Creating a clear and concise receipt payment template helps both parties track transactions and stay organized. With the right format, you can ensure all necessary details are included for future reference and accountability. Here’s what a solid payment receipt should contain:

Date – Make sure to include the exact date of the payment to keep records up to date.

Receipt Number – This unique identifier makes tracking payments easier, especially for accounting purposes. Keep it sequential to avoid confusion.

Payment Method – Specify whether the payment was made via cash, credit card, bank transfer, or another method. This helps avoid misunderstandings and disputes later.

Amount – Clearly list the amount paid, including any applicable taxes or discounts. This provides transparency and avoids ambiguity.

Payer Details – Include the name of the payer, which ensures proper documentation and verification. If needed, also list their contact information.

Payment Description – Add a brief description of what the payment was for, such as a service, product, or fee. This helps both parties understand the nature of the transaction.

Seller Details – Include your business name, contact information, and address. This establishes credibility and ensures the payer knows how to reach you for future queries.

With these elements, your receipt template will be both practical and professional, helping you maintain transparent and reliable financial records.

Here is the corrected version without word repetition, keeping their quantity and meaning intact:

Make sure the payment details are clear and accurate. Begin with the payer’s name and contact information, followed by the recipient’s details. Include the payment amount and method used. Specify the invoice number and date of transaction. Ensure each section is organized for easy readability, separating key information with headers or bullet points. Avoid unnecessary jargon or confusing terms that could complicate understanding. Confirm all amounts and references are consistent and aligned with the agreement terms.

Be sure to include a breakdown of the payment if applicable, showing the specific items or services covered. A brief note explaining any taxes or additional fees can help clarify the total amount paid. Finish with a thank-you note or confirmation of payment receipt, reinforcing a positive experience for the recipient.

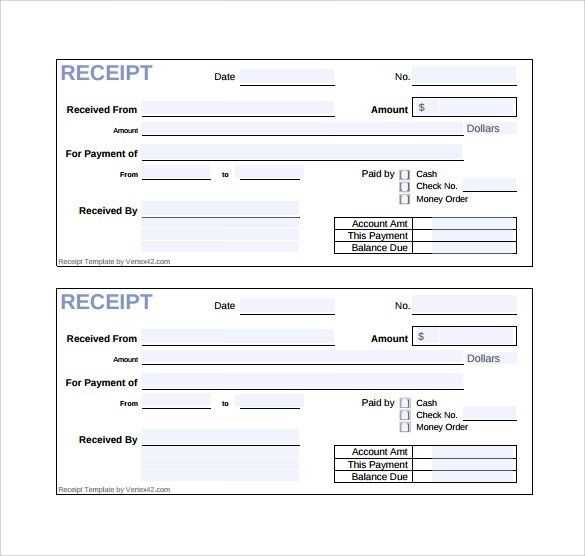

- Receipt Template for Payment

Creating a clear and accurate receipt template is key to maintaining transparency in financial transactions. Below is a simple yet effective structure for a payment receipt.

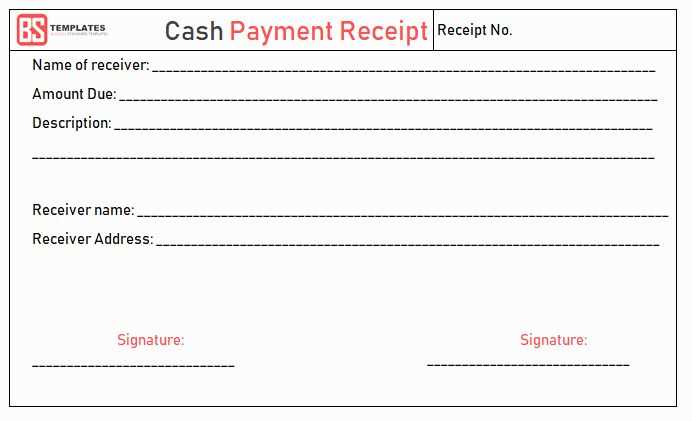

Receipt Template Elements

- Receipt Header: Include your business name, logo (if applicable), and contact information. Clearly label the document as “Receipt”.

- Receipt Number: Assign a unique receipt number for reference and organization.

- Date of Payment: Specify the date the payment was received.

- Payment Details: Include a description of the products or services provided. List the amount paid, payment method (cash, credit card, etc.), and the total amount.

- Customer Information: Include the customer’s name and contact details to ensure proper identification.

- Seller Information: Provide the business name, address, and contact details for easy follow-up.

- Tax Information: Include the tax rate and the total amount of tax, if applicable.

- Signature: If necessary, add a space for the signature of both the buyer and the seller for validation purposes.

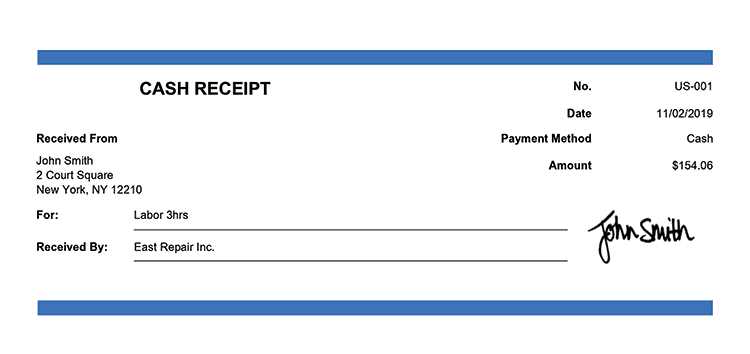

Sample Receipt Layout

Here’s an example of how you can structure your payment receipt:

- Receipt Number: 00123

- Date of Payment: January 6, 2025

- Payment Method: Credit Card

- Description: Consulting Services for Project XYZ

- Total Amount: $500.00

- Tax (5%): $25.00

- Customer Name: John Doe

- Seller: ABC Consulting

This straightforward template ensures all critical details are clearly outlined, making the receipt both useful and professional for future reference.

Creating a payment receipt in Word or Excel is straightforward. Both programs offer easy-to-use templates that you can customize for your needs. Here’s how you can do it step by step.

Using Microsoft Word:

1. Open a blank document in Word and go to the “File” tab. Click on “New” and search for “receipt” templates.

2. Choose a template that suits your style, then click “Create” to open it.

3. Edit the placeholder fields with the transaction details: the date, payer’s name, amount paid, payment method, and description of the product or service.

4. You can add your company logo or contact information for a more professional look.

5. Once done, save the document and print it if needed or send it digitally as a PDF.

Using Microsoft Excel:

1. Open a new Excel sheet and search for a “payment receipt” template in the “File” tab under “New.” Select a template that fits your requirements.

2. Fill in the required details such as date, recipient, amount, and payment method.

3. Excel allows you to add formulas if you want to automatically calculate totals or taxes based on the payment information.

4. You can format the receipt by adjusting fonts, adding borders, and coloring cells to make the document visually clear and professional.

5. Save your receipt and either print it or share it electronically.

Both options are quick and efficient for creating a payment receipt that looks polished and serves its purpose. Whether you use Word for a more text-heavy format or Excel for an organized, spreadsheet-style receipt, you can easily customize each template to reflect your business needs.

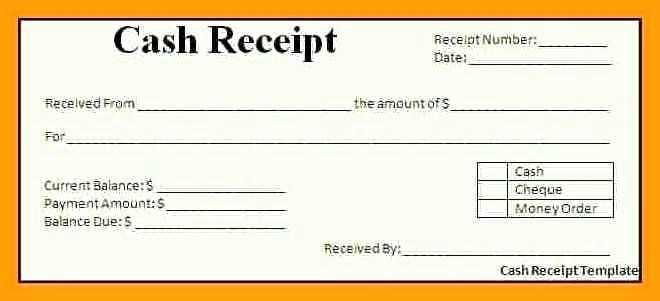

To ensure clarity and avoid disputes, include specific details on your payment receipt template. Start with the full name of both the payer and the payee. This establishes who is involved in the transaction and adds a level of professionalism. You should also note the transaction date, which serves as a clear reference point for both parties.

Transaction Details

Specify the payment method, whether it’s cash, credit card, check, or online transfer. This information verifies how the transaction was processed. Include a breakdown of the items or services purchased, along with their respective prices. If applicable, list any discounts or taxes added to the total. Make sure the total amount paid is clearly stated, without ambiguity.

Additional Information

If the payment was made in installments, indicate the amount paid and the remaining balance. Providing a receipt number can help with tracking and future reference. Include your contact details–such as phone number and email–so the payer can reach out if needed.

Choose a clean, minimalist design that prioritizes readability. Keep the layout simple with clear sections for each piece of information. Use a consistent font style throughout–something professional like Arial or Helvetica–and make sure text is large enough to read easily. Avoid excessive use of bold and italics, as they can distract from the content.

Layout Structure

Ensure the template includes distinct areas for key details such as the company logo, contact information, payment summary, and terms. Align text to the left for a professional appearance and make use of white space to avoid clutter. Organize the information in a logical order, starting from the most crucial details at the top.

Branding and Customization

Integrate your brand colors subtly in the design. Limit the use of bright, overpowering colors to maintain a polished look. Choose a complementary color scheme that enhances the template’s readability. Allow room for personalization, such as adding your company logo or adjusting the payment details section to fit your needs.

Finally, ensure the template is flexible enough to be used in various formats, including PDF or Word, for easy sharing. Keep the file size manageable for quick downloads and printing.

Double-check the payment amount before finalizing the template. Inaccurate totals can lead to confusion and delays, especially if the template is used multiple times.

Be cautious with incorrect date formatting. Ensure that all dates, including payment due dates, are clear and in a universally understandable format, such as DD/MM/YYYY or MM/DD/YYYY, depending on your audience.

Ensure you’re including all required details, like the payment method, account number, and any applicable reference numbers. Missing this information can result in payments not being processed correctly.

Avoid using ambiguous language. Be specific about the services or goods being paid for, including any additional charges, such as taxes or shipping fees.

Don’t forget to proofread. Typos or unclear wording may cause misunderstandings or miscommunications between you and the payer.

Don’t use overly complex templates. Keep the layout clean and easy to read to avoid confusion and ensure that all critical information stands out clearly.

Always test the template before sending it out. Check how it displays on different devices and email clients to ensure compatibility.

Adjust your payment receipt based on the method used to ensure accuracy and clarity for your customers. Tailor the receipt format for cash, credit card, and online transactions to match the specifics of each payment method.

Cash Payment Receipts

For cash payments, include the exact amount received, the currency, and the name of the person making the payment. Acknowledge the cash payment with a clear statement of “Cash Payment” and specify the amount in both numerical and written forms to avoid any confusion.

Credit Card and Online Payment Receipts

For credit card or online payments, include additional details like the last four digits of the card number, transaction ID, and payment gateway used. Always mention the transaction status, such as “Approved” or “Declined,” along with the transaction date and time.

| Payment Method | Key Details |

|---|---|

| Cash | Amount received, currency, payer’s name, amount in words |

| Credit Card | Last four digits of the card, transaction ID, approval status |

| Online Payment | Transaction ID, payment gateway, approval status, transaction time |

Integrating payment systems with automated receipt generation streamlines your business operations and ensures accuracy. Payment platforms like Stripe or PayPal provide tools to automatically issue receipts once a transaction is completed. These receipts can be customized with specific details such as the item description, price, date, and transaction ID.

To set up automatic receipt generation, link your payment system to an invoicing or accounting tool that supports this feature. Systems such as QuickBooks or Xero can automatically import payment details and create a formatted receipt without manual intervention. This reduces human error and saves time for your team.

Customizing receipt formats to match your branding is simple. Most payment systems allow you to adjust the layout, add your logo, and even include personalized messages. With automated receipts, you also enhance the customer experience by providing immediate confirmation of payment without delay.

Incorporating automation not only saves time but also helps with compliance. Automated systems ensure that receipts are generated for every transaction, helping you maintain accurate financial records and simplifying tax reporting.

Streamlining Your Payment Receipt Template

To improve clarity and readability, replace repetitive phrases with synonyms and restructure sentences. This approach helps maintain a smooth flow and avoids redundancy. Below are some practical suggestions:

- Instead of repeatedly using “payment received,” try variations such as “payment confirmed,” “funds deposited,” or “transaction completed.” This will make the document sound more dynamic.

- If “Thank you for your payment” appears multiple times, substitute with phrases like “We appreciate your payment” or “Your payment has been acknowledged.” This avoids sounding too repetitive.

- Change passive structures to active ones for more direct communication. For example, instead of “The payment was processed,” write “We processed your payment.”

- Group similar ideas together. For example, if the receipt contains information about the payment method, consolidate it into a single section instead of repeating it throughout the document.

- Ensure that your sentences are varied in structure to keep the reader’s attention. Mix short, punchy statements with more detailed explanations where necessary.

By making these adjustments, you can create a more engaging and professional payment receipt template.