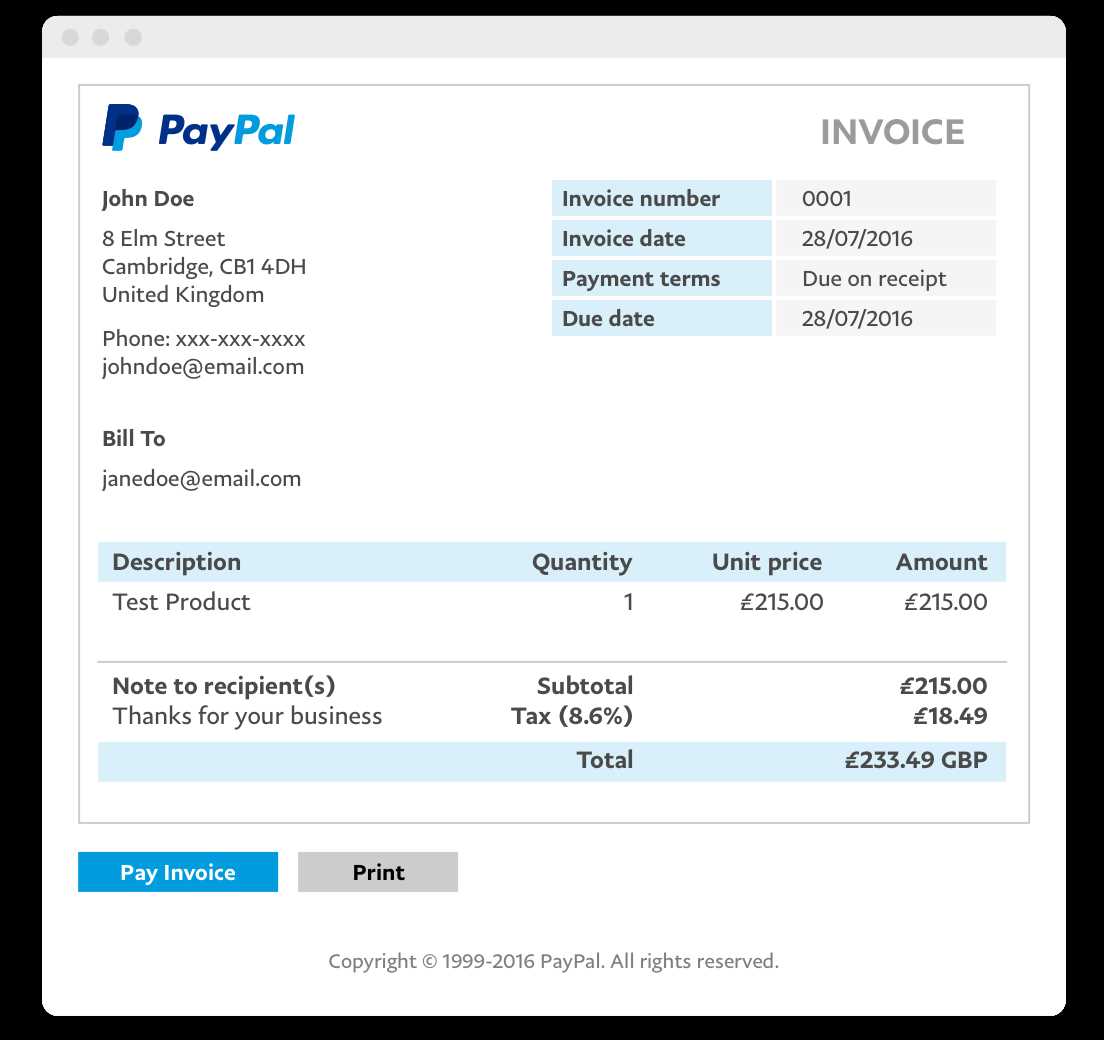

A well-structured receipt payment invoice template ensures accurate records and clear communication between businesses and clients. Start with a header that includes your company name, logo, and contact details. Add a unique invoice number and issue date for easy tracking.

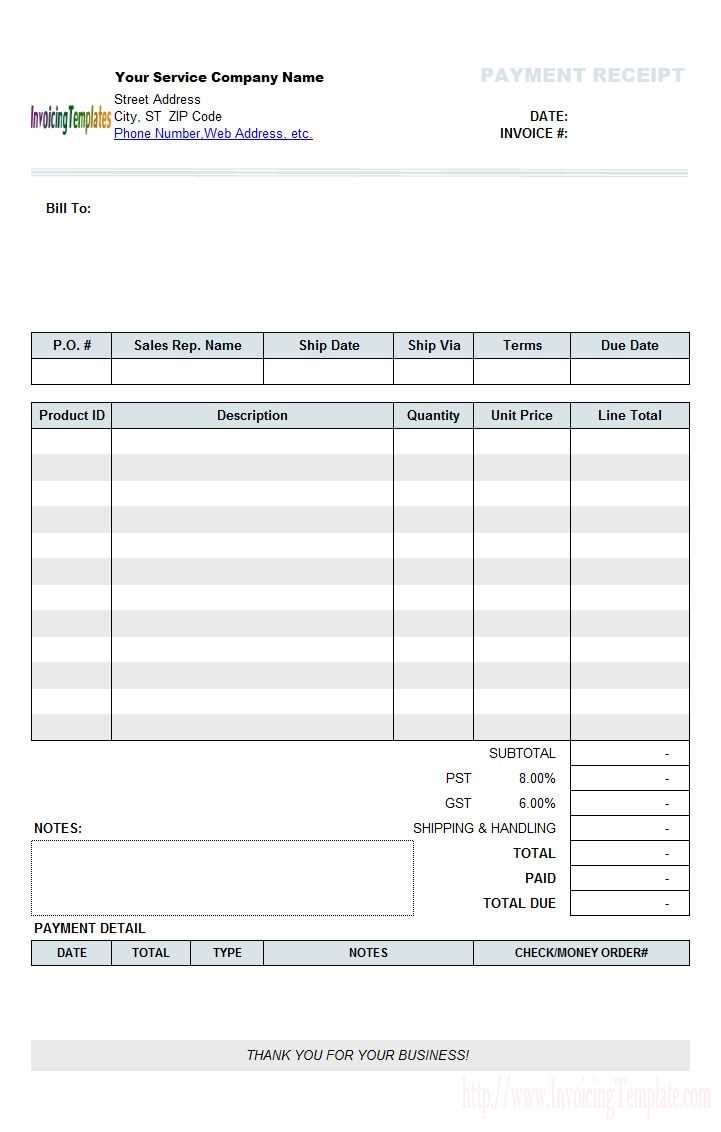

List the buyer’s details, including name, address, and contact information. Clearly outline each item or service provided, specifying quantity, unit price, and total cost. Use a subtotal section followed by applicable taxes and discounts before displaying the final amount due.

Specify payment terms, including due dates and accepted payment methods. A brief note thanking the customer adds a professional touch. Save templates in formats like PDF or Excel for easy reuse and customization.

Receipt Payment Invoice Template

Key Differences Between These Financial Documents

Fields to Include in the Template

Formatting for Clarity

A receipt confirms payment, a payment invoice requests payment, and an invoice details charges before payment. Each document serves a distinct purpose and should not be used interchangeably.

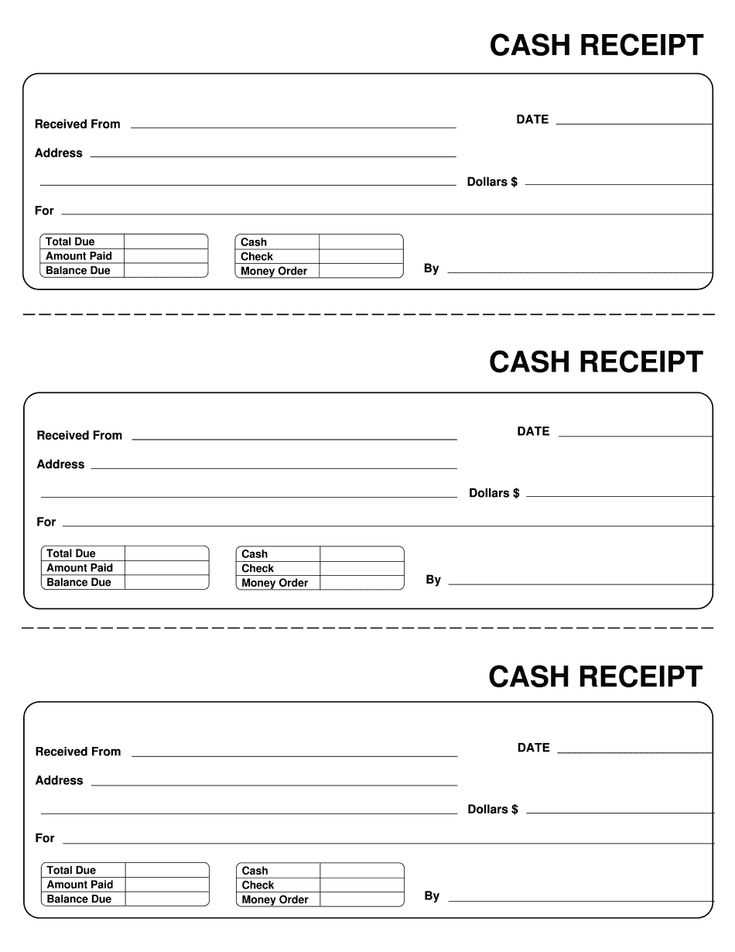

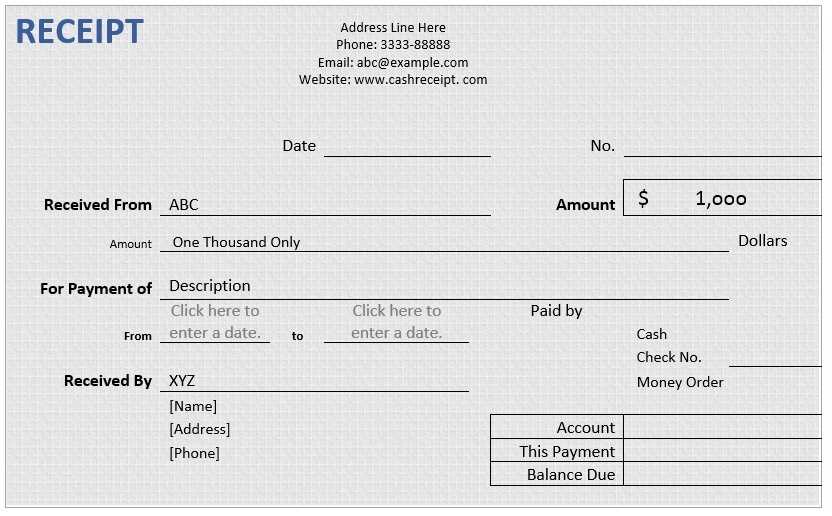

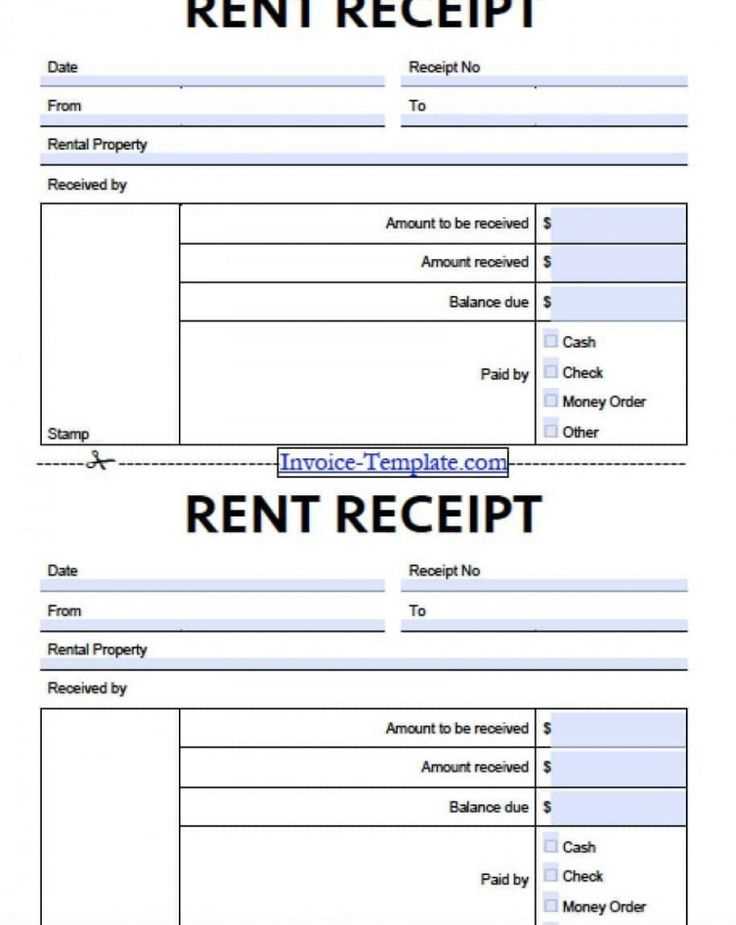

Include these fields in a receipt: date, unique receipt number, payer’s and payee’s names, amount paid, payment method, description of goods or services, and signature or company stamp. A payment invoice requires an invoice number, issue date, due date, itemized list of charges, payment terms, and contact details. An invoice shares similar fields but may include discounts, taxes, and late payment penalties.

For clarity, structure each document with aligned columns, legible fonts, and sufficient spacing. Use bold headers for key sections, and ensure numerical data stands out. Avoid excessive detail–keep descriptions concise yet informative.

Customizing for Various Business Needs

Mistakes to Avoid in Creation

Printable and Digital Templates: Pros and Cons

Adjusting for Different Business Models

A retail store requires itemized receipts with product descriptions and tax calculations, while a freelancer benefits from a simple layout with service details and payment terms. A subscription-based business needs recurring billing options. Tailor fields, fonts, and colors to align with branding and compliance.

Errors That Lead to Payment Delays

Omitting due dates, unclear descriptions, and inconsistent numbering cause confusion. Incorrect tax rates lead to disputes. Always verify client details, double-check totals, and ensure all necessary fields are present before finalizing.

Printed vs. Digital: Key Differences

Printed invoices provide a tangible record and suit customers who prefer paper documentation. However, they require storage space and are prone to loss. Digital formats enable instant delivery, automated tracking, and easy retrieval. Choose based on client preferences and record-keeping needs.