To create a standard payment receipt template, start by ensuring that it includes key details: the payment amount, date, and the names of both the payer and recipient. This straightforward structure helps clarify the transaction for both parties. The template should also have a unique receipt number for easy reference and record-keeping.

Clearly list all items or services that the payment covers, providing a breakdown if necessary. This will make it easy to identify what the payment pertains to and prevent any confusion. If applicable, include payment methods such as credit card, cash, or bank transfer, and specify any transaction numbers linked to these methods.

Always include contact information for both parties involved, especially if there is a need to follow up or dispute any details later. A section for notes or additional terms can also be added, especially for agreements or special conditions tied to the transaction.

Here are the corrected lines where words are not repeated more than 2-3 times, maintaining the meaning:

When creating a payment receipt template, focus on clarity and simplicity. Include key elements such as the amount, date, and description. Avoid redundant terms that might clutter the layout.

| Element | Description |

|---|---|

| Amount | State the total paid, clearly marking the currency. |

| Date | Include the date of payment for accurate record-keeping. |

| Description | Briefly describe the payment purpose, such as “service fee” or “purchase of goods.” |

Ensure consistency throughout the document. Choose phrases that are straightforward to avoid confusion. This helps the receiver understand the details without re-reading.

By streamlining the content and reducing unnecessary repetition, you create a professional receipt template that remains clear and effective.

- Standard Payment Receipt Model

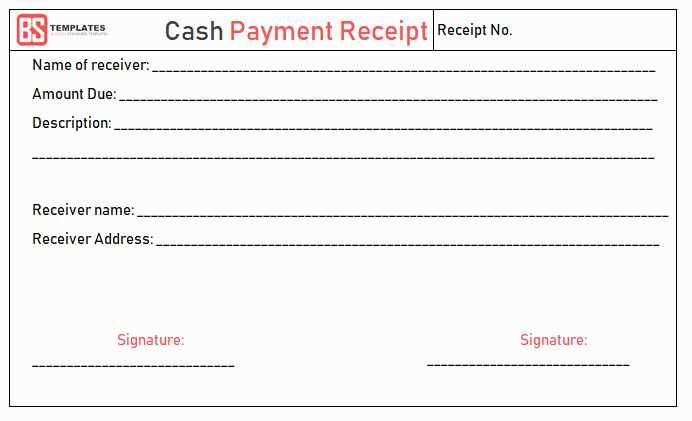

To create a clear and professional payment receipt, include the following components:

- Date of payment: Clearly mention the date the payment was made.

- Receipt number: Assign a unique identifier to each receipt for easy reference.

- Payer’s name: Include the full name or business name of the individual or entity making the payment.

- Amount paid: Specify the exact amount paid, including the currency.

- Method of payment: Mention whether the payment was made by cash, cheque, credit card, or another method.

- Payment details: Provide a description of what the payment covers (e.g., services, products).

- Recipient’s name: List the person or company receiving the payment.

- Signature: Include a space for the payer’s or recipient’s signature, as proof of transaction.

This template ensures transparency and keeps records organized. A detailed payment receipt helps avoid confusion and can be used for bookkeeping or accounting purposes.

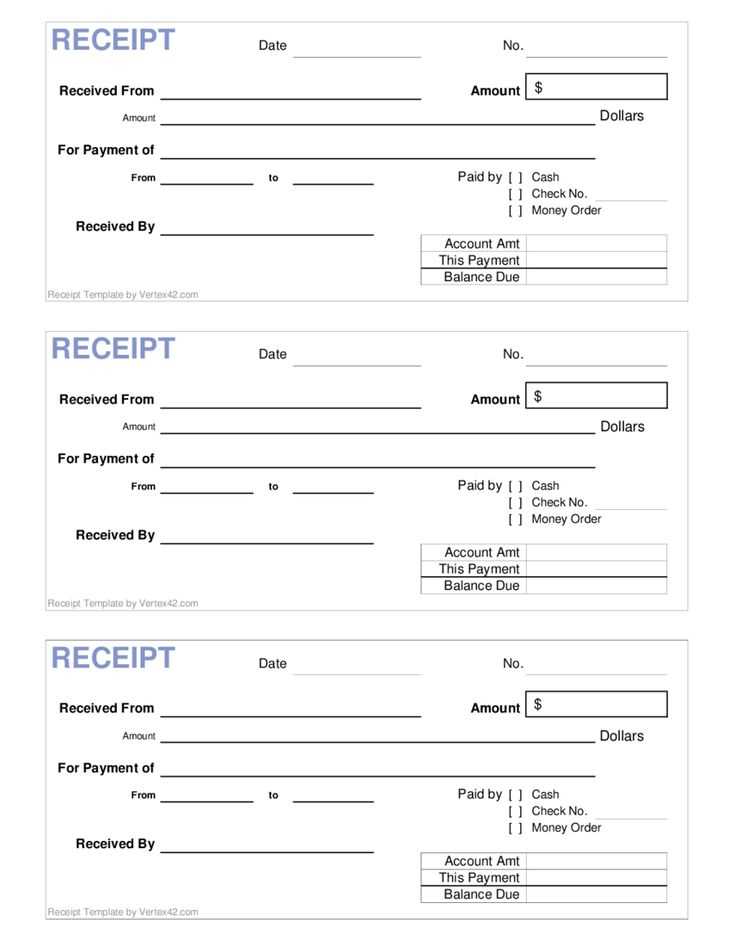

Create a payment receipt template by focusing on clarity and simplicity. Begin by including your business name and contact information at the top. Clearly state that the document is a payment receipt to avoid confusion. Underneath, add the payment date, receipt number, and the method of payment (cash, card, etc.). Include a description of the goods or services provided, with corresponding amounts for each item, followed by a total amount. If applicable, add tax details or any discounts applied. Lastly, provide a space for both the customer’s signature and your own to confirm the transaction.

Use a clean, easy-to-read font and organize the details logically, ensuring that all required information stands out. Keep it concise, focusing on accuracy rather than extraneous details. You can customize the template to suit your business’s needs, including fields for additional charges or notes, but always make sure the core elements–payment amount, date, and transaction method–are clearly visible.

Consider creating this template in a digital format, like a Word document or PDF, for easy reuse and customization. This ensures that every receipt is consistent and professional, giving your business a reliable record of transactions.

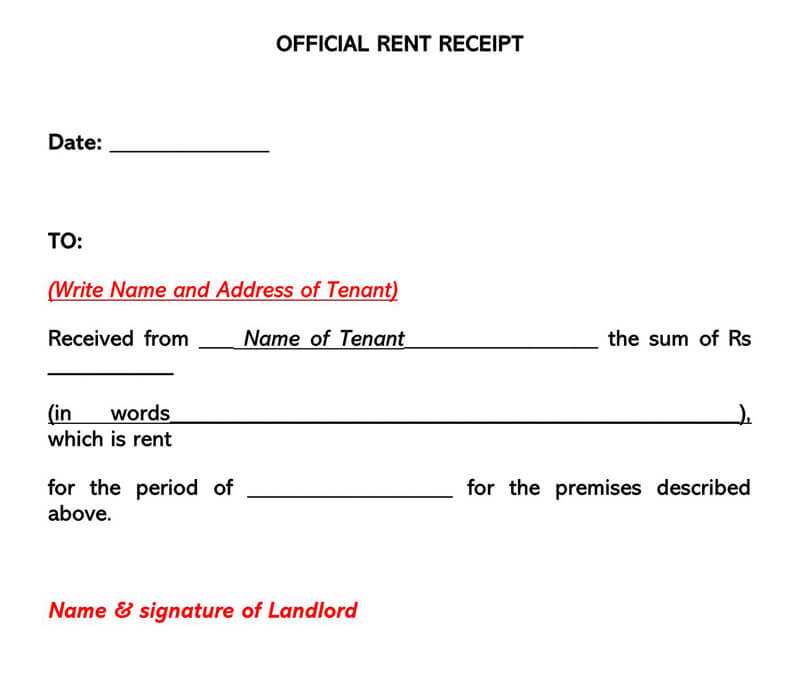

A payment receipt should include specific details to ensure clarity for both the buyer and seller. These components help to verify the transaction and maintain transparency. Below are the key elements to include in a standard payment receipt:

1. Seller Information

Clearly list the name, address, and contact information of the seller or business. This helps in case of future inquiries or disputes.

2. Buyer Information

Include the buyer’s name, address, and contact details. This is especially useful for reference in long-term transactions or for warranty purposes.

3. Transaction Date

Always provide the exact date when the payment was made. This serves as a timestamp for the transaction.

4. Description of Goods or Services

- Provide a detailed list of items or services that were purchased.

- Each item should include the quantity, unit price, and total price.

5. Payment Method

Specify how the payment was made, such as by cash, check, credit card, or online transfer. This can be important for tracking the source of payment.

6. Total Amount Paid

The total amount should be clearly mentioned, including taxes or additional charges, if applicable. This ensures no confusion about the payment amount.

7. Payment Reference Number

Include a unique reference number for the transaction. This helps to track and reference the payment if needed in the future.

8. Signature (Optional)

If the transaction requires formal confirmation, including a signature can serve as proof of agreement between both parties.

9. Terms and Conditions (Optional)

If relevant, include any specific terms of the sale or payment that may affect the buyer’s rights or obligations.

By including these elements, the payment receipt serves as a complete and clear record of the transaction, reducing potential confusion or disputes.

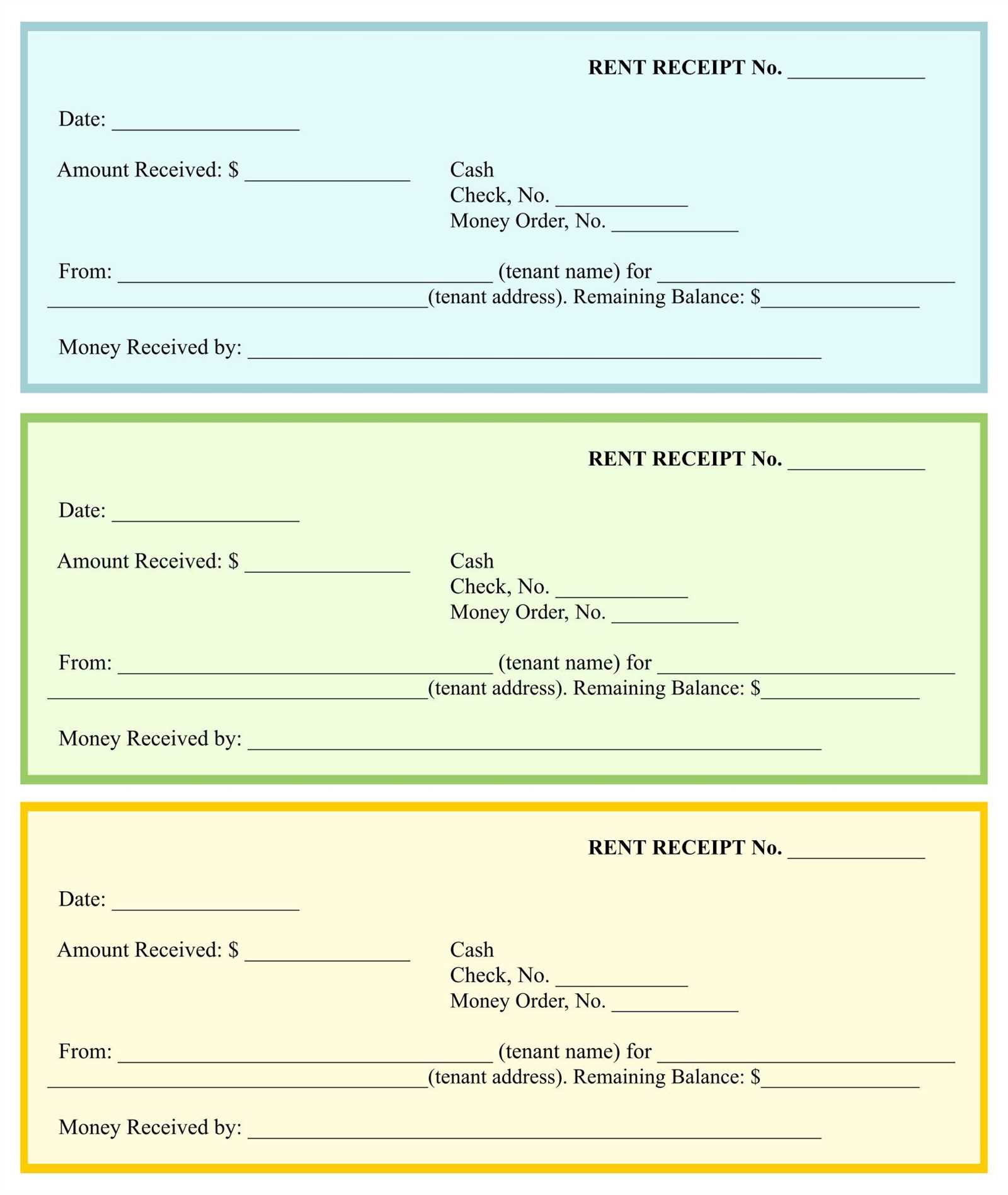

Make sure the receipt clearly displays all payment details. Missing essential information like the payment amount, date, or payment method can create confusion for both the customer and the business. This can lead to misunderstandings or disputes, so double-check each section of the receipt.

1. Skipping the Payment Breakdown

Never omit a detailed breakdown of the payment. Including itemized charges–such as taxes, discounts, and shipping fees–provides transparency. Customers should know exactly what they are paying for, and this helps avoid potential questions or complaints later on.

2. Inaccurate Payment Date or Time

Always record the exact date and time of the transaction. An incorrect or missing payment date can cause issues with record-keeping, tax filing, and returns. Ensure that the date is automatically generated or entered correctly in the system to avoid mistakes.

3. Using Unclear or Hard-to-Read Fonts

Use legible fonts and appropriate font sizes. A receipt is a legal document, and unclear or overly decorative fonts can make important details hard to read. Choose simple fonts like Arial or Times New Roman in sizes that are easy to scan quickly.

4. Incomplete or Incorrect Contact Information

Always include the business’s full contact details, including name, address, and phone number or email. If customers need to contact you regarding their payment, they should have no trouble finding how to reach you.

5. Failing to Include a Unique Transaction ID

Assign a unique transaction or receipt ID for each payment. This helps with tracking payments and resolving issues quickly. Avoid using generic numbers or leaving this field blank.

6. Not Considering Currency or Payment Method

Specify the currency used for the transaction and the payment method (e.g., credit card, PayPal, cash). This ensures clarity for both parties, especially in international transactions where confusion about currency can arise.

7. Ignoring Terms and Conditions

If applicable, include a brief section about your return or refund policy. This helps protect your business and informs customers about their rights. Make sure this section is clear and easy to understand, without overwhelming the receipt with excessive legal language.

8. Overloading the Receipt with Unnecessary Information

Avoid including irrelevant details that could clutter the receipt. Stick to the essentials, and don’t overload the customer with unnecessary information such as promotional offers or unrelated notices. Focus on what’s needed for record-keeping and verification.

Use the closing tag correctly to end an unordered list in HTML. Ensure it appears right after the last

Missing or incorrect closing tags may cause elements to overlap or break the layout. Check your HTML code for any unclosed tags, especially in lists, where these errors are common. Maintaining proper tag structure keeps your web pages running smoothly and ensures compatibility with browsers.