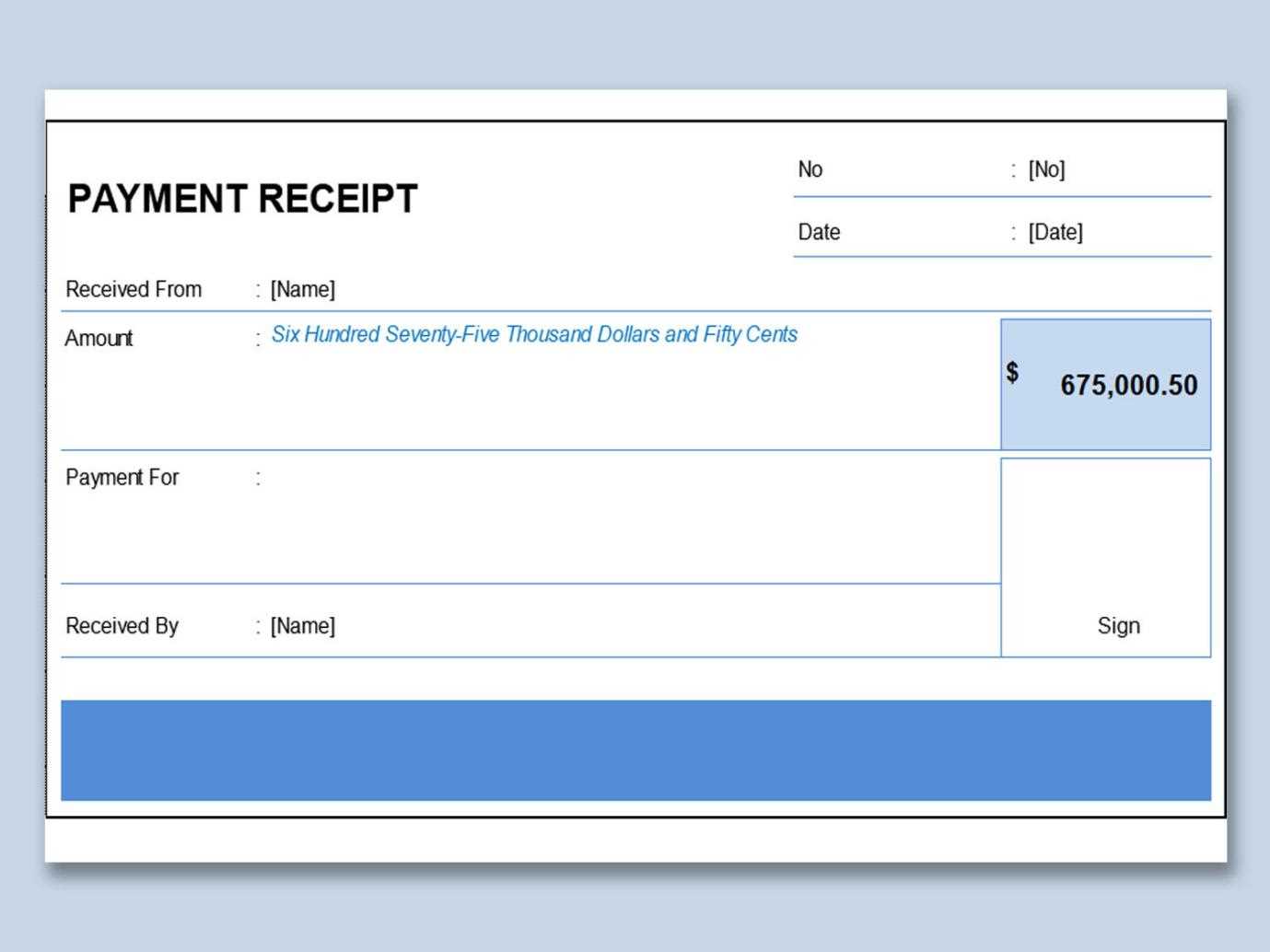

To create a clear and professional service payment receipt, include the date of the transaction, the service provided, the total amount paid, and the payment method. Be sure to list both the service provider’s and customer’s details, including names, addresses, and contact information. This ensures all parties have a clear record of the payment.

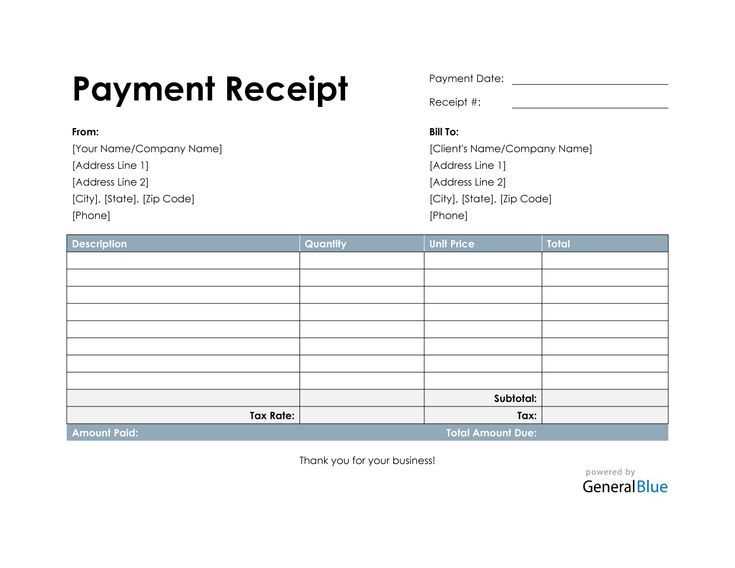

Payment details should be easy to read. Break down the total amount by listing each service rendered, along with the associated price. This adds transparency and helps avoid confusion. For digital payments, specify the transaction ID or confirmation number as proof of payment.

Don’t forget to include a receipt number for your records. This makes it easier to track payments in the future and maintain an organized accounting system. A well-organized receipt template provides security and clarity for both the customer and the service provider.

Lastly, if any discounts, taxes, or additional fees were applied, make sure to clearly state these on the receipt. This level of detail improves customer satisfaction and helps avoid disputes over charges.

Updated Version with Minimal Repetition: Practical Guide for Service Payment Receipt Template

Ensure that your service payment receipt template includes clear sections for essential details. This structure will help avoid confusion and streamline the process for both the issuer and recipient.

Key Information to Include

- Service Provider Details: Include the name, address, and contact information of the business or individual offering the service.

- Client Information: Clearly state the client’s name, address, and any relevant contact details.

- Service Description: Provide a detailed description of the service rendered. Be specific about what was provided to avoid ambiguity.

- Amount Paid: State the exact amount received for the service, along with the payment method used (e.g., cash, credit card, bank transfer).

- Receipt Date: The date of the transaction should be clearly indicated.

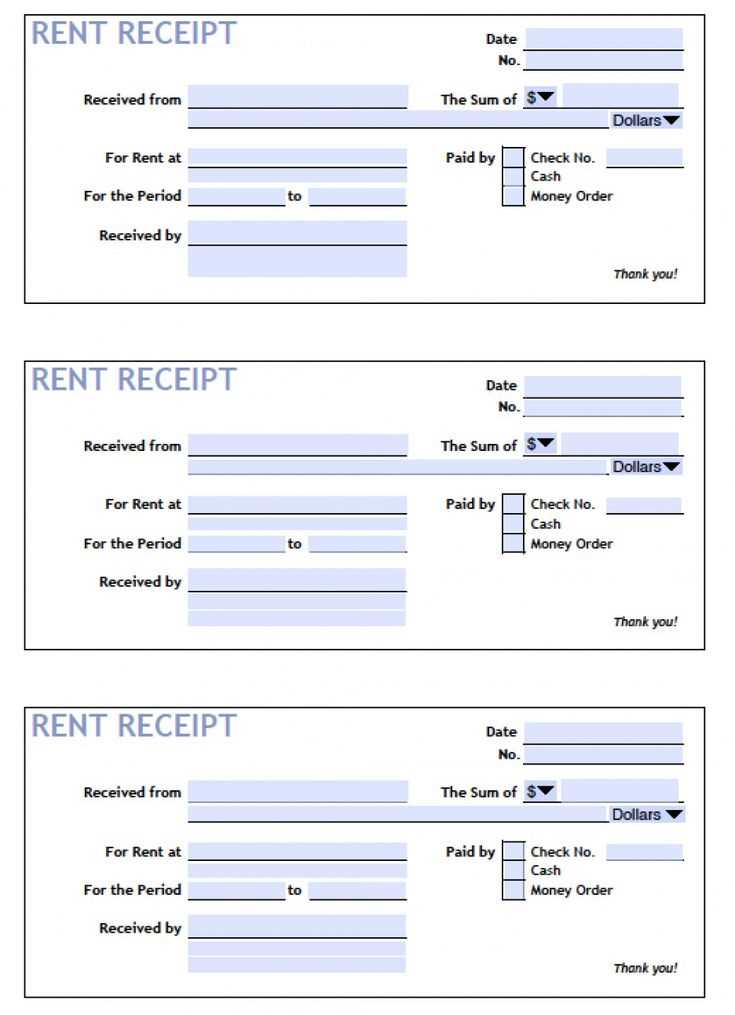

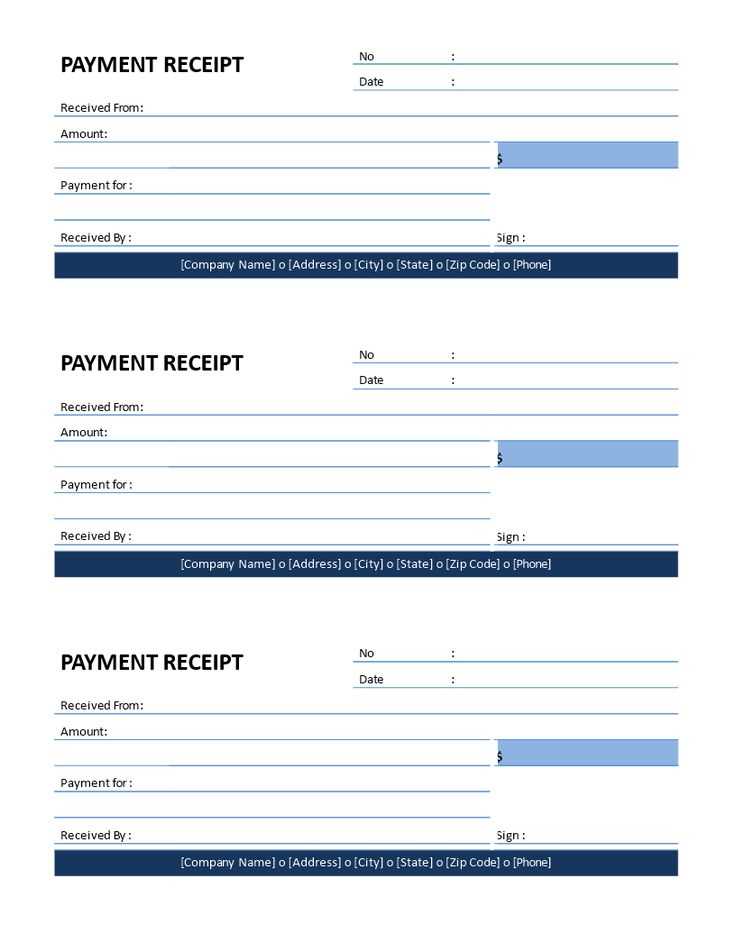

Formatting the Receipt

- Readable Font: Use a clear, legible font such as Arial or Times New Roman. Ensure the text size is appropriate for easy reading.

- Consistent Layout: Organize the information in a structured format. The service provider’s details should be placed at the top, followed by client information and the service description.

- Distinct Sections: Divide the receipt into clearly labeled sections, such as “Service Details” and “Payment Information,” to guide the reader.

Additional Considerations

- Tax Information: If applicable, include any relevant tax details, such as VAT or sales tax, and break down the total amount accordingly.

- Invoice Number: Assign a unique invoice or receipt number for easy tracking and reference.

- Payment Confirmation: A brief statement confirming that the payment has been received can provide extra clarity.

How to Customize a Receipt

Begin by adjusting the layout of your receipt. Most templates allow you to change the alignment of text, the size of the font, and the positioning of key information such as business name, address, and transaction details. You can modify the header section to include your logo or company tagline for branding purposes.

Next, review the fields displayed. Common fields include transaction date, payment method, amount paid, and service description. Ensure that each field aligns with the information you want to highlight. For example, you might want to show additional details about the service provided or provide a breakdown of any taxes applied.

Consider adding or removing sections that may not be relevant to your business model. For instance, you can remove or customize the “thank you” note, or include a personalized message for repeat customers. If the receipt will be emailed, ensure the design is mobile-friendly and concise.

Another useful customization is adjusting the receipt format for different transaction types, such as refunds or partial payments. Customize these to reflect accurate information without overwhelming the customer with unnecessary details.

Finally, make sure the receipt includes necessary legal and financial disclaimers relevant to your region. Update them regularly to ensure they are accurate and compliant with current regulations.

Key Information for a Receipt

A receipt should clearly present the following details to ensure its validity:

Transaction Date: Always include the date of the transaction. This ensures the customer can track the payment and serves as proof of purchase.

Service Description: Provide a concise description of the service rendered. Avoid vague terms and be specific about what was provided.

Amount Paid: Clearly state the total amount the customer paid, including taxes, discounts, or any additional charges.

Payment Method: Specify how the payment was made–whether by cash, credit card, bank transfer, or other methods. This helps resolve potential disputes.

Business Information: Include the name, address, and contact details of the business providing the service. This information should be easy to find and verify.

Receipt Number: Assign a unique number to each receipt for reference. This helps with organization and tracking in case of returns or follow-ups.

Customer Details: If applicable, include the customer’s name or account number for easy identification. This is especially useful for long-term service contracts.

Tax Information: Display the tax rate or exemption status, if relevant. This transparency helps customers understand the breakdown of their payment.

Common Mistakes in Receipt Creation

Incorrect Date Formatting: Always double-check the date format. Different regions may use different conventions (e.g., DD/MM/YYYY vs. MM/DD/YYYY). Make sure the date is clear and understandable for your client to avoid confusion.

Missing or Incorrect Service Details: Include a thorough description of the service provided, ensuring it matches what the customer is expecting. Vague or incomplete descriptions lead to misunderstandings and complaints.

Not Including Payment Method: Always specify how the payment was made, whether via cash, credit card, or another method. This helps maintain clear records and prevents disputes about how payments were processed.

Errors in Amounts or Taxes: Double-check the total amount and the applied tax rates. Even small mistakes can lead to customer frustration or legal complications. Break down the tax calculation clearly on the receipt.

Omitting Contact Information: Include your business’s contact details. This should cover your phone number, email, and physical address. This not only ensures customer satisfaction but also helps in case they need to reach out for queries or future service requests.

Failure to Provide Unique Receipt Numbers: Each receipt should have a unique identification number. This aids in tracking and ensures that both the business and customer can reference specific transactions if needed.

Unclear or Missing Refund Policy: If applicable, include a brief mention of your refund or exchange policy on the receipt. This minimizes disputes in the future by clarifying the terms for returns or adjustments.