To create a clear and organized payment receipt, focus on including key details such as the payer’s name, amount paid, date of transaction, and method of payment. This will ensure that both the payer and the recipient have a solid record of the transaction.

Start with clear identification: Include your business name or logo, along with the contact details for easy reference. This establishes the document’s legitimacy and helps the recipient easily connect it to your company.

Specify payment details: Outline the exact amount received, the date of payment, and the payment method (e.g., cash, credit card, bank transfer). This transparency reduces confusion and creates a reliable trail for both parties.

Include any applicable notes: If there are specific terms or conditions attached to the payment, like partial payments or deposits, be sure to highlight them. This avoids any future misunderstandings.

By sticking to these points, your receipt will not only serve as a proof of payment but also as a professional document that reflects your company’s attention to detail and commitment to clarity.

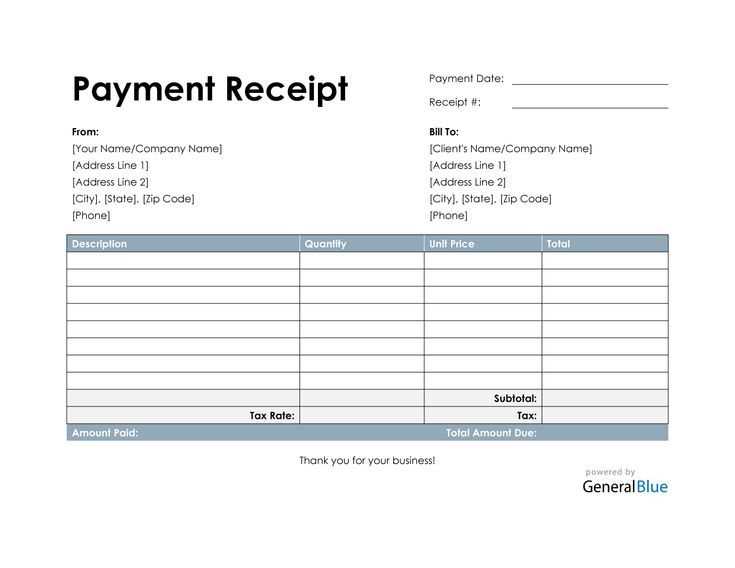

Template Receipt of Payments

Use a simple and clear template for payment receipts to ensure transparency and accuracy. A well-designed receipt provides the necessary details about the transaction, which can be easily referenced later. Here’s a straightforward template structure for a payment receipt:

Receipt Header

Include the company or individual’s name at the top, along with their contact information. This helps the recipient identify the source of the transaction. Adding a unique receipt number and the date of the payment ensures proper tracking.

Transaction Details

List the specifics of the payment. Include the amount paid, the method of payment (e.g., credit card, bank transfer), and a brief description of the goods or services provided. Ensure to include any taxes or additional charges if applicable. A breakdown of costs helps both parties verify the transaction’s accuracy.

Finally, ensure there is a section for the payer’s information, such as name and contact details, along with space for both parties to sign, confirming the payment was received.

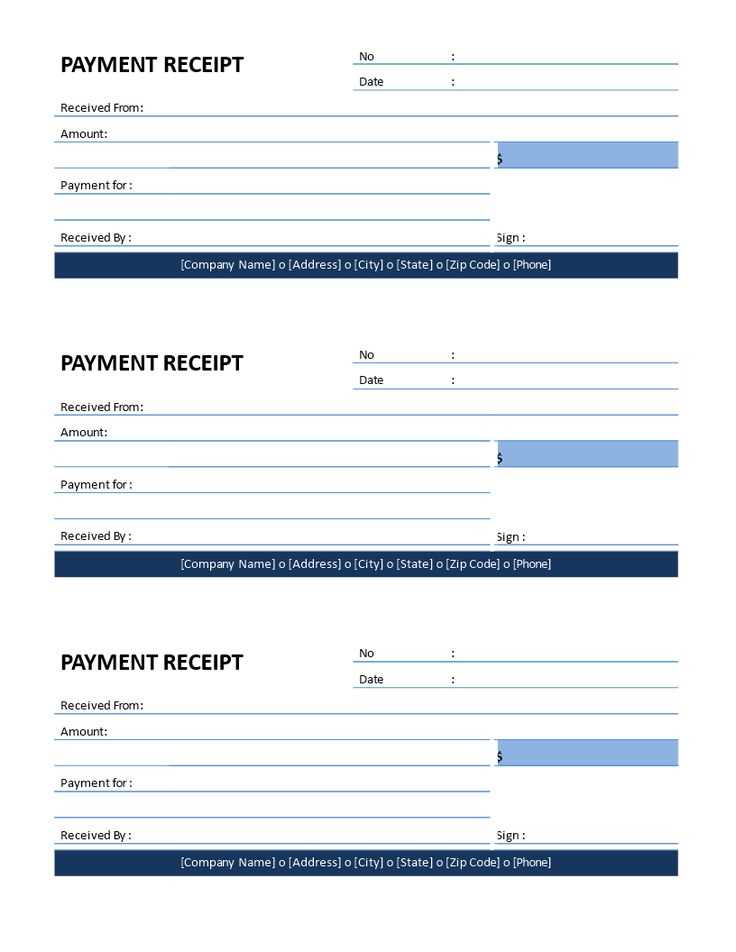

How to Design a Simple Payment Receipt Template

Begin by choosing a clear, readable font like Arial or Times New Roman. Set the font size to 12–14 pt for readability. Create a structured layout with clearly defined sections for key details like the payment amount, date, and payment method.

Key Information to Include

At the top, include the business name, logo, and contact information. Below this, display the receipt number for easy reference. Include the date and time of the transaction. Under the payment section, list the payment amount, any taxes, and total payment. Add a line or space for any payment method used, whether it’s cash, credit card, or online transfer. If applicable, include a reference number or invoice number for further clarity.

Final Touches

Finish the receipt with a thank you note and your terms of service or return policy. Leave space for signatures if needed. Make sure the layout is clean and uncluttered to help the customer easily read and understand all the details.

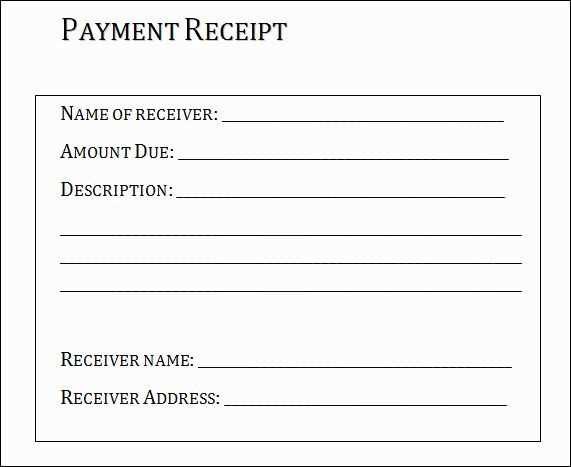

Customizing Payment Receipts for Different Transaction Types

Tailor payment receipts for different transaction types to ensure clarity and meet specific business needs. Each transaction type may require unique details on the receipt, reflecting the nature of the payment and the services or products involved.

- Product Purchase: Include itemized lists, product descriptions, and quantities. Specify the price for each item and calculate applicable taxes and discounts.

- Service Payment: Mention the service provided, duration, and hourly rate if applicable. If the payment is for a subscription, include renewal dates and terms of service.

- Refunds: Show original transaction details alongside the refunded amount. Indicate if any restocking fees or additional charges apply.

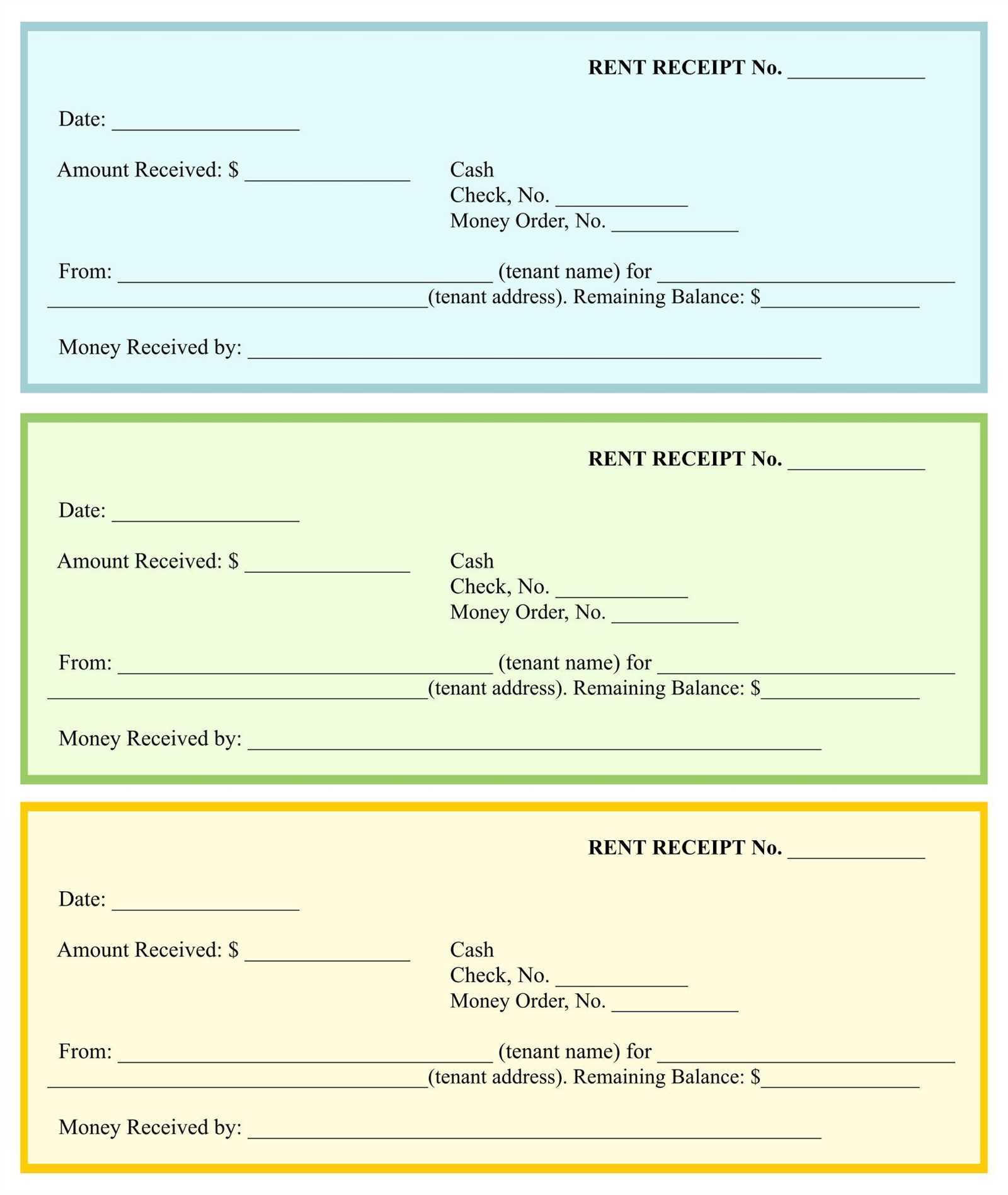

- Deposits: List the amount deposited, any associated agreement terms, and the date of payment. Indicate whether the deposit is refundable or non-refundable.

- Membership Fees: Provide the membership type, renewal date, and any special conditions related to the membership.

Customize the layout and information presented based on these types. Add specific payment methods used, like credit card, PayPal, or bank transfer, to give recipients a clear record of how the transaction was processed. Additionally, highlight any applicable taxes or processing fees for transparency.

For digital transactions, include any relevant online order numbers or digital receipt codes to facilitate easy reference in the future. Adjust your receipts depending on the payment platform, as different systems may generate receipts with varying levels of detail.

By aligning the receipt’s content with the transaction type, both your business and customers will have a clear understanding of the payment terms and details involved.

Automating the Payment Receipt Process with Software Tools

Using software tools to automate payment receipt processes reduces human error and saves time. Integrating payment gateways, accounting platforms, and customer relationship management (CRM) systems streamlines tracking, confirmation, and reporting. This eliminates the need for manual data entry and ensures accurate recording of every transaction.

Choose the Right Software Integration

Look for tools that offer seamless integration with your existing accounting software, such as QuickBooks or Xero. Connecting payment processors like Stripe, PayPal, or Square directly to your system ensures that receipts are generated automatically as payments are processed. These integrations sync transaction details in real-time, minimizing manual input.

Utilize Cloud-Based Solutions

Cloud-based payment receipt software ensures that records are always up to date and accessible from anywhere. Whether you’re using a basic tool like Google Sheets or a specialized platform like Zoho Invoice, cloud solutions enable fast access and secure storage of all payment data. This way, receipts are automatically issued to clients, reducing the need for paper records and manual follow-up.