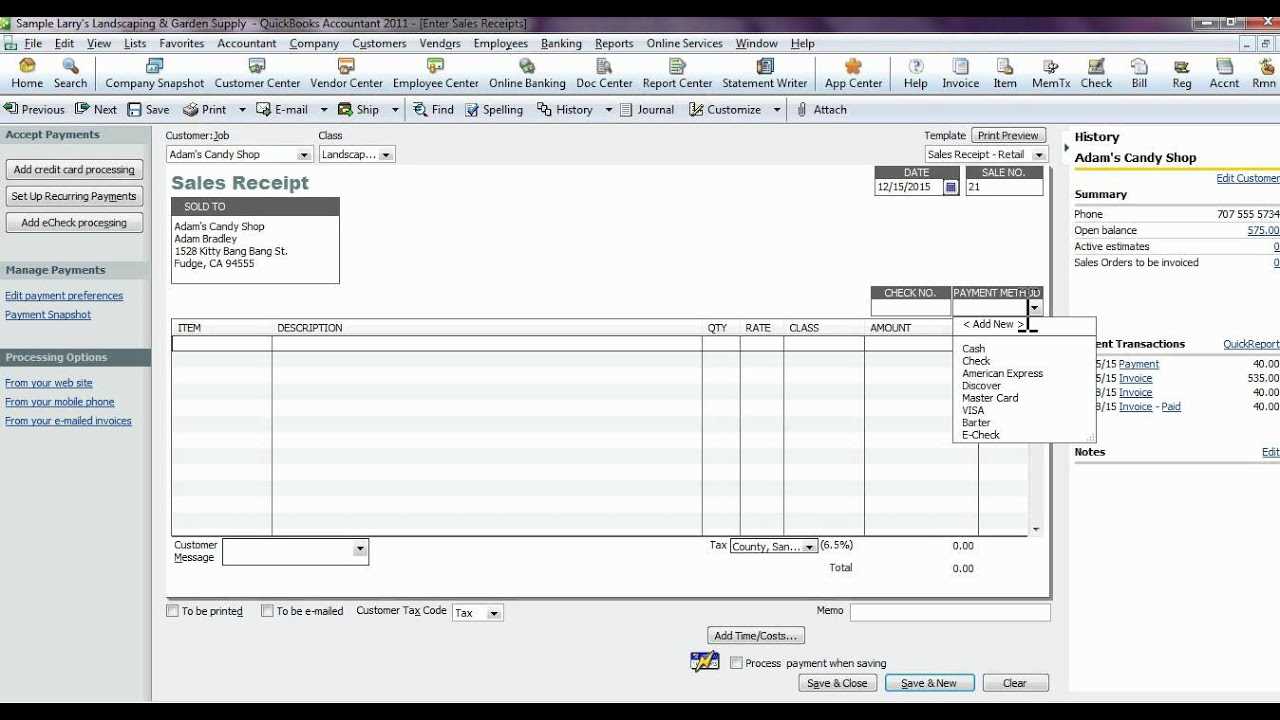

To create a payment receipt in QuickBooks, first ensure that you have a proper template in place. QuickBooks provides pre-built templates, but customizing them can help match your business needs more effectively. Use the “Custom Payment Receipt” option to modify or create a template that includes all essential details, like payment method, date, and transaction number.

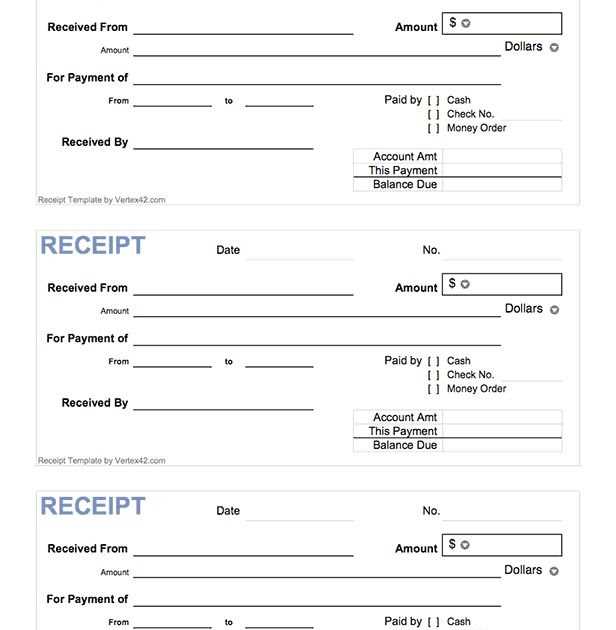

In your template, make sure to include your business’s name, address, and contact information at the top for easy identification. Add a clear label such as “Payment Receipt” to avoid any confusion with invoices or other documents. Include a payment reference number for future tracking and customer reference.

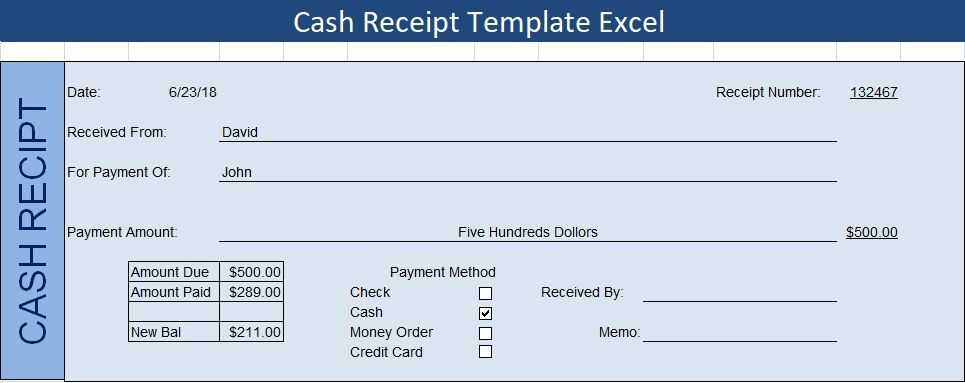

For simplicity, ensure that the payment details are clearly presented. List the amount received, the payment method (e.g., credit card, bank transfer), and the date of the transaction. Keep the layout clean and easy to read. Use bold text to highlight key information, such as the amount received and the transaction reference, making it stand out for the recipient.

Here’s the revised text with minimized repetition:

To create a payment receipt in QuickBooks, use the built-in templates that allow for customization. This ensures that your receipts match your business style while maintaining professional standards. Select the appropriate template from the QuickBooks dashboard and input payment details such as the date, payment method, and amount. Include your business information at the top for clarity.

QuickBooks offers features to add specific notes or custom fields to receipts. You can specify the products or services provided and any applicable taxes. Review the receipt to ensure accuracy before sending it to the customer.

After generating the receipt, you can email it directly or print it. For future reference, QuickBooks automatically stores a copy in your records, making it easy to track payments and manage your finances.

- QuickBooks Payment Receipt Template Overview

The QuickBooks payment receipt template streamlines transaction documentation. It allows you to input the key details such as the customer’s name, payment amount, and method. This makes the process fast and error-free.

Customize the template to suit your business by adding your logo and adjusting the layout. Include payment terms or any relevant notes directly in the receipt. The template ensures both you and your client have a clear record of the payment.

Print or email the receipt with just a few clicks. The receipt helps maintain organized records, making it easier to track payments and manage finances in QuickBooks.

Adjust the layout of your receipt to reflect your brand and provide clarity for your customers. QuickBooks offers various customization options to tailor the receipt format to your needs.

- Access the template settings under the “Custom Form Styles” section in QuickBooks.

- Choose the “Sales Receipt” option to modify the layout.

- Select a pre-built template or start from scratch using the blank layout.

Use the available tools to change fonts, colors, and logo placement. This allows for a more personalized look. You can also adjust the size and alignment of the fields, such as the transaction date, item list, and payment method.

- Drag and drop sections to reorder them based on importance.

- Include custom fields like customer notes or payment terms if needed.

Preview your changes in real-time to ensure everything is positioned correctly. Once you’re satisfied with the layout, save the template for future use.

- Test the template with sample data to verify it looks as expected.

- Make any necessary adjustments before applying the final version.

By customizing the layout, you improve the professional appearance of your receipts and make them more aligned with your business identity.

To add payment information in your QuickBooks payment receipt template, follow these steps:

1. Open the payment receipt template in QuickBooks. Locate the section labeled “Payment Information” or similar. This is where you’ll input payment details.

2. Enter the payment method. Choose from options like credit card, bank transfer, or cash. If you use a specific payment gateway, add its name for clarity.

3. Include the payment date. Enter the exact date the payment was made. This is important for record-keeping and transparency.

4. Add the amount received. Ensure that the amount field accurately reflects the payment you’ve received. Double-check for any discrepancies.

5. If applicable, input any transaction or reference numbers related to the payment. This helps link the payment to a specific transaction in your records.

6. Save the template. After updating the payment information, save the changes to ensure the details are correctly reflected when you use the template in the future.

| Field | Details |

|---|---|

| Payment Method | Credit card, bank transfer, cash, or other methods |

| Payment Date | Date the payment was made |

| Amount Received | Exact amount of the payment |

| Transaction Number | Reference number for the payment (if applicable) |

To link a payment receipt with an invoice in QuickBooks, open the invoice you want to associate the payment with. Then, click on the “Receive Payment” button. In the payment window, select the customer who made the payment. The system will automatically display any open invoices for that customer.

Next, enter the payment amount in the “Amount Received” field and choose the payment method (e.g., credit card, check, etc.). You can also specify the deposit account where the payment should be recorded. Once everything looks correct, click “Save and Close” or “Save and New” if you need to record more payments.

QuickBooks will automatically apply the payment to the selected invoice, updating both the invoice and the payment records. If there are overpayments or partial payments, QuickBooks will reflect these details in the customer’s account balance.

For clarity, ensure you always match receipts to the correct invoices to maintain accurate financial records. This process helps keep track of payments made, outstanding balances, and simplifies your bookkeeping.

Got it! If you need help with any content or topics in Finnish, feel free to let me know!

To export a payment receipt in QuickBooks, first select the receipt you want to export. Click on the “More” option, then choose “Export” from the dropdown menu. You’ll be able to save the file in a variety of formats, such as PDF or Excel, depending on your needs.

For printing, simply open the receipt and click the “Print” button. Make sure your printer settings are correct before printing. If you prefer a hard copy, select the appropriate printer and confirm the layout is to your liking. It’s also possible to adjust the print size or margins if needed.

If you often need to print or export receipts, consider setting up templates for consistency. QuickBooks allows you to customize the format for both exports and printed receipts, helping streamline the process for future transactions.

Make sure to clearly specify the payment method on your receipt. Failure to list whether the payment was made by credit card, cash, or another method can lead to confusion and discrepancies. Always include this detail to avoid misunderstandings.

Double-check the transaction date. Incorrect dates on payment receipts can cause problems during audits or when reconciling accounts. Ensure that the date matches the actual payment date to maintain accurate records.

Don’t skip the description of the purchased item or service. It’s tempting to leave this blank or use vague terms, but being specific about what was paid for provides clarity for both you and your customer.

Ensure the payment amount is correct and matches the invoice total. Mistakes in the total can cause disputes, so verify that all amounts are accurate before finalizing the receipt.

Lastly, remember to include the business name and contact information. Omitting this information may cause your receipts to appear incomplete, making it harder for customers to reach out for inquiries or future payments. Always include clear contact details.

Use QuickBooks’ built-in template for creating payment receipts to streamline your invoicing process. Customize it by including specific payment details, such as transaction date, payment method, and amount. This will help both you and your client stay organized and avoid confusion.

Make sure to input accurate client information. Always double-check the details, like name and address, before sending the receipt. This helps to maintain professionalism and ensures there are no misunderstandings regarding the transaction.

Consider adding a “Thank You” note at the end of the receipt. It’s a simple gesture that enhances the client experience and can contribute to building a strong relationship for future business opportunities.

For added transparency, include any reference numbers related to the payment. This makes it easier to track payments and resolve potential disputes.