Use a clear and concise receipt template for payment letters to ensure both parties have a documented proof of transaction. A well-structured letter offers transparency and clarity. Begin by including the date of the payment, the amount received, and the method of payment. This establishes a record for both the sender and receiver.

Details to Include: Include the name of the payer, the payer’s contact information, and any reference or invoice number related to the payment. This helps to avoid confusion in the future. If applicable, note any terms or conditions agreed upon between both parties.

Key Sections: A receipt letter should also specify what the payment was for, whether it’s for a product, service, or debt. A clear description of the transaction will safeguard against any future disputes. Closing with a thank-you note is always a good touch.

Here is the revised version with repetitions minimized:

To streamline your receipt letter, focus on clarity and precision. Remove redundant phrases and avoid restating the same idea multiple times. Use simple language that directly conveys the necessary information.

The table below shows an example of an optimized receipt letter format, minimizing unnecessary repetitions:

| Date | Amount | Recipient | Payment Method | Description |

|---|---|---|---|---|

| 2025-02-06 | $500 | John Doe | Credit Card | Payment for services rendered |

| 2025-02-06 | $300 | Jane Smith | Bank Transfer | Consulting fee |

Make sure to include the payment date, amount, recipient name, payment method, and a brief description of the transaction. This format keeps the letter concise and easy to understand.

- Receipt Template for Payment Letters

To create an effective receipt template for payment letters, focus on clarity and key details. Include the following essential elements:

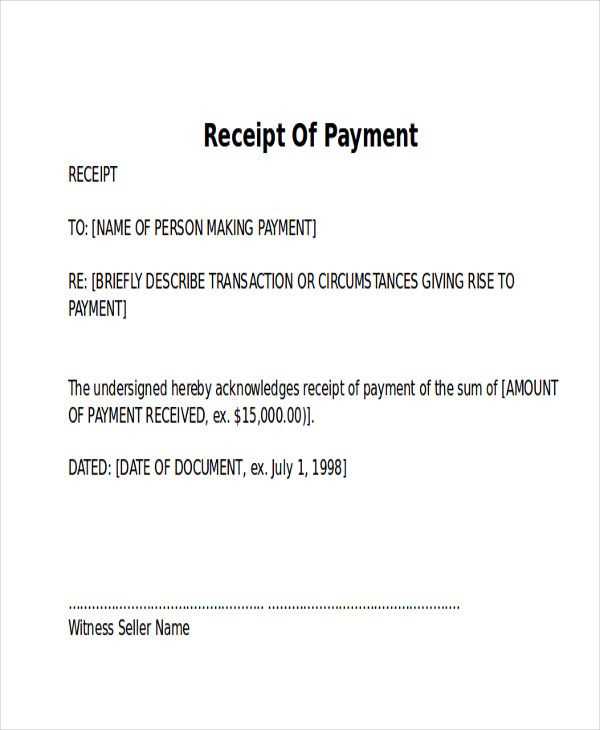

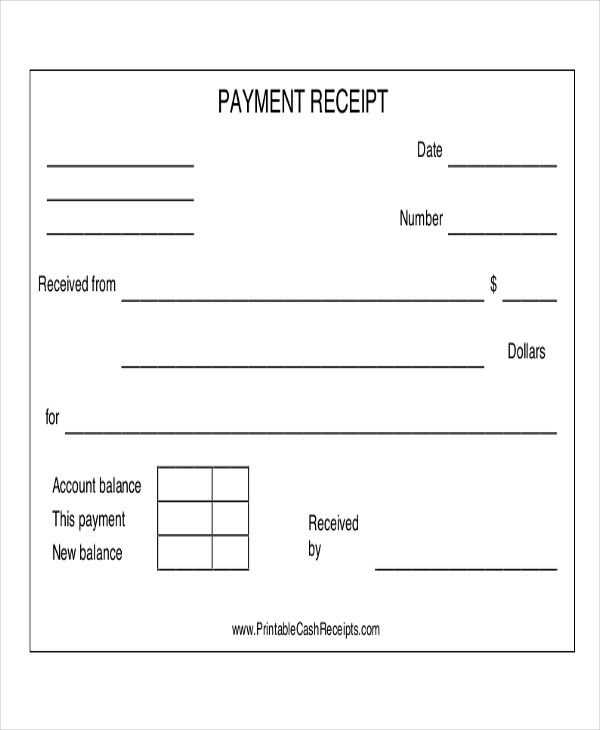

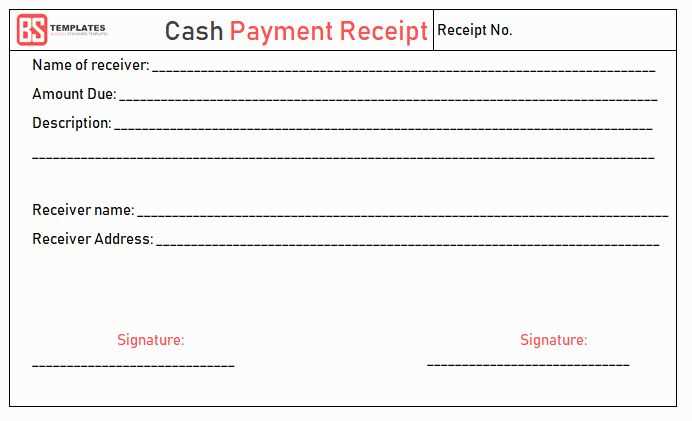

- Header: At the top of the document, place the title “Receipt” along with your business name, logo, and contact details.

- Receipt Number: Assign a unique number to each receipt for easy reference and tracking.

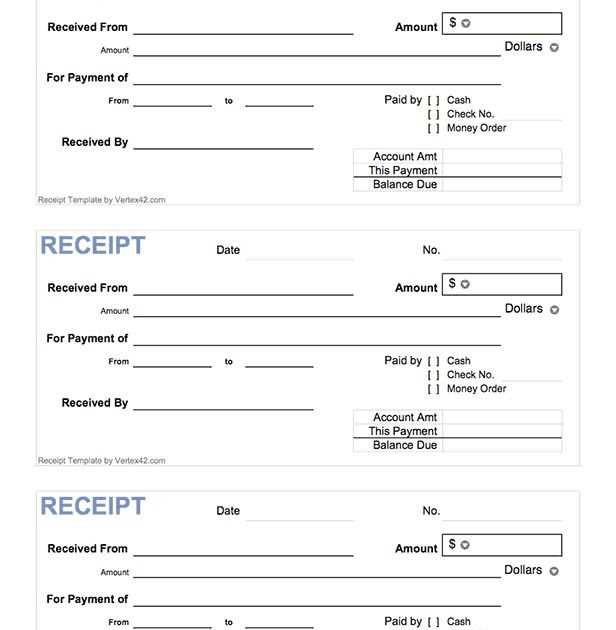

- Payment Details: Clearly state the amount received, payment method (e.g., credit card, cash, check), and date of payment.

- Client Information: Include the payer’s name and address for identification purposes.

- Description of Goods/Services: Provide a brief but clear description of what the payment covers.

- Balance: If applicable, indicate if there is any remaining balance due or if the payment covers the full amount.

- Signature: Leave space for both the payer’s and the issuer’s signature, confirming the payment transaction.

How to Format the Template

Use a clean, easy-to-read font and maintain consistent spacing throughout the document. Organize the information logically to ensure all necessary details are visible at a glance. Avoid overcomplicating the layout with unnecessary designs or graphics. Keep the structure straightforward and professional.

Additional Tips

- Ensure your template complies with local laws and regulations regarding receipt documentation.

- Consider adding a thank you message at the bottom to build goodwill with your clients.

A well-structured receipt letter should include key elements that ensure clarity and verification. These components should cover essential details of the transaction while being easy to understand.

1. Date and Receipt Number

Start with the date the payment was received and a unique receipt number for tracking purposes. This helps both parties reference the transaction easily in the future.

2. Payee and Payer Information

Clearly identify the recipient and the person or entity making the payment. Include full names, addresses, and contact details if applicable.

3. Description of Goods or Services

- Provide a brief description of what the payment covers.

- Include the quantity, service type, or itemized list for better transparency.

4. Payment Amount

- State the total amount paid, including currency details.

- Indicate any taxes or fees, if relevant, for a clear breakdown.

5. Payment Method

Specify how the payment was made (e.g., cash, credit card, bank transfer), and include any transaction IDs or reference numbers for verification.

6. Signature and Acknowledgment

A signature, either from the payee or an authorized representative, confirms the transaction’s completion.

To tailor a payment receipt template to specific needs, adjust the payment details section. Ensure fields such as payment method, transaction reference, and date are clearly highlighted. Add any relevant identifiers, such as invoice number or order ID, to match the specific transaction.

Adjust Payment Amount and Currency

Modify the payment amount field to include precise figures. If dealing with international payments, ensure the currency symbol or code is included and is accurate to avoid confusion.

Include Custom Fields

For special payments, such as deposits or partial payments, introduce custom fields that reflect these distinctions. This will provide clearer context and make the document easier to understand for both parties.

Payment receipts must contain certain key details to be legally compliant. Ensure the receipt includes the transaction date, the amount paid, and the method of payment. Always list the name of the payer and the recipient, along with any relevant reference numbers that tie the payment to an invoice or agreement. These details serve as proof of the transaction and are crucial for both parties’ records.

In many jurisdictions, businesses are required to provide receipts for all transactions, regardless of the payment method. Failure to issue receipts when mandated can result in fines or penalties. Additionally, keeping accurate records of issued receipts is important for tax and accounting purposes.

It is also important to ensure that the receipt is issued at the time of payment. This helps avoid disputes and ensures transparency. For businesses that handle recurring payments, a system that automatically generates receipts can streamline compliance and improve efficiency.

Lastly, be aware of industry-specific regulations. Certain sectors, such as real estate or health services, may have additional requirements for the information included in payment receipts. Always review relevant legal obligations to ensure full compliance.

Begin by clearly labeling the document as a “Payment Receipt” at the top. This provides immediate context to anyone reviewing the document.

Include the date of payment. This is a critical detail to ensure both parties are aware of when the transaction occurred.

Provide a unique receipt number. This number can serve as a reference for future inquiries or disputes related to the payment.

State the amount paid. Be specific about the currency, and if there are any taxes or fees, break down the total to show a clear view of the payment.

Describe the payment method used, such as cash, check, credit card, or bank transfer. This can be particularly useful for record-keeping purposes.

Specify what the payment was for. List the goods or services provided to avoid confusion in the future.

Include the name of the payer and the payee. This ensures that both parties are clearly identified in the document.

Optionally, add a section for any remaining balance, if applicable. This keeps the financial status clear and updated.

Finally, include a line for signatures. Both the payer and the payee should sign, confirming the transaction.

Ensure the receipt letter includes the correct date of payment. A common error is omitting or incorrectly recording the payment date, which can create confusion for both parties.

Be precise with the payment amount. Double-check numbers to avoid discrepancies. Incorrect amounts or missed decimals can lead to misunderstandings or disputes.

Clearly reference the transaction method. Not specifying whether the payment was made by credit card, bank transfer, or cash can lead to ambiguity and problems with future verification.

Avoid leaving out the purpose of the payment. Make sure you describe what the payment was for, whether it’s for a service, product, or donation. This eliminates confusion about the transaction’s purpose.

Don’t forget to include both parties’ contact information. Omitting phone numbers or emails makes it difficult for recipients to follow up if there are questions or concerns later on.

Store receipts in a secure, organized manner to ensure easy access and tracking. Start by creating a dedicated space for physical receipts. Use a filing system with labeled folders, dividing receipts by categories like purchases, services, or taxes.

Digital Receipts

For digital receipts, use cloud storage or dedicated apps. Organize files by date and category for faster retrieval. Consider using software that automatically scans and categorizes receipts, reducing manual effort.

Regular Review and Backup

Set a schedule for reviewing and archiving receipts. Back up digital copies regularly to avoid data loss. Consider shredding physical receipts that are no longer needed for tax purposes, ensuring privacy and reducing clutter.

To ensure clarity and consistency in your financial records, use a simple and clear receipt template letter for payment. This template can help streamline communication with clients, providing them with the necessary information in a professional manner.

Key Components to Include

- Recipient Information: List the name, address, and contact details of the person receiving the payment.

- Payment Details: Specify the payment amount, date, and method used. This ensures transparency and accurate record-keeping.

- Description of Goods or Services: Include a brief description of what the payment is for. This helps avoid any confusion later on.

- Transaction ID or Reference Number: This is critical for both parties to track and verify the payment if necessary.

- Signature or Acknowledgment: End the receipt with either a signature or an acknowledgment of receipt, confirming that the payment has been received.

Tips for Clarity and Accuracy

- Use clear and concise language to avoid misunderstandings.

- Ensure that the template matches the tone and formality of your business transactions.

- Keep the layout simple but structured, ensuring that all key details are easily identifiable.