Creating a clear and concise receipt template is key for tracking payments and maintaining accurate records. A well-structured template should capture all necessary details, ensuring both parties have a clear understanding of the transaction. Include the transaction date, amount, and method of payment, along with any applicable taxes or discounts.

List the payer’s and recipient’s names and addresses, making it easy to identify the parties involved. If relevant, provide an invoice number for reference. This keeps the payment documented in an organized manner for future follow-up or verification.

A section for additional notes can be useful if there are special instructions or terms related to the payment. Keep this part simple to avoid clutter. By maintaining a straightforward and easily understandable format, you enhance the transparency of your payment process.

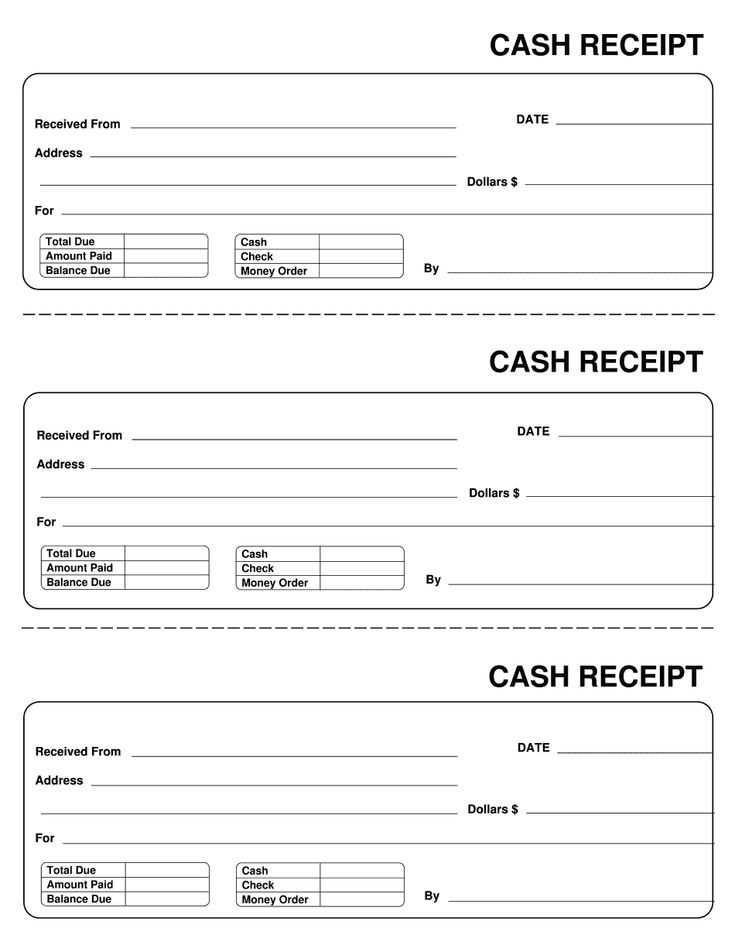

Template for a Receipt of Payment

A clear and structured template for a payment receipt helps ensure all necessary details are captured accurately. A simple format typically includes the following sections:

Key Details to Include

At the top of the receipt, list the name and contact information of the business or individual issuing the payment. Directly below, include the date the payment was received. Next, note the payment amount, currency, and method used (e.g., cash, credit card, bank transfer). It’s also helpful to provide an invoice number or transaction ID for reference.

Additional Information

Ensure the receipt includes a clear description of the goods or services paid for, along with any relevant dates. If applicable, outline the payment terms or any discounts applied. Finally, add a signature or a statement confirming the transaction was completed.

This format guarantees transparency and provides both parties with a clear record of the payment. Customize the template based on specific requirements, but always prioritize accuracy and clarity in the details provided.

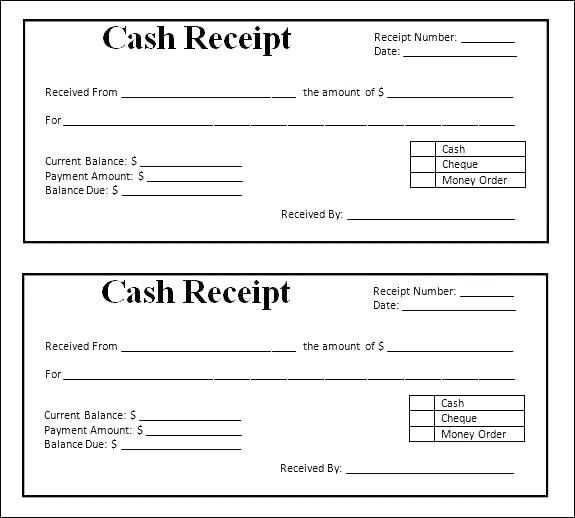

Key Components of a Payment Receipt

Clearly label the receipt with the name of the business or organization issuing the payment. Include a unique receipt number for tracking purposes.

List the date and time the payment was made. This helps to establish the exact moment the transaction occurred, ensuring clarity in case of any disputes.

Include a detailed breakdown of the items or services paid for, specifying the quantity, price, and any taxes applied. This provides transparency and a clear record of the transaction.

Display the total amount paid, clearly indicating the currency used. This ensures there’s no ambiguity about the value of the transaction.

Include the method of payment, whether cash, card, or other forms, to reflect how the payment was processed.

If applicable, add information regarding any balance due or changes applied. This helps customers track any remaining financial commitments or adjustments to their account.

Provide contact details for the business, such as phone number or email address, so the customer can easily reach out for inquiries or support.

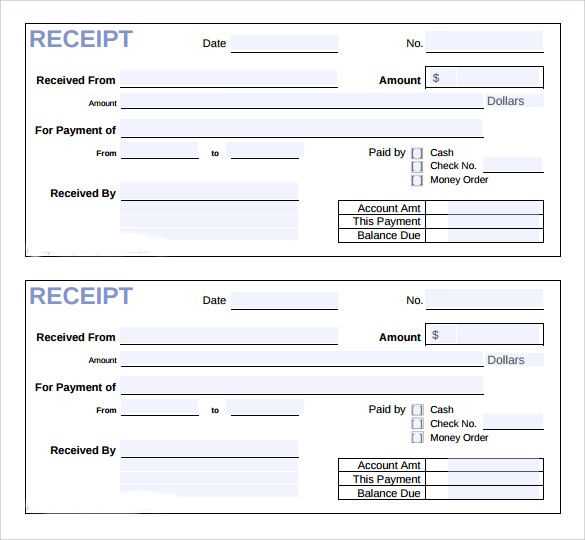

Customizing Your Receipt Template for Different Transactions

Adjust the details based on the type of transaction. For a retail purchase, include the item description, quantity, unit price, and total price. For services, list the specific services rendered, along with the rate and total amount. Tailor the format to fit the transaction type, ensuring clarity for both the payer and the payee.

For subscription-based services, add the billing period and recurring amount. In cases of partial payments, indicate the amount paid and the remaining balance. Provide space for discounts or taxes, if applicable. Customizing the template with transaction-specific fields will enhance accuracy and provide a clear record of the exchange.

Consider the customer’s preferences. Some may prefer more detailed receipts, while others might only need the basics. Include contact information for customer inquiries or further support. Adjust the template’s design to reflect the nature of the transaction, ensuring that it conveys professionalism while maintaining simplicity.

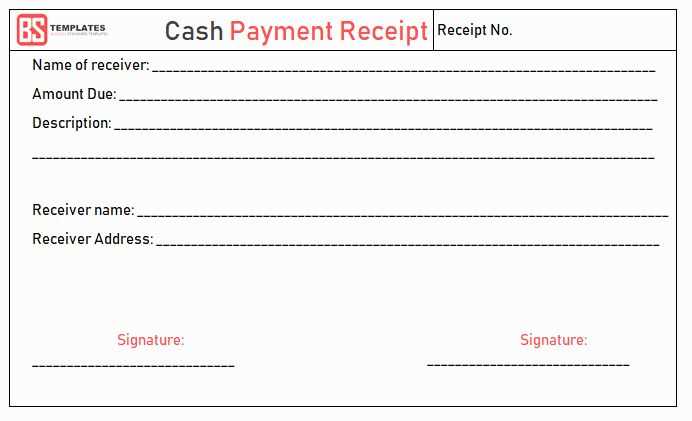

Ensuring Legal Compliance and Record Keeping

To maintain legal compliance, ensure your receipt of payment template includes all required details such as the payer’s name, the amount paid, the date of payment, and a description of the service or goods provided. Be precise in the formatting and language used to avoid confusion or ambiguity.

Key Elements to Include

- Payer’s information (name, address, or account details)

- Transaction amount and currency

- Date of payment

- Description of goods or services

- Payment method (e.g., cash, check, card)

- Any applicable taxes or discounts

- Receipt number for tracking purposes

Best Practices for Record Keeping

Keep copies of all receipts, both digital and physical, for a minimum of 3-5 years. Store them securely to protect sensitive information and ensure they are easily accessible in case of an audit. Regularly review your system for compliance with local tax regulations and industry standards.

Consider using accounting software to streamline the record-keeping process and reduce errors. This also provides a backup in case of data loss and simplifies future tax filings or legal reviews.