A well-organized receipts and payments account can simplify the process of tracking your finances. An Excel template tailored for this purpose allows you to easily manage your income and expenses, giving you a clear overview of your cash flow. With this tool, you can efficiently record transactions, calculate balances, and ensure that your financial records are up-to-date.

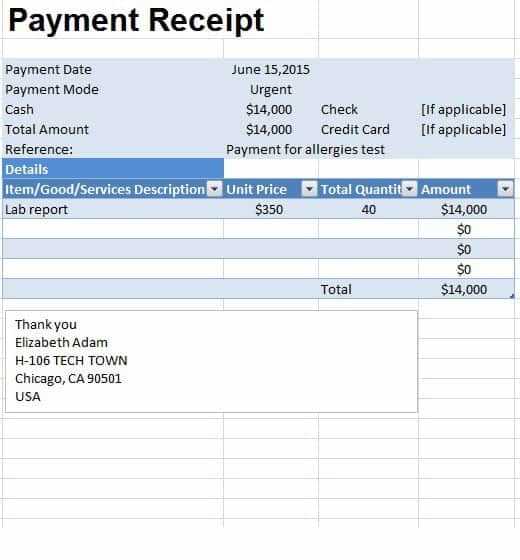

Choose a template that includes separate columns for receipts and payments, along with corresponding dates and categories. This will help you track the source of each payment or receipt, whether it’s from sales, investments, or any other income streams. Having this information at your fingertips allows for quick analysis and can guide your future financial decisions.

Customize your Excel template by adding additional fields that match your specific needs. For example, you might want to include a column for notes, detailing the nature of each transaction, or a field for VAT if applicable. The flexibility of Excel ensures that your template can evolve with your financial tracking requirements.

Here are the corrected lines:

To ensure clarity and accuracy in your receipts and payments account, it is vital to verify each line’s date, amount, and category. Correctly label all entries, ensuring that the amounts align with the respective entries in the bank statements or invoices. Double-check the formula used for calculating totals to avoid discrepancies.

Consider adding a separate column for reference numbers, such as transaction IDs or invoice numbers, which can help track specific payments or receipts. This extra step can prevent confusion in the future and ensure the integrity of your data.

Review the formatting of the document–ensure that currency values are consistently presented with the appropriate number of decimal places, and use a clear currency symbol. This prevents potential misinterpretations when reviewing or sharing the account.

Regularly update the account to reflect any new payments or receipts, keeping the document current. Lastly, avoid merging cells in critical rows where calculations or data entry occur to maintain the integrity of your Excel template.

- Receipts and Payments Account Excel Template

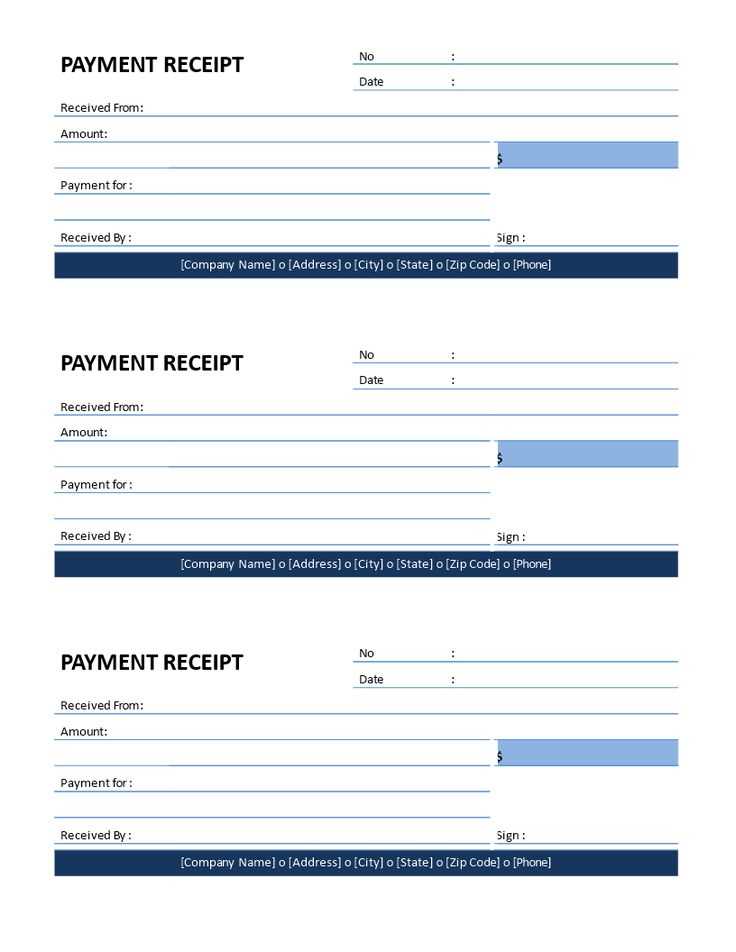

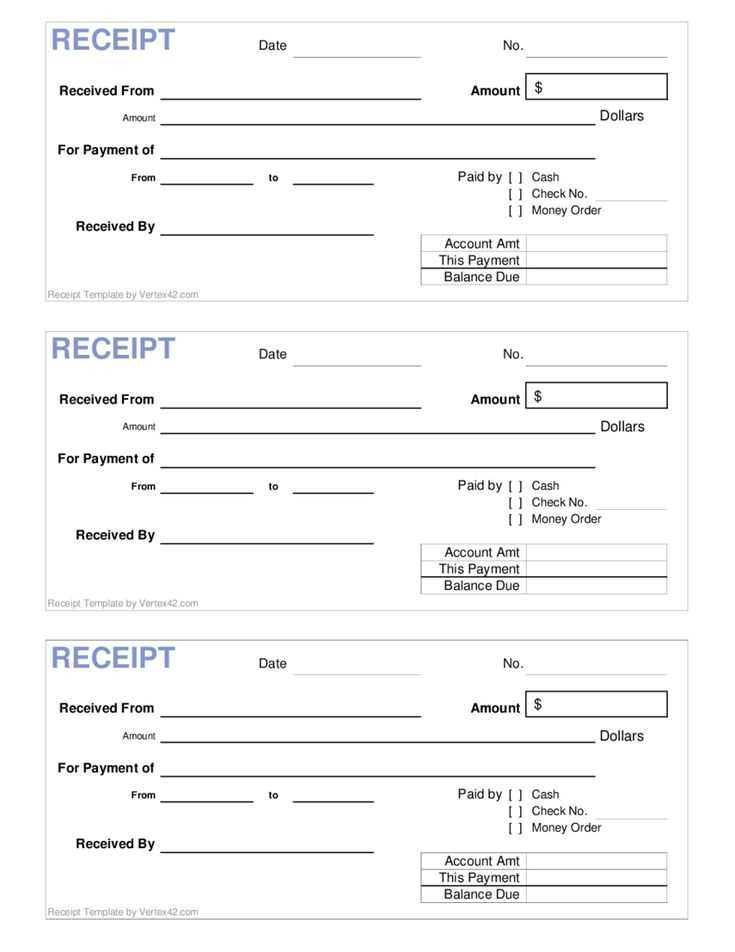

For a streamlined management of finances, use an Excel template for your Receipts and Payments Account. Start by organizing the document into clear sections: one for receipts and another for payments. Each section should include columns for date, description, amount, and category. This setup ensures all transactions are recorded with full details, aiding in better tracking and reporting.

Within the receipts section, list income from various sources such as sales, donations, or service fees. In the payments section, include all outflows like expenses, purchases, and salaries. Make sure to balance both sections regularly to maintain an accurate record of your financial status. Consider adding filters to each column to make sorting through data easier as you update your records.

Utilize built-in Excel functions like SUM to automatically calculate totals for receipts and payments, reducing the risk of errors. You can also use conditional formatting to highlight discrepancies or specific entries, such as large transactions or overdue payments. If you are managing multiple accounts, it might be helpful to create separate sheets within the same workbook for each account, linking totals to a master summary sheet.

With this approach, you’ll have a clear, organized view of all financial activity, ensuring that your records are transparent and easy to manage. The template can be customized further to meet the specific needs of your business or personal financial tracking. Regularly updating the template will help you stay on top of your finances and avoid surprises at the end of the month or year.

Create your template by focusing on key elements: date, description, receipts, payments, and balance. In Excel, use separate columns for each category to track the flow of funds clearly. Start by labeling your columns: “Date,” “Description,” “Receipts,” “Payments,” and “Balance.” Ensure the “Balance” column calculates the running total of funds, adjusting after each receipt or payment entry.

Setting Up Your Template

Begin by entering the column titles in row 1. Under “Receipts” and “Payments,” use simple number formats to represent amounts. The “Balance” column will be calculated by the formula: =Previous Balance + Receipts – Payments. Input this formula for the first row and drag it down to auto-calculate for each new entry.

Adding Data

As you make entries, enter the date and description of the transaction, along with the amount in the respective “Receipts” or “Payments” column. Excel will automatically update the “Balance” column with the running total, making it easy to track your financial position at any time.

To track cash flow accurately in your Receipts and Payments account, use these essential formulas and functions that can simplify calculations and provide clarity. These formulas help in monitoring inflows and outflows, ensuring that your financial records remain up-to-date and correct.

1. Simple Cash Flow Formula

Start by calculating the net cash flow with this basic formula:

Net Cash Flow = Total Receipts - Total Payments

Apply this formula in the template to determine the balance for any period. This will give you a quick snapshot of your financial standing.

2. Running Balance Calculation

To track your cumulative cash flow, use the following formula for running balance:

Running Balance = Previous Balance + Current Net Cash Flow

Update this formula in your Excel sheet to reflect changes in your cash position after each transaction. By doing so, you’ll get an up-to-date overview of your financial state at any given point.

3. Receipts and Payments Breakdown

Using Excel’s SUMIF function, you can quickly total all receipts and payments from specific categories. For example, if you have separate columns for categories such as “Sales,” “Investments,” or “Loan Repayments,” apply the following formula to calculate the total for each category:

SUMIF(range, criteria, sum_range)

This formula sums all receipts or payments in a particular category, simplifying financial analysis.

4. Cash Flow Forecasting

To project future cash flow, use Excel’s Forecast function. You can input your historical data and forecast expected cash flow for the next period:

FORECAST.ETS(target_date, historical_data, timeline)

This function helps estimate upcoming cash inflows and outflows based on past performance, assisting in long-term financial planning.

5. Payment and Receipt Timing

If you want to monitor timing for each transaction, the formula for identifying delayed payments or early receipts can be beneficial:

IF(payment_date > due_date, "Late", "On Time")

Tracking payment schedules ensures you stay on top of your obligations and can make adjustments as needed.

6. Net Cash Flow Percentage

For a more in-depth understanding of your cash flow performance, calculate the percentage change in your net cash flow with this formula:

Percentage Change = ((Current Period Cash Flow - Previous Period Cash Flow) / Previous Period Cash Flow) * 100

This helps you evaluate how your cash flow is improving or declining over time.

Summary Table

| Formula | Purpose |

|---|---|

| Net Cash Flow = Total Receipts – Total Payments | Calculate overall cash flow |

| Running Balance = Previous Balance + Current Net Cash Flow | Track cumulative balance |

| SUMIF(range, criteria, sum_range) | Sum receipts/payments by category |

| FORECAST.ETS(target_date, historical_data, timeline) | Forecast future cash flow |

| IF(payment_date > due_date, “Late”, “On Time”) | Monitor payment timing |

| Percentage Change = ((Current Period Cash Flow – Previous Period Cash Flow) / Previous Period Cash Flow) * 100 | Evaluate cash flow performance |

Adjust your receipts and payments template by adding fields that are relevant to your business type. For example, retail businesses may need columns for product name, quantity, and price per unit, while service-based businesses should include service descriptions, hourly rates, and hours worked. This customization makes it easier for you and your clients to track and understand the transactions.

If your business deals with multiple currencies, integrate a currency column that updates automatically based on current exchange rates. This feature reduces the risk of errors when working with international transactions.

Add automated calculations for totals, taxes, and discounts to streamline the process. This will help ensure accurate and efficient invoicing. Also, consider creating a section that lists payment methods, such as credit card, bank transfer, or cash, so you can track how each transaction was made.

Include a recurring payment tracker if your business runs on subscriptions or long-term contracts. Add a column to track payment dates and amounts, making it easy to see upcoming payments and manage cash flow.

For a more professional look, personalize the template with your business logo and brand colors. This ensures consistency in your paperwork and adds a polished touch to your financial records.

Finally, make sure your template allows for invoice number tracking and due dates. This is particularly useful for businesses with frequent transactions and helps maintain organized records for easier financial management.

Optimizing Your Receipts and Payments Management

To keep track of finances with ease, use a template that provides a straightforward and organized way to record both incoming and outgoing funds. The layout should clearly separate receipts from payments, enabling a simple overview of cash flow.

Key Features for Effective Templates

- Clear Date Entry: Ensure each transaction is recorded with a date for chronological accuracy.

- Transaction Description: Label each receipt and payment with a short description for future reference.

- Category Columns: Organize entries by categories, such as sales, expenses, or other relevant classifications.

- Balance Tracking: Add a column that calculates the running balance after each transaction, so you can easily spot discrepancies.

How to Customize Your Template

- Adjust column widths to fit the amount of detail you need for descriptions or figures.

- Add color coding for different categories to quickly identify financial trends.

- Incorporate formulas for automatic summing of receipts and payments for faster reconciliation.

This approach minimizes manual calculations and helps maintain accurate records over time.