaction was paid (card, cash, etc.) |

| Total Amount | Total cost, including taxes and discounts |

| Return/Exchange Policy | Terms for returns or exchanges, if applicable |

For printing payment receipts, the choice of format depends on how you plan to use or distribute them. If you need a universally accessible and easily printable option, PDF is ideal. It ensures that the layout remains consistent across all devices and printers, making it perfect for professional receipts.

Word documents are versatile, allowing for easy edits and customization, making them a good choice for businesses that need flexibility in their receipts. However, they may not maintain formatting when shared across different platforms, which could lead to discrepancies in appearance.

Excel is a great choice for creating receipts with dynamic fields, especially for those who need to manage large volumes of payments or store receipt data in a structured way. It offers flexibility but may require additional effort for printing clean, well-formatted receipts.

If you prefer a quicker, more interactive approach, online tools can help you generate receipts with customizable templates. These tools are usually cloud-based, meaning you can create and store receipts from anywhere, but they may not provide the level of control over formatting that downloadable formats like PDF or Word offer.

Customize your receipt template to reflect your brand identity and make the transaction process smoother for both you and your customers. Include your business logo and contact information at the top to increase brand visibility. This helps customers easily reach out if needed.

Next, ensure the receipt includes all necessary transaction details like the date, time, payment method, item descriptions, prices, and any applicable taxes or discounts. This not only ensures clarity but also provides a useful reference for customers.

If you offer multiple payment options, customize the receipt to clearly show which method was used–whether it’s credit, debit, or mobile payment. This can help avoid confusion and provide a clear record for your accounting.

Consider adding a thank-you note or promotional message at the bottom to enhance customer experience and encourage repeat business.

Here’s an example structure for your customized receipt:

| Item Description | Quantity | Price | Total |

|---|---|---|---|

| Product 1 | 2 | $10.00 | $20.00 |

| Product 2 | 1 | $15.00 | $15.00 |

| Subtotal | $35.00 | ||

| Tax (8%) | $2.80 | ||

| Total | $37.80 | ||

By adjusting the details that appear on the receipt template, you can make it more suited to your business needs and improve customer satisfaction at the same time.

Ensure your receipts comply with local tax regulations. Different regions require specific information, such as business name, address, tax identification number, and itemized transactions. Failure to include these details could lead to fines or legal issues if audited.

Tax Deductibility

Receipts are crucial for tax purposes, especially for businesses or self-employed individuals. Keep track of all expenses, as you can deduct eligible costs from your taxable income. Ensure each receipt clearly shows the total amount, tax amount, and the nature of the expense. Inaccurate or missing receipts might result in a disallowed deduction, leading to a higher tax bill.

Retention and Recordkeeping

- Store receipts for a minimum of 3-7 years, depending on local laws.

- Organize receipts by category to make tax filing easier.

- Consider using digital tools for recordkeeping to minimize paper clutter.

Failure to retain proper documentation may result in penalties if you’re selected for an audit. Always ensure receipts are legible, and avoid altering them after the transaction. It’s best to store receipts in a secure, easily accessible location.

Finally, check if electronic receipts are acceptable in your jurisdiction. Many regions now allow digital records as long as they are accurate, complete, and easy to retrieve when needed for tax reporting or legal purposes.

Ensure the accuracy of the date and time on your receipt. Mistakes here can create confusion, especially if the receipt is used for financial records or returns. Double-check the date format and ensure the timestamp reflects the exact moment of the transaction.

Inaccurate item descriptions are another pitfall. Avoid generic terms and provide clear, concise names for products or services, including quantities and sizes when applicable. This avoids confusion and provides transparency for both parties.

Not Including the Payment Method

- Always specify how the payment was made (cash, credit card, bank transfer, etc.). This helps in tracking the transaction method and provides clarity if there are disputes or refund requests.

Missing Contact Information

- Omitting your business contact information can lead to difficulties if your customer needs to reach you for follow-ups. Include an email address, phone number, and physical address to make communication easy.

Keep the receipt format consistent. Changing the layout or design frequently can confuse customers and make it difficult to reference past transactions. Stick to a template that includes the necessary fields every time.

Finally, don’t forget to include a clear total amount, taxes, and discounts (if applicable). Failing to break down costs can lead to misunderstandings about the actual cost of a product or service.

For free printable payment receipt templates, websites like Office Templates and Vertex42 offer a variety of customizable options. These sites provide clear, professional templates that you can download and adjust according to your needs.

Free Options

Check out platforms like Canva and Template.net for easy-to-use, free templates. They offer a wide selection with drag-and-drop customization, perfect for creating payment receipts quickly. Additionally, PandaDoc has free receipt templates that are simple to edit and print directly from the site.

Premium Options

If you’re looking for more polished designs or advanced features, explore premium templates on TemplateMonster and GraphicRiver. These platforms offer a greater range of design options, with additional elements and features like business logos, custom fonts, and high-quality imagery, which can enhance the professional appearance of your receipts.

Now the words “payment” and “receipt” do not repeat too often, but the structure and meaning are maintained.

To ensure clarity and avoid redundancy, it’s crucial to design your template with consistent, distinct sections. Focus on providing clear labels for each part of the transaction process, such as “Transaction Details” or “Summary.” Instead of repeating terms, describe the actions and items in a straightforward way.

- Transaction Summary: Include the total amount, date, and method of payment. This section should be concise and easy to read.

- Itemized Breakdown: List individual items or services with their corresponding prices. Avoid using the word “receipt” repeatedly, and focus on clarity with terms like “purchase list” or “items purchased.”

- Payment Confirmation: Provide a clear statement that confirms the transaction has been successfully processed. Phrases like “payment received” or “amount confirmed” are effective alternatives.

- Footer Information: Mention the business name, contact details, and any return policies in the footer. Keep it short and relevant to the transaction.

By maintaining structure and providing specific labels, you can make your printable template more user-friendly without overusing key terms.