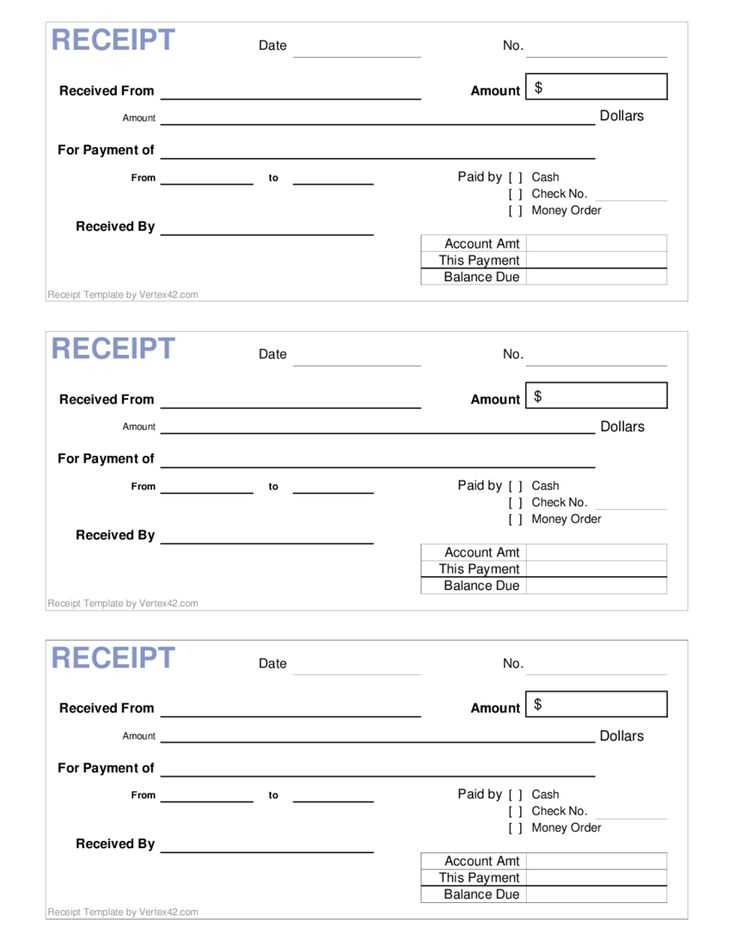

When you receive a payment, a receipt template can streamline the documentation process and make transactions transparent for both parties involved. It ensures that there’s a clear record of the payment for future reference or any potential disputes. A well-structured receipt shows the payment details accurately, including the date, amount, method, and payer’s information. This helps maintain trust and avoids confusion.

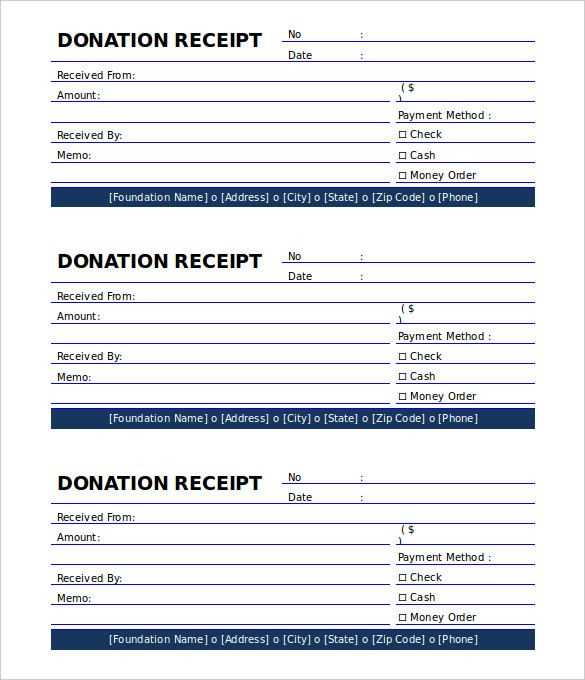

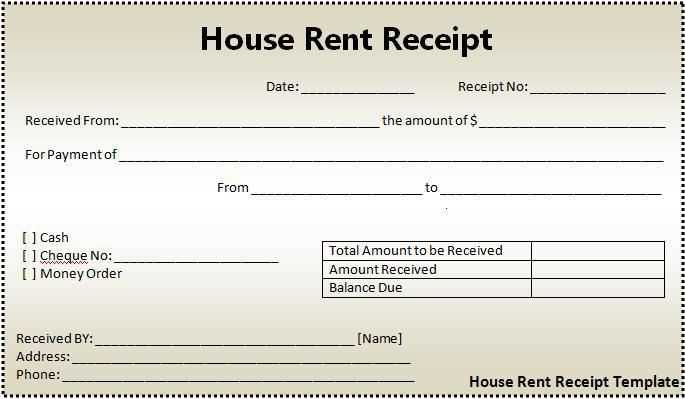

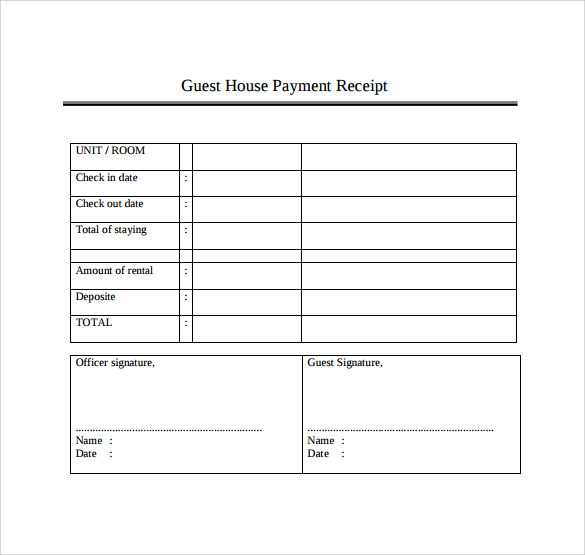

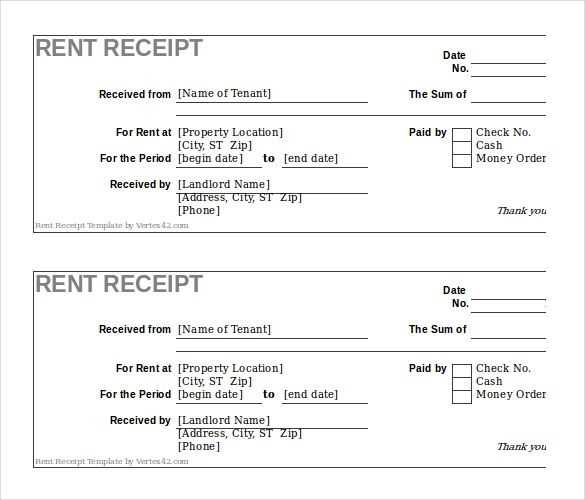

Start by including key details such as the payer’s name, the amount paid, and the payment method. Specify any goods or services provided in exchange for the payment. Include the transaction date and any relevant reference numbers to ensure clarity. If taxes were applied, they should be itemized. Providing a clear breakdown is especially important for business transactions, where accuracy can help with accounting and reporting.

Using a template also saves time. Instead of writing a new receipt from scratch each time, you can fill in the necessary fields quickly. Customize the template to fit your needs, whether it’s for a one-time service or a recurring payment. In addition, having a digital or printable template makes record keeping easier. You’ll always have a professional and consistent format to use, which is important for maintaining good business practices.

Here are the corrected lines with duplicate words removed:

Remove unnecessary repetitions in the sentences to make them clear and concise. For example:

Before:

“We have received your payment payment for the amount of $100. The payment payment has been processed successfully.”

After:

“We have received your payment of $100. The payment has been processed successfully.”

When reviewing your text, check for words or phrases that repeat in close proximity. Repeating terms can clutter the message and reduce readability. Keep your sentences short and to the point to ensure clarity.

Also, avoid redundant phrases like “the payment has been received and is confirmed.” Instead, simply state “the payment has been received.” This eliminates any overlap in meaning and keeps the message straightforward.

Eliminating repetitive words improves the professionalism and clarity of your communication. It ensures that your receipt template remains clean, simple, and easy to understand for your audience.

- Receipt Template for Payment Received

Include the following details in your receipt template to ensure a complete record of the transaction:

1. Business Name and Contact Information: Clearly display the name of your business along with contact details such as phone number, address, and email.

2. Receipt Number: Assign a unique number to each receipt to keep track of payments. This helps in referencing and managing receipts effectively.

3. Date of Payment: Record the exact date when the payment was received. This ensures both parties have a clear timeline of the transaction.

4. Payer Information: Include the name of the person or entity making the payment. This adds clarity in case the payment needs to be traced back to the payer.

5. Amount Paid: Specify the amount in both numerical and written form. Double-check this value for accuracy.

6. Payment Method: Note how the payment was made, whether by cash, check, credit card, or another method. This helps in reconciling payments and avoiding misunderstandings.

7. Description of Goods or Services: Provide a brief description of what the payment is for, such as the product or service provided. This adds transparency to the transaction.

8. Tax Information: If applicable, include any tax details, such as the tax rate or tax number, for proper recordkeeping and compliance.

9. Signature Line: Provide space for the person receiving the payment to sign. This adds an extra layer of acknowledgment that the transaction has been completed.

By following this template, you can ensure each payment is well-documented, providing both you and your clients with the necessary details for future reference.

Begin by structuring your receipt clearly. At the top, include your business name, logo, and contact details. This establishes trust and makes the receipt easily identifiable. Below this, clearly label the document as a “Receipt” or “Payment Receipt”.

Next, include a unique receipt number and the date of the transaction. This will help in tracking payments and maintaining an organized record. Specify the payment method (e.g., cash, credit card, bank transfer) for clarity.

List the items or services purchased with a brief description, quantity, and unit price. Add up the total amount, including applicable taxes or discounts, in a simple, easy-to-read format.

Conclude with a thank-you note or any further instructions, such as return policies or warranty information, if relevant. This adds a personal touch and makes the document more functional.

Ensure that the design is straightforward, with enough white space to avoid clutter. The font should be legible, and the layout should make it easy for the recipient to find the information they need quickly.

Each payment receipt must contain specific details to ensure clarity for both the payer and the payee. Here’s a breakdown of the key elements:

- Receipt Number: A unique identifier helps track each transaction. It prevents confusion when multiple receipts are issued over time.

- Date of Payment: Include the exact date when the payment was made to confirm the transaction’s timing.

- Amount Paid: Specify the total amount received. If the payment is partial, clearly indicate the remaining balance.

- Payment Method: Identify how the payment was made (e.g., cash, credit card, bank transfer). This offers transparency on the transaction type.

- Recipient’s Information: Include the name, address, or company details of the entity receiving the payment for record-keeping.

- Payer’s Information: If applicable, add the payer’s name and contact details. This is useful for both legal and communication purposes.

- Purpose of Payment: State the reason or description of the goods/services provided in exchange for the payment. This helps clarify the transaction’s intent.

Optional Details

- Tax Information: If relevant, include tax identification numbers or any details related to taxes, such as VAT or sales tax.

- Terms and Conditions: If the payment is part of an ongoing agreement, mention any related terms or conditions that apply.

Ensure the receipt is clear, complete, and easy to understand. This will make future reference simple and minimize potential disputes.

To align your receipt template with your business, focus on including key details that reflect your brand. Modify the template to feature your logo, business name, and contact details prominently. This gives customers a professional and personalized experience. If your business deals with specific products or services, consider adding customized fields like product descriptions or service categories. It will make your receipts not only functional but informative.

Next, adjust the layout for clarity. Place important details like the amount paid and the date in a way that makes them easily visible. If your business requires tax identification numbers or VAT details, add these to ensure transparency. You can also modify the font style and size to match your brand’s look while keeping readability intact.

If your business has a loyalty program or special offers, consider adding a section for discounts or membership details. This not only improves customer service but encourages repeat business. For more flexibility, add customizable fields where you can manually input extra details for specific transactions or clients.

Test the template on different devices to make sure it appears correctly in both printed and digital formats. Regularly review and update the template to reflect any business or legal changes. Customizing your receipt template helps reinforce your brand identity and improves the overall customer experience.

To create a professional receipt template, choose a format that ensures clarity and ease of use. The most popular formats include PDF, Word, and Excel. Each format offers distinct benefits based on how you intend to distribute and manage receipts.

PDF is the most widely accepted format for receipts due to its compatibility across devices and its ability to preserve the layout. It’s perfect for sending receipts via email or storing them digitally, as it maintains the format regardless of the device being used to view it.

Word is a good option for users who want flexibility in editing the receipt layout. It’s particularly useful if you need to make frequent changes or adjust the template based on specific transaction details. However, it’s less secure than PDF and can be easily modified, which could be a concern for some users.

Excel is ideal for businesses that deal with large volumes of transactions. It allows you to easily track payments, calculate totals, and generate reports. The spreadsheet format enables easy sorting and data analysis, but it may not look as polished as a PDF receipt for customer-facing scenarios.

| Format | Best For | Pros | Cons |

|---|---|---|---|

| Official receipts, email distribution | Widely compatible, preserves formatting, secure | Not easily editable | |

| Word | Frequent updates or customizations | Easy to edit, flexible layout | Can be easily modified, less professional |

| Excel | Tracking large volumes of transactions | Easy data organization, calculations | Not visually polished for customer-facing use |

Choose the format based on your specific needs, whether that’s sending official receipts, tracking data, or ensuring flexibility for frequent updates. Keep in mind your customers’ preferences and the level of detail required in each transaction.

Ensure receipts contain the necessary legal information, such as the business name, address, and tax identification number. This helps protect both parties in case of disputes or audits. Keep records of all issued receipts for at least the legally required period, which varies by jurisdiction, to comply with tax regulations.

- Verify that receipts include clear terms about the transaction, including the total amount paid, payment method, and the description of the goods or services provided. Avoid vague wording to prevent misunderstandings.

- Include any relevant disclaimers about returns, warranties, or refunds if applicable to your business. This creates transparency and prevents future disputes over terms.

- Ensure compliance with consumer protection laws. Receipts may need to provide proof of compliance with specific regulations based on the industry or transaction type.

- In some cases, electronic receipts may need to meet specific standards. Check the legal requirements for digital receipts in your jurisdiction, especially if operating in a regulated field.

- Offer customers an option to receive a receipt, as some jurisdictions may mandate that receipts are provided for certain transactions or upon request, even for small purchases.

Failing to follow these guidelines could lead to legal consequences, such as fines or difficulties during tax audits. Always stay informed about local regulations and adjust your receipt practices accordingly to minimize risks.

Use invoicing software or payment platforms that automatically generate receipts once a payment is confirmed. Integrate your payment system with an invoicing tool to ensure seamless, immediate receipt creation. Set up templates that include payment details such as amount, date, and payment method, and have them auto-populate with transaction information.

Automate notifications so customers receive receipts via email or SMS without manual input. Many platforms offer automatic email options with customizable templates for your branding. Customize the receipt’s look to match your business needs, ensuring all necessary details are present.

If you’re using accounting software, configure it to generate payment receipts each time a transaction is processed. This can reduce human error and eliminate the need for manual tracking of payments.

For businesses using e-commerce platforms, integrate your payment gateway with automated receipt generation. When a customer completes a purchase, the system should automatically generate and send a receipt.

Test the system regularly to ensure accuracy and consistency in the receipts, making sure all payment details, tax information, and customer data are correctly recorded. This approach speeds up the process and provides your customers with instant confirmation of their payments.

Receipt Template for Payment Received

For a clear and professional receipt, include specific details that prove the transaction. Start by listing the payment amount, date, and payment method (e.g., cash, credit card, bank transfer). This ensures both parties know exactly what was paid and how.

Next, provide a unique receipt number for tracking purposes. This helps in future reference and keeps records organized. Clearly mention the product or service received, describing it briefly for clarity.

Include the business name and contact information at the top, so the customer can reach out if necessary. Make sure to include any applicable tax rates and amounts to show full transparency in the transaction.

Finally, offer a simple thank you or acknowledgment message at the bottom, which adds a touch of customer care without overwhelming the receipt with unnecessary information.