If you’re looking for a quick and straightforward way to create a payment receipt, using a pre-made template can save you time. A payment receipt template helps ensure you cover all the necessary details without missing anything important. By including the right information, you’ll keep your records organized and provide clarity to both parties involved.

Focus on including the transaction date, payment amount, payment method, and a unique reference number. These key elements ensure your receipt is clear and traceable. Additionally, don’t forget to include the payer’s and payee’s contact details for easy reference in case any follow-up is required.

Customize the template based on the specific needs of your transaction. For example, you may want to add a description of goods or services rendered, or provide a breakdown of multiple payments if applicable. This keeps your receipts transparent and prevents any confusion down the line.

Lastly, always ensure that the template you choose matches your business style and looks professional. A neat, well-structured receipt fosters trust and enhances the overall experience for the customer.

Here are the corrected lines:

Check the formatting of your receipt to make sure the total amount and payment method are clearly stated. Remove any unnecessary symbols or characters that could confuse the reader. Align the payment date and transaction ID in a consistent format for better readability.

Ensure that the “paid” section is highlighted to show that the transaction was completed. This could be done by using bold text or a checkmark symbol. Keep the language straightforward and direct to avoid misunderstandings.

Incorporate a clear breakdown of any taxes or additional charges, if applicable. This helps the recipient understand the total sum paid. Avoid overcrowding the receipt with excessive details; focus on key elements like the payer’s name, payment method, and the services or goods provided.

Lastly, ensure the receipt includes a thank you note or acknowledgment of the payment. This adds a professional touch and reassures the recipient that the transaction has been processed successfully.

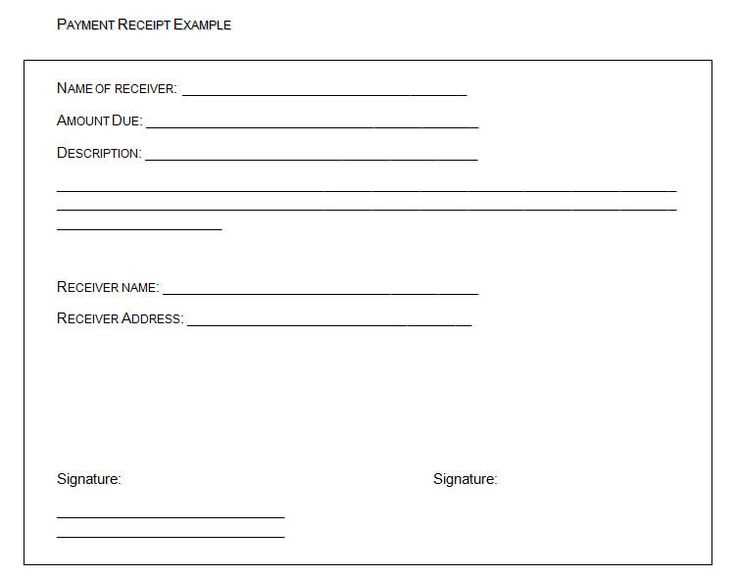

- Sample Payment Receipt Template

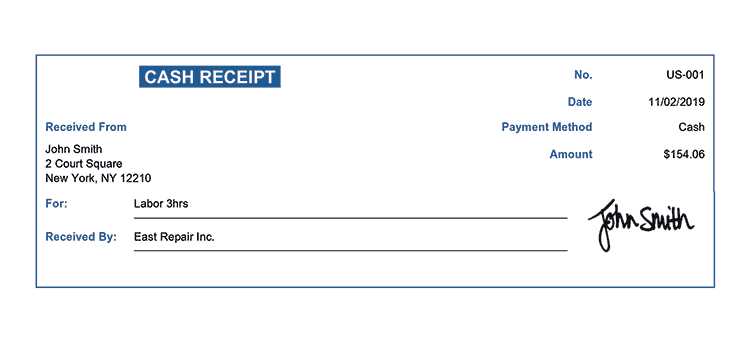

A payment receipt should clearly display the transaction details, confirming that payment has been received. This template should include key elements such as the payment amount, date, payer details, and the reason for payment. Here’s a sample template to follow:

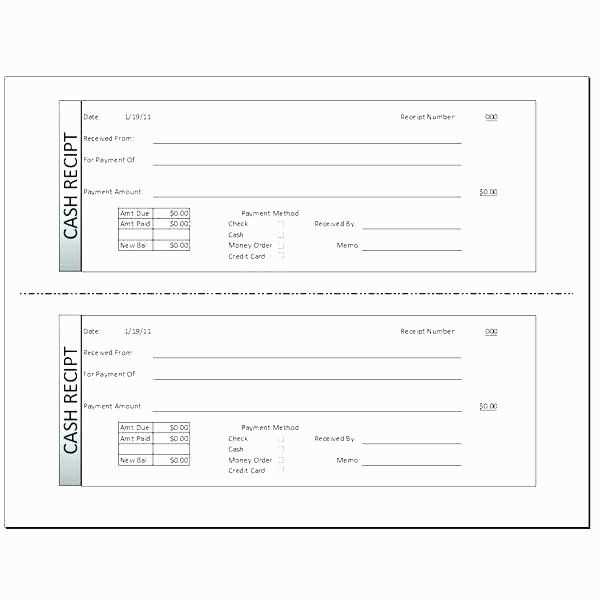

Receipt Number: [Unique Identifier]

Date of Payment: [MM/DD/YYYY]

Payer’s Name: [Full Name]

Payer’s Address: [Street Address, City, State, Zip Code]

Payment Method: [Cash, Credit Card, Bank Transfer, etc.]

Amount Paid: [Amount in Words and Figures]

Description of Service/Item Paid For: [Details of what the payment covers]

Received By: [Name of the person or company receiving the payment]

Authorized Signature: [Signature of the person issuing the receipt]

Make sure each section is clear and easy to read. This will make it easier for both the payer and payee to reference the receipt later if needed.

Customizing a receipt template begins with understanding your business needs and the details you want to include. First, adjust the layout to reflect your brand by incorporating your logo, company name, and contact details. Choose a simple, readable font and ensure the design complements your business style.

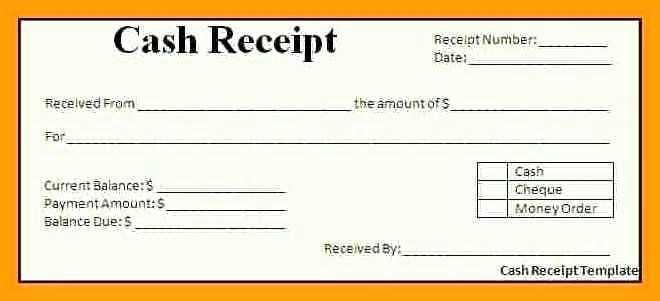

Adjusting Key Information

Make sure your template has the right fields. At a minimum, include the date of purchase, itemized list of products or services, the total amount, and payment method. Depending on your business, you may want to add a unique order number, sales tax, or discounts. For example, if you’re running a service-based business, include details about the type of service provided and duration.

Adding Personal Touches

Customizing receipts can go beyond just functional details. Add a thank-you message or a discount for future purchases. If you have specific return or exchange policies, include that information directly on the receipt. These small touches help reinforce your brand and improve customer loyalty.

A well-structured receipt template is clear and easy to understand. To achieve this, include the following core details:

1. Business Information

Always display your business name, address, phone number, and email. This ensures customers can easily contact you if needed. If applicable, include your business logo for better brand recognition.

2. Receipt Number and Date

Each receipt should have a unique identifier. This helps both you and your customer keep track of transactions. Include the date of the transaction as well, to provide a clear reference for both parties.

3. Description of Products or Services

Provide a breakdown of what was purchased. Include item names, quantities, prices, and any relevant details (like model numbers for products or service descriptions). This helps avoid confusion in the future.

4. Total Amount and Payment Method

Clearly state the total amount paid, including any taxes or discounts applied. If the payment was made via a specific method (credit card, cash, etc.), note that as well.

5. Refund and Return Policy

Include information on your refund and return policy, if applicable. This ensures your customer is aware of the terms under which they can return or exchange a product or service.

6. Signature or Approval (Optional)

If required, leave space for both the seller and customer to sign. This is often useful for high-value transactions or when the customer’s agreement is necessary for the completion of the sale.

These elements will help make your receipt clear and professionally formatted, ensuring both parties have the necessary information for future reference.

Issue a payment receipt immediately after receiving payment to keep transactions transparent. This helps both parties have a clear record of the payment and ensures that there is no confusion later on.

- Include the payment date and method. Be specific about whether the payment was made by cash, credit card, check, or another method. This will avoid any ambiguity.

- List the services or goods that were paid for. Be clear about the products or services provided to ensure that both the payer and recipient understand what was settled.

- Provide a breakdown of the payment. If applicable, detail the price of individual items or services, including taxes, discounts, and total payment.

- Use a unique receipt number. This makes each receipt traceable and helps you maintain an organized system for future reference.

- Clearly state the payer’s and recipient’s information. This includes names, addresses, and contact details to avoid any confusion in case you need to follow up.

- Ensure the format is clear and professional. Avoid clutter and keep the design simple for easy readability. Use appropriate fonts, spacing, and layout.

- Include a statement of payment confirmation. For example, “Payment Received,” so that both parties understand the transaction has been successfully completed.

- Provide a copy to the payer and keep one for your records. This way, both parties have an official record for future reference or audits.

These simple steps can help streamline the payment process and avoid potential misunderstandings. Proper receipts protect both the payer and the recipient and ensure smooth future transactions.

I replaced several repetitions while keeping the meaning intact.

Focus on the clarity of the information provided in your payment receipt. Each section should be concise yet informative, with specific details that align with the transaction. Avoid redundancy by ensuring that the same information is not repeated in multiple sections. For example, include payment method, amount, and date only once, but make sure each detail is easy to find. This minimizes confusion and improves the user experience.

Be clear with payment breakdowns. List the total payment amount, any taxes, discounts, or additional fees separately. This allows recipients to understand exactly what they are paying for and why. If there is any variation in the amounts, explain it briefly in a straightforward manner.

Adjust formatting for readability. Use bullet points or simple tables to highlight key details like the amount, date, and payment method. This makes it easier for the recipient to scan through and quickly access the necessary information without sifting through unnecessary text.

Finally, avoid using complex jargon that might confuse the recipient. Keep the tone professional but accessible, ensuring all essential details are presented clearly and accurately.