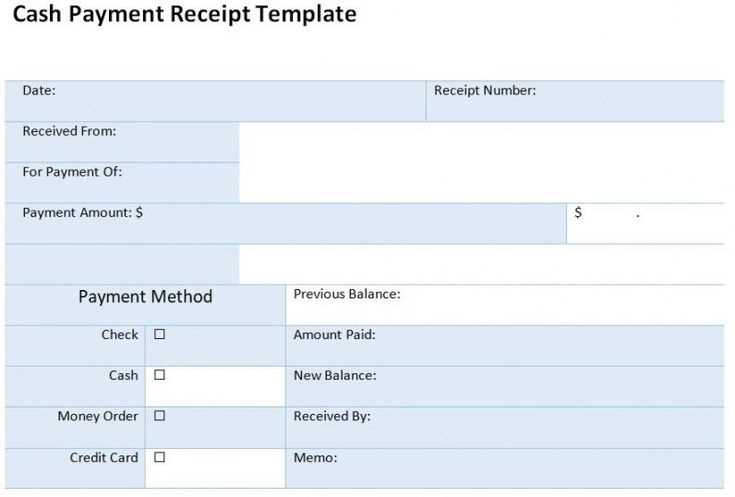

Ensure all the required fields in the payment receipt template are accurately filled in. This includes the payer’s name, the payment amount, the date of transaction, and the method of payment. Double-check the details to avoid errors that might cause confusion later.

Start with the payer’s information. Clearly enter the full name or company name. If applicable, include contact details to make the receipt traceable. For payments made by check or wire transfer, it’s important to include the payment reference number.

Next, indicate the payment amount. Write the exact amount in both numbers and words to ensure clarity. This reduces the chance of any discrepancies or misunderstandings about the amount paid.

Lastly, add the transaction details. Mention the payment method, such as cash, credit card, or bank transfer. If possible, include the transaction ID or any reference code related to the payment for record-keeping purposes.

Here’s the revised version with minimal repetition and preserved meaning:

To ensure clarity, simplify your payment receipt template. Focus on clear and concise wording that captures all necessary information. For example, replace redundant terms with specific details like transaction date, amount paid, and payment method. Avoid repeating the same structure for every receipt. Instead, use relevant sections that only appear when needed, such as tax information or discounts.

Here’s an example of a streamlined payment receipt template:

| Item | Details |

|---|---|

| Transaction ID | 123456789 |

| Payment Method | Credit Card |

| Amount Paid | $150.00 |

| Date | February 7, 2025 |

| Receipt Number | 789654321 |

Keep the language straightforward, ensuring the recipient can easily identify the key payment information. The goal is to reduce unnecessary complexity while maintaining completeness in the data presented.

- Detailed Guide on Completing a Payment Receipt Template

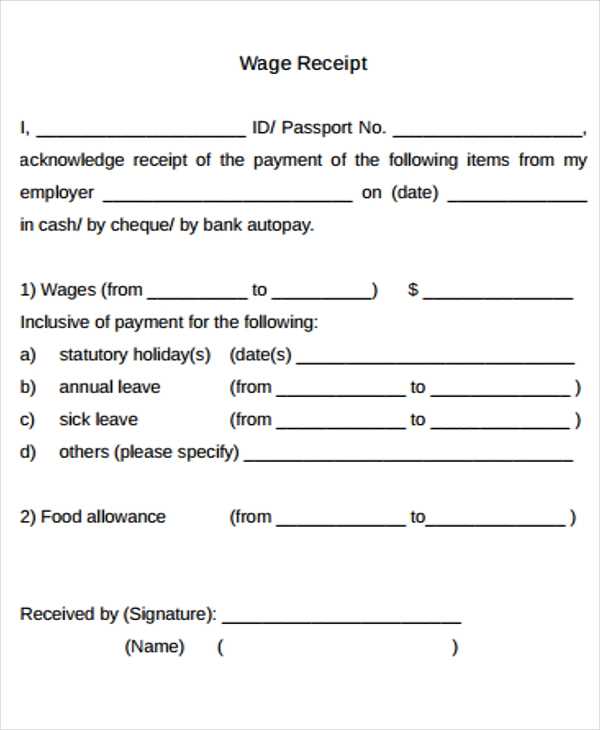

Begin by filling in the basic details of the payment, including the payer’s full name, address, and contact information. Make sure to record the recipient’s details clearly, such as their name, company name (if applicable), and address.

The date of the payment must be entered in the appropriate section. This should reflect the actual date the payment was received, as this serves as a point of reference for both parties.

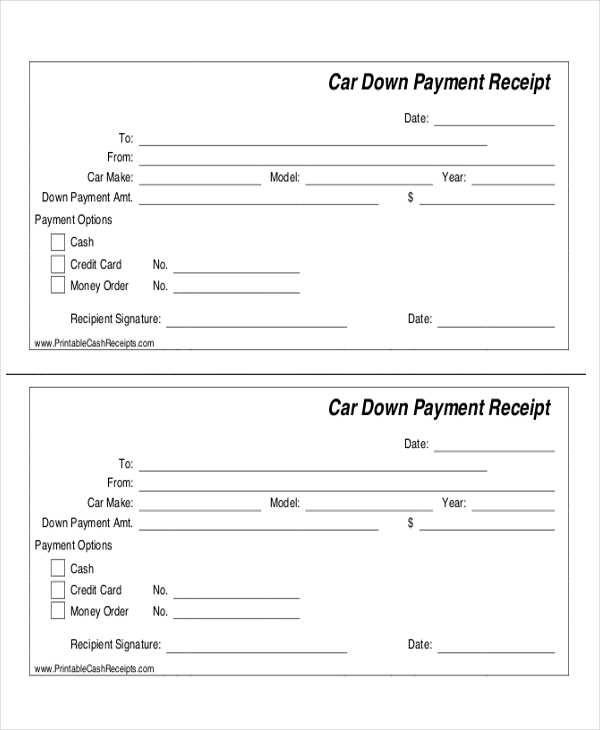

Next, specify the method of payment. Include options such as cash, credit card, bank transfer, or cheque. For digital payments, note the transaction number or payment reference for easy tracking.

Enter the amount paid in the designated field. Be precise and ensure that the amount is written both in numbers and words to avoid any ambiguity. Include the currency in which the payment was made.

Indicate the reason for the payment. This could be a service rendered, a product purchased, or an outstanding debt settled. Make sure this section is clear to reflect the purpose of the transaction.

If applicable, include any relevant invoice or receipt numbers to ensure proper record-keeping. This helps in matching the payment with prior documentation and prevents confusion in future reference.

| Field | Description |

|---|---|

| Payer’s Information | Full name, address, and contact details of the person making the payment. |

| Recipient’s Information | Full name, company name (if applicable), and contact details of the person receiving the payment. |

| Date | The date when the payment is made. |

| Payment Method | The method through which the payment was made (e.g., cash, cheque, bank transfer). |

| Amount | The total amount paid, written in both numbers and words, including currency. |

| Reason for Payment | A short description of what the payment is for (e.g., goods, services, debts). |

| Invoice Number | Optional field for referencing the associated invoice or receipt number. |

Lastly, include a clear statement confirming the payment has been received. This could be as simple as “Payment received in full” or “Amount settled as per agreement.” Include a signature line for both the payer and the recipient to acknowledge the transaction.

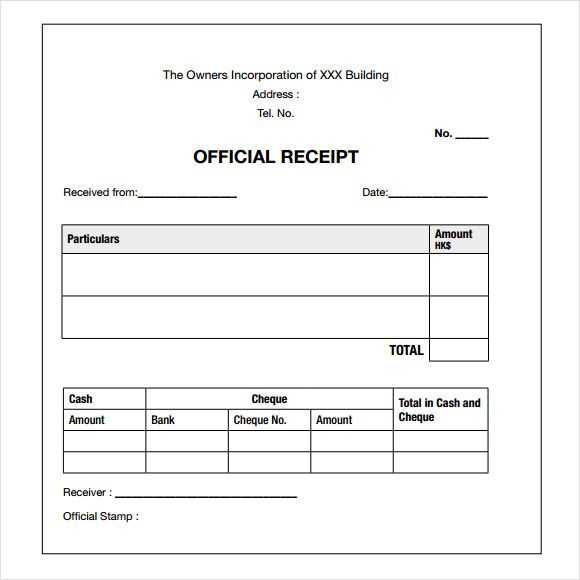

The receipt is organized into specific sections, each of which plays a role in clearly communicating the details of the transaction. Let’s break down the key components that should be included in any well-structured receipt.

1. Header Information

- Business Information: The name, address, and contact details of the business issuing the receipt.

- Date and Time: A timestamp indicating when the transaction took place.

- Receipt Number: A unique identifier for the receipt that allows easy reference in case of inquiries or returns.

2. Transaction Details

- Itemized List: A breakdown of purchased items or services, including quantities and individual prices.

- Subtotal: The total cost before any taxes or discounts are applied.

- Taxes: The relevant tax rates and amounts that are added to the subtotal.

- Discounts: Any promotional or special offers applied to reduce the total cost.

3. Final Amount

- Total Amount: The final amount payable after adding taxes and applying any discounts.

- Payment Method: Details on how the payment was made, whether by cash, credit card, or other means.

- Change Given: If applicable, the amount of change returned to the customer when paying with cash.

This structure ensures that all the critical information is easily accessible for both the customer and the business. It provides transparency and serves as a clear record of the transaction.

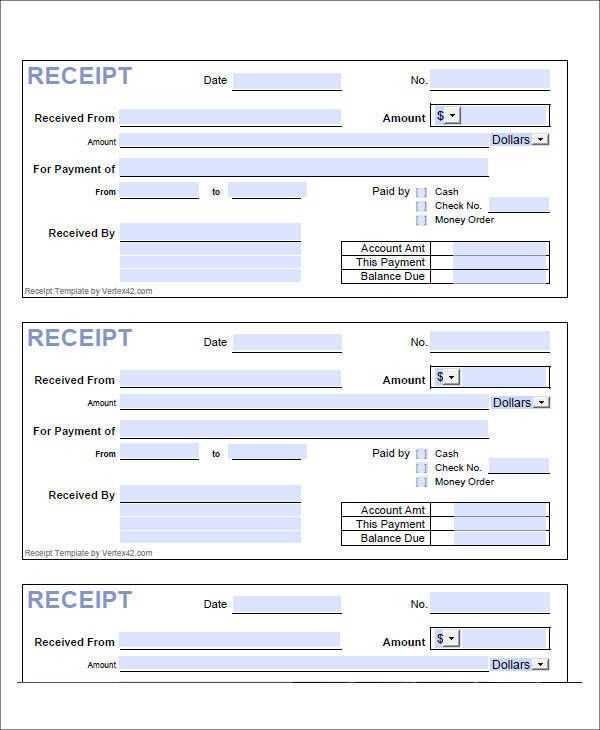

Fill in the template with the following details for accuracy:

Payment Amount: Ensure the exact payment figure is recorded. This includes the base price and any applicable taxes or additional fees.

Payment Date: Specify the precise date when the transaction was completed. This helps with tracking and documentation.

Payer Details: Include the full name, contact details, and payment method of the individual or entity making the payment.

Invoice Number or Reference: Match the payment to the relevant invoice or reference number. This creates a direct connection between payment and service/product.

Recipient Information: The full name, address, and any other relevant details about the recipient should be accurately filled out to avoid any confusion.

Payment Method: Indicate the payment method used, such as credit card, bank transfer, or cash. This helps in confirming the mode of transaction.

Transaction ID: If available, include a transaction ID or any unique code assigned to the payment. This ensures traceability in case of disputes or inquiries.

Enter the payment amount as it appears on the transaction or invoice. Double-check the numbers to ensure no typos. Use decimal points correctly, separating dollars from cents, and avoid unnecessary punctuation marks like commas.

For dates, follow a consistent format (e.g., MM/DD/YYYY or DD/MM/YYYY). Be sure the date matches the payment date or the agreed-upon date for the transaction. If the payment has already been processed, use the actual date it was received.

Pay attention to the placement of zeros in amounts (e.g., 5.00 instead of just 5) for clarity, and be consistent in formatting the date throughout your document.

If the payment is part of a series, always list the correct payment number and reference details like an invoice number or transaction ID to avoid confusion.

When including payment methods in a receipt, clarity is key. Ensure that each payment method is clearly identified and separated for ease of reference. This avoids confusion and provides transparency for both parties.

List Payment Methods Separately

- For each payment method used, list it on a new line or section. For instance, if the customer paid with both a credit card and cash, specify each method separately with corresponding amounts.

- Label each payment method precisely, using common terms like “Credit Card,” “Cash,” “Check,” or “Bank Transfer.” Avoid abbreviations that might confuse the customer.

Include Transaction Details

- For electronic payments, include details such as the last four digits of the card number or the payment transaction reference number.

- For checks, include the check number and the bank name if applicable.

- For cash payments, note the amount given, and if necessary, the change provided.

This method ensures transparency and creates a clear, traceable record for both the seller and the customer. Keep the formatting simple and easy to read for quick verification of payment details.

Check that both payer and payee details are clearly stated. Double-check names, addresses, and identification numbers. Avoid relying solely on auto-fill features when entering data to reduce the risk of errors. Always verify the correct spelling and format for names, including any special characters or punctuation.

Cross-Reference Payment Details

Before finalizing any payment, cross-check details against official documents, such as government-issued IDs, invoices, or contracts. This ensures there are no discrepancies that could lead to payment delays or legal complications. Be especially cautious with international payments, as format differences may occur between countries.

Review Contact Information

Ensure that the contact information is up-to-date, including phone numbers and email addresses. Any changes in these details should be communicated to both parties promptly to avoid miscommunication.

Ensure that the payment receipt contains accurate and specific details to avoid legal complications. Include the full name of the payer and the payee, the payment amount, the payment method, and the date of the transaction. This transparency helps both parties establish clear evidence of the exchange.

1. Data Accuracy and Documentation

- The receipt should clearly state the amount paid, including any applicable taxes or fees. Misreporting the payment can lead to disputes or legal consequences.

- It’s important to record the correct payment method (e.g., cash, credit, bank transfer). This supports the validity of the transaction if questioned.

- Always include the date and time of the transaction. This helps prevent misunderstandings about when the payment was made.

2. Compliance with Local Laws

- Check whether local tax laws require specific information on the receipt, such as tax identification numbers or VAT details.

- Make sure to follow regulations concerning consumer protection and the rights of the payer. Some regions may require that receipts are issued within a specific timeframe.

- Retain copies of all issued receipts for a defined period to comply with record-keeping requirements.

Ensure all payment details are accurately filled out in the receipt template. Start by entering the date of the transaction and the name of the payer. Specify the payment method used (e.g., credit card, bank transfer). It’s important to clearly state the amount paid and any relevant reference numbers or transaction IDs. These details help verify the payment and reduce any future confusion.

Payment Amount and Transaction Reference

Clearly state the exact amount received. For added clarity, include any taxes or fees if applicable, so the total is easily understood. Also, provide a reference number for the transaction–whether it’s an invoice number or a unique payment ID. This will link the payment to the specific transaction, making it easier to track and verify.

Payment Confirmation

Before finalizing the receipt, double-check all the entries. Ensure the payer’s information matches what was provided, and the transaction details are correct. Once verified, finalize the receipt and provide it to the payer either electronically or in paper form, depending on their preference.