To create a salary payment receipt, make sure to include the necessary details such as the employee’s full name, payment date, and the total amount paid. Additionally, specify any deductions, bonuses, or overtime, as well as the breakdown of the salary components. This helps in maintaining clarity for both the employer and the employee.

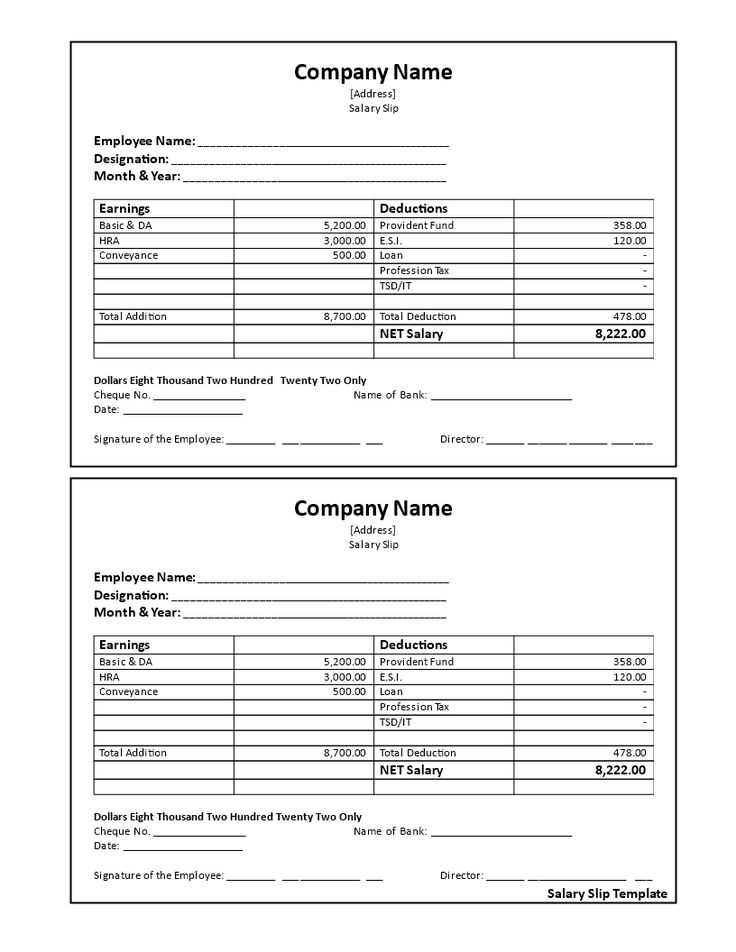

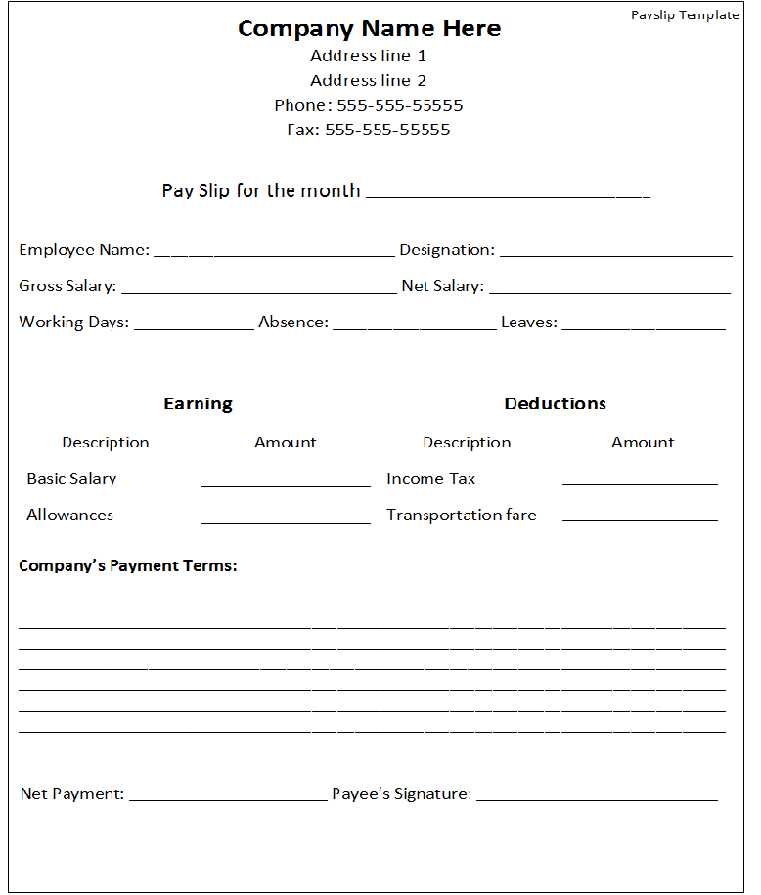

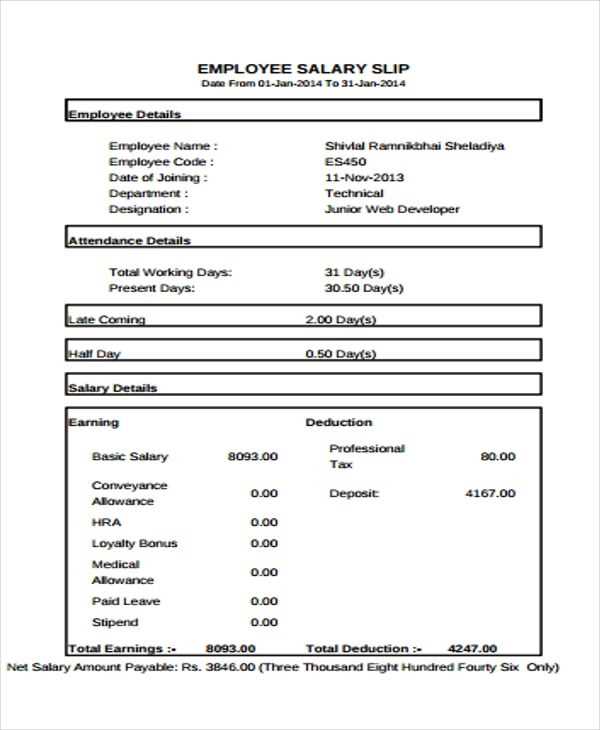

Start by including the employee’s basic information–name, employee ID, and designation. Then, clearly outline the payment period covered by the receipt. This ensures the employee understands exactly which work period the salary corresponds to.

Next, specify the payment breakdown. List all the key elements such as base salary, allowances, and any bonuses. Also, make sure to include deductions like taxes, insurance, or retirement contributions. Providing this level of detail ensures transparency and prevents misunderstandings.

Finally, include the payment method used, whether by bank transfer, check, or cash. Including the transaction reference number, if applicable, adds an extra layer of verification for both parties.