Key Elements to Include

Ensure the receipt includes the following details:

- Taxpayer Information: Name, address, and account number.

- Payment Amount: Clearly state the amount paid.

- Date of Payment: Record the exact date of transaction.

- Payment Method: Specify the method used (credit card, bank transfer, check, etc.).

- Property Information: Include the property address or ID number.

- Tax Year: Mention the year for which the payment is being made.

- Receipt Number: Unique identifier for tracking purposes.

- Official Sign-off: Authorized signature or seal from the taxing authority.

Formatting Tips

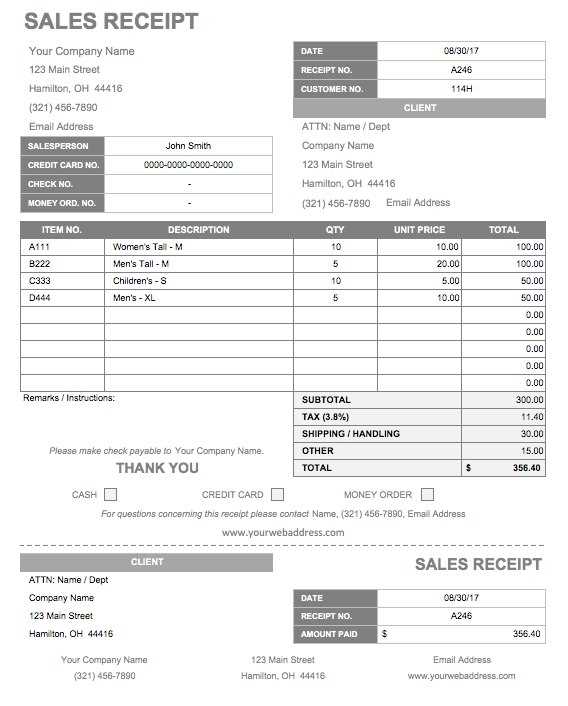

Follow these guidelines for clear and professional receipt design:

- Use a clean, easy-to-read font such as Arial or Times New Roman.

- Ensure that the receipt is organized with distinct sections for each element listed above.

- Use bold for headings and important details like payment amount, date, and taxpayer name.

- Keep the layout simple with sufficient space between sections for easy readability.

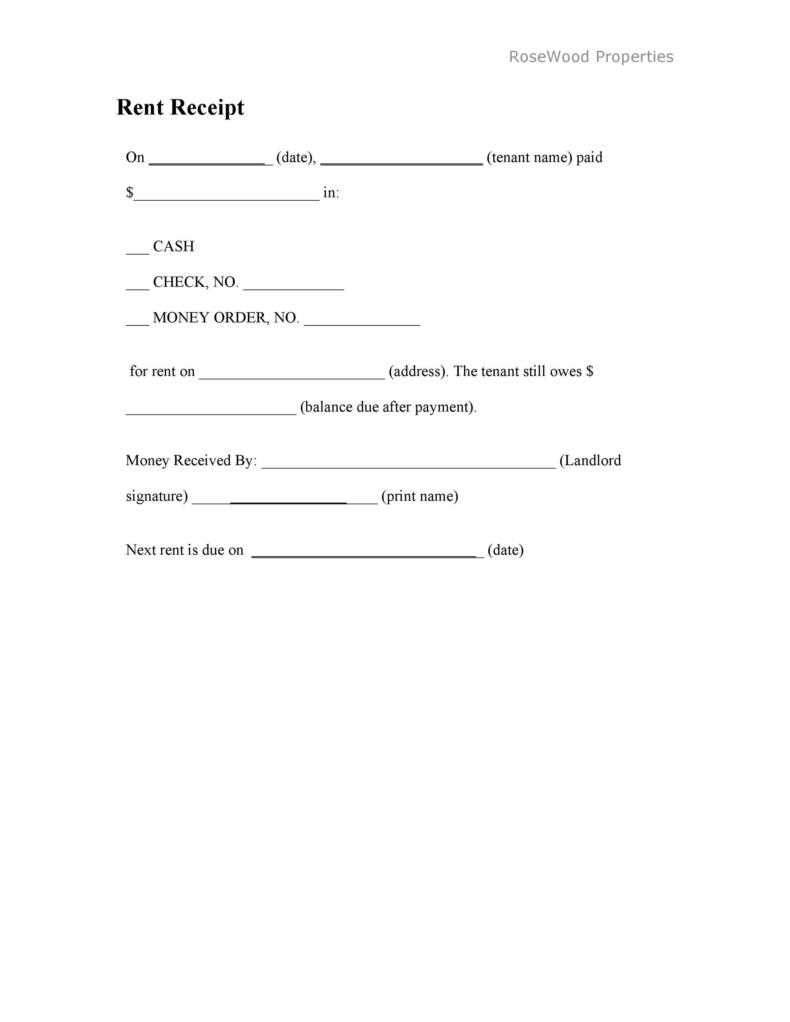

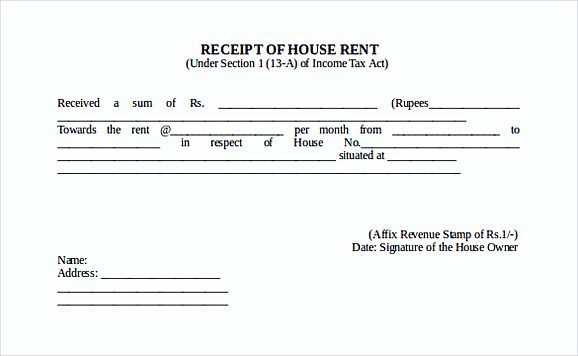

Example Template

Here’s an example of a property tax payment receipt:

----------------------------------------------- PROPERTY TAX PAYMENT RECEIPT ----------------------------------------------- Taxpayer Name: John Doe Account Number: 123456789 Property Address: 123 Main St, SpringfieldAmount Paid: $1,250.00 Payment Method: Credit Card Payment Date: February 13, 2025Tax Year: 2024 Receipt Number: 00124567Authorized Signature: _______________________

Make sure to adjust the template to fit your specific requirements, adding any additional information as needed. This simple structure helps ensure that all the necessary details are captured clearly for both the taxpayer and the tax authority.

Receipt for Property Tax Payment

When structuring a property tax payment receipt, focus on clarity and transparency. The receipt should provide the necessary details to confirm the payment and its allocation. Start by including the following key elements:

Key Details to Include in a Receipt

1. Payment Date: Indicate the exact date the payment was made.

2. Taxpayer Information: Name and address of the taxpayer should be included to verify the individual responsible for the payment.

3. Property Information: Specify the property address or tax parcel number associated with the payment.

4. Amount Paid: Clearly state the total amount paid, along with a breakdown if there are multiple tax categories.

5. Payment Method: Note the method used (e.g., check, credit card, or electronic transfer).

6. Receipt Number: Assign a unique receipt number for easy tracking and reference.

7. Tax Year: Indicate the tax year for which the payment applies.

8. Issuing Authority: Mention the name of the tax authority or government agency issuing the receipt.

Steps for Customizing Your Template

To create a tailored receipt template, adjust the layout to match the requirements of your local tax agency. Make sure to include all relevant details while maintaining a clean and professional design. If you use a digital template, ensure it’s compatible with the software or system your tax office uses. Add placeholders for dynamic fields, such as payment date, amount, and taxpayer details, to streamline the process for future use.