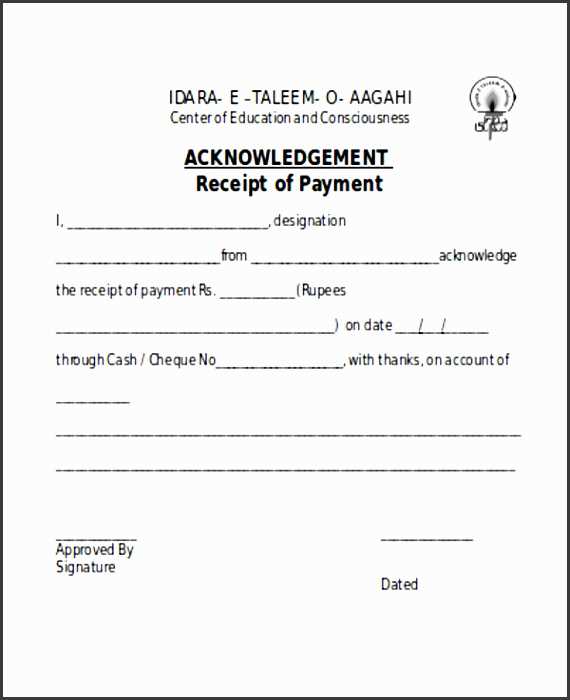

To confirm the receipt of payment, use a clear and straightforward acknowledgment template. This document should include details such as the amount received, the date, and any reference numbers for tracking purposes. It ensures both parties are on the same page and helps avoid any confusion later on.

Make sure the payment details are correct in the acknowledgment, including the name of the payer, payment method, and any relevant transaction references. It’s important that the recipient verifies all information before sending the receipt to maintain transparency.

Providing a receipt immediately after payment demonstrates professionalism and builds trust with your clients. It’s a simple way to show you value their business and confirm that their payment has been processed successfully.

Here are the revised lines with reduced repetitions:

To make the acknowledgment more concise and clearer, eliminate unnecessary phrases. Begin by confirming receipt of payment and providing specific details such as the amount, date, and payment method. For example, instead of repeating “we acknowledge receipt” multiple times, streamline the sentence to directly acknowledge the payment in one statement.

Correct format: “We have received your payment of $500 on February 11, 2025, via bank transfer.”

Revised text: “Your payment of $500 was received on February 11, 2025, through bank transfer.”

This approach makes the message shorter, more direct, and avoids redundancy while maintaining clarity.

Template for Acknowledging Receipt of Payment

When you need to confirm receipt of a payment, providing a clear and professional acknowledgment is key. Below is a simple template you can use to acknowledge payment from a client or customer.

Payment Acknowledgment Template

- Date: [Insert date]

- Payment Amount: [Insert amount received]

- Payment Method: [Insert payment method, e.g., bank transfer, credit card]

- Transaction Reference Number: [Insert transaction number or invoice reference]

Dear [Client Name],

We confirm receipt of your payment in the amount of [Insert amount] made on [Insert date]. The payment has been successfully processed, and your transaction reference number is [Insert transaction reference].

If you have any questions or require further information, please don’t hesitate to reach out.

Thank you for your prompt payment.

Sincerely,

[Your Name]

[Your Company Name]

Tips for Acknowledging Payment

- Ensure the payment acknowledgment is sent promptly to maintain clear communication.

- Provide specific details such as the payment amount and transaction reference for clarity.

- Consider including a message of appreciation to strengthen customer relations.

A well-organized payment receipt format ensures clarity for both the payer and the recipient. Start by clearly identifying the parties involved at the top of the document. This includes the payer’s and payee’s full names, addresses, and contact information. Next, include the receipt number for easy reference.

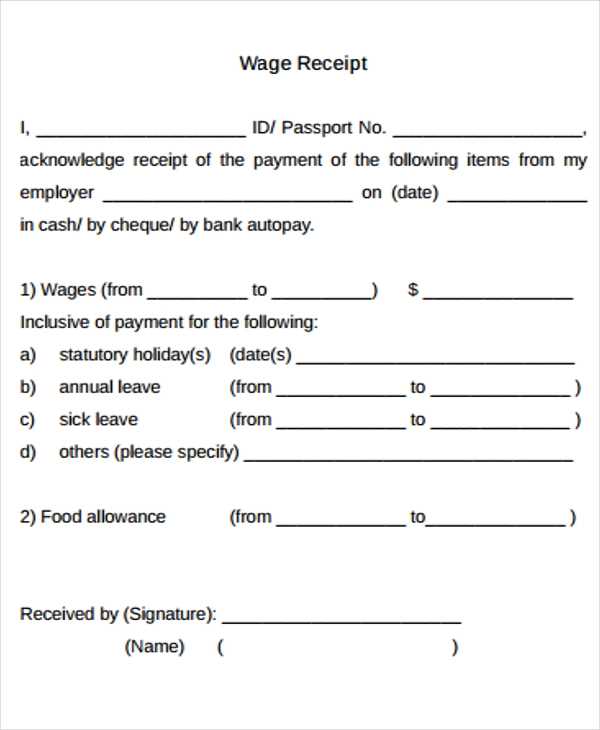

Details of the Payment

Specify the payment amount in both numerical and written form. Add the date of the transaction to indicate the time of payment. If the payment is for a particular service or product, describe it briefly but clearly. This section should also mention the method of payment, such as cash, credit card, or bank transfer.

Terms and Conditions

Include a brief section outlining any relevant terms, such as payment deadlines, late fees, or refund policies. This ensures that both parties are aware of their obligations. If applicable, include a statement confirming that the payment has been fully received and that no further action is required.

Finish the receipt with a thank you note or acknowledgment of the transaction. This adds a personal touch to the document, reinforcing a positive relationship between the payer and payee.

For payments made through bank transfers, include the transaction ID and the payment reference number in the acknowledgment. Clearly specify the date the funds were received and the exact amount paid. This helps the recipient easily track and verify the payment.

In the case of credit card payments, ensure the acknowledgment mentions the card type (Visa, MasterCard, etc.) and the last four digits of the card number for verification purposes. If applicable, note the approval code or authorization number.

For online payments, such as those made through PayPal or other e-wallets, include the payment ID and the date the funds were processed. Confirm the payment method and any associated fees, especially if the amount received differs from the invoiced amount.

If the payment is partial, indicate the amount received and the remaining balance, along with any deadlines or conditions for completing the payment. This helps maintain clarity on the status of the transaction and avoids confusion.

In case of multiple payments or installments, break down the total amount and highlight each individual payment with its corresponding date. This is particularly useful for subscription-based services or long-term contracts.

Include clear details in each payment receipt. Specify the amount paid, the method of payment, the date of payment, and the recipient’s name. This transparency minimizes any confusion for both parties and ensures a smoother transaction process.

Maintain Consistency in Format

Establish a consistent format for all receipts. Include the same set of details in each document to make it easy for both customers and your team to track payments. This consistency will simplify record-keeping and reporting.

Provide a Unique Identifier

Assign a unique reference number to each receipt. This will allow you to quickly track and reference a payment if needed, reducing the chances of confusion or duplication in future transactions.

Ensure your payment acknowledgment template includes clear language, specifying the payment amount, method, and date received. Start with a concise statement confirming the payment, followed by relevant transaction details. This keeps the recipient informed and reassured.

For example, “We have received your payment of [amount] through [payment method] on [date]. Thank you for your prompt settlement.” It’s important to include any reference numbers or invoices associated with the payment for easy tracking.

End the acknowledgment with a polite note encouraging future business or thanking the recipient for their trust. A short, appreciative closing statement helps maintain a positive relationship moving forward.