A well-structured payment receipt confirms a completed transaction and protects both parties. Use a clear format that includes essential details such as the payer’s name, service description, date, and amount paid. This ensures transparency and simplifies record-keeping.

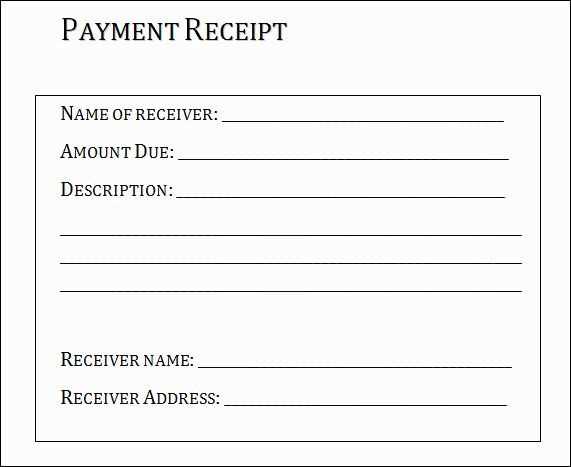

Start with a professional header containing your business name, address, contact information, and logo. Below, prominently display the title “Receipt of Payment” to eliminate confusion. The main section should include:

- Receipt number for tracking

- Payment date for accurate records

- Client’s name and contact details

- Service description with clear pricing

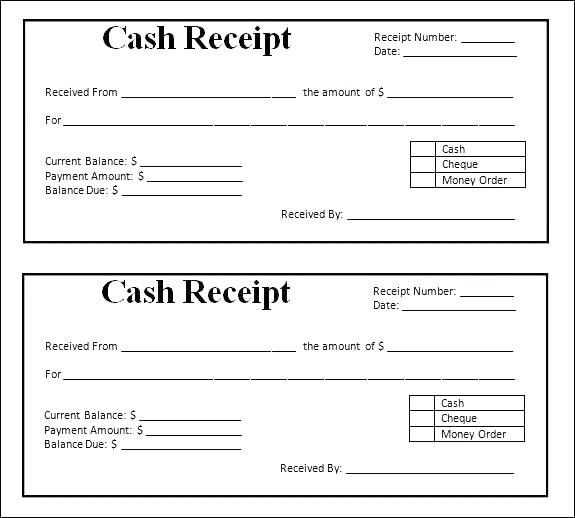

- Payment method (cash, card, bank transfer, etc.)

- Subtotal, taxes, and total amount

For added credibility, include a signature line or company seal. Digital receipts can also feature a confirmation statement, such as “This receipt serves as proof of payment.” Ensure the document is easy to read and formatted consistently.

Using a structured template saves time and minimizes errors. Whether creating one from scratch or using a pre-designed format, a detailed and professional receipt enhances business operations and client trust.

Here is the corrected version with the removal of duplicates:

Ensure that each payment receipt contains the correct and necessary details, without redundancy. Here’s how to avoid unnecessary repetition:

- Start with the transaction number. This serves as a unique identifier for the payment and should not be repeated elsewhere in the receipt.

- Clearly list the payment amount and the service it relates to only once. Avoid restating the amount in multiple sections of the document.

- Provide a date and time of payment, but don’t repeat this information in both the header and footer of the receipt.

- Describe the services rendered in concise terms. Repeating the same service description in different areas of the document can create confusion.

- If the receipt includes a breakdown of the amount, ensure it’s only listed once and avoid reiterating the details in another part of the document.

By following these steps, you can ensure that your payment receipts are clear, easy to read, and free of redundancy.

- Template for Service Payment Receipt

Ensure that the payment receipt clearly identifies the services provided, the amount paid, and the details of the transaction. Below is a recommended template structure to follow:

Header Information

Start with your business name, contact details, and logo. Include the date of the payment and a unique receipt number for easy tracking.

Payment Breakdown

List the services rendered, with a brief description of each item and the respective cost. Include the total amount paid and the payment method (e.g., credit card, cash, or bank transfer).

Finish by providing the payment confirmation, such as a transaction ID or a signature line for physical receipts. Always ensure the format is simple and the key details stand out for clarity.

A payment receipt must include several key components to ensure clarity and legality. The following elements should always be present:

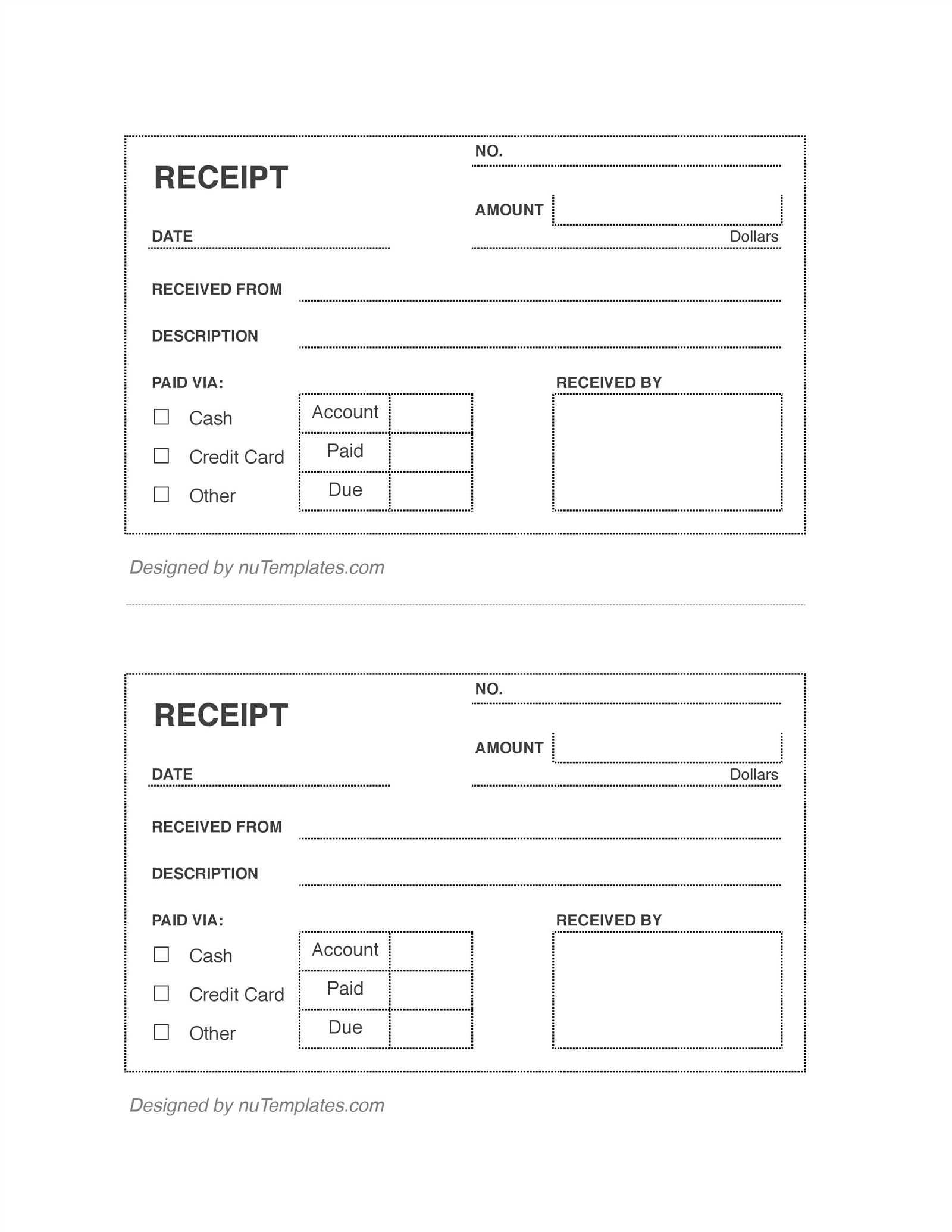

1. Payment Details

This section should list the amount paid, the payment method (e.g., cash, credit card, bank transfer), and the date the payment was received. It’s crucial for this information to be precise to avoid any confusion later on.

2. Service or Product Description

Clearly state what the payment was for, whether it’s for a service rendered or a product purchased. Include details like the quantity, service type, and any relevant dates or descriptions.

3. Receipt Number

Each receipt should have a unique identifier or receipt number. This helps both parties track the transaction and serves as a reference in case of disputes.

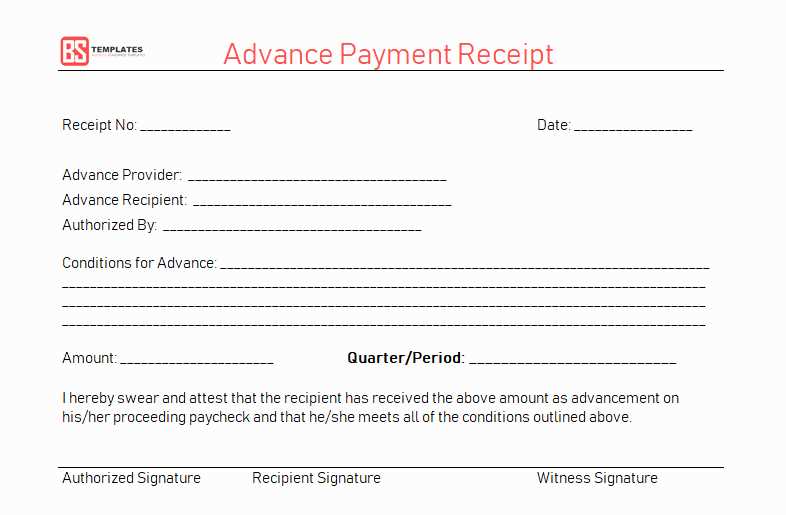

4. Business Information

Include the business’s name, address, and contact details. This gives the receipt legitimacy and ensures that the payer knows where to reach the business for future inquiries.

5. Payer Information

While not always mandatory, having the name of the individual or company making the payment can provide additional clarity, especially in a business-to-business context.

6. Taxes and Fees

Include any taxes or additional fees that apply to the transaction. If applicable, list the tax rate and the total amount of tax charged.

7. Payment Confirmation

Clearly state that the payment has been received in full. A statement like “Paid in full” or “Payment completed” should be included to avoid misunderstandings.

8. Signature (if applicable)

Some receipts may require a signature from either the payer or the payee. This confirms the transaction took place and provides an additional level of verification.

Sample Payment Receipt

| Payment Details | Service/Product Description | Amount |

|---|---|---|

| Bank Transfer on 09-Feb-2025 | Consulting Services for Web Development | $500.00 |

| Total: $500.00 | ||

| Business Name | Payer Name | Signature |

| Tech Solutions LLC | John Doe | _________ |

Ensure the receipt is clear and well-structured. Begin with your company name, logo, and contact information at the top. This provides immediate identification for your client. Position the receipt number and date in a way that makes them easy to find, ideally in the upper right corner. These details help track and organize your transactions.

Divide the receipt into sections for easy navigation. The first section should display a description of the service provided, along with the corresponding amount charged. Use a clean, readable font to avoid any confusion.

Include a clear payment method section. Specify whether the payment was made by cash, credit card, bank transfer, or other means. This clarifies how the transaction was completed.

Clearly state the total amount at the bottom of the receipt, bolded or in a larger font, so it stands out. Adding a line for any discounts or taxes applied provides transparency.

Finally, ensure the layout is balanced, with adequate space between sections. This improves readability and avoids making the receipt look cluttered.

Issuing payment receipts must comply with local tax and accounting laws. Always include accurate details such as the full name of the payer, the amount paid, the date of payment, and a description of the service rendered. A receipt should be provided immediately or shortly after the transaction to confirm the exchange.

Required Information on a Receipt

A legal payment receipt must clearly identify both the payer and the recipient. This includes the names, addresses, and registration numbers of the parties involved, if applicable. For businesses, always include tax identification numbers (TIN) or VAT numbers. The receipt should also specify the service or product for which the payment was made, including any applicable terms such as taxes or discounts.

Retention of Receipts

Both the issuer and the recipient must retain payment receipts for a specific period, typically ranging from three to five years, depending on the jurisdiction. These records are vital for tax reporting, audits, and legal compliance. Keep receipts in a secure, organized manner to avoid legal penalties for non-compliance.

Customizing receipt templates for different services ensures clarity and professionalism. A template should reflect the specifics of each service provided while maintaining a consistent format for easy recognition by clients. For instance, a receipt for a consultancy service might prioritize detailing the hours worked, rate per hour, and project specifics, whereas a receipt for a retail purchase will focus on itemized products, quantities, and prices.

1. Service-Specific Details

Focus on including the key components that matter for the service in question. For a medical service, it’s vital to add a breakdown of procedures or consultations, while for an educational service, listing course names, durations, and the applicable fees ensures transparency. Consider what data makes the transaction clear to both the provider and the client, and tailor the template accordingly.

2. Adjusting Payment Methods

Ensure your template accommodates various payment methods. Some services might require the option to specify payment plans, deposits, or installment schedules. Retail services may focus on card payments or cash, while subscription services require details on recurring payments. Being specific about the method and status of payment helps prevent any future confusion.

Digital receipts offer convenience and eco-friendliness. Storing them is simple, as they can be saved on your device or cloud storage, reducing paper waste. They are easy to organize, search, and access at any time, and they don’t take up physical space. Additionally, digital receipts can be automatically sent to your email or app, eliminating the need to carry them around.

On the flip side, paper receipts provide a tangible record of your transaction. Some people prefer keeping them for personal reference, as they can be easily stored in a wallet or filing system. In some cases, retailers or service providers may offer paper receipts for warranty or return purposes, where digital versions may not always suffice.

Drawbacks of digital receipts include the reliance on technology. If your phone or computer malfunctions or data is lost, retrieving receipts can become difficult. Additionally, not all businesses offer digital receipt options, which may force you to rely on paper receipts.

Paper receipts can fade over time, especially if they’re exposed to sunlight or heat. This could make them harder to read, and if lost, it’s difficult to recover them. Also, paper receipts contribute to waste, which could have an environmental impact, especially if printed in excess.

Both methods offer benefits, but choosing one depends on personal preference, environmental considerations, and the nature of the transaction.

Ensure the accuracy of the details in the receipt to prevent confusion or disputes. Below are common mistakes to avoid:

- Incorrect Payment Amount: Double-check the payment amount before issuing a receipt. Mistakes here can lead to confusion or issues with refunds.

- Missing Payment Date: Always include the exact date the payment was made. This helps with record-keeping and resolving future questions about the transaction.

- Unclear Service Description: Clearly describe the service provided. Avoid vague terms and ensure that the description matches the transaction.

- Omitting Payment Method: Indicate whether the payment was made in cash, by card, or through other methods. This detail helps clarify the nature of the transaction.

- Incorrect Contact Information: Verify that all contact details are correct, including the service provider’s name, address, and phone number. This ensures the recipient knows how to get in touch if needed.

- Missing Invoice or Receipt Number: For easy tracking and reference, always include a unique invoice or receipt number.

- Not Including Terms of Service: If there are specific terms or agreements related to the payment, ensure they are clearly listed to avoid misunderstandings.

- Failure to Include Taxes: If applicable, include taxes or VAT in the breakdown of the payment. This is particularly important for businesses operating under tax regulations.

By avoiding these common errors, you can ensure smooth transactions and clear communication with your clients.

Meaning retained, repetitions removed, the text remains accurate and natural.

Ensure the payment receipt clearly states the service provided, along with the exact amount paid. This prevents misunderstandings and keeps everything transparent. Use precise language to detail the service, including dates and any reference numbers related to the transaction.

Include both the payer’s and the recipient’s details. Names, addresses, and contact info should be clear to avoid confusion. Consider adding a unique invoice number for tracking purposes, especially when dealing with multiple transactions.

Make sure the receipt is dated. This helps to establish the exact timing of the payment and ensures both parties are on the same page. You can also list payment methods used (e.g., cash, credit card, bank transfer) for further clarity.

Always offer the receipt in a printable or downloadable format. This makes it easy for both parties to keep records for future reference or audits.

Lastly, avoid any redundant phrases. Direct, clear information ensures that the receipt is functional without overwhelming the reader. Stick to the facts to make your receipt both useful and professional.