When issuing a receipt for loan payment, clarity and accuracy are key. A well-structured receipt ensures both the lender and borrower have a clear record of the transaction. The template should include all relevant details, such as the loan agreement, payment amount, payment date, and balance remaining. By using a consistent format, you streamline the process and avoid any confusion down the line.

To create a solid receipt template, start by including the borrower’s name, contact information, and any reference numbers from the loan agreement. Specify the payment amount, how it was made (e.g., cash, bank transfer), and any other important transaction details. Always include the updated balance after the payment is processed. For a professional touch, consider adding a space for signatures or additional notes to confirm the agreement.

Keep your template simple, but thorough. This ensures that both parties can reference it with confidence in case of any future questions or disputes. By providing a detailed and organized receipt, you contribute to a transparent and smooth loan repayment experience.

Here’s the updated version, where repetitive words have been shortened, while meaning and structure are preserved:

To streamline your loan payment receipt, consider removing redundant phrases. Replace lengthy sections with simpler, clearer language without losing key details. For example, instead of writing “the amount due to be paid on the given date,” use “due amount on [date].” Similarly, “the borrower’s name and the loan amount” can be shortened to “borrower’s name and amount.”

Loan Amount and Payment Date

Use specific fields for the loan amount and payment date. Ensure these are easily identifiable, such as “Amount: [amount]” and “Payment Date: [date].” Avoid lengthy descriptions unless necessary for legal clarity.

Clear Payment Acknowledgment

Provide a straightforward acknowledgment of payment received. Example: “Payment of [amount] received on [date].” This eliminates unnecessary elaboration while delivering the required confirmation.

Finally, review your template to keep it clean and focused on key elements. By eliminating excess wording, you ensure your document is professional and to the point, improving readability and efficiency.

- Loan Payment Receipt Template

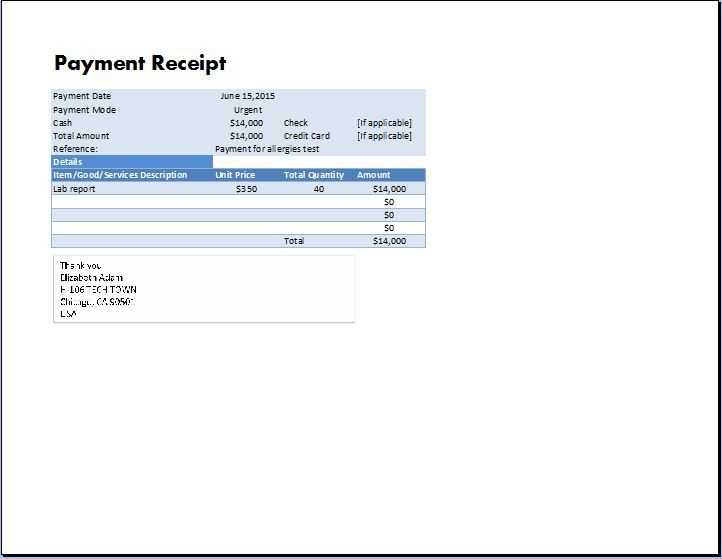

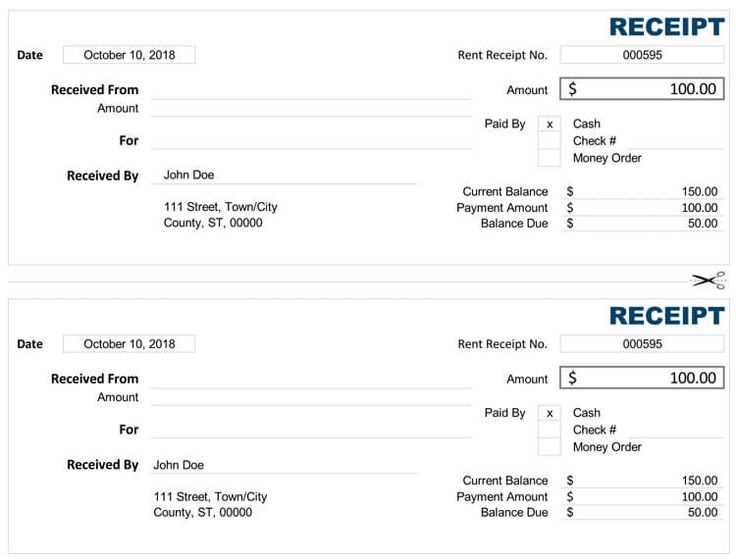

A loan payment receipt template is a simple document that confirms a borrower has made a payment towards their loan. It includes necessary details such as the amount paid, the date of the transaction, and the remaining balance. Below is a basic layout of a loan payment receipt template you can use for record-keeping purposes.

Key Elements of a Loan Payment Receipt

The receipt should contain the following key information:

| Element | Description |

|---|---|

| Borrower Name | Name of the person who made the payment. |

| Lender Name | Name of the entity receiving the payment. |

| Loan Number | The unique identifier for the loan agreement. |

| Payment Amount | The exact sum paid by the borrower. |

| Payment Date | The date the payment was received. |

| Payment Method | Method of payment (e.g., cash, check, bank transfer). |

| Remaining Balance | The outstanding amount after the payment. |

| Receipt Number | A unique number for tracking purposes. |

Sample Loan Payment Receipt

Here is a simple example based on the elements above:

| Borrower Name | John Doe |

|---|---|

| Lender Name | XYZ Bank |

| Loan Number | 123456789 |

| Payment Amount | $500 |

| Payment Date | February 4, 2025 |

| Payment Method | Bank Transfer |

| Remaining Balance | $2,000 |

| Receipt Number | RB123456 |

Use this template to create clear, concise receipts for each loan payment. This ensures both parties have accurate records for tracking payments and loan balances.

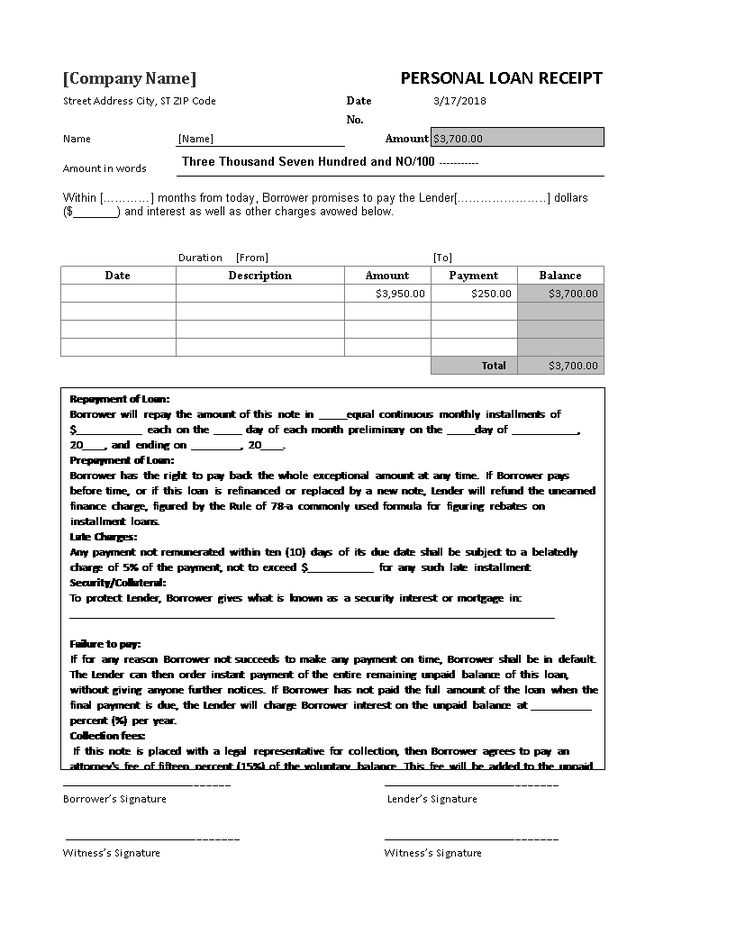

Creating a loan payment receipt involves several clear steps to ensure that both parties have accurate records of the transaction. Follow these guidelines:

- Include the Loan Details: Start by mentioning the loan amount, loan agreement number, and the date the loan was issued. This sets the context for the payment being made.

- Specify the Payment Amount: Clearly state the amount paid and its breakdown (if applicable). If the payment includes interest, list the amount paid toward the principal and toward interest separately.

- State the Date of Payment: Include the exact date the payment was received. This is crucial for record-keeping and helps avoid misunderstandings about when payments are made.

- Payment Method: Specify how the payment was made (e.g., bank transfer, check, or cash). If it was made online, note the transaction ID or reference number for tracking purposes.

- Outstanding Balance: Provide the current balance remaining on the loan after the payment. This helps both parties track the loan’s progress and keep accurate financial records.

- Include Both Parties’ Information: Clearly state the lender’s and borrower’s names and contact information. This helps identify who is involved in the transaction.

- Signature: Include a space for both parties to sign the receipt, acknowledging that the payment was made and received. This serves as confirmation for both sides.

Once you have all this information, review it for accuracy before providing the borrower with a copy. Keep a duplicate for your own records.

To create a clear and accurate loan payment receipt, include the following key details:

1. Receipt Number

Assign a unique receipt number for each transaction. This helps both parties track the payment history and resolve any discrepancies in the future.

2. Date of Payment

Specify the exact date when the payment was made. This serves as proof of timely payment and assists with the loan’s payment schedule tracking.

3. Borrower’s Information

Clearly state the name and contact details of the borrower. This ensures that the payment is accurately attributed to the correct individual.

4. Lender’s Information

Include the lender’s full name and contact details. This adds transparency and ensures accountability for both parties involved in the transaction.

5. Amount Paid

Indicate the exact amount of the loan payment. Be specific about whether it is a full or partial payment, and break down any principal or interest amounts if needed.

6. Remaining Balance

Show the outstanding balance of the loan after the payment. This helps both the borrower and lender keep track of the remaining debt and its reduction over time.

7. Payment Method

State the payment method used (e.g., cash, bank transfer, check). This ensures transparency and provides a reference for both parties.

8. Loan Details

Include relevant loan details, such as the loan agreement number or the specific loan that the payment pertains to. This ties the payment to the correct loan agreement.

9. Signature

Include a section for both the borrower and lender’s signatures to confirm the transaction. This adds authenticity and is useful for record-keeping purposes.

10. Acknowledgment of Payment

State that the payment has been received in full or specify if the payment was applied to the principal or interest. This clarifies the purpose of the payment and its allocation.

| Element | Details |

|---|---|

| Receipt Number | Unique identifier for the transaction |

| Date of Payment | Exact date of payment |

| Borrower’s Information | Full name and contact details of the borrower |

| Lender’s Information | Full name and contact details of the lender |

| Amount Paid | Amount of payment made, including principal and interest breakdown if applicable |

| Remaining Balance | Remaining loan balance after payment |

| Payment Method | Method used for the payment (e.g., cash, bank transfer) |

| Loan Details | Loan agreement number or specific loan reference |

| Signature | Borrower and lender signatures confirming the payment |

| Acknowledgment of Payment | Statement confirming payment receipt or allocation |

To tailor a receipt for various loan types, focus on incorporating specific loan details that relate to each loan’s structure. For example, a mortgage loan receipt should highlight the principal balance, interest rate, and remaining loan term. Include property details and any applicable escrow payments for clarity. For personal loans, emphasize the amount borrowed, payment due dates, and the borrower’s credit terms. Make sure to include any late fees or changes in the loan agreement if applicable.

If the loan is secured by an asset, such as an auto loan, mention the collateral (vehicle details) and loan terms related to the asset. In the case of student loans, ensure you list the school’s name, loan type (federal or private), and the student’s enrollment status. These distinctions provide the borrower with a clear breakdown relevant to their loan agreement.

For payday or short-term loans, it’s critical to include the short repayment period, loan fees, and the date by which the borrower must repay. Specify the payment method and due date prominently to avoid confusion. By customizing the receipt according to the loan type, you ensure transparency and prevent misunderstandings for both the lender and borrower.

Ensure that the loan receipt clearly specifies the exact amount of money received. Omitting or inaccurately listing the sum can cause confusion later, leading to disputes. Double-check the numbers before finalizing the document.

Incorrect loan terms are another frequent mistake. Clearly state the repayment schedule, including the interest rate, payment due dates, and any other relevant conditions. Ambiguity in these details can create misunderstandings or even legal issues down the line.

Don’t forget to include both parties’ full names and contact details. A loan receipt without proper identification of the lender and borrower is incomplete and may be deemed invalid in some cases.

Failure to record payment method is also a common error. Always specify whether the payment was made via cash, check, bank transfer, or any other method. This adds clarity and traceability to the document.

Be careful with missing signatures. Both parties must sign the receipt to acknowledge the terms of the loan and its repayment. A receipt without signatures may not hold up in court.

Finally, never forget to double-check for typographical errors or missing details, as small mistakes can make the entire document less credible. Attention to detail is key to avoiding issues in the future.

Ensure that all loan receipts include the necessary legal information to avoid complications. Start by listing both the lender and borrower’s full names, addresses, and contact information. Make sure the loan amount, interest rate, payment terms, and due dates are clearly defined. Specify any penalties for missed payments or defaults, and confirm the repayment schedule (e.g., monthly or lump sum). A legally binding signature from both parties is crucial, including the date of the transaction.

Include Clear Terms and Conditions

Be explicit about the loan’s terms. Include the loan principal, interest rate, repayment schedule, and consequences for late or missed payments. These details protect both parties and provide clarity in case of disputes. Avoid vague or ambiguous language that could lead to legal confusion.

Ensure Compliance with Local Laws

Familiarize yourself with the specific regulations governing loans in your jurisdiction. Each region may have different requirements regarding interest rates, repayment terms, and borrower protections. Adhering to these laws ensures the validity of the agreement and helps avoid future legal issues.

Always issue loan receipts promptly after each payment. This ensures clarity for both the lender and borrower and prevents misunderstandings about the loan’s status.

- Provide Clear Payment Details: Include specific information like the loan reference number, payment amount, date, and any remaining balance. This helps both parties track payments efficiently.

- Choose a Secure Delivery Method: Send receipts via email or through a secure online portal to avoid issues with lost documents. For paper receipts, use certified mail or another tracked service.

- Store Receipts Safely: Maintain copies of receipts in both digital and physical formats. Store digital receipts in encrypted files or cloud storage, while paper copies should be filed in a secure location.

- Maintain a Receipt Log: Keep a log or spreadsheet detailing each payment receipt sent. This log can be useful for both parties during audits or future reference.

- Use Receipt Templates: Standardize your receipt format to ensure consistency and accuracy across all transactions. This reduces errors and makes reviewing records easier.

- Set a Retention Period: Retain loan receipts for a specified period, such as seven years, to comply with tax or legal requirements.

By following these best practices, both lenders and borrowers can maintain clear records, reduce the risk of disputes, and ensure transparency throughout the loan repayment process.

To create a loan payment receipt template, follow these simple steps to ensure clarity and completeness. Each section should include the necessary details for both parties involved.

- Header: Include the title “Loan Payment Receipt” at the top. Make it clear and concise to avoid confusion.

- Payment Information: List the payment amount, the date it was made, and the loan account it applies to. This helps both parties track payments effectively.

- Borrower and Lender Details: Provide the full name, address, and contact information for both the borrower and lender. This ensures that the receipt is traceable and provides accountability.

- Loan Agreement Reference: Mention the loan agreement or contract number, if applicable. This helps link the receipt back to the original terms and conditions of the loan.

- Signature Section: Add a space for both the borrower and lender to sign, confirming the payment has been made and received.

Incorporating these elements into your loan payment receipt template will ensure it serves its purpose and avoids confusion. Make sure all sections are clear and accurate before finalizing the document.