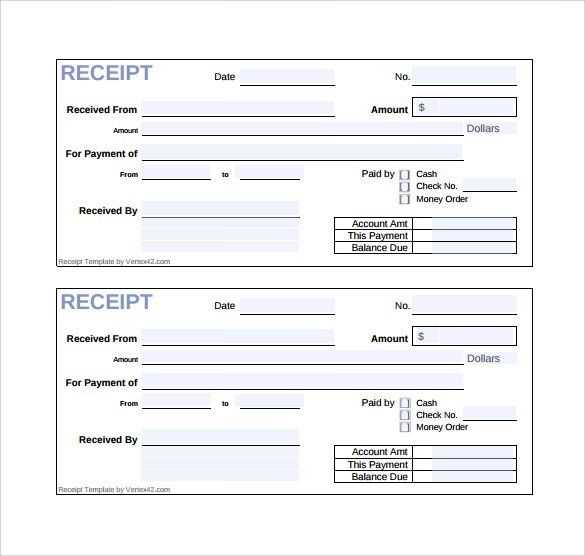

Creating a receipt template for payments simplifies record-keeping and ensures both parties have a clear, accurate understanding of the transaction. The receipt should include specific details such as the transaction date, the amount paid, the payment method, and a breakdown of products or services purchased.

A good template offers a straightforward format that can be customized for various payment scenarios, whether for small businesses or larger operations. It helps in providing a professional touch to your transaction documents, enhancing transparency and trust with customers.

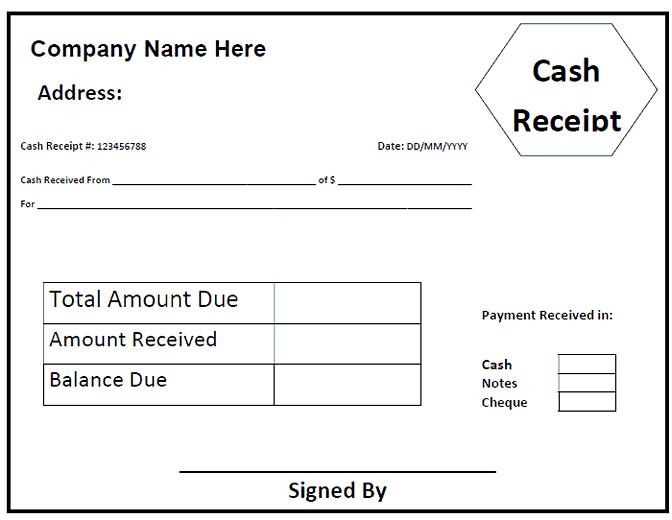

When designing your receipt, include key components such as the transaction ID, payer details, and any taxes or discounts applied. Clear formatting, along with a space for both parties to sign, adds credibility and ensures that the document can be used for future reference, whether for accounting purposes or warranty claims.

Here’s the corrected version:

To create a receipt for payment template, ensure that all key details are clear and concise. Start by including the payment amount, date of transaction, and the payment method used. This helps to keep records accurate and straightforward.

- Payment Amount: Specify the exact amount paid, avoiding ambiguity.

- Transaction Date: Clearly indicate the date when the payment was made.

- Payment Method: Specify the method used (e.g., cash, credit card, bank transfer).

- Payee Information: Include the name and address of the person or company receiving the payment.

- Payer Information: Include the name and contact details of the person making the payment.

- Receipt Number: Provide a unique identifier for easy reference.

Ensure your template allows for easy customization, so you can modify details for different transactions. Using clear sections and bold headings improves readability.

Keep the design simple and avoid unnecessary elements. This makes it easy for both parties to verify payment details quickly. A straightforward template reduces the chance of confusion.

- Receipts for Payment Template

Create a simple and accurate payment receipt with these key details:

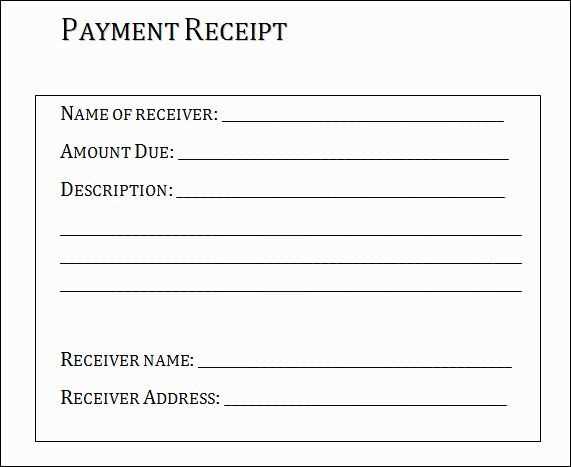

1. Title: Label the document clearly as “Payment Receipt” for easy identification.

2. Receipt Number: Assign a unique receipt number to ensure that the transaction is easily trackable.

3. Date: State the date when the payment was made to maintain an accurate record.

4. Payer’s Information: Include the payer’s full name, address, and contact details to identify who made the payment.

5. Payee’s Information: List the payee’s name, business name (if applicable), and contact details for clarity.

6. Payment Details: Describe the goods or services purchased. Include item quantities, unit prices, and any relevant details.

7. Total Amount: Display the total payment amount, including taxes or fees, to avoid any misunderstandings.

8. Payment Method: Clearly indicate the payment method (cash, credit card, bank transfer, etc.) for transparency.

9. Signature Line (Optional): You may include a space for signatures if both parties wish to acknowledge the transaction formally.

This template helps keep transaction records clear and ensures that both parties have the necessary details for future reference.

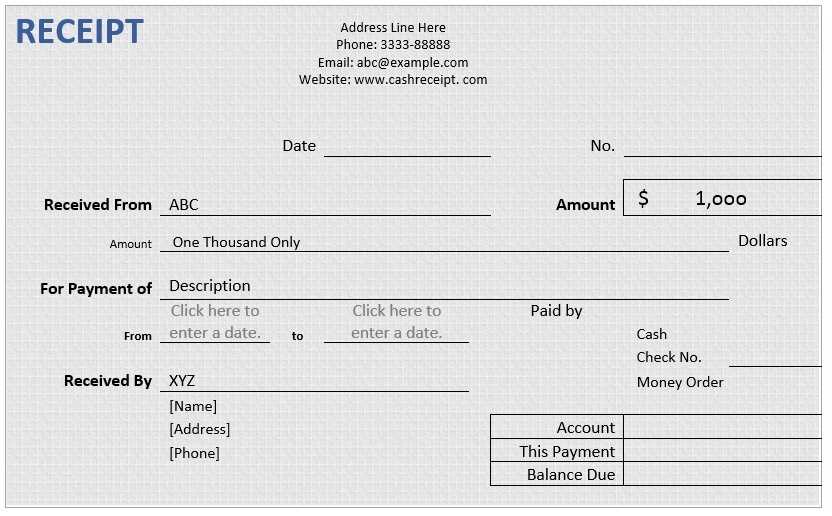

Begin with a clear header, such as “Payment Receipt,” to immediately convey the purpose of the document. Include the business or service name, address, and contact details at the top for easy reference. This provides the recipient with important information about who issued the receipt.

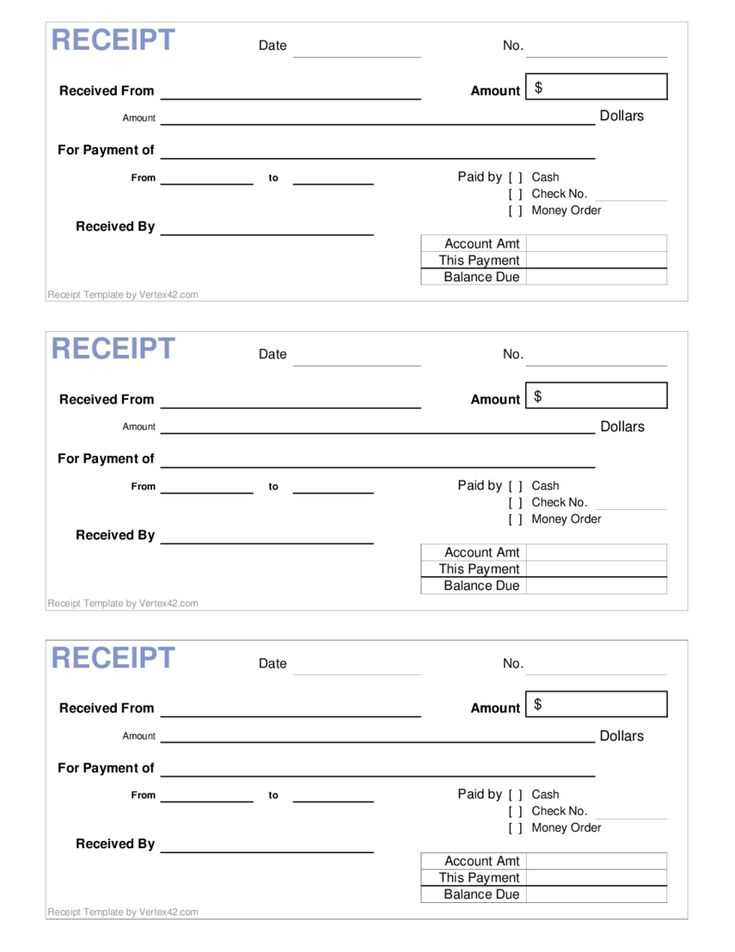

Next, add the date of payment and a unique receipt number to avoid confusion with other transactions. A proper reference number makes it easier to track and verify future payments.

Clearly specify the amount paid, both numerically and in words, to eliminate any possible misunderstandings. Include the payment method, whether it’s cash, credit card, or another form, so both parties have a record of how the transaction was completed.

Provide a brief description of the product or service for which payment was made. This is essential for both the payer and the payee to ensure transparency and accuracy.

Don’t forget to include tax information, such as the applicable tax rate and the total tax amount, if relevant. This detail is especially important for businesses that need to report taxes.

Lastly, include a space for the signature of the person who issued the receipt or authorized the payment. This adds credibility and can be important for legal purposes.

Once all the elements are in place, your template should be clear, concise, and easy to read for both the issuer and the recipient. This layout ensures that all necessary details are covered, making the receipt both functional and professional.

To tailor a payment receipt template to different business needs, focus on the unique elements each business type requires. For retail businesses, for instance, ensure that the receipt displays product details, quantities, and individual prices. Service-based businesses, such as consultants or repair services, should prioritize the description of services rendered, including hourly rates or fixed service fees.

Retail Business Receipt Template

Retail businesses benefit from receipts that clearly outline purchased items, discounts, taxes, and total amounts. Add sections for product names, quantities, unit prices, and itemized totals. It’s crucial to provide a subtotal before taxes to give customers a clear breakdown.

| Item | Quantity | Unit Price | Total |

|---|---|---|---|

| Shampoo | 2 | $5.00 | $10.00 |

| Conditioner | 1 | $4.50 | $4.50 |

| Subtotal | $14.50 | ||

| Tax (8%) | $1.16 | ||

| Total | $15.66 |

Service-Based Business Receipt Template

For service-based businesses, the focus should shift to services performed. Include service descriptions, the time spent, rates, and any additional fees. It’s useful to separate labor costs from material costs if applicable, so clients can easily track both expenses.

| Service | Hours | Rate | Total |

|---|---|---|---|

| Consulting | 2 | $100/hr | $200.00 |

| Materials | $50.00 | ||

| Subtotal | $250.00 | ||

| Tax (10%) | $25.00 | ||

| Total | $275.00 |

Adjusting the receipt format to match your business type will not only improve clarity for your customers but also help ensure transparency in your financial transactions.

Ensure that your payment receipt template complies with local laws and tax regulations. The receipt should clearly identify the payer, payee, date of transaction, payment amount, and the method of payment. These details are often required for auditing purposes and tax reporting. Accurate record-keeping of payments can prevent potential disputes and inaccuracies during tax filings.

For tax purposes, ensure that your receipt includes the applicable tax rate and the amount of tax charged if the transaction involves goods or services that are taxable. This helps provide transparency and ease during tax audits. In some jurisdictions, businesses must issue receipts for all transactions, even if the transaction value is minimal.

If your business operates in a specific industry, review the relevant regulations to confirm whether you need to issue receipts for every payment or only under certain conditions. In some cases, digital receipts may be acceptable, but physical receipts could be required in others. Always consult with a local tax advisor to ensure compliance.

Additionally, keep in mind that certain jurisdictions may require the use of specific receipt formats or templates. While you can customize your template, be aware that failure to include required information could result in penalties. It is often advisable to use templates that meet standard legal requirements to avoid complications.

Finally, understand that payment receipts serve as legal proof of transactions. As such, they must be stored properly for a set period, as determined by local laws. This can assist in resolving disputes, clarifying payments, and ensuring that tax liabilities are met without issues. Keep records organized to comply with applicable retention laws and protect your business from potential legal challenges.

Ensure your payment receipt template is clear and concise. Begin by including the payment amount, currency, and date. This establishes the core details for both parties involved.

Key Components

Start with the payer’s name, followed by the payee’s information. If applicable, include their business name and address for better clarity. This step can prevent future confusion, especially in cases of returns or disputes.

Additional Details

Always incorporate a unique transaction ID for tracking purposes. This number ensures each receipt can be referenced easily if needed. Additionally, include the method of payment used, whether it’s cash, credit card, or digital transfer. This transparency helps both parties confirm the payment details.