Every financial transaction requires proper documentation, and a well-structured receipt serves as undeniable proof of payment. Whether issuing a simple confirmation or a detailed breakdown of charges, a clear format ensures transparency and avoids disputes. Using a standardized template saves time and maintains consistency across records.

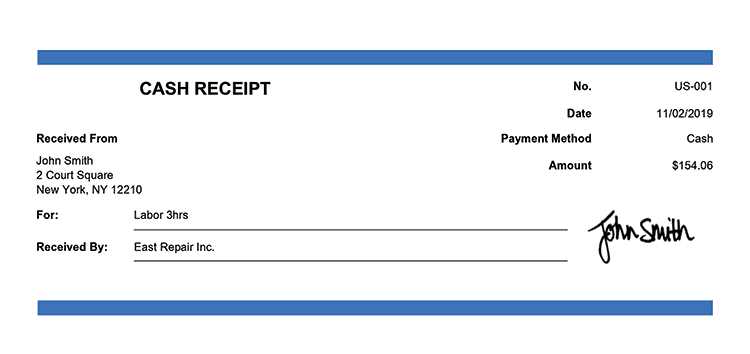

A functional receipt includes key elements: the amount paid, date, payment method, and recipient details. Adding a unique reference number strengthens traceability, while a concise description clarifies the nature of the transaction. If taxes or additional charges apply, itemizing them enhances clarity for both parties.

Choosing a digital or printed format depends on business needs. Electronic receipts streamline record-keeping and integrate seamlessly with accounting systems, while printed versions remain essential for in-person transactions. Regardless of format, ensuring readability and accuracy builds trust and simplifies financial management.

Template of Receipt of Payment

A clear and structured receipt confirms a financial transaction and provides essential details for both parties. Include the date, unique receipt number, payer and recipient information, amount, payment method, and a brief description of the service or product. Ensure tax details and currency are clearly stated if applicable.

Use a consistent format for readability. Align key details in sections, separating transaction specifics from legal disclaimers. If issuing digital receipts, use a PDF format to maintain integrity and prevent unauthorized modifications. Adding a company logo and contact details enhances credibility.

For recurring payments, automate receipts with a standardized template, ensuring accuracy and timely issuance. Digital tools simplify this process, reducing administrative work and minimizing errors. Always store a copy for record-keeping and compliance purposes.

Key Elements of a Payment Receipt

Ensure every receipt includes the transaction date, as it confirms when the payment was made. Without this detail, tracking financial records becomes challenging.

Identifying Information

Include the payer’s and recipient’s names or business details. This prevents disputes and provides clarity for both parties. If applicable, add tax identification numbers for compliance with financial regulations.

Transaction Details

List the payment amount, currency, and method used, such as card, bank transfer, or digital wallet. Specify any applicable taxes, fees, or discounts to maintain accuracy. For installment payments, indicate the balance due to avoid misunderstandings.

A unique receipt number helps with record-keeping and future references. Adding a brief description of the product or service purchased enhances transparency.

Finally, ensure the receipt includes a confirmation statement, such as “Payment received in full,” to eliminate any ambiguity regarding the transaction status.

How to Format Payment Details

List the payment date, amount, and method at the top. Specify the currency and ensure numerical values use consistent formatting, such as two decimal places for cents. Separate thousands with commas if required by regional standards.

Include the payer’s and recipient’s names or business entities. Use official names to prevent discrepancies. If applicable, add a reference number or invoice ID for tracking.

Provide a clear breakdown if multiple items or services are covered. Align amounts in a column for readability. If taxes or fees apply, indicate them separately to avoid confusion.

End with confirmation details, such as a signature, digital stamp, or authorization code. If issuing a digital receipt, ensure it is accessible in a standard format like PDF.

Legal Considerations for Receipts

Include Mandatory Information. A receipt must display the transaction date, amount, and a clear description of the goods or services provided. If applicable, tax details and business registration numbers are also required.

Ensure Accuracy and Transparency

Incorrect or missing details can lead to disputes or compliance issues. Double-check amounts, dates, and descriptions before issuing a receipt. If corrections are needed, issue an amended version rather than altering the original.

Maintain Proper Record-Keeping

Store receipts securely for the legally required period, which varies by jurisdiction. Digital copies should be backed up, while physical receipts should be kept in an organized system for easy retrieval if needed.

Customizing a Receipt for Different Transactions

Adjust the receipt format based on the type of transaction. For retail purchases, highlight itemized details, tax breakdowns, and return policies. Service-based payments benefit from a clear description of work performed and applicable warranties.

Highlight Key Information

Emphasize relevant details based on transaction type. A rental agreement receipt should include rental period, security deposits, and payment terms. For online payments, display transaction IDs and payment gateways used.

Adapt Layout and Structure

Modify layout elements to fit business needs. Restaurants often include gratuity suggestions, while corporate transactions may require legal disclaimers or approval signatures. Digital receipts can incorporate QR codes for easy record-keeping.

Fine-tuning receipts ensures clarity, reduces disputes, and enhances customer confidence. Align details with transaction specifics for a smooth experience.

Digital vs. Paper Receipts: Pros and Cons

Choose digital receipts for convenience and environmental benefits. They reduce clutter, simplify expense tracking, and minimize waste. Businesses save on printing costs, and customers can easily store receipts in apps or cloud services.

- Accessibility: Digital receipts are searchable and retrievable from anywhere. No need to dig through stacks of paper.

- Security: Encrypted storage protects against loss and unauthorized access, unlike physical copies that can fade or be misplaced.

- Automation: Integrate with accounting software for real-time financial tracking and tax preparation.

Paper receipts still serve a purpose where digital options are limited. They provide instant proof of purchase, especially in areas with restricted internet access or businesses without electronic systems.

- Universality: Accepted everywhere without requiring a device.

- Legality: Some jurisdictions mandate printed copies for tax or warranty claims.

- Customer Preference: Not all shoppers are comfortable with digital alternatives.

For best results, offer both options. Let customers decide based on their needs, ensuring flexibility and efficiency in transactions.

Common Mistakes When Creating Receipts

Ensure all the payment details are correct, including the amount, date, and payment method. Double-check the spelling of the client’s name and the transaction number to avoid confusion later.

Inaccurate Dates

One common error is using incorrect or outdated dates. Always confirm that the receipt shows the exact transaction date, especially for ongoing services or recurring payments.

Missing or Incorrect Information

Leaving out crucial details such as the service description or a breakdown of costs can create confusion for both parties. Ensure that each charge is clearly stated with sufficient details to avoid misunderstandings.

| Possible Mistake | How to Fix |

|---|---|

| Incorrect Payment Amount | Verify the payment amount before finalizing the receipt. |

| Missing Transaction Number | Always include a unique transaction number for tracking purposes. |

| Unclear Service Description | Provide a clear and concise description of the service or product. |