For businesses, creating a clear and professional receipt of payment is key to maintaining transparent transactions with clients. A payment receipt template with a stamp adds a layer of formality and verification, making the document legally recognized in many cases. A template ensures consistency and saves time by eliminating the need to recreate the same format for every transaction.

When designing or selecting a payment receipt template, focus on including all critical details: payer’s information, transaction date, payment amount, payment method, and a clear stamp that signifies approval or confirmation. The stamp should be easily distinguishable and placed in a way that doesn’t obscure other important details. This guarantees that both the payer and payee have a clear, verifiable record of the transaction.

Make sure your template is customizable to fit your business type, whether you’re running a retail shop, freelance service, or larger enterprise. Adjustments to fields like “Invoice Number” or “Transaction ID” will enhance clarity. Many software tools now offer pre-made templates, but customizing them ensures the final document aligns with your branding and legal needs.

Here are the corrected lines:

Make sure to clearly indicate the payment receipt number for easy reference. Add a timestamp for the payment date and time for clarity.

Receipt Number

- Include a unique, sequential number for each receipt.

- This will help track payments and prevent confusion.

Payment Date and Time

- Ensure the date and time are accurate to avoid disputes.

- Format the date as “DD/MM/YYYY” and include the exact time of the transaction.

Stamp placement should be on the bottom right corner of the receipt. It must not overlap with any critical payment details, ensuring readability.

- The stamp should be clearly visible and large enough for legibility.

- Use a simple design for the stamp, including the company name and date of payment.

- Template Receipt of Payment with Stamp

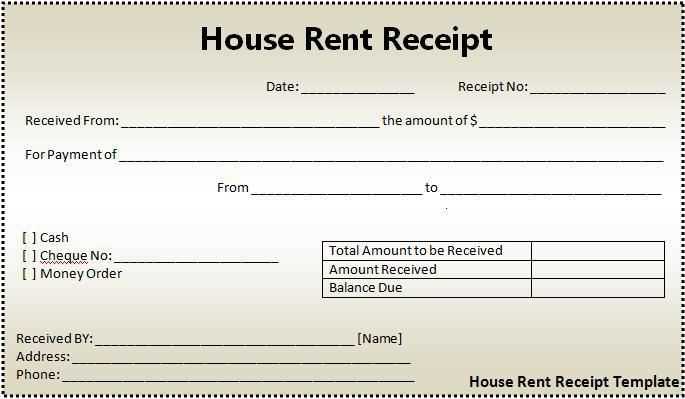

When creating a receipt of payment with a stamp, the document must include specific details to ensure it’s valid. Start by ensuring the document includes the following:

Key Components

- Receiver’s Name: Clearly state the name of the entity or individual receiving the payment.

- Amount Paid: Specify the exact amount received, including currency. This should match the payment details.

- Date of Payment: Include the date when the payment was made. This establishes the timing of the transaction.

- Purpose of Payment: Briefly describe the purpose, such as for goods or services.

- Payment Method: Specify how the payment was made (e.g., cash, bank transfer, check).

Stamp and Signature

The receipt must be stamped with the official seal of the business or organization. Ensure that the stamp is clearly visible and includes the entity’s name and registration number. Additionally, a signature from the person receiving the payment should be included to authenticate the document.

These details guarantee that the receipt is both professional and legally binding. By adhering to this template, you maintain clarity and protect both the payer and the payee in case of future disputes.

Pick a template that fits your business needs and legal requirements. Ensure that it includes all mandatory details like the date, amount, and description of the transaction. The design should be clear, with enough space for the stamp and other important information.

Consider the following points:

- Format: Choose between a digital or paper template based on your preferred method of storing and sending receipts.

- Customization: Ensure the template allows easy adjustments to fit your specific business, like adding a logo or adjusting layout for clarity.

- Compliance: Check if the template meets local tax and legal standards, including space for required stamps or signatures.

- Clarity: A simple, easy-to-read design reduces the chance of errors and confusion during audits or customer inquiries.

- Reusability: Select a template that you can use across different types of transactions, ensuring consistency across receipts.

Choosing the right template streamlines your operations and improves your professional image. Make sure it’s adaptable, functional, and legally compliant to ensure smooth business transactions.

Place the stamp clearly in the designated area on your receipt. Typically, this is on the top right corner or at the bottom center, but it depends on the template you are using. Ensure the stamp is fully visible, with no part of the design cut off.

Make sure the stamp is legible. Use a high-quality ink pad to ensure the text or logo on the stamp appears crisp. If the stamp is blurry, it could cause confusion or invalidate the receipt.

Position the stamp so it does not overlap with important details like payment amounts or dates. A clean placement helps maintain the professionalism of the document and ensures that all information is easily readable.

If your receipt includes multiple stamps (e.g., a tax stamp and a payment confirmation), keep them separated by a small gap to avoid clutter. The spacing should be consistent for a neat appearance.

Apply the stamp with even pressure to avoid smudging or fading. If you’re using a rubber stamp, ensure the rubber is clean to avoid unwanted marks.

Ensure the correct and consistent use of dates. Often, receipts show outdated or incorrect transaction dates. Always double-check the date format and confirm that it matches the actual payment date.

Missing or unclear payment details can create confusion. Be specific about the amount paid, currency, and payment method used. Avoid vague terms like “payment received” and include detailed breakdowns if applicable.

Incorrect or missing sender and receiver information can cause legal issues. Always include the full names, addresses, and contact details for both parties. This creates clarity and reduces the chance of disputes.

Avoid using ambiguous language in the receipt’s description. A clear description of the goods or services rendered ensures both parties understand the transaction. Use precise wording and avoid general terms.

Double-check for spelling and grammatical mistakes. Errors in the template diminish professionalism and can be misinterpreted. Proofreading is key before finalizing the receipt.

Omitting a unique identifier like a receipt number or transaction ID complicates tracking. Always generate a unique reference for each receipt to maintain clear records and simplify future inquiries.

Ensure the stamp or signature is properly positioned and legible. A poorly stamped or signed receipt may lack credibility. Use high-quality tools and place the stamp where it is clearly visible.

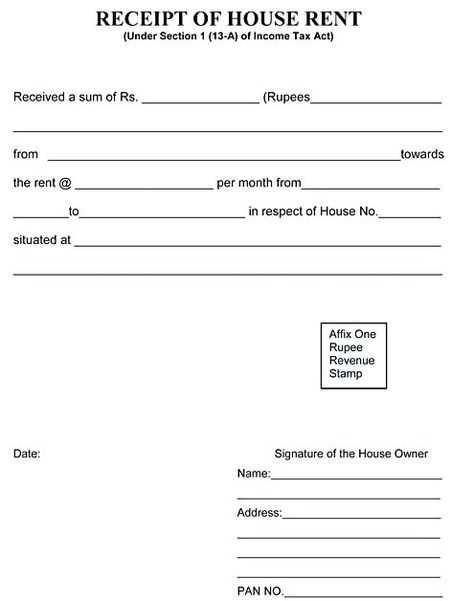

In many regions, receipts with stamps are required to meet specific legal standards to ensure validity. These requirements usually depend on the type of transaction, the involved parties, and local tax laws. It is important to ensure that receipts are correctly formatted and contain all necessary elements to avoid disputes or legal issues.

The stamp, often a company seal or a tax authority stamp, is an official mark that certifies the authenticity of a transaction. Typically, a receipt must include the following:

| Element | Description |

|---|---|

| Receipt Date | It must include the exact date of the transaction. |

| Amount Paid | The total sum of the transaction must be clearly stated. |

| Stamp | Often required by local regulations to validate the document. |

| Company Information | The business name, registration number, and contact details should be visible. |

| Signatures | Some regions may require signatures of the involved parties alongside the stamp. |

Make sure the stamp matches the format required by local regulations, whether it’s from the business, tax authority, or another entity. In some cases, a digital stamp might be acceptable, but verifying its legal standing is important. Regularly check with legal advisors to ensure your receipts comply with the current standards in your region.

Ensure seamless integration between payment templates and your accounting system by automating data transfer. Link payment receipt fields directly to your accounting software to eliminate manual entry. This reduces human error and streamlines record-keeping.

Start by mapping the required fields from the payment template, such as invoice number, amount, payment method, and date, to the corresponding fields in your accounting system. Most modern accounting platforms support API integrations that allow direct importation of payment data from templates.

Regularly update the integration settings to accommodate any changes in your accounting software or payment methods. This ensures that all transaction details are correctly captured and recorded in real time, reducing discrepancies and improving reporting accuracy.

Consider using cloud-based solutions for easier access and automatic synchronization between your payment templates and accounting system. This also provides remote access to financial records, allowing for quicker audits and adjustments when needed.

Test the integration process periodically. Small issues, like mismatched field names or incorrect data formatting, can cause problems. By checking the integration after updates, you maintain the smooth flow of data and prevent interruptions in your accounting processes.

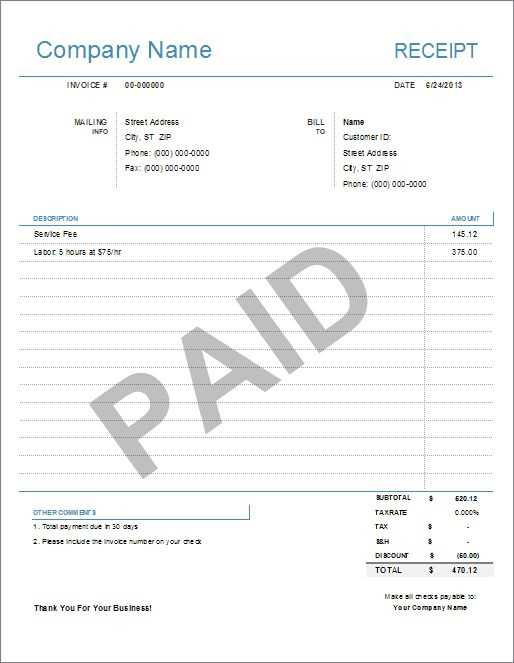

Adjusting a receipt template helps tailor it to your specific business requirements. Below are the key customization options to consider:

- Logo and Branding: Add your business logo, colors, and fonts to reflect your brand identity. This gives receipts a professional and personalized look.

- Itemized Breakdown: Depending on the nature of your products or services, you may need to include detailed descriptions, quantities, and prices for each item. This helps customers understand the charges more clearly.

- Payment Method: Customize the payment method field to accommodate your specific transactions, such as credit card, cash, or online payments. Add relevant icons or abbreviations to make it more readable.

- Discounts and Taxes: For businesses offering promotions or specific tax rates, clearly display any applied discounts and taxes. This ensures transparency and reduces confusion for your customers.

- Legal Information: Some businesses must include terms, disclaimers, or return policies on receipts. Adjust the layout to make room for this important information without crowding the template.

- Serial Numbers: For businesses dealing with large inventories or high-value items, including serial numbers can help track individual products or services. It’s a good practice for warranty and return management.

- Contact Information: Display your business’s contact information prominently, including a phone number, email, and physical address. This allows customers to easily get in touch with you if needed.

- Custom Footer: Add a call to action or a message at the bottom of the receipt, such as a thank you note or a reminder about future promotions. This helps enhance customer experience.

Customizing your receipt template not only improves your customer experience but also ensures your receipt meets all regulatory or business-specific needs.

Receipt of Payment Template with Stamp

Reduce redundancy and maintain clarity by streamlining payment receipt templates. Ensure the format is simple and direct. Include key details: payment amount, recipient, date, and transaction method. The stamp should appear in a prominent position, confirming the validity of the document.

| Detail | Example |

|---|---|

| Payment Amount | $500.00 |

| Recipient | John Doe |

| Date | February 6, 2025 |

| Transaction Method | Credit Card |

Make sure the receipt is legible, with the stamp clearly marking it as official. Avoid over-complicating the design, as a clean, professional appearance is key. Always check that all required details are present before issuing the receipt.