For any tuition payment, obtaining a tax receipt is key to ensuring you can claim any applicable deductions. This document acts as proof of payment, making it easier to document your educational expenses. Use a clear and precise template to capture the necessary details, ensuring accuracy and smooth processing of your tax returns.

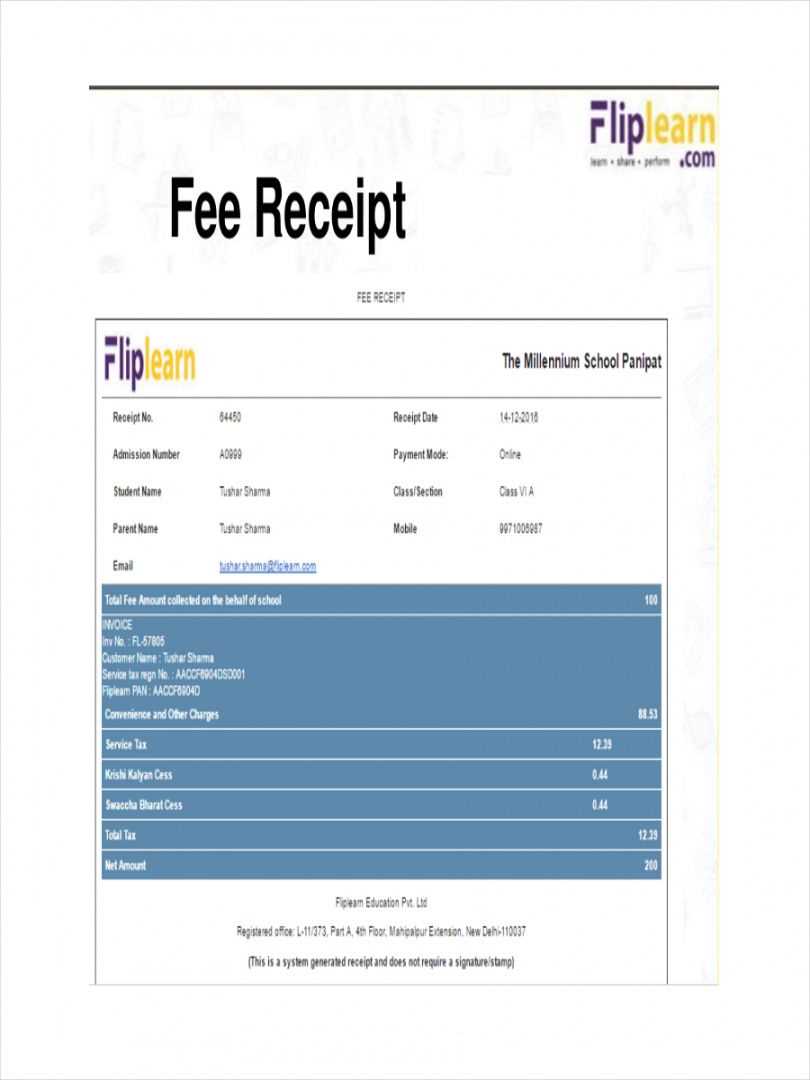

A well-designed receipt should include essential data such as the student’s name, institution name, amount paid, payment method, and the date of transaction. It is also helpful to mention the specific term or academic year for which the payment is made. These details are often required by tax authorities when submitting claims or verifying educational expenses.

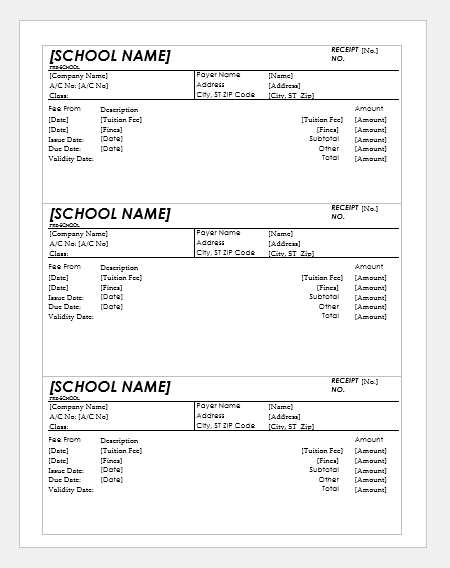

Consider using a template that allows you to fill in this information easily. Ensure the document is clear and legible, highlighting key sections like the total payment, institution’s contact information, and any applicable reference numbers. This will save you time and prevent confusion when you need the receipt for your tax filing.

Tuition Payment Tax Receipt Template Guide

A clear and precise tuition payment tax receipt helps students and parents claim deductions or verify payments. Follow these steps to create a template that meets necessary requirements:

- Header Information: Include the name and contact details of the educational institution, such as the school or university name, address, and phone number.

- Student Information: Provide the student’s name, enrollment details, and identification number or account number for easy tracking.

- Payment Details: Clearly state the date of the payment, the total amount paid, and the payment method (credit card, check, etc.).

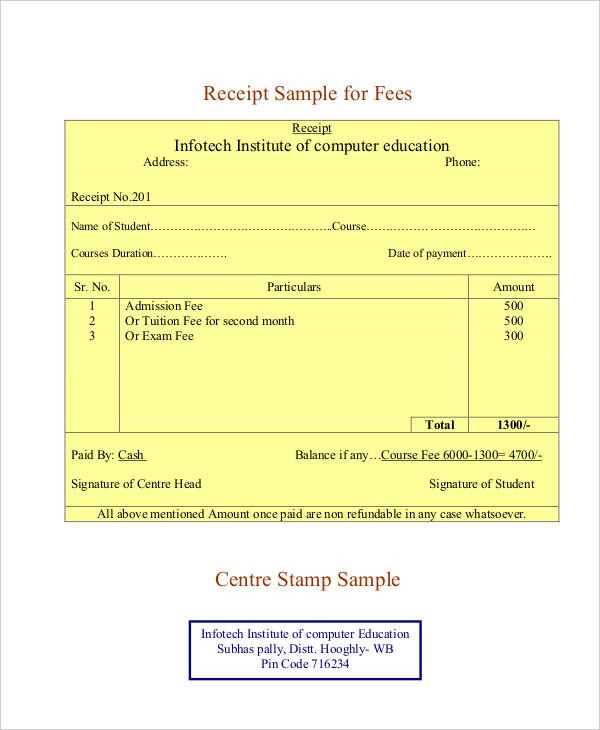

- Tuition Breakdown: Specify the amount allocated to tuition, fees, and other charges if applicable.

- Tax Identification Number (TIN): Include the institution’s TIN for tax purposes to make the receipt valid for deductions.

- Signature: Provide a space for the institution’s authorized representative to sign, verifying the accuracy of the receipt.

- Additional Information: Optionally, include any other relevant details, such as scholarship amounts or discounts applied to the tuition payment.

This format ensures that all necessary information is easily accessible, allowing for a smooth tax filing process for both students and educational institutions.

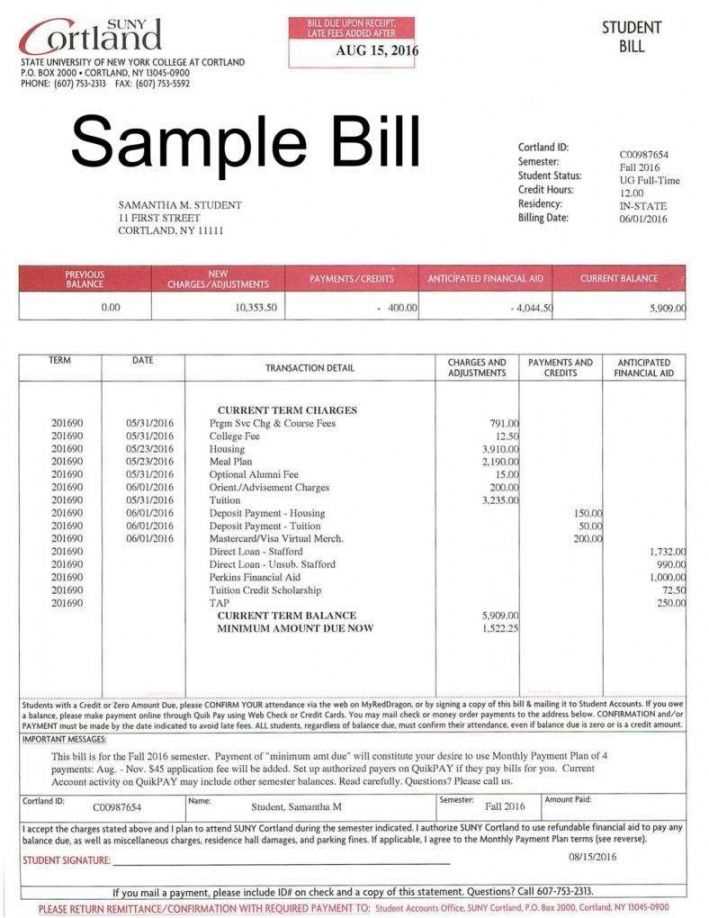

How to Format Tuition Payment Information

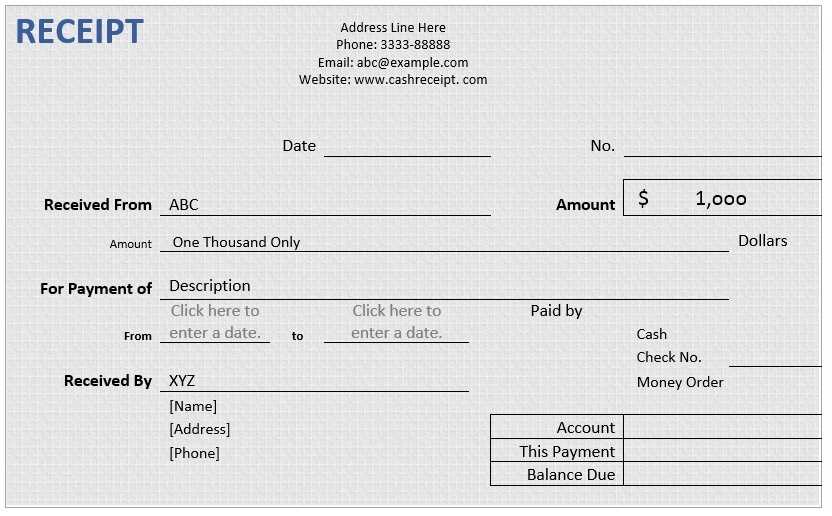

Include the student’s name and the academic year for which the payment applies. Clearly state the tuition amount paid and any additional fees such as activity, technology, or lab fees. If multiple payments were made, list each payment with corresponding dates and amounts, ensuring clarity in the payment history.

Payment Method Details

Specify the payment method used, whether by check, credit card, or bank transfer. For check payments, include the check number and the bank’s name. If applicable, include any reference numbers or transaction IDs for credit card or online payments to ensure traceability.

Institution Information

Provide the institution’s full name, address, and contact details. If available, include the department or office that processed the payment. Ensure the receipt includes the official logo or seal for authenticity, if required by your institution.

Incorporating Necessary Tax Details

Include the taxpayer’s full name, address, and Social Security Number (SSN) or Employer Identification Number (EIN) on the receipt. This ensures accuracy when filing taxes and prevents any potential delays during the tax season. The payment date should be clearly stated, as it determines the fiscal year of the payment.

Provide a breakdown of the tuition amount paid, specifying the exact figures for tuition, fees, and any other charges. This clarity helps taxpayers claim deductions accurately. If the institution offers financial aid, include details about any grants or scholarships applied to reduce the total payment amount.

Incorporate the institution’s Tax Identification Number (TIN) or Employer Identification Number (EIN). This is required for verifying the tax-exempt status of the institution and for ensuring that the payment is linked to the correct entity in tax records.

Include a statement indicating whether the payment is for qualified education expenses, as defined by the IRS. This detail helps the taxpayer determine eligibility for tax credits like the American Opportunity Credit or Lifetime Learning Credit.

Clearly outline the total payment amount, breaking down any eligible expenses versus non-eligible ones, such as course materials or activities not related to education. This transparency avoids confusion and ensures that the recipient can accurately file their taxes.

Steps to Customize the Template for Specific Use

Modify the template to match the specific details of your institution or organization. Start by replacing placeholder information, such as institution name, address, and contact details, with accurate data. This step ensures all relevant details are clearly communicated.

Adjust Payment Information Section

Customize the payment breakdown section by specifying tuition fees, discounts, or additional charges. Update payment method options to reflect the available payment channels, such as credit cards, bank transfers, or online platforms. Clarify any payment deadlines or due dates for transparency.

Include Specific Tax Information

Ensure that tax information is accurate. If there are specific deductions or exemptions, add them to the receipt. Customize fields for tax rates or applicable rules depending on the region or type of educational program.