Use a template receipt of payment to streamline your financial documentation process. By standardizing the format, you ensure clarity and consistency in all transactions, making it easier for both parties to keep track of payments.

A payment receipt template should include key details such as the date of payment, amount paid, payment method, and the recipient’s information. This ensures transparency and prevents any confusion in the future.

Once you have the template set up, it’s important to personalize it with the relevant transaction data. This will allow you to issue receipts quickly and accurately, whether for one-time payments or recurring transactions.

Here’s the revised version with minimal repetition of words:

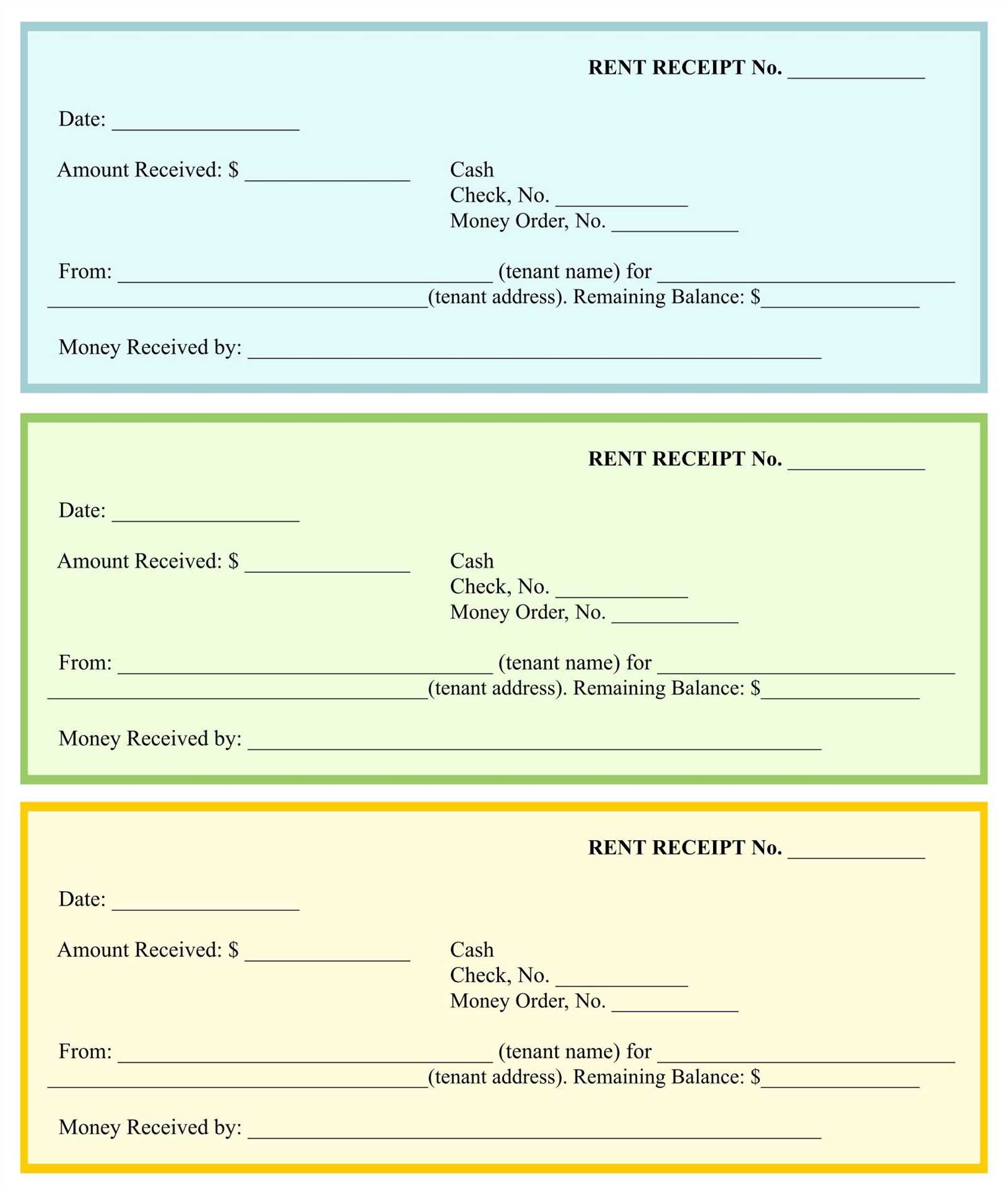

Ensure that the receipt of payment template clearly indicates the amount received, payment method, and date of transaction. This clarity prevents confusion for both parties. Include a unique receipt number for easy reference and tracking. List the payer’s details, such as name and address, to ensure the payment is attributed correctly. Avoid unnecessary details that don’t add to the transaction history. Specify whether taxes are included in the total amount or if they are itemized separately.

Make sure the template is formatted to highlight key information, such as total amount, date, and payment method, making it easy to locate. Maintain simplicity, avoiding complex wording. Double-check that all fields are filled out correctly before issuing the receipt to prevent errors.

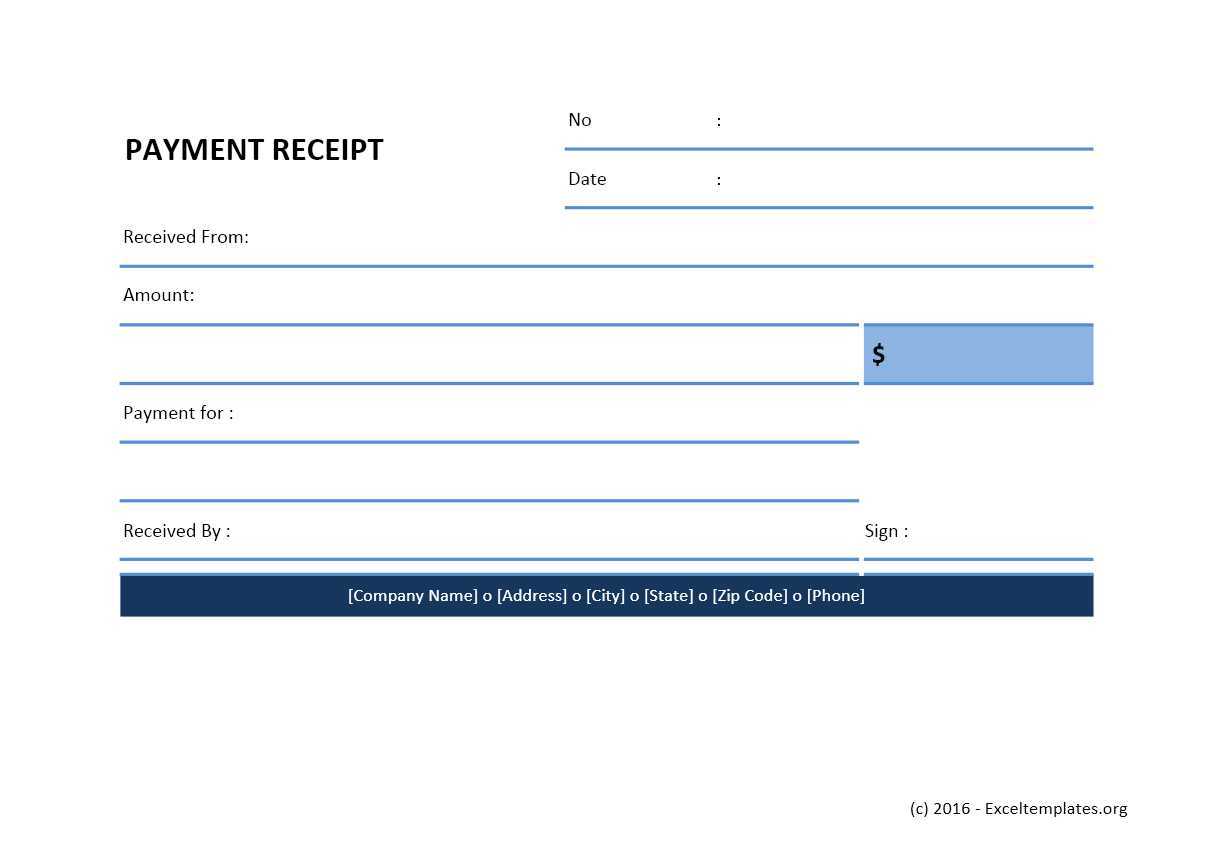

- Payment Receipt Template

A payment receipt template should include specific details for clarity and record-keeping. Ensure the following elements are present:

Key Components

Include the payment date, method, amount, and the name of the payer. Specify the services or products paid for, along with their respective costs. Always add a unique reference number to track the receipt easily.

Additional Details

Incorporate any taxes or additional fees, if applicable. If there are any discounts applied, mention them clearly. Don’t forget to state the recipient’s full name or company name, along with their contact details for verification.

Begin by selecting a clear layout that includes key elements: company name, receipt number, date, payment method, and details of the goods or services provided. Ensure there is space for the customer’s name and contact information as well.

Use tables for organization. Place each element in its own row for readability. Keep the format simple and easy to follow, avoiding unnecessary details. Highlight the total amount due, taxes, and any discounts in bold to make them stand out.

Add a section for any special terms or return policies, if needed. Include space for a signature if it’s required for validation. Make sure all text is legible, using clear fonts and appropriate sizes.

Once the layout is complete, test the template by inputting mock data to verify that everything aligns correctly. Adjust margins or spacing if necessary to ensure a polished appearance when printed.

Include the following key details in a receipt to ensure clarity and proper record-keeping:

- Date and time of the transaction: Always specify the exact date and time the payment was made.

- Payment method: Indicate whether the payment was made by cash, credit card, debit card, check, or online transfer.

- Amount paid: Clearly state the total amount that was paid, including any taxes or additional fees.

- Transaction reference number: Provide a unique identifier for the transaction, especially for online or credit card payments.

- Merchant or business details: Include the name, address, and contact information of the business or individual receiving the payment.

- Itemized list of products or services: For clarity, provide a breakdown of what was purchased or the services rendered, including quantities and unit prices where applicable.

- Payment confirmation: Indicate that the payment has been successfully processed, including any relevant confirmation number or code.

Including these details not only ensures transparency but also provides a reliable reference for both the payer and the payee in case of disputes or future inquiries.

One common mistake in receipts is omitting or inaccurately listing the transaction date. Always ensure the date reflects the actual payment, as discrepancies can lead to confusion or disputes. Make sure the format is clear and easy to read, such as using day/month/year for international consistency.

Check for Accurate Payment Information

Double-check the payment method listed. Whether it’s cash, credit, or another form, this information must match what was actually used. Inaccuracies in payment methods can create discrepancies in financial records and delay processing.

Ensure Correct Amounts and Taxes

Errors in calculating totals or tax can cause problems for both you and the customer. Always verify the subtotal, any discounts, taxes, and the final amount. Use reliable software or tools to reduce the risk of manual mistakes.

Finally, always include all relevant details like the business name, contact information, and receipt number to ensure traceability. A well-structured receipt minimizes confusion and builds trust.

For a clear and organized template receipt of payment, focus on structuring the details with precision. Start by ensuring all the essential elements are included–payment amount, recipient details, payment method, and date. A clean layout will make this information easy to find for both the payer and the recipient.

Include Clear Payment Details

Each receipt should explicitly list the amount paid, the method of payment (e.g., credit card, bank transfer, cash), and the date of the transaction. This ensures transparency and can be easily referenced later. Keep the amount in both numerical and written format to avoid any confusion.

Specify Recipient and Payer Information

Include full names, contact information, and addresses of both parties involved. This provides clarity and helps in the case of any follow-up questions or disputes. You should also consider including a unique receipt number for better tracking and record-keeping.

Finally, a well-structured payment receipt should be concise yet thorough. Avoid clutter and ensure readability by using clear fonts and spacing. This makes it easier for all parties to understand the transaction details.