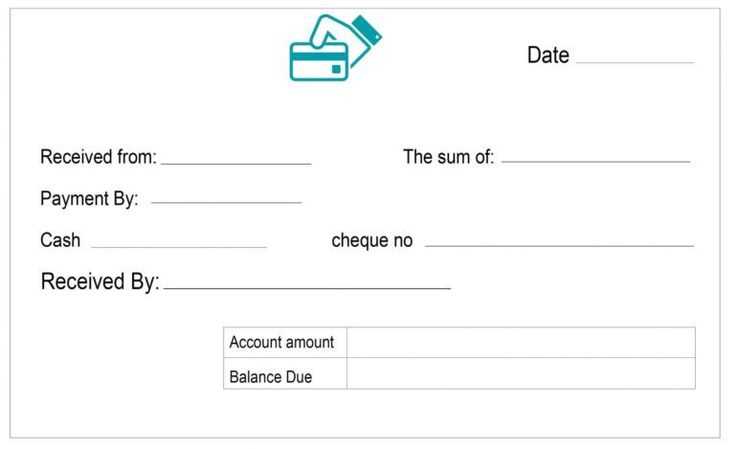

To create a clear and professional receipt, include the date of payment, the amount received, and a breakdown of the payment method. Ensure the document identifies both the payer and the recipient, including full names and addresses if relevant. Always list the transaction number or reference code for easy tracking.

A good template should also specify the product or service purchased, along with any applicable taxes or discounts. Make it clear that the payment has been fully received, and state any terms related to refunds or future transactions, if necessary.

Remember to maintain consistency in formatting, using legible fonts and properly aligned text. Make the receipt easy to read, ensuring all necessary details are highlighted, such as payment method and contact information for both parties. Include a thank you note to personalize the receipt and leave a positive impression.

Sure! Here’s the revised version of your text:

A payment receipt should include specific details to ensure clarity and legal compliance. Include the following elements:

- Payment Date: Clearly state the date when the payment was made.

- Payment Method: Specify how the payment was processed (e.g., credit card, bank transfer, cash).

- Amount Paid: State the total amount that was paid, including any taxes or fees.

- Transaction ID: Include a unique transaction number for reference.

- Seller Information: Name, address, and contact details of the seller.

- Buyer Information: Name and contact information of the buyer.

- Item Description: Provide details of the item or service purchased, including quantities if applicable.

Structuring the Receipt

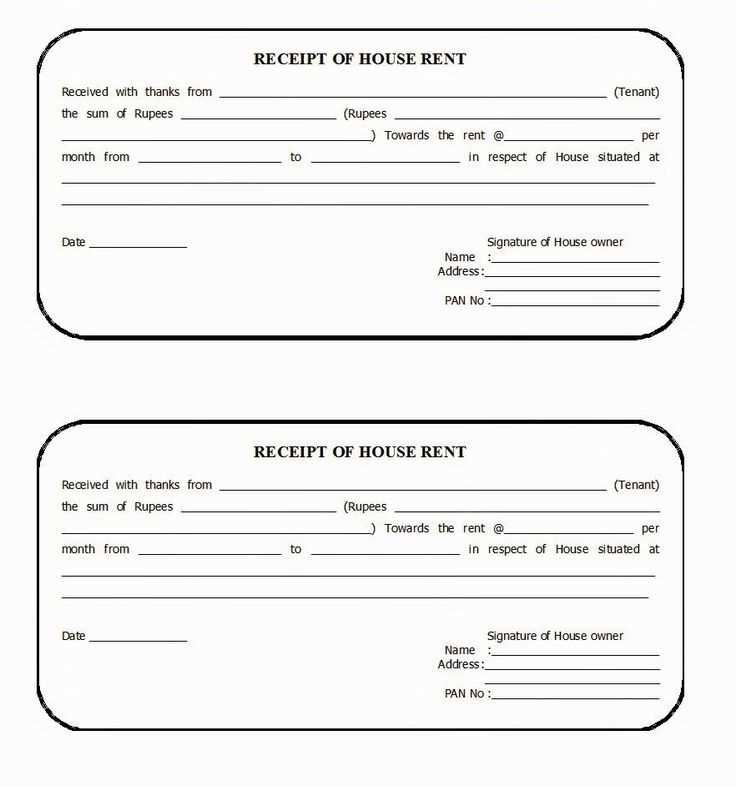

Ensure the receipt is easy to read. Organize the details in a clean layout, starting with the seller’s and buyer’s information, followed by transaction specifics. Clear headings help the reader navigate the receipt quickly.

Legal and Tax Considerations

Check local regulations to confirm if any additional details are required, such as tax information or the presence of specific disclaimers. A properly formatted receipt can protect both parties in case of disputes.

- Receipt for Payment Confirmation Template

Creating a receipt confirming payment ensures transparency and trust in any transaction. A clear and concise payment confirmation helps both parties reference the terms of the payment and details for future communication or inquiries.

Key Elements to Include in the Receipt

- Receipt Number: A unique identifier for the receipt.

- Transaction Date: The exact date the payment was processed.

- Payment Method: Specify how the payment was made (e.g., credit card, bank transfer, cash).

- Amount Paid: The total amount that was received, including currency type.

- Payment Details: Any specific payment references or invoice numbers for clarity.

- Payer Information: Include the name and contact details of the individual or company who made the payment.

- Receiver Information: Include the details of the entity confirming the payment (your company or organization).

Best Practices for Payment Confirmation Receipts

- Make sure the format is clear and easy to understand, avoiding complex jargon or confusing wording.

- Ensure that the amounts are correct and match the initial invoice or transaction.

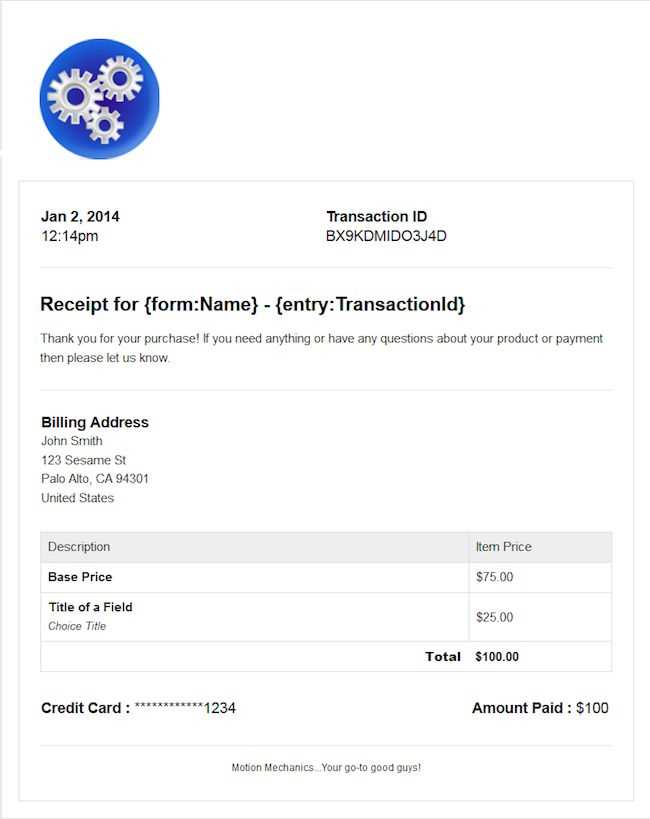

- Include your business logo or other branding elements for professional appearance.

- If relevant, specify whether any taxes, discounts, or additional fees were included in the payment.

- Offer an option to contact the receiver for any payment disputes or questions.

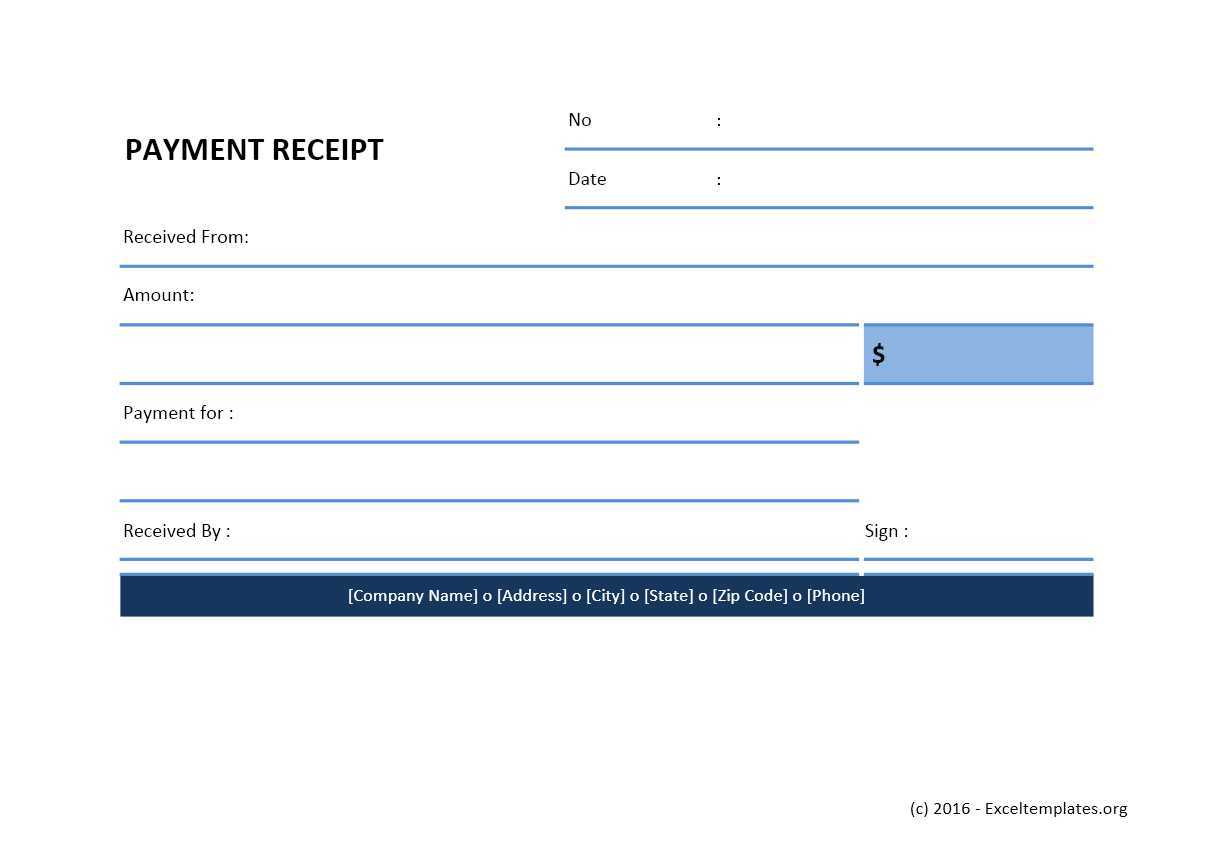

To create a payment confirmation receipt, include the following key details: the payer’s name, the amount paid, the payment method, and the date of the transaction. Start by listing your business name and contact information at the top of the receipt. This ensures clarity and transparency for both parties.

Next, clearly state that this document serves as proof of payment. Include a unique receipt number for easy reference and tracking. It’s important to specify the amount paid, breaking it down if necessary (e.g., tax, shipping fees, etc.). Also, provide a brief description of the service or product provided to confirm the transaction.

Include a payment method section to specify how the payment was made, such as via credit card, PayPal, or bank transfer. Finally, include a thank-you note to show appreciation for the transaction, and make sure to sign the receipt for authenticity.

A payment confirmation document should include specific details to ensure clarity and legal validity. Include the following elements for a comprehensive receipt:

| Element | Description |

|---|---|

| Date of Payment | Clearly state the exact date when the payment was received. |

| Amount Paid | Indicate the exact amount of money that was paid, including currency details. |

| Payment Method | Specify the method used (e.g., credit card, bank transfer, cash). |

| Payment Reference Number | Include a unique reference number for tracking the payment. |

| Sender and Recipient Details | List the name and contact information of both the payer and the recipient. |

| Invoice or Transaction Number | Provide the invoice or transaction number linked to the payment. |

| Description of Goods or Services | Briefly outline what the payment covers (e.g., purchase, subscription, service fee). |

| Confirmation Statement | State clearly that the payment has been received and processed successfully. |

Including these elements ensures that the payment is well-documented and can be referred back to for verification or dispute resolution.

Ensure the payment amount is clearly stated and easily readable. A common mistake is placing the total in a confusing location or using a font that’s hard to read. Use a larger, bold font for the total amount to draw attention and avoid ambiguity.

Don’t forget to include all relevant details such as the payment method, transaction ID, and date. Omitting any of these details can lead to confusion or disputes in the future. Every piece of information should be placed in a logical, easy-to-follow order.

Be mindful of the design’s clutter. Avoid adding unnecessary graphics or excessive text that may distract from the important details. Keep the layout clean and straightforward, ensuring that the focus remains on the payment specifics.

Do not skip the inclusion of company information. Your business name, address, and contact information should always be visible. This helps the customer identify the source of the receipt and easily reach out if necessary.

Ensure proper spacing between sections. Crowded text can make it difficult to read the receipt. Use adequate white space between the payment details, company information, and terms to create a visually appealing document that’s easy to understand.

Verify the accuracy of all the data before finalizing the receipt. Even minor errors, such as a misspelled name or incorrect amount, can lead to serious complications. Double-check each detail to ensure precision.

Lastly, avoid using vague descriptions for purchased items or services. Be specific in listing what was paid for, as unclear descriptions can cause confusion or misunderstandings later on.

Receipt Confirmation Template: Clear and Concise Approach

The payment confirmation should include details like the transaction amount, payment method, date, and payer’s information. Avoid redundancy in the language to ensure clarity. For example, use concise phrases like “Payment of $100 received on February 12, 2025” instead of longer, repetitive sentences. This structure improves readability while maintaining essential details.

Incorporate sections for both payer and payee details. Ensure that each party’s information is accurate and distinct. For example: “Payer: John Doe, Payee: ABC Services.” Be direct and straightforward, eliminating unnecessary wording while keeping the focus on the transaction.

For added clarity, consider including a reference number or transaction ID to make future correspondence easier. This number helps both parties track the payment without confusion. Additionally, avoid over-complicating the language–keeping it simple enhances the document’s utility and effectiveness.