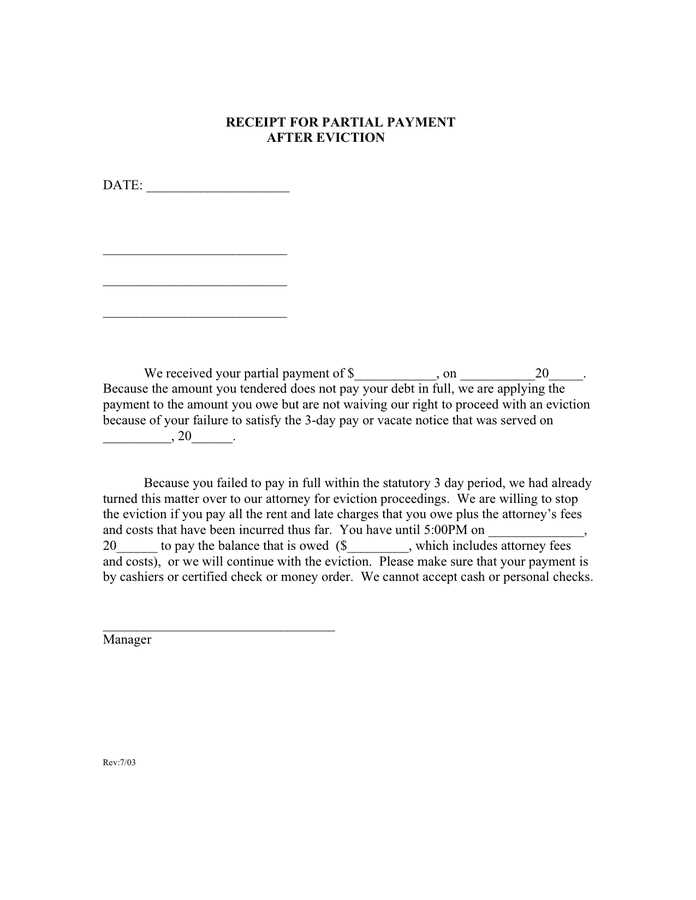

To ensure legal validity, it is important to have a payment receipt notarized. A notarized receipt of payment acts as an official document confirming the exchange of funds between parties. This adds a layer of credibility and protection in case of disputes. The document should clearly state the transaction details, such as the amount paid, the date, and the involved parties. The notary verifies the authenticity of the signatures and affixes their seal, ensuring that the document is legally binding.

When preparing a receipt, include the full names of both the payer and the recipient, their addresses, and the purpose of the payment. Attach any relevant details such as the invoice number or transaction reference to make the receipt more specific. The notary will then confirm the identity of the signatories and certify the document’s legitimacy. Make sure the document is signed in front of the notary to prevent any future challenges regarding the authenticity of the transaction.

A notarized receipt offers strong protection, especially when larger sums of money are involved. It is a useful tool for resolving conflicts and ensuring that both parties are on the same page regarding the terms of the payment. When seeking a notarized receipt, choose a notary with a solid reputation to avoid unnecessary complications.

Here’s the modified version of your text with reduced word repetition while maintaining the meaning:

To ensure clarity, use concise and precise terms while avoiding redundant phrases. In legal or official documents, like payment receipts, removing excess wording enhances readability and efficiency.

For instance, instead of repeatedly using “payment” or “receipt,” alternate with terms such as “transaction confirmation” or “proof of payment.” This provides variation without changing the meaning.

- State the amount clearly and use specific terms like “total sum” or “final balance” to clarify payment details.

- Include any applicable dates, transaction numbers, and parties involved. Replace phrases like “transaction occurred” with “processed on” or “completed on” for a more direct expression.

- Use “notarized” sparingly and only when necessary to maintain the formality of the document.

By focusing on clarity and precision, you ensure your document remains professional and to the point without unnecessary repetition.

- Receipt of Payment Template – Notarized

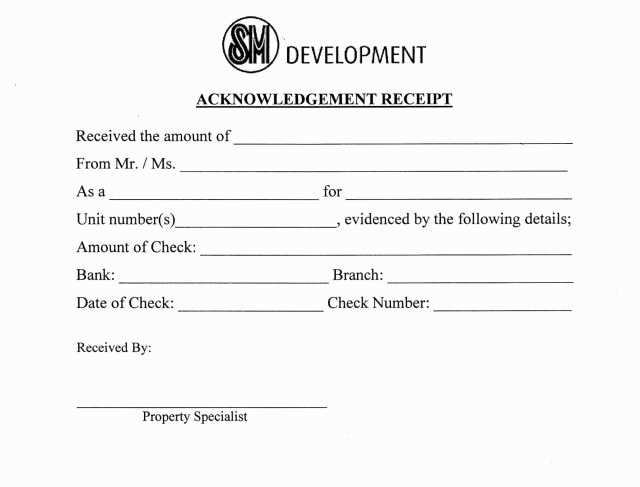

To create a notarized receipt of payment, start by ensuring that the document is legally binding and contains all the necessary details. The receipt should clearly identify both the payer and payee, along with the date and amount of the transaction. It’s crucial to include a brief description of the payment purpose, as this adds clarity to the agreement.

Key Elements of a Notarized Receipt

Make sure to incorporate the following components in the receipt:

- Payer’s Information: Full name, address, and contact details.

- Payee’s Information: Full name, address, and contact details.

- Transaction Date: The exact date the payment was made.

- Payment Amount: Clearly state the amount received, including currency.

- Payment Purpose: Briefly describe what the payment is for (e.g., service, product, debt repayment).

- Signature Section: The document must include space for the signatures of both parties and the notary public.

Notarization Process

Once the receipt is prepared, take it to a notary public for authentication. The notary will verify the identity of both parties and witness the signing of the document. The notary’s stamp and signature will certify that the transaction has been officially recorded. Ensure that the notary has completed the necessary steps, including affixing their seal, to make the document legally valid.

Having a notarized receipt of payment ensures that the transaction is documented and protected from potential disputes. This adds an extra layer of security to financial agreements, making it easier to resolve any issues that may arise.

Notarization plays a key role in enhancing the credibility of payment receipts. By involving a notary, the document gains an official status that confirms the authenticity of both the transaction and the signatures. This helps to prevent fraud or disputes related to the payment process.

When you notarize a payment receipt, it ensures that all parties involved have legally agreed to the terms without any external pressure or manipulation. Here’s why it matters:

- Verification of Identity: A notary confirms the identities of those involved, ensuring the right parties sign the document.

- Prevention of Fraud: Notarization makes it harder for individuals to falsify receipts, making the document more trustworthy.

- Legal Enforceability: A notarized receipt carries more weight in legal proceedings, should there be a need to verify or enforce the payment terms.

- Clear Record Keeping: Notarized documents are easier to keep for future reference and can provide a clear record in case of any audit or legal inquiry.

Incorporating notarization into payment receipts can offer both parties additional security, making the transaction process smoother and more reliable. This simple step can save a lot of potential hassle in the future.

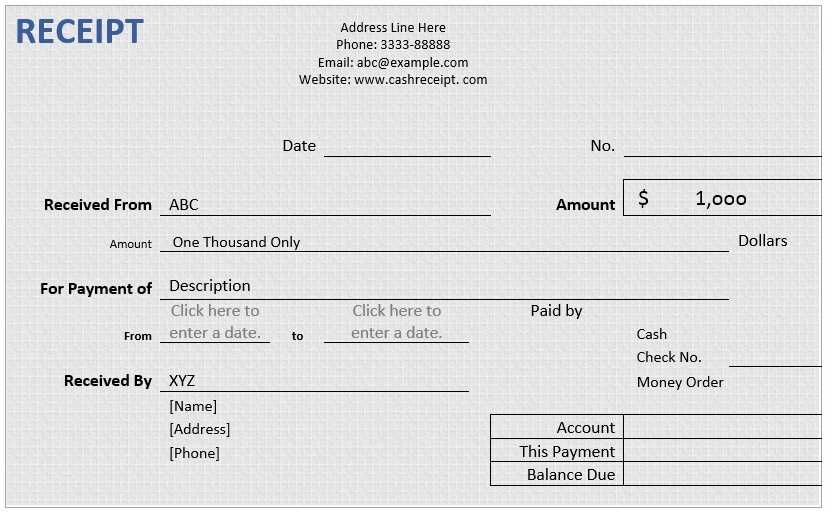

First, gather all necessary information. This includes the full names of the payer and payee, the exact payment amount, the date of the transaction, and a brief description of the reason for the payment. Ensure that this data is accurate to avoid any discrepancies later on.

Formatting the Receipt

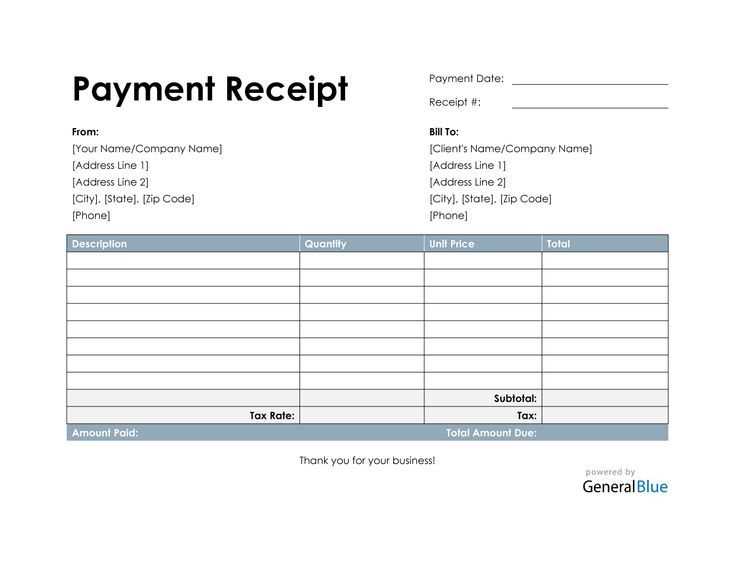

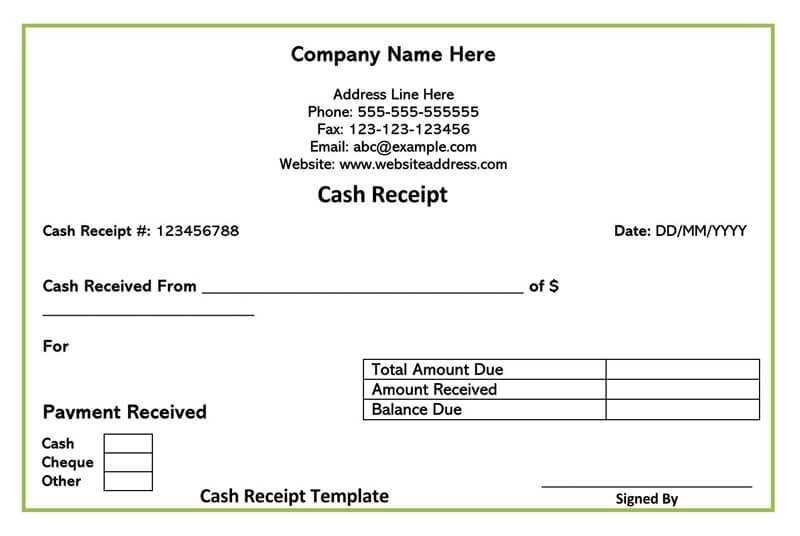

Clearly structure the payment receipt. Start by listing the payer’s and payee’s names and addresses at the top. Include the transaction date, payment amount, and payment method. Specify whether the amount was paid in cash, via check, or electronically. If applicable, include check numbers or payment reference numbers.

Notarization Details

Leave space for the notary’s seal and signature at the bottom. The notary will need to confirm the identities of both parties involved. Arrange for the notary to witness both the payer and payee signing the receipt. Ensure that the date of notarization is clearly noted.

Once signed and notarized, the document becomes a legally recognized record of the payment. Keep a copy for your own records and provide the original notarized receipt to the other party as confirmation of the transaction.

To process payment receipts for notarization, you need to provide clear proof of the transaction. This typically includes the original receipt, a signed agreement between the payer and recipient, and identification documents to verify the parties involved. Ensure the receipt contains specific details such as the payment date, amount, and method of payment.

In addition to the payment receipt, any related contracts or invoices that outline the terms of the payment should also be included. This helps establish the context and confirms that the payment was made according to the agreed terms.

Both parties must present valid government-issued identification. This is to confirm the identities of those involved in the transaction and avoid potential fraud. For notarization purposes, the notary will also ask for personal details to complete the notarization process accurately.

If the payment involves a third party, such as a company or agent, additional documents may be required to establish their role and authority in the transaction. Always check with the notary in advance for any specific requirements.

Ensure the receipt includes all required information, such as the full names of both parties, the amount paid, and the purpose of the transaction. Missing details can lead to confusion or even disputes later on.

Check that the date and time of the transaction are correct. A discrepancy in this information could make the receipt invalid or harder to verify.

Verify that the signature of the person receiving the payment is legible and properly placed. A poorly executed signature might cause the receipt to be rejected by the notary or other parties involved.

Double-check the notary’s information, including their stamp or seal. If any required fields are missing or unclear, the document may not be accepted as legally binding.

Do not rush through the process; ensure every detail is accurate before finalizing the document. Errors may be hard to correct later, and the notarization could be delayed.

Refrain from using unclear language in the receipt. Avoid vague descriptions or abbreviations that might leave room for misinterpretation.

Ensure the payment method is clearly stated. If it’s cash, check, or another form, clarify this detail to avoid confusion regarding the transaction.

Finally, confirm that the notary witnesses the signing of the receipt and the payment transaction. A notarized document without proper witnessing may not hold legal weight.

To ensure the legal standing of your notarized payment document, take the following steps:

1. Verify Notary Credentials

Before proceeding, confirm that the notary handling your document is licensed and authorized to perform notarial services in your jurisdiction. The notary should provide clear identification and a valid stamp or seal on the document. This confirms their legitimacy and the authenticity of their actions.

2. Accurate and Complete Information

Double-check that all details on the payment document are correct and complete. This includes the names of the parties involved, the payment amount, the date of the transaction, and any other pertinent terms. Inaccuracies could lead to disputes or the document being contested in court.

3. Signatures and Witnesses

Ensure all required parties sign the document in the presence of the notary. The notary may also require witnesses, depending on the type of document and jurisdiction. Missing signatures or witness attestations could jeopardize the document’s legal enforceability.

4. Notary’s Certification

Ensure the notary provides an official certification. This includes their signature, seal, and a statement affirming that they have properly executed the notarization. Without this, the document may not be recognized as legally valid.

5. Keep Records of Notarization

Maintain copies of the notarized document along with any supporting materials. Notaries are required to keep records of their notarial acts, which can be helpful if you need to verify the document’s authenticity later.

6. Legal Compliance with Local Laws

Consult your local laws or a legal professional to ensure your notarized payment document complies with all regional requirements. These requirements may differ based on jurisdiction and the nature of the transaction.

| Step | Action |

|---|---|

| Verify Notary Credentials | Ensure the notary is licensed and authorized to act in your area. |

| Accurate Information | Ensure all details, including names, amounts, and dates, are correct. |

| Signatures and Witnesses | Confirm signatures from all parties, including any witnesses. |

| Notary’s Certification | Check for the notary’s seal, signature, and certification statement. |

| Record Keeping | Keep copies of the notarized document and supporting materials. |

| Local Law Compliance | Ensure compliance with your jurisdiction’s notarial and legal requirements. |

Notary services for receipt verification typically involve two key factors: cost and time. Notaries charge based on the complexity of the task and the location of service. On average, a notary may charge anywhere from $5 to $15 per signature. However, additional fees may apply if the service requires extra documentation or a travel charge. Always confirm the total cost upfront to avoid surprises.

The time needed for notarization largely depends on the number of documents and signatures involved. For a simple receipt, the process can be completed in under 10 minutes. If there are multiple pages or if you require multiple signatures, expect a longer wait, usually up to 30 minutes. Scheduling ahead of time can help minimize delays, especially during peak hours when demand is higher.

Some notaries offer mobile services, which may be more convenient but can come with a higher cost due to travel fees. If speed is crucial, it’s helpful to inquire about same-day services, but keep in mind that availability may vary depending on your location and the notary’s schedule.

To structure a receipt of payment template that is notarized, it’s important to focus on clarity and accuracy. This document should outline key details, such as the amount paid, the payer’s information, the payee’s details, the method of payment, and the date of transaction. Each section needs to be easy to read and understand, ensuring that no ambiguity exists around the payment process.

Key Elements for the Template

The document should include the following sections:

- Payer Information: Full name, address, and contact details of the person making the payment.

- Payee Information: Full name, business name (if applicable), address, and contact information of the recipient.

- Payment Details: Clear mention of the amount paid, including currency, payment method (cash, check, wire transfer, etc.), and any reference number or transaction ID.

- Date and Time: Exact date and time of the payment.

- Notary Acknowledgement: Include a statement where the notary confirms the authenticity of the signatures and the document’s legitimacy.

Notarization Process

Once the payment receipt template is drafted, take it to a notary public for validation. The notary will review the document, verify the identities of the parties involved, and then apply their seal. It’s crucial that all parties involved sign the document in the presence of the notary to ensure its legitimacy.