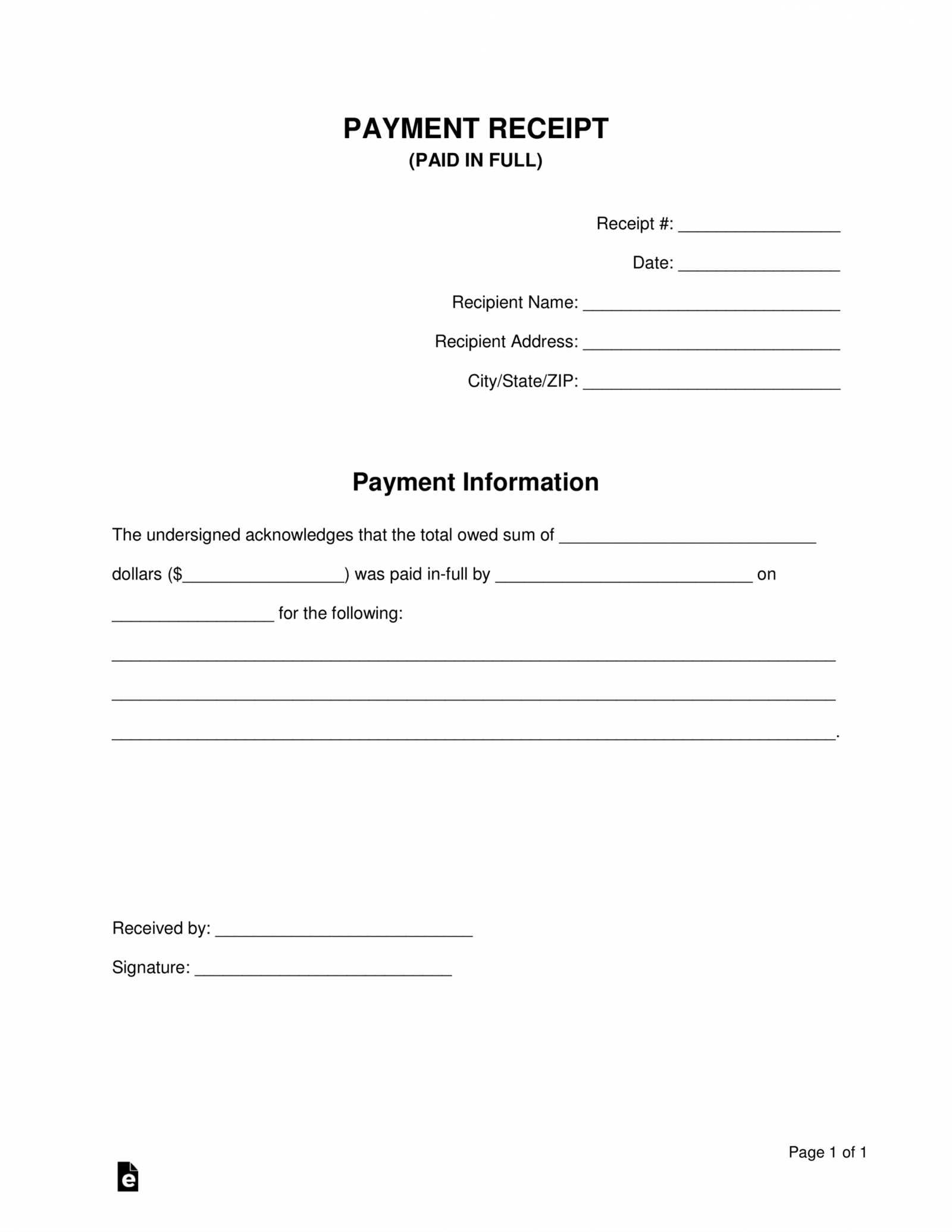

Creating a statement of receipts and payments requires clarity and accuracy. This template serves as a straightforward tool to track financial transactions in a concise, easy-to-follow format. Use it to record all incoming and outgoing funds, ensuring transparency and helping maintain organized financial records.

Begin by listing receipts, such as payments received from clients or any other income. Then, document the payments made, from operational expenses to other outflows. Each entry should include the amount, date, and a brief description of the transaction to avoid confusion later.

The template can be customized based on your needs, whether for a small business or a personal project. Keep it simple, focusing on essential data, and update it regularly to monitor your financial standing. With proper use, this statement will offer you a clear overview of your cash flow and assist in budgeting and planning.

Statement of Receipts and Payments Template

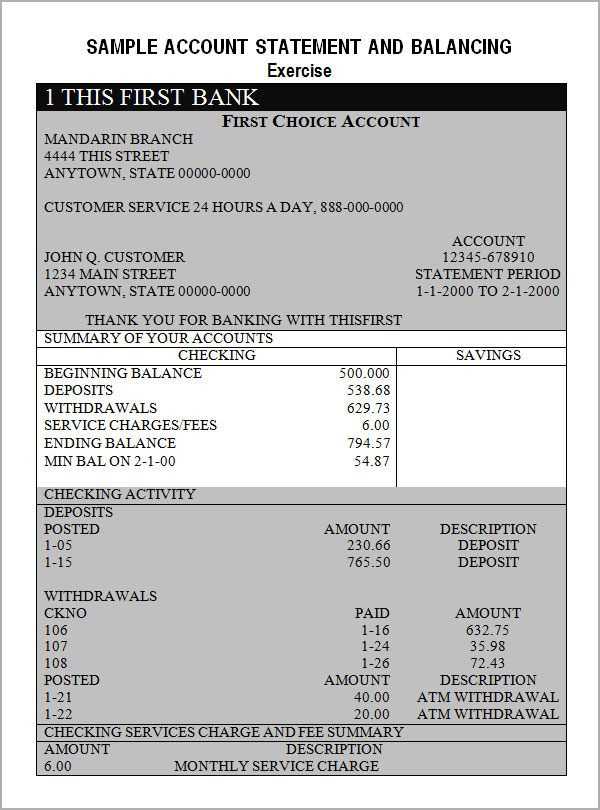

A clear and well-organized statement of receipts and payments can help you track your finances effectively. Start by creating a simple table that divides your entries into two sections: Receipts (income) and Payments (expenses). This structure allows easy monitoring and understanding of cash flow.

Receipts Section

List all income sources in this section. Include amounts and relevant dates. Each entry should be as specific as possible–mentioning the purpose or source, such as “donations,” “sales,” or “service fees.” Example:

- Date: January 5, 2025

- Source: Donations

- Amount: $1,500

Payments Section

For payments, follow the same approach. Clearly list each payment, including the vendor or payee name, purpose, date, and amount. This helps avoid confusion later on. Example:

- Date: January 10, 2025

- Payee: Office Supplies Store

- Purpose: Office supplies

- Amount: $200

Keep track of your balance after each section, noting any outstanding amounts. A quick summary at the end can help with financial analysis.

How to Structure the Columns for Clear Financial Reporting

Use specific, descriptive column headers to provide clarity in financial statements. This ensures each item is easily identifiable and can be analyzed without confusion. Keep your columns focused on key data points only, to avoid clutter.

- Date: Place this column at the beginning to track the timing of transactions. It helps in organizing the flow of financial activities over time.

- Details/Description: Use this column to describe each transaction in a brief, clear manner. Be precise but concise to maintain readability.

- Receipts: List all incoming funds in this column. Break them down by type (e.g., sales, grants) to provide transparency.

- Payments: Track all outgoing funds here, categorized by type (e.g., operational costs, wages). This helps in understanding where money is going.

- Balance: Include a running balance column. This allows users to quickly see the financial position after each transaction.

- Notes: Use a final column for any additional details that need clarification, such as invoice numbers, payment terms, or references to supporting documents.

By keeping the structure simple and focusing on these key columns, you ensure that financial data remains clear and easy to interpret. Organize the columns in a logical flow that mirrors the process of financial tracking and reporting.

Common Mistakes to Avoid When Filling Out a Receipt and Payment Statement

Ensure that all entries are accurate and reflect the actual amounts received or paid. Double-check numbers, especially when dealing with multiple transactions. A common mistake is rounding or guessing amounts, which can lead to discrepancies later on.

1. Missing or Incomplete Details

Always include the date, transaction type, and any relevant references (such as invoice numbers). Omitting these details can create confusion and make it difficult to track payments or receipts accurately. Missing descriptions of the transactions is another common mistake that complicates future record-keeping.

2. Incorrect Categorization

Misclassifying payments or receipts is easy to do, but it can throw off your financial reporting. Ensure each entry is correctly categorized–whether it’s income, expense, or a refund. This helps keep your records clear and prevents errors during reconciliation.

Don’t forget to update totals regularly. As you add more entries, ensure your running totals are correct and that all amounts are balanced. Inaccurate totals can cause major issues when reviewing statements.

Best Practices for Customizing the Template to Fit Specific Accounting Needs

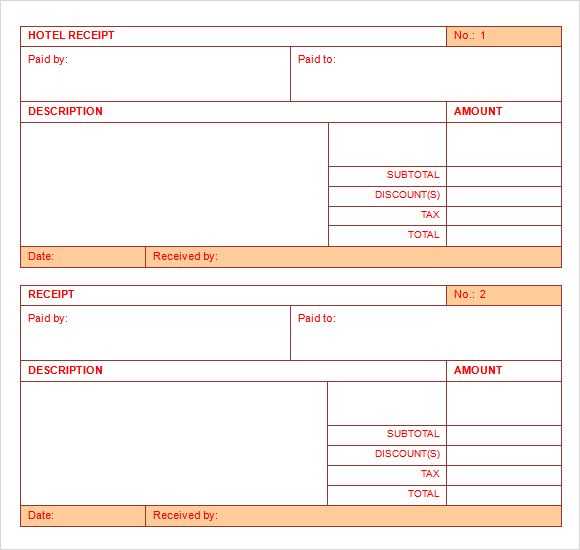

Modify categories and subcategories in the template to reflect your unique accounting structure. For instance, if you’re handling multiple departments or projects, create specific sections for each. This ensures that every receipt or payment is tracked accurately in its respective area.

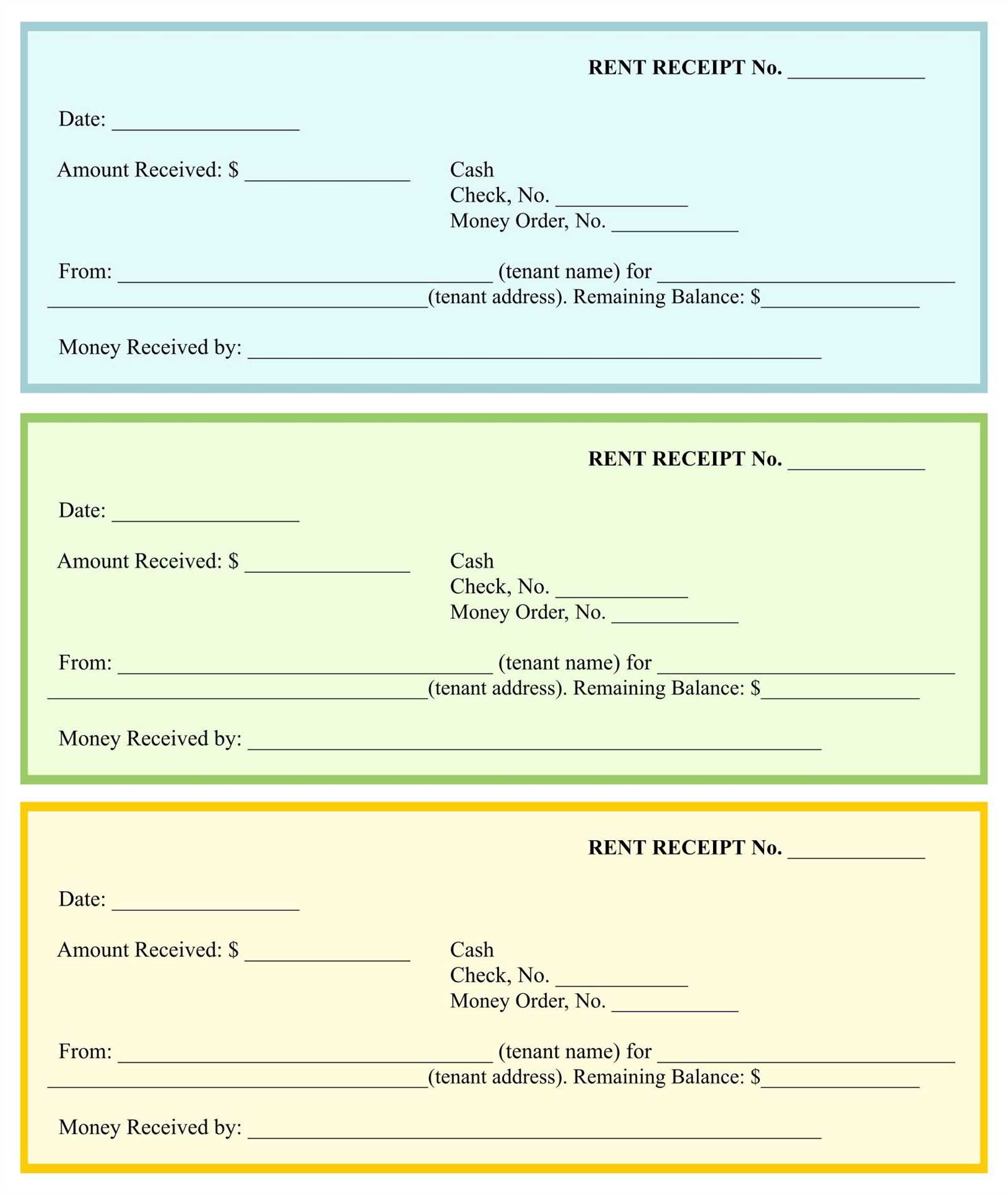

Adjust Date and Amount Formats

Make sure the date format aligns with your region’s standards or your business’s preference. Adjust the amount format for clarity–either in full numbers or rounded decimals, depending on your accounting practices. This avoids confusion and streamlines data entry.

Incorporate Custom Columns

If your accounting needs include tracking additional information, such as invoice numbers or payment methods, add custom columns. This prevents missing details and helps keep records organized without excessive back-and-forth between documents.

Use Conditional Formatting to highlight discrepancies or categorize entries based on amounts or dates. It can help quickly spot missing data or identify trends, reducing the chance of manual errors in your bookkeeping process.

Regularly update the template as accounting methods or requirements shift, whether due to tax law changes or internal adjustments. A template that evolves with your system ensures consistency and accuracy.