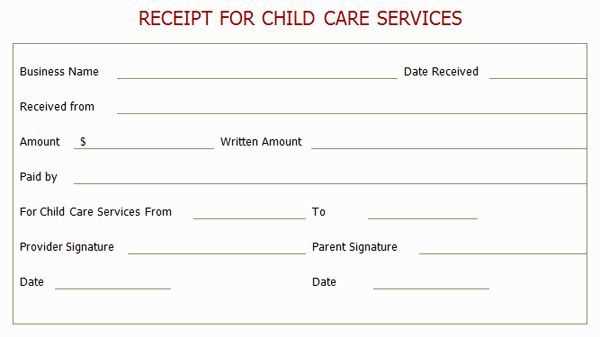

If you’re looking for a straightforward way to keep track of daycare expenses, a daycare receipt template in PDF format is the perfect solution. These templates allow you to easily document payments made for daycare services, providing clear and organized records for both parents and providers. With a template, there’s no need to reinvent the wheel each time you need to issue a receipt.

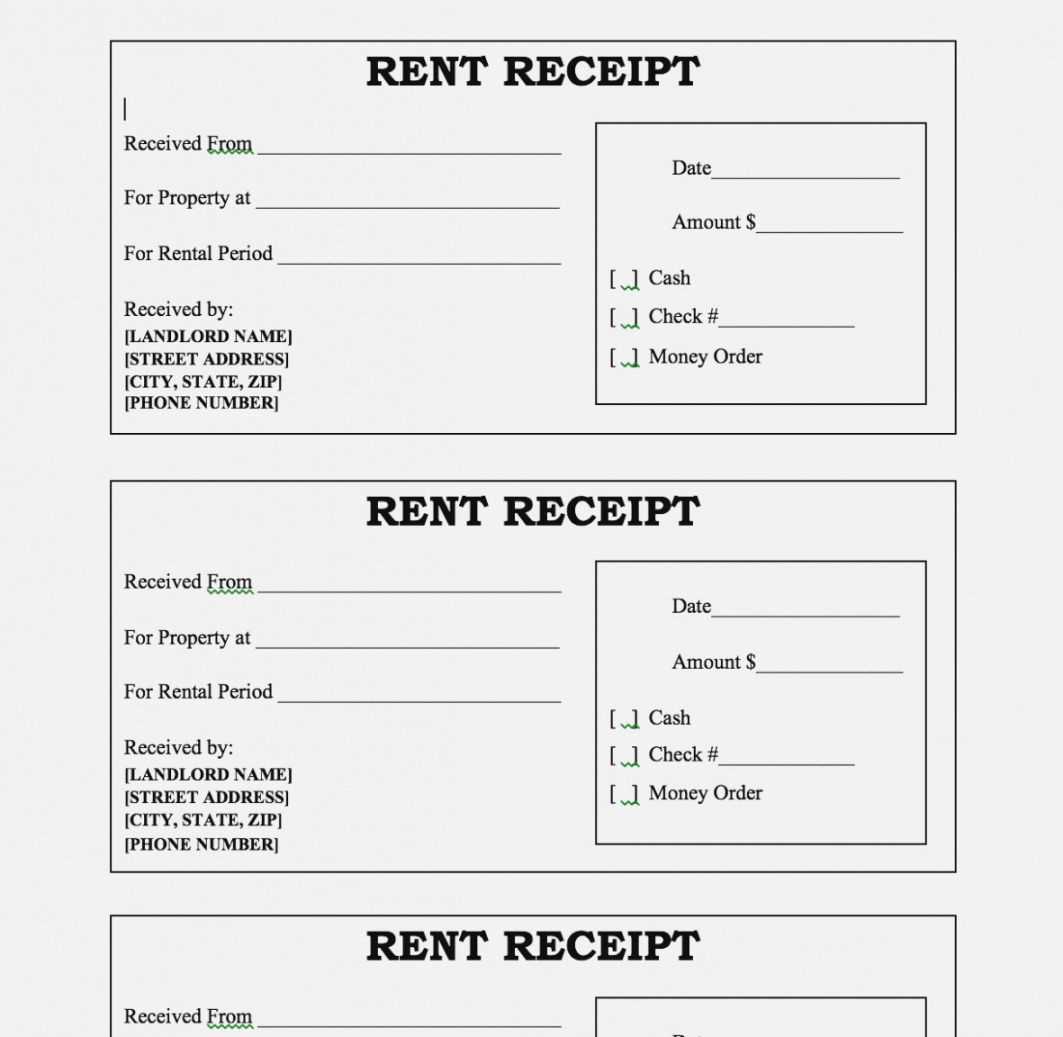

Customize the template with your daycare’s name, address, and contact information. Include details such as the date of payment, amount paid, and the child’s name. This ensures that each receipt is unique and matches the specifics of the transaction. Many templates also have space for additional notes, such as payment method or service descriptions, making them more versatile.

Having a well-structured receipt helps maintain transparency and can simplify tax reporting for both daycare providers and parents. You can download the PDF version and fill it out digitally or print it for physical records. It’s a time-saving tool that reduces administrative work and ensures that all information is clearly presented and easy to track over time.

Here is the revised version with minimized word repetition:

To create an efficient daycare receipt template, ensure the following key components are included:

- Receipt title (e.g., “Daycare Service Receipt”)

- Date of service

- Provider’s contact details

- Parent’s name and contact information

- Breakdown of services provided (e.g., hours, dates, or specific care types)

- Total payment amount

- Payment method used (e.g., credit card, cash, check)

- Receipt number for reference

How to Format the Template

Organize your information clearly. Place the daycare’s details at the top, followed by the parent’s information, ensuring readability. The service details should be presented in a list format, and payment breakdowns can be shown in a simple table. For an easy-to-fill form, use placeholders where needed.

Tips for Accuracy

Verify all details before issuing the receipt, especially dates, payment amounts, and method of payment. This reduces errors and helps maintain transparency. If using a digital template, consider including automated fields for faster processing.

- Daycare Receipt Template PDF

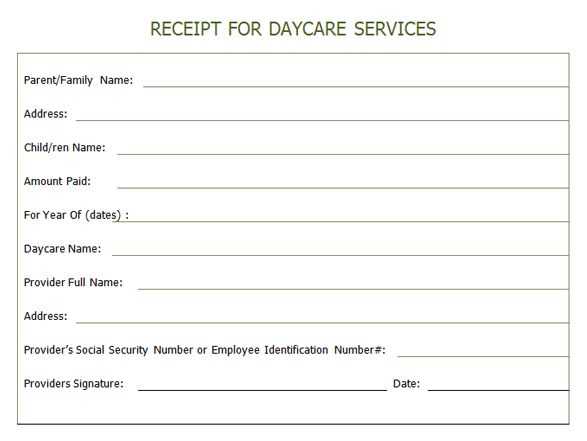

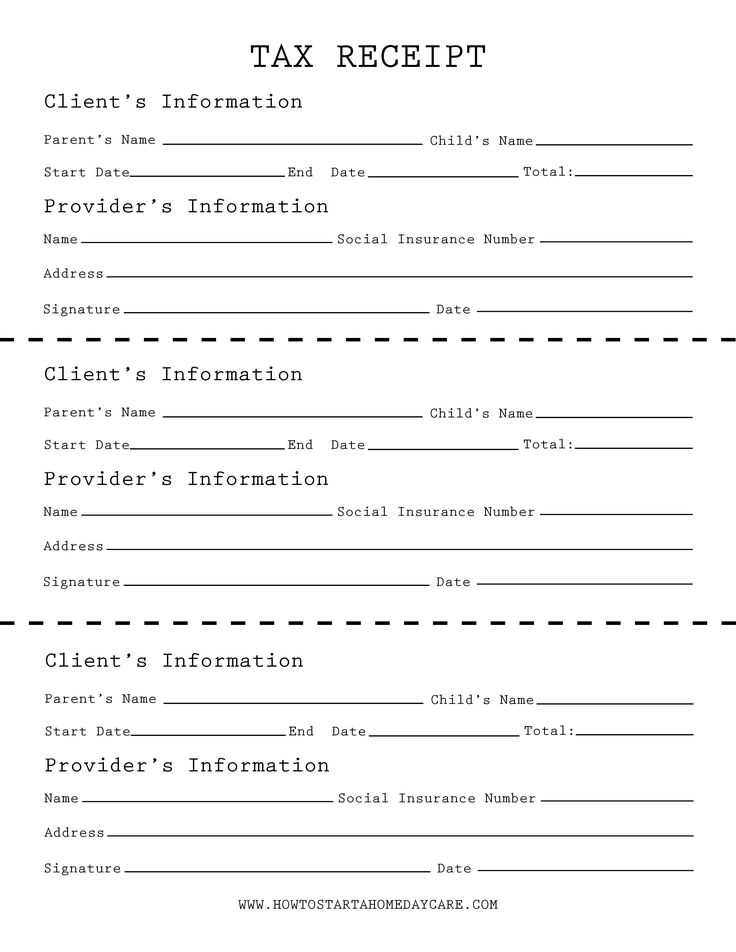

Creating a daycare receipt template in PDF format simplifies financial record-keeping for both parents and daycare providers. Start by including the necessary details such as the daycare provider’s name, address, and contact information. Clearly state the dates of service, the child’s name, and the total amount paid for the services rendered.

To keep things organized, list each service separately along with its cost. This helps provide transparency in case of any inquiries. The receipt should also include the payment method (cash, check, or credit card) and a unique receipt number for easy reference.

A well-structured receipt ensures proper tracking for tax purposes. When designing your PDF template, make sure the font is legible, and the layout is clean. You can use online tools or software to create and customize the template, ensuring it meets your specific needs. Once the template is ready, you can save it in PDF format and use it for each transaction.

Having a ready-to-use daycare receipt template reduces administrative tasks and ensures both the provider and the client have accurate documentation of their payments.

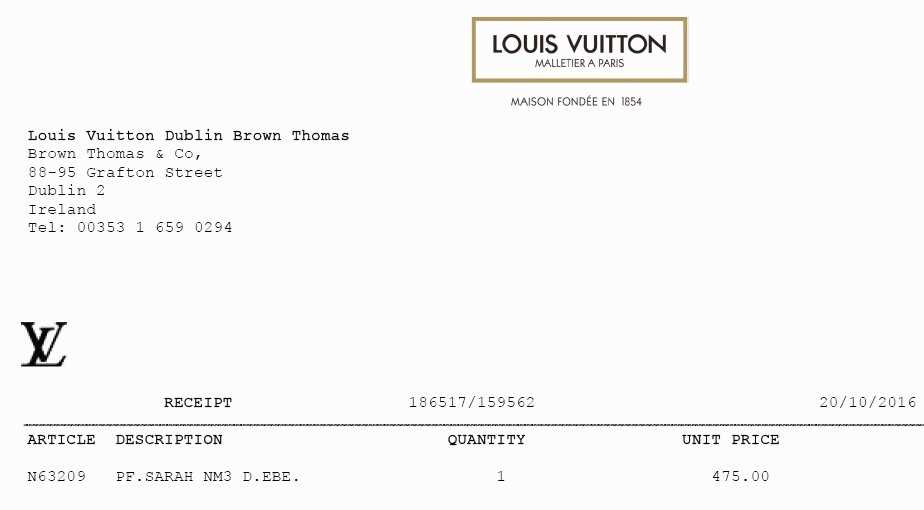

Tailoring your receipt template to reflect your business can help create a professional image and improve customer experience. Start with the basics, like your business name, address, and contact details. Ensure these are clearly visible at the top of the receipt.

1. Add Your Business Branding

- Incorporate your logo in the header area for brand recognition.

- Choose colors that match your business theme and make the text legible.

- Include your slogan or tagline if relevant, making the receipt feel more personal.

2. Organize the Information for Clarity

- List the purchased services or items with a clear description and quantity.

- Make sure the pricing is easy to understand, breaking down taxes and discounts separately.

- Ensure the total amount is bolded or highlighted to draw attention.

By adjusting these details, your receipt becomes more than just a proof of purchase – it reflects your brand’s identity and builds a more consistent customer experience.

For clarity and accuracy, include these key details in a daycare invoice:

- Provider’s Name and Contact Information: List your daycare business name, address, phone number, and email address. This ensures parents know who to contact for any questions.

- Parent’s Information: Include the name and contact details of the parent or guardian being invoiced. This helps avoid confusion, especially if multiple children are enrolled.

- Invoice Number: Assign a unique invoice number for easy tracking and future reference.

- Dates of Service: Clearly state the dates for which the daycare services are being billed. This includes both start and end dates for the care period.

- Detailed Description of Services: List all services provided, such as daycare hours, meals, special activities, or any additional services like transportation or after-hours care. Specify the charge for each service.

- Hourly or Daily Rate: Include the rate charged for daycare services, whether it’s per hour, day, or week. This helps parents understand the breakdown of the costs.

- Payment Due Date: Set a clear due date for the payment, providing ample time for parents to process the payment.

- Late Payment Fees: If applicable, outline any penalties for late payments, along with the specific fee structure.

- Total Amount Due: List the total amount due, ensuring all services, taxes, and fees are included in this final sum.

- Payment Methods Accepted: Specify the acceptable payment methods (e.g., check, credit card, online payment). This makes it easier for parents to pay on time.

Including these elements helps avoid misunderstandings and ensures smooth communication between you and the parents.

Include the name and address of the daycare provider on each receipt. This helps verify the legitimacy of the service, ensuring that it meets IRS standards for tax deductions. Additionally, make sure to list the service dates, including the start and end of care for each session. Accurate dates ensure that the deduction covers only the appropriate period.

Clearly state the total amount paid for services rendered. If any discounts or partial payments were applied, break down the amounts to maintain transparency. The IRS requires a precise breakdown to avoid any confusion during an audit.

Indicate the nature of the services provided. Whether it’s hourly care, part-time, or full-time daycare, the receipt should specify the type of care. This helps establish the cost structure and avoids any ambiguity in tax filings.

Be sure to include the tax identification number (TIN) or employer identification number (EIN) of the daycare provider. This is a necessary detail for verification purposes, especially if you plan to claim any tax credits or deductions related to childcare expenses.

Provide a unique transaction number for each receipt. This adds a layer of accountability and helps both the provider and you track payments in case of discrepancies or audits. Keep all receipts organized and stored securely for easy access when tax time arrives.

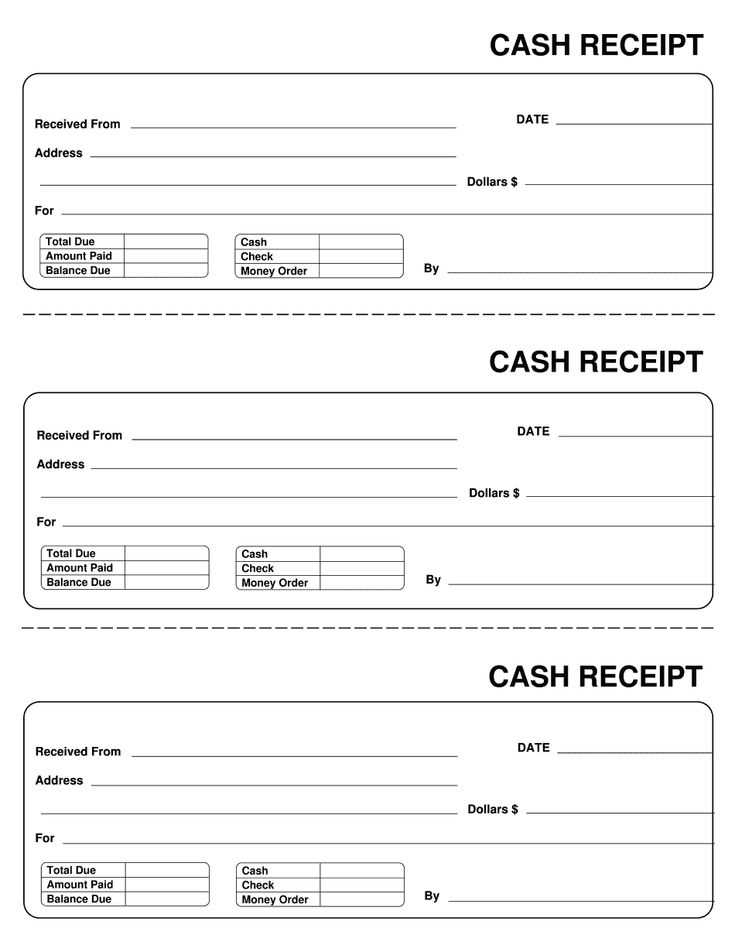

First, choose the right receipt template format. You can create it in a word processor, spreadsheet software, or a specialized receipt maker. Customize the fields like date, amount, and client information to match your needs.

Once your template is complete, save it in an editable format, such as DOCX or XLSX, if you plan on making changes later. After that, use an online PDF converter or software like Microsoft Word or Google Docs to export it as a PDF.

For Microsoft Word, go to “File,” click “Save As,” and select PDF from the list of formats. For Google Docs, click “File,” select “Download,” and choose PDF Document (.pdf). The PDF version will preserve the formatting, ensuring that your receipt looks the same on any device.

If you’re using an online converter, upload your document and follow the simple steps to convert it. Once converted, download the PDF to your computer. Double-check the file to make sure everything appears correctly.

Finally, save the PDF on your computer or cloud storage for easy access. You can also email it directly to the recipient, or print a hard copy if needed.

Common Mistakes to Avoid When Creating Invoices

Accurate itemization is a must. Avoid vague descriptions or combining multiple services into one line. This may confuse your clients and delay payments. Ensure each product or service has a clear, separate entry.

Double-check the totals. Miscalculations, even small ones, can lead to frustration. Always verify that the sum matches the listed items and any applicable taxes.

Don’t forget due dates. Clearly state the payment deadline to prevent misunderstandings. A missing or unclear due date can lead to delayed payments and unnecessary follow-ups.

Keep your terms simple. Complicated or hidden payment terms can cause confusion. Specify payment methods, late fees, and any other important details in an easy-to-read format.

Missing contact information can delay communication. Always include your business name, address, phone number, and email. This ensures clients can reach out quickly in case of issues.

Here’s a table outlining common invoice mistakes and how to avoid them:

| Mistake | Solution |

|---|---|

| Vague descriptions | Provide specific details for each product or service. |

| Incorrect totals | Double-check calculations and verify totals with applicable taxes. |

| Missing due date | Clearly state the payment deadline on the invoice. |

| Complex terms | Keep payment terms straightforward and easy to understand. |

| Lack of contact info | Ensure your business contact information is clearly listed. |

Distribute receipts through secure channels. For electronic receipts, always use encrypted email services or secure portals. Avoid sending receipts via standard email, which is vulnerable to interception. For physical receipts, ensure they are handed directly to the recipient in a secure manner, such as by using a sealed envelope or requiring a signature upon receipt.

Store receipts in a protected location. For digital receipts, use encrypted cloud storage or a password-protected file system. Maintain backup copies in case of system failure, but keep these backups in a secure environment, separate from primary storage. Physical receipts should be stored in a locked cabinet or drawer, with access limited to authorized personnel only. Regularly audit and update access controls to maintain security.

Implement a retention policy for receipts. Clearly define how long receipts should be kept based on legal and tax requirements, and ensure that they are securely disposed of when no longer needed. Shred physical receipts and securely delete digital files to prevent unauthorized access.

| Action | Recommendation |

|---|---|

| Digital Receipt Distribution | Use encrypted emails or secure online portals |

| Physical Receipt Distribution | Use sealed envelopes or require signature confirmation |

| Receipt Storage | Store in encrypted cloud storage or a locked physical location |

| Receipt Disposal | Shred physical receipts and securely delete digital files |

To create a daycare receipt template in PDF format, use a clear structure that includes key details for both the service provider and the parent. Include the child’s name, the dates of attendance, and the total fees charged. This format helps avoid confusion and provides a straightforward record for both parties.

Key Information to Include

Ensure the receipt includes the following details: daycare provider’s name, address, and contact information. Include the child’s full name and the specific dates of service. Also, specify the hours of attendance and itemize the fees for transparency. Finally, add any relevant tax information, especially if applicable in your jurisdiction.

Making the Template Accessible

Convert the template into a PDF to ensure it is easy to share and store. Choose a simple layout with clearly defined sections. Provide space for a signature from the daycare provider to validate the receipt. Keep the font legible and the format uniform for a professional appearance.