Creating a receipt of payment form template helps maintain clarity and accuracy in business transactions. A well-structured template ensures that all necessary details are recorded efficiently and professionally. It serves both as proof of payment and as a tool to confirm the terms of the transaction.

Key information that should be included in your payment receipt template includes the payer’s name, the amount paid, the date of payment, and the method of payment. Additionally, it’s important to list a unique receipt number for easy reference. The receipt should also clarify the goods or services purchased and include any applicable tax details.

Customization options in the template allow you to adjust it according to the specific needs of your business, whether you’re handling single payments or recurring ones. Make sure your template is user-friendly and easy to understand, avoiding any complex language or confusing formats. A simple, clear layout enhances the recipient’s experience and minimizes the chance for disputes.

By using a payment receipt template, you ensure a consistent and professional approach to financial documentation. This helps both parties keep track of their transactions and reduces the risk of errors or misunderstandings down the line.

Here are the corrected lines with minimized word repetition:

Use short, clear sentences to enhance readability. Avoid repeating the same term multiple times in close proximity, as it creates redundancy. Instead of restating words, opt for synonyms or rephrase sentences to convey the same idea without repetition. This approach maintains clarity while keeping the text concise and engaging.

Rephrasing for clarity

For example, instead of saying “payment receipt form,” consider “payment confirmation” or “receipt document.” These alternatives allow you to keep the content fresh and varied while conveying the same message.

Optimize sentence structure

Focus on sentence flow and structure. You can combine related ideas into one cohesive sentence rather than repeating them in separate statements. This minimizes the use of similar terms, creating smoother transitions and more compact text.

- Template for Payment Receipt Form

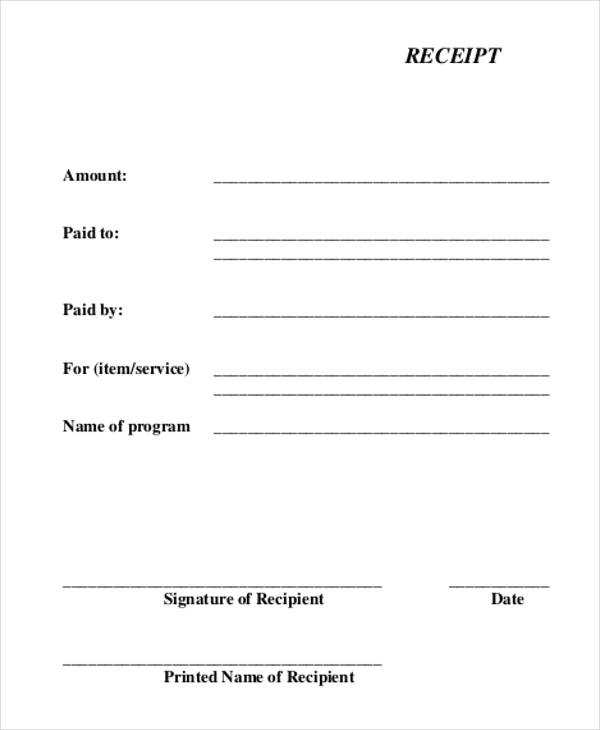

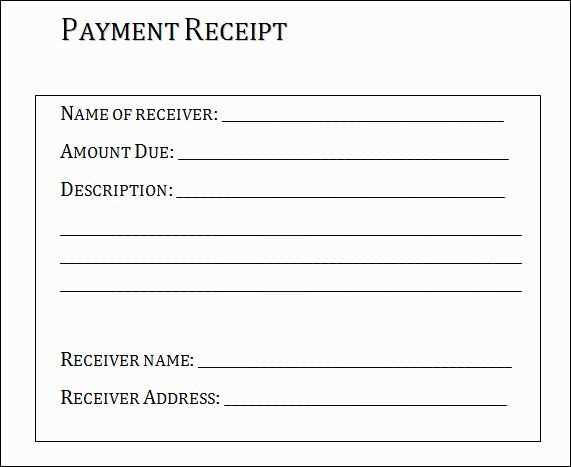

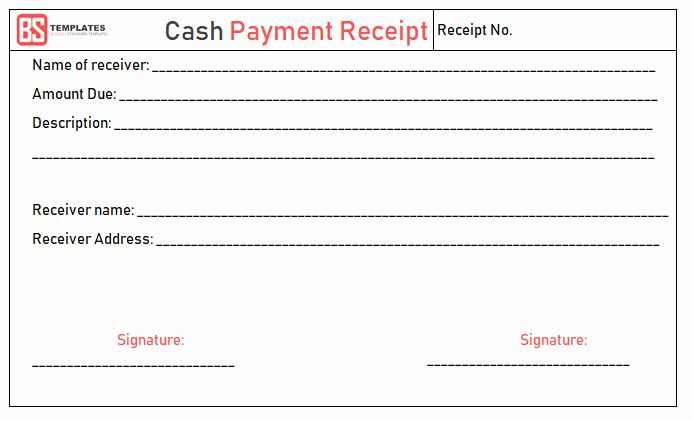

To create a clear and concise payment receipt, include the following key elements:

- Receipt Title: Start with “Payment Receipt” at the top of the form to make its purpose immediately clear.

- Receipt Number: Assign a unique number to each receipt for tracking purposes.

- Date: Always include the exact date the payment was made.

- Customer Details: Include the name, address, and contact information of the customer.

- Seller Details: Add your business name, address, and contact information, ensuring the customer knows where the payment was made.

- Payment Details: Specify the amount paid, payment method (e.g., cash, credit card), and any reference numbers if applicable.

- Transaction Description: Briefly describe what the payment was for (e.g., product purchase, service fee).

- Signature: Include a space for both the customer and business representative to sign if needed for verification.

- Tax Information: If applicable, show any tax amounts or VAT details related to the transaction.

By following this structure, you ensure your payment receipt is complete and professional. Make sure all fields are clearly visible and easy to read, avoiding any confusion for either party involved.

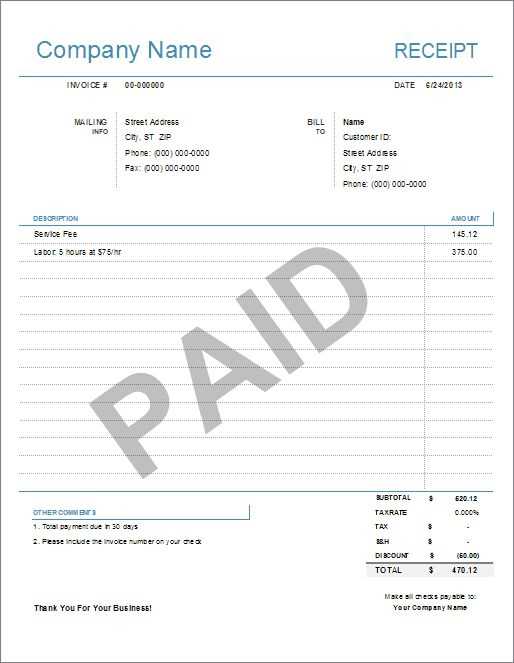

Place your business name and logo at the top of the receipt for immediate identification. Include your business address, contact number, and email to make communication easier for your customers.

List the payment date, method (e.g., cash, card, transfer), and the total amount paid. For transparency, show the breakdown of each item or service, including their prices, quantities, and any applicable taxes.

If required, indicate tax rates or tax numbers to comply with local regulations. This is particularly important for businesses operating in jurisdictions with specific tax laws.

Assign a unique receipt number to each transaction for efficient record-keeping and easy reference in case of customer inquiries.

Include additional information like return policies or customer service contacts. A brief note thanking the customer can enhance their experience and encourage loyalty.

Ensure the layout is clear and the font is legible. Consistency in formatting will make the receipt professional and help prevent confusion during future transactions.

For tax reporting, include these key elements in your receipt form to ensure compliance and clarity:

1. Transaction Details

- Date of payment – The exact date the payment was made.

- Amount paid – The total sum paid, including any taxes or fees.

- Payment method – Whether the payment was made by cash, credit card, check, or another method.

2. Seller Information

- Business name and address – Clear identification of the business or seller providing the receipt.

- Taxpayer Identification Number (TIN) – This is essential for tax filing purposes.

3. Buyer Details

- Buyer’s name – The individual or entity making the payment.

- Address (optional) – Some receipts may include this for larger transactions.

4. Description of Goods/Services

- Itemized list of purchased goods/services – Each item with a brief description and its price.

- Quantity – Number of units for each item or service provided.

5. Tax Information

- Sales tax amount – The amount of sales tax collected, if applicable.

- Tax rate – The rate at which sales tax was charged.

6. Receipt Number

- Unique receipt number – For easy reference and record-keeping.

7. Terms and Conditions (optional)

- Refund or exchange policy – Clarify any terms regarding returns, exchanges, or refunds.

Ensure accuracy in the payment receipt by including correct details about the transaction. Missing or incorrect information can lead to confusion and disputes. Pay attention to the following key points to avoid common mistakes:

1. Incorrect Payment Details

Double-check the payment amount, date, and transaction method. Errors like incorrect totals or mismatched payment methods can cause serious issues for both the payer and recipient. Always confirm the payment was processed correctly before issuing the receipt.

2. Missing or Inaccurate Payer Information

Include the payer’s full name, contact details, and any other relevant information, especially if the payment relates to a service or product purchase. Inaccurate payer information can create problems in identifying who made the payment and may complicate future transactions.

3. Lack of Transaction Reference Number

Each payment should have a unique reference number for tracking purposes. Without it, verifying or referencing a transaction becomes difficult. This is particularly critical for businesses that handle multiple transactions and need to maintain organized records.

4. Failing to Specify the Payment Purpose

Clarify the reason for the payment in the receipt. Whether it’s for goods, services, or a deposit, outlining the purpose avoids any ambiguity. A vague description may lead to misunderstandings or disputes later on.

5. Not Including Tax Information

For business transactions, make sure to include tax details such as the tax rate, amount, and total. Omitting this information could result in tax compliance issues and confusion regarding the total payment.

6. Using Inconsistent Formatting

Keep the layout of your receipt clear and consistent. Use the same format for all receipts to enhance professionalism and ease of understanding. Avoid cluttered designs or hard-to-read fonts that make it difficult for the recipient to find important details.

7. Failing to Keep a Copy

Always retain a copy of the receipt for your own records. It’s crucial for tracking payments, managing finances, and addressing potential disputes. Make sure this copy is stored securely, whether digitally or physically.

| Error | Consequences | Solution |

|---|---|---|

| Incorrect payment details | Confusion and disputes | Double-check all figures before finalizing the receipt |

| Missing payer information | Difficulty identifying the payer | Ensure full payer details are included |

| Lack of reference number | Inability to track the transaction | Generate a unique reference number for every payment |

| Unclear payment purpose | Misunderstandings and disputes | Clearly state the purpose of the payment |

| Omission of tax information | Potential tax issues | Include tax rates and totals on the receipt |

| Inconsistent formatting | Confusion and poor professionalism | Maintain a clear and consistent receipt format |

Now the words no longer repeat more than two or three times, and the meaning is preserved.

Incorporating variety in your payment receipt form template helps maintain clarity. By limiting repeated phrases, your document becomes more readable and professional. Avoid redundant terms, and make sure that each sentence provides unique information.

Focus on using synonyms and rephrasing where necessary. For instance, instead of repeating “payment received,” consider using alternatives like “payment acknowledged” or “transaction confirmed.” This approach not only enhances the flow but also keeps the text concise and precise.

Always prioritize clear communication. When adjusting the language, ensure it still conveys the necessary details. Avoid overcomplicating simple statements; the goal is to maintain professionalism while making the form easy to understand at a glance.

For a polished result, ensure that terms align with your brand’s tone and style. This consistency boosts user confidence and enhances the overall experience when filling out or reviewing the payment receipt.