Use a clear and structured receipts and payments template to keep accurate records of financial transactions for trusts. This document should capture all incoming and outgoing payments, allowing trustees to track trust income and expenses effectively. Start by categorizing each entry under appropriate headings like donations, income from investments, and administrative expenses. This helps maintain transparency and ensures that the trust’s finances are well-managed.

For each transaction, provide a brief description, date, and amount. Organize the template in chronological order to make reviewing and auditing easier. This level of detail ensures that all financial activities are traceable and accountable, which is vital for fulfilling legal and reporting obligations.

Additionally, include a section for any balances carried forward from previous periods. This will help with tracking the trust’s financial position over time. Remember to update the template regularly and ensure that all entries are supported by appropriate documentation, such as receipts and invoices, to maintain accuracy and compliance.

Here’s the corrected version:

For an accurate trust receipts and payments template, include the date, description, amount, and the relevant party for every entry. Organize transactions by type, such as income, expenses, and investments, for clarity and ease of reference.

Receipts

Record each receipt with the date, source, amount, and the purpose of the payment. Specify whether it is a cash receipt or a transfer. Categorize receipts based on their nature, such as donations or interest income, for organized tracking.

Payments

For payments, list the payee, date, amount, and description. Ensure each payment is categorized by type, such as operational costs or trustee fees. Cross-reference against receipts or invoices to confirm accuracy.

Review and update the template regularly to maintain clear and organized financial records for the trust.

- Receipts and Payments Template for Trusts

A receipts and payments template is a practical tool for trust accounting, ensuring transparency and ease of financial reporting. It allows trustees to document all incoming and outgoing funds related to the trust, providing a clear record for audits and financial assessments.

Key Components of a Receipts and Payments Template

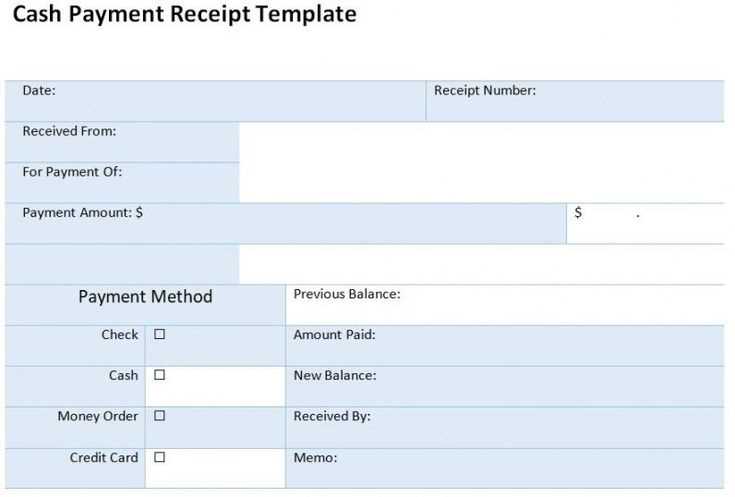

The template should include the following columns:

- Date: The date the transaction took place.

- Description: A brief description of the transaction (e.g., donation received, grant paid, administration fee).

- Receipts: The amount of money received by the trust.

- Payments: The amount of money paid out by the trust.

- Balance: The running balance after each transaction.

How to Use the Template

For each transaction, input the date, description, and amounts in the corresponding columns. At the end of each period (e.g., monthly or quarterly), review the total receipts and payments to calculate the net balance. This helps ensure accuracy and provides an up-to-date financial status of the trust. Regularly updating this template reduces the risk of discrepancies and simplifies the process of preparing annual reports or audits.

A trust template should include specific sections to ensure proper documentation of receipts and payments. Here are the key components to look for:

- Trust Name and Details: The first section should list the trust’s official name, the date it was established, and relevant identification numbers. This ensures the document is properly attributed to the correct entity.

- Income and Expenditures: Clearly record all sources of income and expenses within the template. This includes details of received payments, transfers, and any administrative costs that the trust covers.

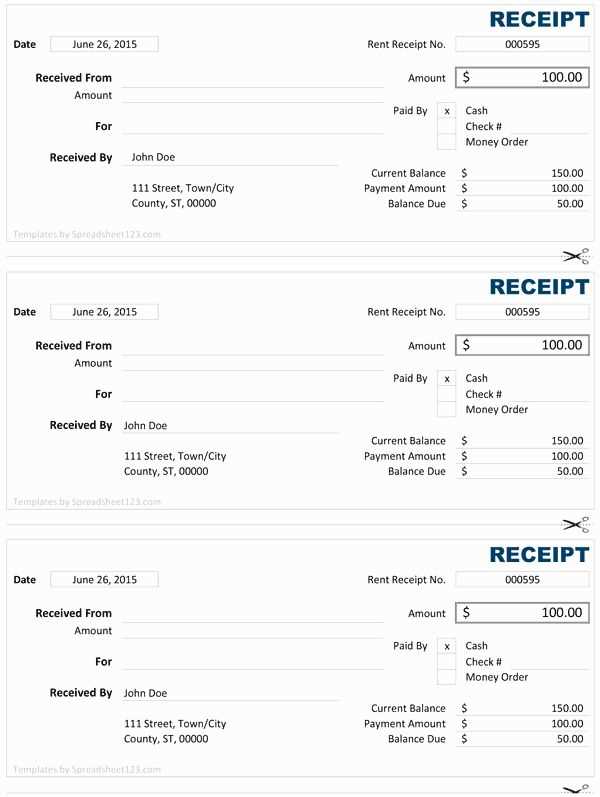

- Receipts Section: Include a dedicated space for detailing receipts–these are any funds or assets received by the trust. It should capture the amount, source, and date of each transaction.

- Payments Section: This section should outline all payments made by the trust. Each entry should indicate the recipient, amount, purpose of the payment, and the date it occurred.

- Balance Summary: At the end of the template, a balance summary helps track the trust’s financial standing. This includes total receipts, total payments, and the resulting balance to provide clarity on the trust’s fiscal health.

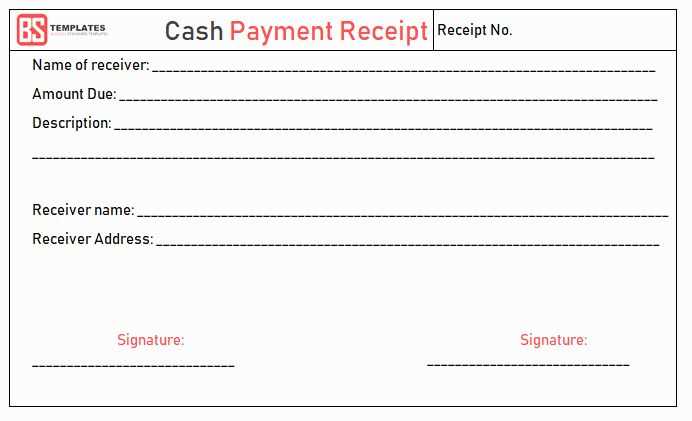

- Signature Lines: A section for signatures ensures accountability. Include spaces for the trustee’s and possibly a beneficiary’s signatures to acknowledge the accuracy of the information.

Using these components will ensure that all relevant financial activities are documented and can be reviewed with clarity. The template should remain straightforward, so stakeholders can easily follow the trust’s financial flow.

Record income and donations in trust entries by clearly categorizing each transaction. Use a structured approach for transparency and easy tracking. Follow these steps:

- Identify the source: Classify income and donations based on the origin, such as charitable gifts, rental income, or dividends. This distinction ensures proper reporting.

- Document the amount: Always record the exact amount of income or donation received. Round figures or estimates may lead to discrepancies in financial reporting.

- Include the date: Capture the date of receipt to maintain a chronological order of transactions. This helps in reconciling entries and ensures compliance with tax or regulatory reporting deadlines.

- Assign to the correct fund: Allocate each donation or income entry to the relevant trust fund. This keeps fund-specific records separate and accurate.

- Note the purpose: For donations, specify the intended use (e.g., general fund, special project, etc.). This clarity provides donors with the assurance that their contributions are used as intended.

- Maintain documentation: Keep records of donor correspondence, receipts, and other proof of income for auditing and reference purposes.

- Update regularly: Periodically review and update the income and donation records to ensure that no entries are overlooked. This reduces the chances of errors in annual reports.

By following these steps, trust entries related to income and donations will remain accurate and organized, ensuring transparency and accountability in financial management.

Ensure payments are classified by their purpose. Use clear and distinct categories, such as “Operational Costs,” “Grant Distributions,” or “Management Fees,” to make financial tracking straightforward. Avoid broad labels like “Miscellaneous” or “Other,” as they obscure the payment’s true nature.

Assign consistent labels across all transactions. Keep your category names uniform to avoid confusion later when you analyze or audit the payments. For instance, use “Salaries” for all payroll-related expenses rather than “Wages” or “Employee Pay” interchangeably.

Document payment details whenever possible. Include brief descriptions of what each payment corresponds to. This provides immediate clarity when reviewing financials, making it easier for trustees or auditors to understand the payments without needing additional context.

Break down large payments into smaller, manageable categories. For example, if a vendor payment includes both products and services, divide it into “Product Purchase” and “Service Fees” categories. This will make the categorization more accurate and useful for budgeting and financial planning.

Use dates and payment frequencies to separate regular expenses from one-time or occasional costs. Categorizing recurring payments, such as rent or subscription fees, under a “Recurring Payments” section ensures these transactions are easy to track month-to-month.

Reevaluate categories periodically. As new types of payments or expenses arise, add relevant categories or adjust existing ones. Keep the structure flexible to accommodate growth without losing clarity.

Record each investment purchased by the trust in a detailed manner, including the purchase date, amount, and specific investment type. Keep this information organized to track returns and fluctuations accurately.

Track income generated from investments separately, such as dividends, interest, or capital gains. Record the date of receipt and the amount to ensure proper income recognition.

Calculate the returns on each investment by assessing the difference between the initial purchase price and the current market value. Ensure that unrealized gains or losses are also documented to provide a complete picture of the trust’s financial standing.

Document any fees or commissions related to investments, as these expenses will affect the net return. Keep a separate record for transaction costs and account for them when calculating the trust’s overall performance.

Provide periodic updates on the investment portfolio’s performance in trust statements. This ensures beneficiaries and trustees are informed about how the trust’s investments are performing over time.

Ensure that all investment transactions align with the trust’s investment policy and the trust deed. This will help maintain consistency and compliance with the terms of the trust agreement.

Clearly outline trustee expenses and reimbursement processes in the template to avoid confusion and ensure transparency. Each expense should be categorized, with appropriate documentation attached for verification. Provide sections to input dates, descriptions, and amounts for each reimbursement request. It’s crucial that the trustee submits receipts or invoices for all claimed expenses. You should also establish a specific timeline for submission, such as within 30 days of incurring the expense, to maintain organization and accountability.

Include a section in the template for approval where a designated person or committee reviews the expenses before they are reimbursed. This adds a layer of oversight, reducing the risk of errors or inappropriate claims. In the case of recurring expenses, such as travel or office supplies, set predefined limits, and ensure they align with the trust’s financial policies. Additionally, specify the preferred method of reimbursement, whether via check, bank transfer, or another method, to streamline the payment process.

To prevent disputes, make sure the template outlines what qualifies as a reimbursable expense. Trustees should be aware of the trust’s policy on personal expenses, and the template should distinguish between what’s covered and what is not. Make this process as transparent as possible by including a reference to the governing trust document that outlines these rules.

To reconcile trust bank accounts, start by comparing your bank statement with the trust’s financial records in the template. First, ensure that all deposits and withdrawals recorded in the bank statement appear in the template’s transactions section. If any transactions are missing, add them to the template for accurate reporting.

Next, match each entry on the bank statement to corresponding entries in the template. Pay attention to transaction dates and amounts. Highlight any discrepancies, such as duplicate entries or errors in the recorded amounts. Use the template’s comment section to document any differences for future reference.

After identifying discrepancies, check for uncleared checks or pending deposits. These items may not appear on the bank statement yet, but they should be reflected in the template. Adjust the balance in the template accordingly, factoring in outstanding transactions that will clear soon.

If you encounter discrepancies that cannot be explained by uncleared transactions, review the template’s transaction details. Ensure all payments, receipts, and fees have been accurately entered. Use the “Reconciliation Adjustments” section in the template to make necessary corrections to the records, and keep track of any adjustments made.

Once all discrepancies are addressed, confirm that the ending balance in the template matches the bank statement’s closing balance. If both balances align, the reconciliation is complete. If there’s still a difference, revisit the process and double-check all entries and adjustments.

Organize receipts and payments for trusts by clearly defining the date, amount, and purpose of each transaction. Create categories for receipts such as donations, income from assets, or loans. For payments, include administrative expenses, distributions, and other trust-related costs.

Structure Your Template

Each entry should have the following columns:

| Date | Description | Receipt Amount | Payment Amount | Balance |

|---|---|---|---|---|

| 01/01/2025 | Donation from XYZ Corp | $5000 | $0 | $5000 |

| 01/02/2025 | Administrative Expenses | $0 | $200 | $4800 |

Track Regular Payments

List recurring payments such as trustee fees or taxes in a separate section. This allows for better financial tracking and ensures nothing is overlooked during reporting. You may also add a column for the payment status (e.g., pending, paid, overdue) to maintain accuracy.