To acknowledge the receipt of a payment, use this simple template letter. It confirms that a transaction has been completed, outlining key payment details. This document ensures both parties are clear on the terms and date of payment.

Start by including the recipient’s name, the amount paid, and the date of receipt. Specify any payment method used–whether it’s a bank transfer, check, or cash. This clarity avoids confusion and sets a professional tone.

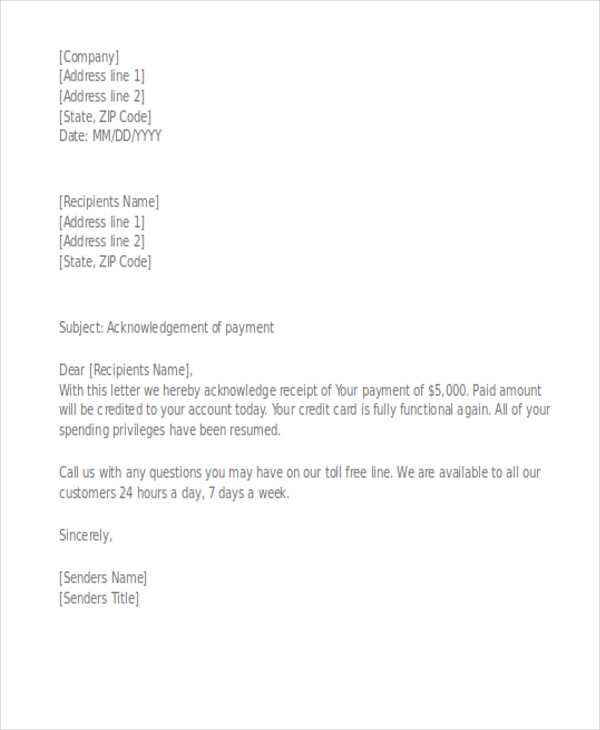

Example template:

Dear [Recipient’s Name],

I am writing to confirm the receipt of your payment of [amount] on [date], received via [payment method]. Thank you for your timely payment.

If you have any questions or need further details, feel free to contact us. We appreciate your business and look forward to continuing our relationship.

Sincerely,

[Your Name]

[Your Contact Information]

Here’s the revised version with minimized word repetition:

Confirm receipt of payment clearly by stating the amount and date of transaction. Specify the method used and express appreciation for the timely payment. Keep the tone professional but warm. For instance, “We have received your payment of $500 on March 5, 2025, via bank transfer. Thank you for processing the payment promptly.” This keeps the focus on the details without unnecessary elaboration.

Include relevant transaction information like invoice numbers or references, if applicable. For example: “The payment corresponds to invoice #12345.” Avoid over-explaining or reiterating information already included in the invoice or agreement.

If further steps are required, state them concisely. For instance, “We will begin processing your order immediately. You will receive a confirmation email once it ships.” This provides clarity without redundancy.

- Template Letter for Payment Receipt

A payment receipt letter confirms that a payment has been received for goods or services rendered. It is a formal document that serves as proof of payment. Below is a simple template you can follow for creating a payment receipt letter.

Template for Payment Receipt Letter

Subject: Payment Receipt for [Invoice Number] – [Amount Paid]

Dear [Client Name],

Thank you for your payment of [Amount Paid], which was received on [Payment Date]. This letter serves as confirmation of your payment for the following invoice:

- Invoice Number: [Invoice Number]

- Invoice Date: [Invoice Date]

- Payment Amount: [Amount Paid]

- Payment Method: [Payment Method]

- Balance Due: [Remaining Balance (if any)]

Your payment has been successfully processed, and your account has been updated accordingly. If you have any questions or need further assistance, please feel free to contact us at [Contact Information].

Thank you for your business!

Sincerely,

[Your Name]

[Your Position]

[Company Name]

[Company Address]

Begin your receipt letter by clearly stating the purpose: acknowledging the payment received. Start with the date of the payment and reference the invoice or transaction number to avoid confusion. For example, “We have received your payment of [amount] on [date], in reference to invoice [invoice number].” This ensures the recipient knows exactly which transaction is being addressed.

Next, confirm the amount received and include details of the payment method. If the payment was made via bank transfer, credit card, or another method, mention this explicitly. “The payment was made via [payment method] and has been successfully processed.” This level of detail provides clarity and transparency.

Include a brief statement expressing appreciation for the payment. Acknowledge the timeliness or reliability of the transaction without overdoing it. For example: “Thank you for your prompt payment.” This adds a personal touch and maintains a positive tone.

If applicable, mention any next steps or additional information. For instance, if the payment clears a balance or activates a service, let the recipient know: “Your payment clears your balance in full and your service will be activated shortly.” This keeps the recipient informed about the outcome of their action.

Finally, include a closing statement that invites further communication or offers assistance if needed. For example, “If you have any questions or need further assistance, feel free to contact us.” This keeps the door open for future interaction.

Start with a clear subject line that specifies the purpose of the letter. Use a simple, direct phrase such as “Receipt of Payment for Invoice #12345”. This helps the recipient understand the context immediately.

Details of the Transaction

Include the payment amount, payment date, and the method of payment (e.g., bank transfer, credit card). This provides clarity and confirms the transaction has been completed. For instance, “We acknowledge the payment of $500 received on January 15, 2025, via bank transfer.”

Invoice Information

Reference the invoice number or any other relevant order identification to ensure the payment can be matched with the correct transaction. For example, “This payment corresponds to Invoice #12345 issued on January 10, 2025.”

It’s also helpful to mention any outstanding balances, if applicable. This keeps the communication clear and transparent. If the full amount has been received, state that there is no outstanding balance.

Adapt your payment receipt template to accommodate the specifics of different payment methods. Each method has unique details that need to be clearly reflected in the receipt for clarity and compliance.

- Credit/Debit Cards: Include the last four digits of the card number, the type of card (Visa, MasterCard, etc.), and the approval code. This helps provide transparency and ensures customers can easily identify the transaction.

- Bank Transfers: Specify the bank name, transaction reference number, and the date of the transfer. If possible, include the sender’s account name to help identify the payment source.

- Online Payment Gateways (PayPal, Stripe, etc.): Mention the payment gateway used and include any transaction ID provided by the service. This helps trace the transaction in case of disputes or queries.

- Cash Payments: Clearly state the total amount paid and the date. If applicable, indicate if change was provided and list the denominations used.

- Cryptocurrency: List the cryptocurrency type (e.g., Bitcoin, Ethereum) and the transaction ID or wallet address. Since crypto transactions are irreversible, the transaction ID is critical for proof.

Always ensure that the payment amount, transaction date, and any reference numbers are included, regardless of the payment method. Personalizing these details helps both the payer and the payee track payments with ease.

Ensure that the receipt clearly includes the date of the transaction, the amount paid, the name of the payer, and a description of the goods or services provided. This information serves as proof of payment and helps avoid disputes in case of future issues.

Specify the payment method, whether cash, credit card, or electronic transfer, as it may affect tax reporting and potential refund requests. Accurate details about the transaction also help ensure compliance with tax regulations and financial reporting requirements.

Confirm that the receipt complies with local laws, which may require particular formats or wording to meet business record-keeping standards. For instance, some jurisdictions may mandate that receipts include tax identification numbers or VAT information if applicable.

If offering goods or services under warranty or specific terms, include relevant policy details on the receipt. This ensures both parties are clear about any limitations or return conditions.

Finally, issue receipts for all transactions, even small ones, to maintain a professional standard and establish a transparent transaction record, protecting both the business and the customer in case of disputes or audits.

Make sure to clearly specify the date of payment in the receipt letter. Ambiguous or missing dates create confusion and might lead to disputes later. Always use an exact date format, for example, “February 7, 2025.” Avoid general phrases like “recently” or “last week.”

Provide accurate details about the payment method used. For instance, instead of just stating “payment received,” mention if it was made via credit card, bank transfer, or cash. A vague description could lead to misunderstandings regarding the transaction.

Do not leave out the full amount paid. Ensure that the exact sum is noted, including any applicable taxes or fees. Failure to include this information can result in inaccurate accounting records.

Avoid generic language when describing the goods or services provided. Be specific about the items or services for which payment was received. A lack of details might lead to confusion, especially in case of returns or disputes.

Refrain from omitting the sender’s and recipient’s full names and addresses. A receipt letter without this information lacks authenticity and might not hold up legally in the future.

Don’t forget to include a clear and unique receipt number. This helps both parties track the transaction and provides a reference for future communication.

Below is a table summarizing common mistakes:

| Common Mistake | Recommended Action |

|---|---|

| Ambiguous or missing payment date | Specify an exact date format |

| Vague payment method description | Include the specific payment method used |

| Incorrect or missing payment amount | Include the total amount, taxes, and fees |

| Generic description of goods/services | Be specific about the items or services paid for |

| Missing sender and recipient details | Include full names and addresses |

| Lack of receipt number | Include a unique receipt number |

Begin by clearly addressing the payment letter to the recipient, including relevant payment details such as the amount, date, and invoice number. Specify the payment method used and any reference number if applicable. Keep your tone professional and polite, ensuring that the letter includes a confirmation request for the recipient to acknowledge the payment.

Choose a reliable delivery method, such as certified mail, to ensure proof of receipt. Alternatively, using an email with a read receipt can offer quicker confirmation and tracking. Include a clear subject line and attachment (if necessary) when sending electronically. Always request an acknowledgment or receipt confirmation from the recipient.

For tracking, maintain records of the delivery, whether through a tracking number for physical mail or delivery confirmation for digital communications. Regularly follow up to ensure the payment has been processed and to resolve any issues promptly.

Always ensure your letter for receipt of payment is clear and direct. Begin by acknowledging the payment received, stating the amount, and the date it was processed. This builds trust and assures the recipient that the payment has been successfully recorded.

Details to Include

Clearly mention the invoice number or reference that corresponds to the payment. It’s helpful to provide a brief description of the product or service that the payment is for, as this minimizes confusion and verifies the transaction.

Next Steps

End the letter with a polite confirmation of the payment status and any follow-up action required, such as confirming the shipment or providing an expected delivery date. A straightforward closing reinforces the purpose of the letter and leaves no room for ambiguity.