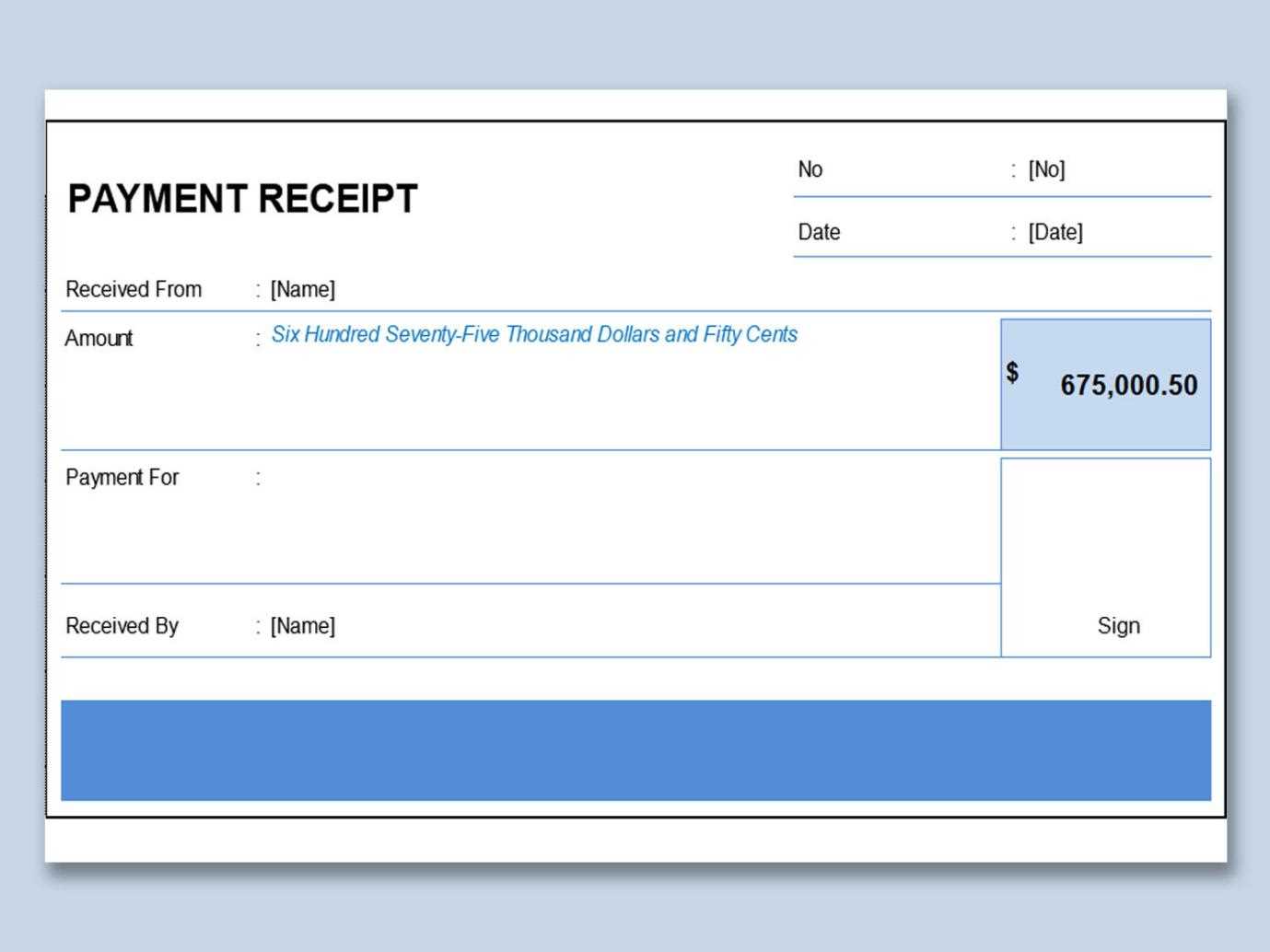

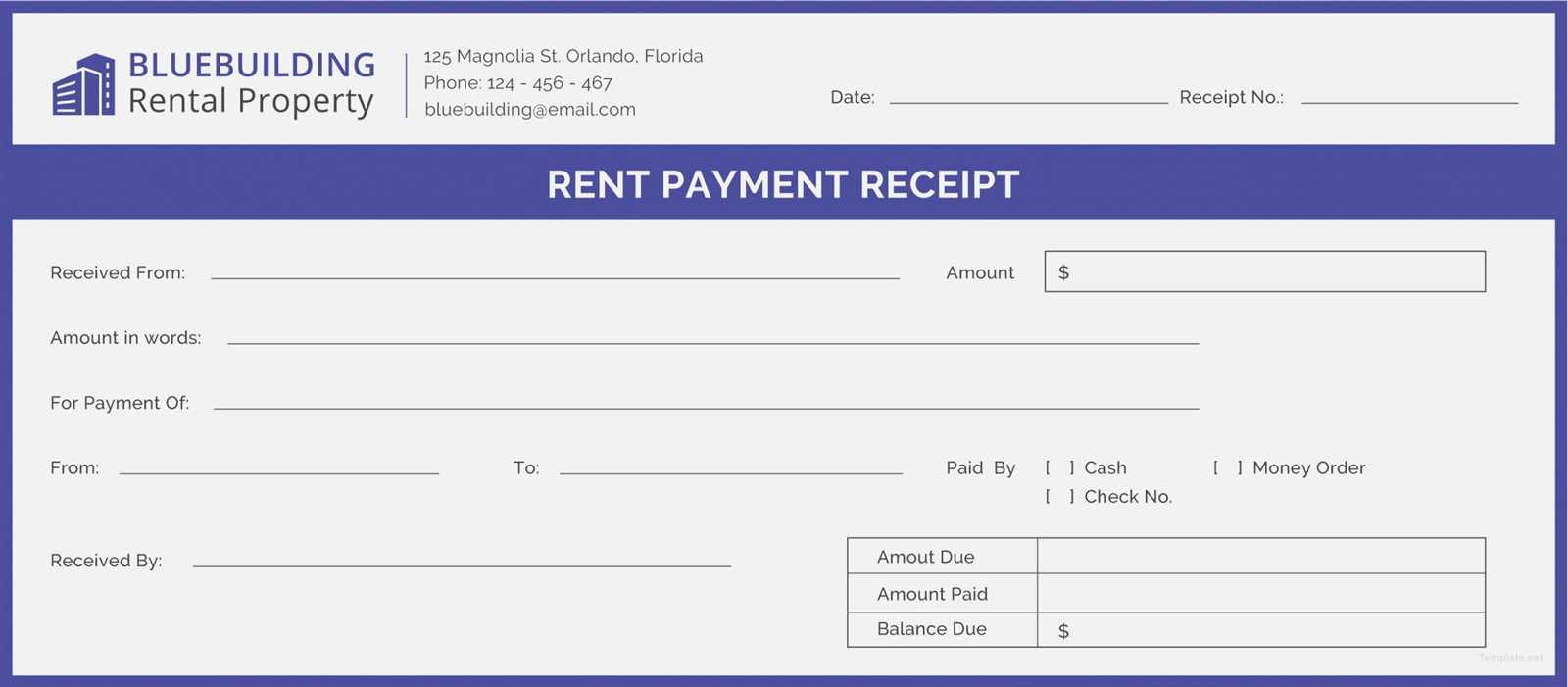

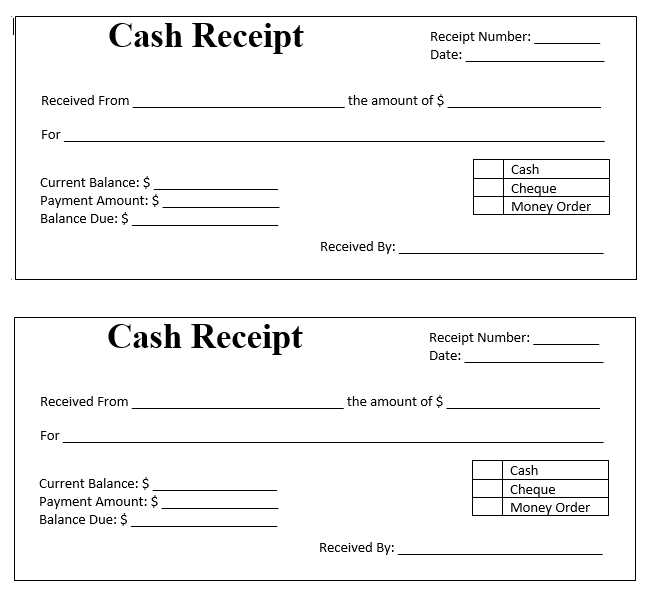

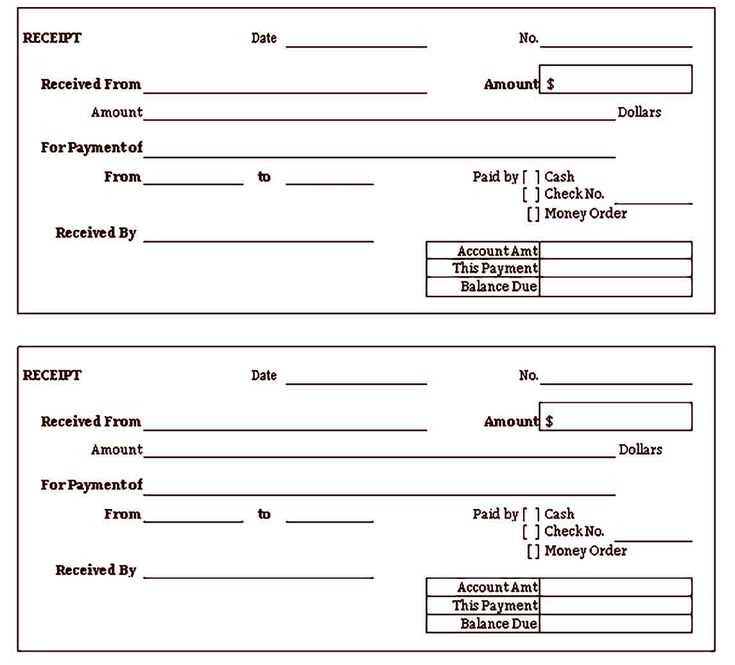

Using a well-structured payment receipt template simplifies the documentation process for transactions. These templates help ensure that all necessary information is included, such as the date, payment amount, and payer details. They are particularly useful for businesses that handle a high volume of payments or wish to maintain a consistent approach in their documentation.

Choosing the right template saves time and reduces the likelihood of errors. Opt for templates that clearly outline payment terms, including method, reference number, and any applicable taxes. A clear breakdown of the payment can also enhance transparency for both the payer and the recipient.

If you manage a small business or work independently, having a template ready can streamline daily operations. Customizable templates allow you to adjust for different payment methods or client needs, offering flexibility while maintaining professionalism. This consistency builds trust with clients and helps keep your records in order.

Here’s the corrected version with minimal repetition:

Focus on streamlining the structure of your payment receipt templates. Ensure the language is clear and concise while covering all necessary details, like payment amount, date, and method. Use consistent formatting throughout to create a professional look. For instance, replace long phrases with simple, direct terms. Avoid redundancy by keeping each line unique and purposeful. Limit unnecessary filler words and ensure that each section adds value. This approach not only improves readability but also enhances the efficiency of the document.

For better usability, organize your templates with clear headings and categories. This will help users quickly find relevant information. Always include space for additional notes or references, which can be crucial for record-keeping. A clean design with well-aligned text will prevent confusion and provide a smooth experience for both the sender and receiver of the payment.

Lastly, make sure to test your templates with different payment scenarios to verify their adaptability. This ensures the format can handle variations like partial payments or refunds without cluttering the layout.

Templates Receipts Payment

How to Create a Payment Receipt Template for Business Purposes

Key Elements to Include in a Payment Receipt Format

Best Practices for Customizing Your Payment Receipt Design

Common Pitfalls to Avoid When Designing Payment Receipts

How to Automate the Generation of Payment Receipts Using Templates

Legal Requirements for Payment Documents in Various Jurisdictions

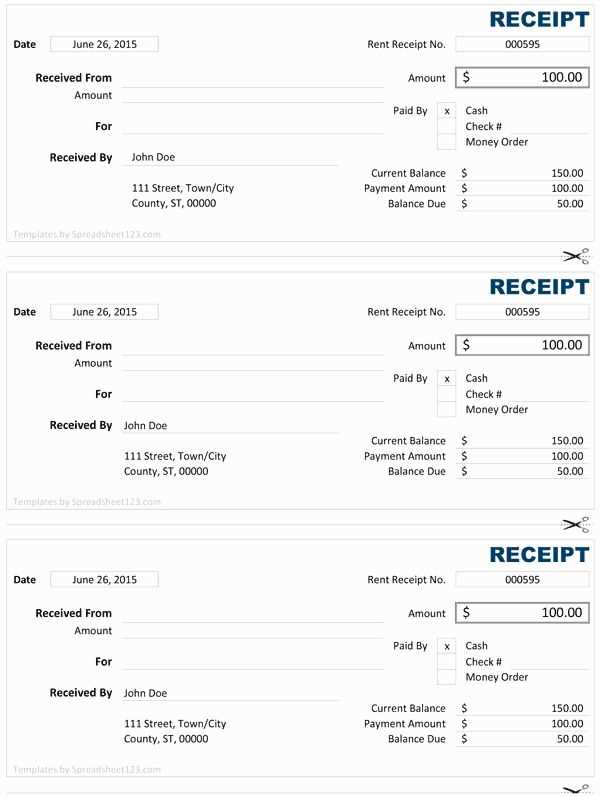

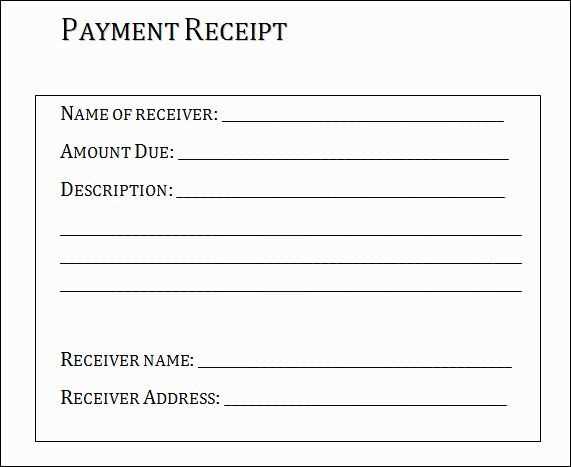

To create a payment receipt template for business purposes, prioritize clarity and accuracy. The receipt should include the following elements: the business name, address, and contact details; the date of payment; the recipient’s name; the payment method used; and a detailed description of the goods or services purchased. Clearly state the total amount paid and the balance due, if any, to avoid confusion.

Key Elements to Include in a Payment Receipt Format

A well-structured payment receipt should contain:

– A unique receipt number for tracking

– Detailed itemized charges or services

– Payment amount (including tax, if applicable)

– Terms of payment (e.g., “paid in full” or “partial payment”)

– Authorized signature or approval from the business, if relevant.

These elements ensure the receipt is both legally compliant and functional for record-keeping.

Best Practices for Customizing Your Payment Receipt Design

When designing your payment receipt, make sure the layout is user-friendly. Use professional fonts, keep the format simple, and avoid overcrowding the document. Incorporate your business logo and color scheme to maintain brand consistency. Make the payment details easy to read by highlighting key sections such as the amount paid and date. Make sure the document is compatible with both digital and printed formats.

Automating the generation of payment receipts is a great way to save time. You can set up a system that generates receipts after a payment is processed through your website or point of sale (POS) system. Many invoicing software tools offer automated templates, reducing manual errors and streamlining your workflow.

Be mindful of the legal requirements for payment documents in various jurisdictions. Different regions may have specific guidelines regarding tax rates, required information, and retention periods for receipts. Ensure your receipt complies with local laws to avoid potential fines or disputes.