Need a structured way to track your income and expenses? A well-designed receipts and payments template simplifies financial record-keeping, helping you maintain clarity and accuracy. Whether you’re managing a small business, a nonprofit, or personal finances, a clear format ensures that every transaction is documented correctly.

The core of an effective template includes date, description, amount received, amount paid, and balance. These columns provide a straightforward snapshot of your cash flow. Adding categories like payment method or transaction type can further streamline reporting.

For businesses, a digital spreadsheet with built-in formulas automates calculations and reduces errors. Consider using tools like Excel or Google Sheets to set up automatic balance updates and conditional formatting for better visibility.

A well-maintained template not only supports budgeting but also simplifies tax reporting and financial analysis. Keep records up to date and categorize transactions properly to gain deeper insights into spending patterns and revenue trends.

Here’s the corrected version without redundant word repetitions:

Ensure that your receipts and payments template is clear and easy to understand. Avoid unnecessary phrases and repetition that might confuse the user. Focus on the key information needed for each transaction.

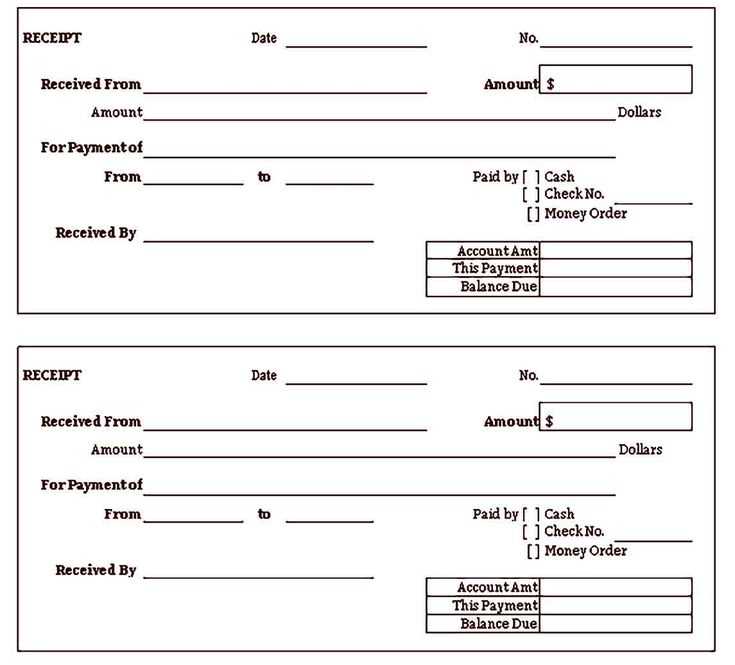

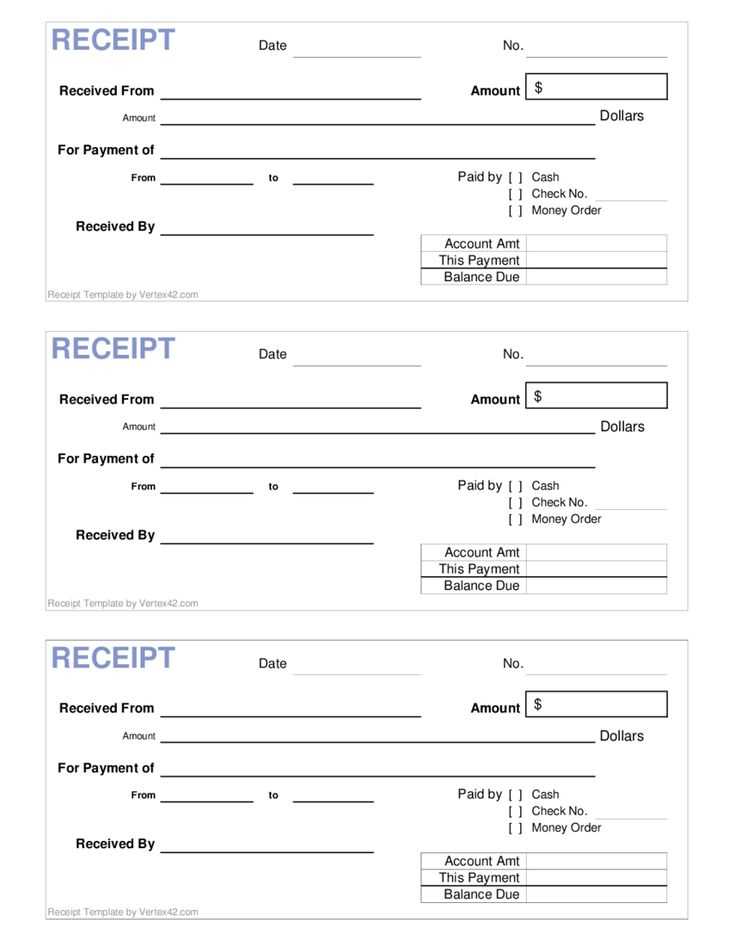

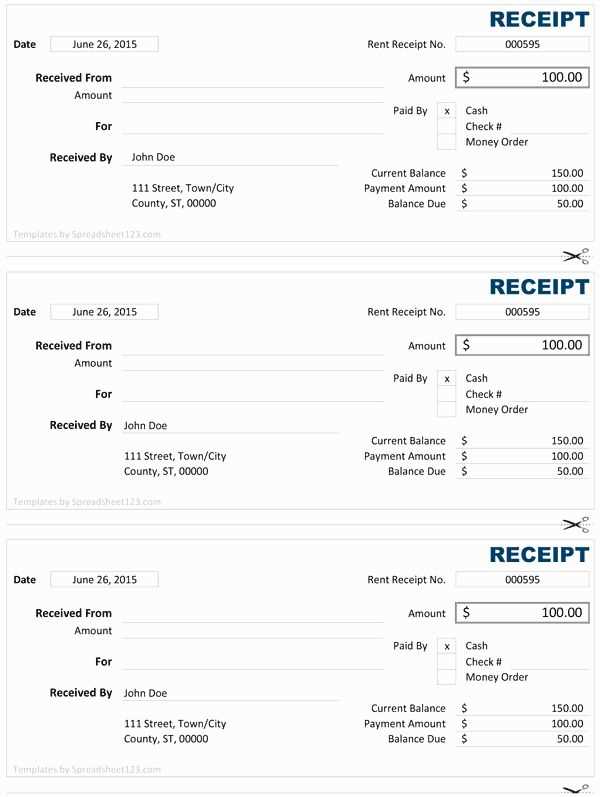

- Provide a clean header with the document title, date, and reference number.

- List the payer and payee details separately with their names, addresses, and contact information.

- Specify the transaction amount, the method of payment, and the purpose clearly without repetition.

- Include a section for payment terms, with space for any additional notes if needed.

- Use a concise footer that includes legal or compliance disclaimers, if applicable.

By focusing on these elements, you ensure that the receipt or payment document remains concise while still containing all necessary details.

- Receipts and Payments Template: A Practical Guide

A simple and organized receipts and payments template ensures that both incoming and outgoing funds are tracked accurately. The key sections in the template should include:

Key Elements to Include

- Date: Include the date of each transaction to ensure proper tracking and prevent any confusion later.

- Description: Clearly describe the nature of the payment or receipt (e.g., “Payment for services” or “Sales receipt”).

- Amount: Specify the exact amount of the payment or receipt, clearly indicating whether it’s an income or an expense.

- Payment Method: Note whether the payment was made by cash, check, credit, or another method for transparency.

- Balance: Keep a running balance to show how each transaction impacts the overall account balance.

Formatting Tips

Consistency in format makes reviewing financial data easier. Align the entries in neat columns to separate dates, amounts, and descriptions. Consider using a table format for clearer presentation.

For small businesses or individuals, customizing the template to match specific needs will ensure all relevant data is recorded. Adjusting categories, like adding columns for specific types of payments or receipts, can also enhance clarity.

Lastly, keep the template simple and easy to update regularly. Staying on top of receipts and payments is vital for maintaining accurate financial records.

A well-structured receipt and payment template should be clear and provide all necessary details. Below are key components that will help you create a functional and comprehensive template.

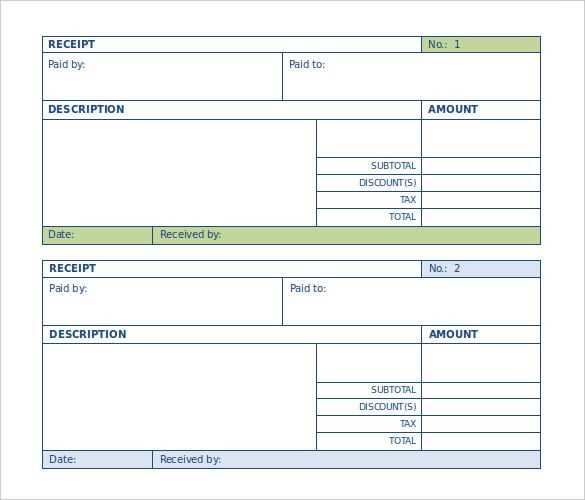

| Component | Description |

|---|---|

| Date | Each transaction must include the date for proper tracking. Make sure the date is easily visible, ideally at the top of the template. |

| Transaction Type | Clearly label the transaction as either a receipt or a payment. This helps to distinguish between incoming and outgoing funds. |

| Description | Provide a brief but clear description of the item or service related to the transaction. This section should be concise but specific. |

| Amount | Indicate the exact amount of money involved in the transaction. Break it down into smaller details if necessary (e.g., tax, discounts). |

| Payment Method | Specify how the payment was made, such as by cash, credit card, or bank transfer. This will clarify the payment’s origin. |

| Receiver/Payee | Include the name of the party receiving the payment or the party making the payment, depending on the transaction type. |

| Signature | Both parties should sign the document. This adds authenticity and finalizes the transaction. |

Each of these components ensures clarity and transparency in financial transactions. A well-designed template helps prevent confusion and provides a clear record for both parties involved.

Define clear and specific categories for both income and expenses to maintain organized financial records. Break down each category based on the nature of transactions and ensure consistency for easy tracking.

Income Categories

Segment income into distinct groups: sales revenue, investment income, rental income, and other income streams. For businesses, consider adding subcategories based on product lines or service types. This helps identify top-performing areas and prioritize efforts for growth.

Expense Categories

Structure expenses into fixed and variable costs. Fixed costs, like rent or salaries, should be separated from fluctuating expenses, such as utilities or materials. Within each group, add more specific subcategories, such as marketing, administrative costs, and production expenses, to track where money is being spent most.

By categorizing in this way, you can easily analyze cash flow, set realistic budgets, and identify areas for cost reduction or investment. Regularly reviewing and adjusting these categories ensures financial accuracy and transparency in the long term.

For tracking receipts and payments, choose the tool that best aligns with your needs. Both spreadsheets and accounting software have their advantages depending on the complexity and scale of your operations.

Spreadsheets:

- Great for small businesses or individuals with simple tracking needs.

- Highly customizable, allowing you to set up specific categories and formulas to suit your tracking preferences.

- Affordable or free, as most basic spreadsheet software is either already available or can be obtained at no cost.

- May require manual entry of data, increasing the risk of human error over time.

- Does not offer automated reporting, which means more time spent on calculations and organization.

Accounting Software:

- Designed for businesses of all sizes, offering advanced features like automatic transaction syncing and tax calculations.

- Automates data entry by connecting directly to bank accounts, saving time and reducing the risk of mistakes.

- Provides pre-built reports for various financial categories and insights, making it easier to assess your financial health.

- Subscription-based, meaning you’ll need to budget for ongoing costs.

- May have a steeper learning curve, especially for users unfamiliar with accounting practices.

For small businesses with simple needs, spreadsheets can be a suitable option. However, as your business grows, accounting software will offer time-saving automation and more detailed tracking features that spreadsheets cannot easily replicate.

To streamline data entry and reduce errors, implement automated formulas and macros in your receipts and payments template. These tools automatically process values based on predefined rules, saving time and improving accuracy.

1. Use Formulas for Calculations

- Set up formulas to automatically calculate totals, taxes, and discounts as soon as data is entered. For instance, you can use the SUM function to add payment amounts, and the multiplication function to apply a tax rate.

- Use conditional formatting to highlight cells that require manual input, making it easy to spot missing data or errors.

2. Implement Data Validation

- Integrate data validation tools to restrict inputs to specific formats or ranges. This prevents users from entering incorrect data, like letters instead of numbers.

- Set up drop-down lists for frequently used items or payment methods to minimize typos and improve consistency.

By automating these processes, you minimize the risk of human error, speed up data entry, and ensure consistency across your records. With the right setup, your template becomes an efficient tool for managing receipts and payments seamlessly.

Mixing personal and business finances often leads to confusion. Keep your accounts separate to ensure clarity and accuracy in tracking income and expenses.

Failing to record all transactions promptly can result in missing details or errors. Make it a habit to update your records immediately after each transaction.

Ignoring small expenses may seem harmless, but they add up over time. Record every transaction, regardless of size, to get an accurate view of your financial situation.

Relying on memory instead of written records is a common mistake. Always use a system for tracking, whether it’s a digital tool or a manual ledger.

Overlooking recurring payments can lead to surprise expenses. Track subscriptions, memberships, and automatic bills to avoid missing payments or forgetting about ongoing costs.

Failing to categorize expenses properly can obscure your financial picture. Be consistent in how you label and group different types of transactions, which will help you analyze your spending more easily.

Not reviewing your financial records regularly is another common mistake. Set a schedule to check your records monthly, ensuring everything is up to date and accurate.

Adapting receipts and payments templates to specific business requirements is critical for accurate financial tracking. By tailoring your template, you can reflect your business model and streamline financial operations.

Adjusting Layouts for Different Industries

Different industries may require various details on receipts and payment documents. For example, a retail store may need to include product descriptions, discounts, and taxes, while a service-based business may prefer to list labor costs and hours worked. Modify your template accordingly to ensure that all relevant data is captured.

Adding Custom Fields for Specific Information

Consider adding custom fields for elements unique to your business. This could include customer reference numbers, purchase order numbers, or project codes. Custom fields make it easier to track and reference transactions, enhancing your record-keeping process.

Table for Template Customization Suggestions

| Industry | Customization Tip | Examples |

|---|---|---|

| Retail | Include itemized product details, tax, and discounts | Item name, quantity, price, tax, discount |

| Service-based | Track hours worked, service details, and labor charges | Service description, number of hours, hourly rate |

| Freelance | Include project names, milestones, and payment terms | Project title, milestone date, payment schedule |

Ensure your template can be easily updated as your business evolves. This will allow you to stay efficient without reformatting from scratch whenever there are changes in your services or products.

So, the meaning is preserved, but unnecessary repetitions are removed.

Focus on removing repetitive phrases or concepts without losing the core message. For instance, instead of repeatedly stating the same information, try using synonyms or restructuring sentences for clarity. This helps maintain a smooth flow of ideas and makes the content easier to read.

Use bullet points or numbered lists to simplify complex information. If similar points are being made, combine them into one concise statement. This not only reduces redundancy but also makes the content more digestible.

Avoid restating the same ideas in different ways. Condense thoughts into one direct statement to eliminate fluff. Consider the structure of each section and ensure it progresses logically without unnecessary restatements.

By doing so, the content becomes more concise, engaging, and easier for the reader to follow without losing important details.