If you’re looking to create a payment receipt, using a receipt template can save you time and help ensure accuracy. A well-structured template includes all the necessary fields to document payment details clearly. You’ll want to include the payment amount, date, method of payment, and a description of the transaction for record-keeping.

Customize the template to fit your specific needs, whether it’s for personal or business use. Be sure to include your contact information, and if applicable, details about the product or service provided. A good receipt template helps you stay organized and provides transparency for both you and the payer.

Key elements to include: the name of the payer, payment method (cash, credit, debit, etc.), transaction ID or reference number, and any applicable taxes or discounts. These elements ensure that the receipt is complete and easy to follow for both parties.

Tip: Keep a copy of all receipts for your records, as they can be important for tax purposes or future reference. Having a standardized template makes this process straightforward and consistent.

Here’s a revised version, where the word “Receipt” appears no more than 2-3 times:

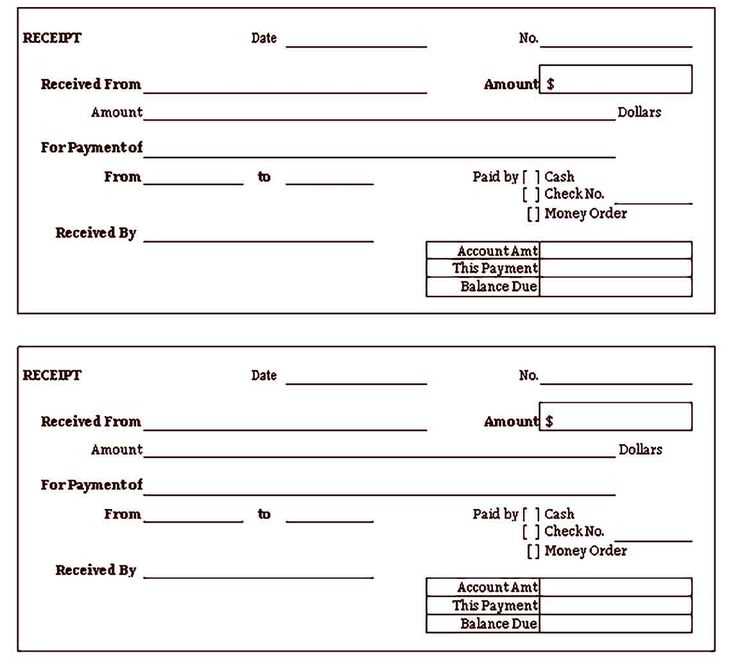

To create a payment confirmation document, begin by listing the payer’s name and contact information, followed by the recipient’s details. Include the date of the transaction and a unique reference number to help track the payment. Clearly specify the goods or services provided along with the corresponding amounts. Ensure the total payment is clearly stated. For ease of reference, you can also include the payment method used, such as credit card or bank transfer.

At the bottom, offer a space for signatures or acknowledgment, which adds authenticity to the document. Ensure that the document is clear, concise, and easy to read, making it useful for both parties.

- Payment Receipt Template

When creating a payment receipt template, include key details that accurately reflect the transaction. Start with the date of the payment, followed by the name of the payer and the payee. Ensure the amount paid is clearly stated, along with the payment method used, whether it be cash, check, or electronic transfer. Specify any invoice number or reference that links the payment to a particular service or product.

It’s also important to note the transaction ID for electronic payments to ensure traceability. If applicable, include details such as a description of the service or product being paid for. The signature of the payer and the payee helps verify the authenticity of the receipt.

Here’s a simple structure for a payment receipt template:

- Date of payment

- Payee’s name and contact details

- Payer’s name and contact details

- Amount paid and payment method

- Invoice or reference number

- Transaction ID (if applicable)

- Service/product description

- Signatures (optional)

Begin by focusing on the core elements: transaction details, buyer and seller information, and a summary of the payment. Keep it clean and organized, ensuring all critical information is clearly visible.

1. Include Transaction Details

- Date of transaction

- Amount paid

- Payment method (credit card, cash, etc.)

- Invoice or receipt number

2. Add Buyer and Seller Information

- Full name or business name of the buyer

- Full name or business name of the seller

- Contact information (email, phone number)

3. Provide a Clear Payment Summary

- Break down the payment (product/service, taxes, discounts)

- Final total

- Payment status (paid, due)

Conclude the receipt with a thank-you message or a note of appreciation for the customer’s purchase. This adds a personal touch without cluttering the design.

Provide clear and precise details in the payment confirmation to ensure both parties have a record of the transaction. Include the transaction ID, the date of payment, the amount paid, and the payment method used. Also, specify any taxes or fees applied, along with the total amount charged.

Transaction Details

Ensure that the transaction ID or reference number is easily visible. This will help identify the payment if there are any issues or follow-up required. The date should be included to mark when the payment occurred, providing an accurate timeline of the transaction.

Payment Breakdown

If applicable, break down the amount paid. This can include base amounts, taxes, discounts, and additional fees. Such details help provide transparency and clarity, ensuring that both parties are on the same page regarding the final payment total.

Ensure that your receipt template is simple and structured. Use clear headings and break the document into sections for quick reference. Each section should be labeled with specific titles, such as “Payment Details” and “Transaction Summary,” to make finding information easier.

Organize Information Logically

Start with basic payment information like the transaction date and receipt number. Follow with a breakdown of the products or services purchased, showing prices, quantities, and any applicable taxes. Conclude with the total amount paid. Keep each section separate with adequate spacing.

Use Bullet Points for Clarity

For quick scanning, use bullet points to list key details such as items purchased, payment methods, or contact information. This structure makes the document easier to follow and avoids overwhelming the reader with dense paragraphs.

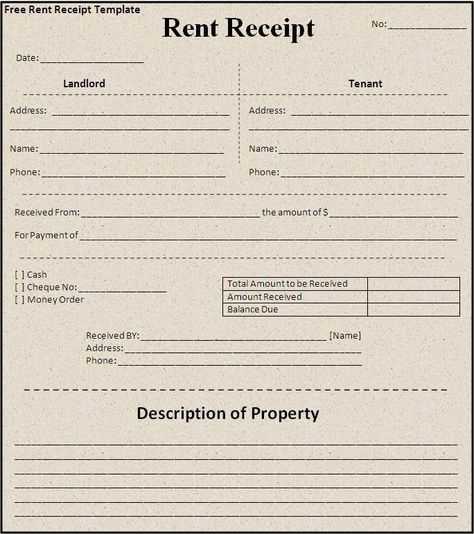

Each industry has unique needs when it comes to payment receipts. Tailoring your receipt layout to fit specific industry requirements improves clarity and professionalism. For example, a retail receipt should highlight product details, taxes, and total cost. On the other hand, a service industry receipt may prioritize service descriptions and hours worked.

Retail Industry

For retail businesses, include product names, quantities, unit prices, and taxes. It’s helpful to break down any discounts applied and clearly show the total amount paid. Adding barcodes or QR codes for easy returns or customer loyalty programs is a great idea.

Freelance or Service-Based Industries

Freelancers or service providers should feature a detailed breakdown of the services rendered, including dates, hours worked, and hourly rates. Specify any applicable taxes or fees and the payment method. Including a section for payment terms (e.g., “Due upon receipt” or “30 days from the invoice date”) can also be beneficial.

Accurate details are critical. Double-check the payment amount and ensure it’s consistent with the agreed-upon terms. Missing or incorrect amounts can create confusion and potential disputes.

Include all relevant payment identifiers like transaction numbers or order IDs. Omitting this information can make it hard to track or verify the payment, leading to delays in processing.

Ensure the payment method is specified clearly. Whether it’s a credit card, bank transfer, or PayPal, not specifying this detail can cause misunderstandings between parties.

Don’t forget to include the payment date. A payment confirmation without a clear timestamp can create uncertainty about when the transaction took place.

Always include the name or business details of the recipient. Failing to do so can make the confirmation look unprofessional and lead to confusion regarding who is receiving the payment.

Avoid vague wording. The language used in the confirmation should be precise and straightforward to prevent any potential misinterpretations.

Double-check the contact information. A confirmation with outdated or incorrect contact details can delay follow-up actions or customer support responses.

Do not omit any applicable tax details or fees. These should be clearly stated, as confusion in this area can lead to customer dissatisfaction.

Visit reliable template websites like Template.net, Jotform, or PandaDoc to find downloadable payment confirmation templates. These platforms offer various pre-made options to suit your needs, from simple receipts to more detailed confirmations. You can download them in different file formats, including PDF, Word, or Excel, for easy customization.

If you’re looking for free options, sites like Vertex42 and Microsoft Office’s template gallery provide straightforward payment confirmation templates at no cost. These templates are compatible with popular software like Microsoft Word and Google Docs, allowing for quick edits and printing.

| Website | Free/Paid | Formats Available |

|---|---|---|

| Template.net | Paid | PDF, Word, Excel |

| Jotform | Paid | PDF, Word |

| PandaDoc | Paid | PDF, Word |

| Vertex42 | Free | Excel |

| Microsoft Office Templates | Free | Word, Excel |

Once you download a template, make sure to customize it with your company’s details and payment information to ensure accuracy and professionalism. These platforms often include pre-filled sections to streamline the process further.

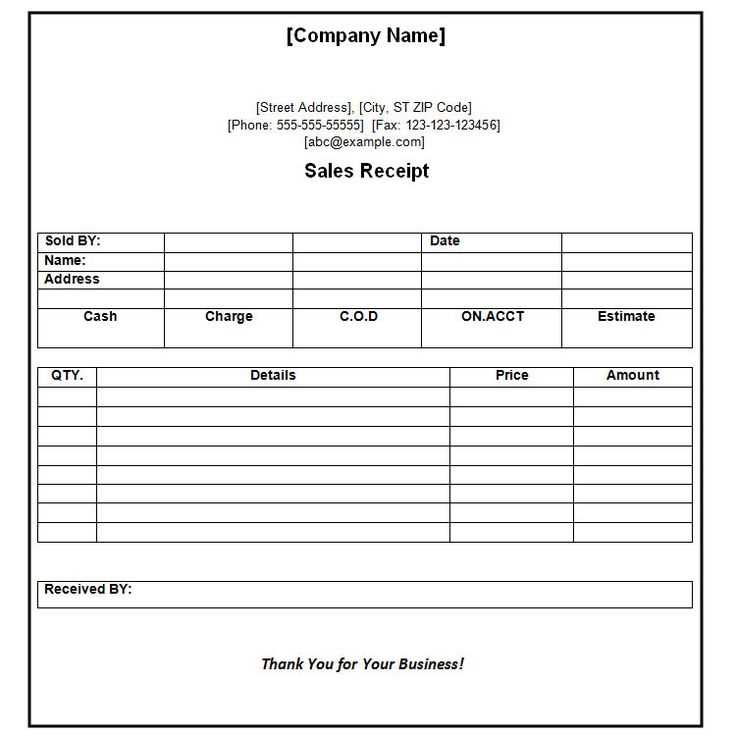

Receipt Payment Receipt Template

To create a receipt payment receipt template, include the following key components:

- Title: Label the document clearly as “Receipt” or “Payment Receipt” at the top of the page.

- Business Information: Add the name, address, and contact details of the business or individual issuing the receipt.

- Recipient Information: Include the name and contact information of the person or business making the payment.

- Receipt Number: Assign a unique receipt number for tracking purposes.

- Date: Record the date when the payment was made.

- Payment Amount: Specify the exact amount paid, along with the currency used.

- Payment Method: Indicate how the payment was made, such as cash, credit card, bank transfer, etc.

- Service or Product Details: Describe the product or service for which the payment was made, including quantity, description, and price.

- Signature (optional): Include space for the signature of the issuer, confirming the payment.

- Thank You Note (optional): Add a short thank you message to acknowledge the payment.

This template ensures that all necessary details are included in a simple and professional manner.