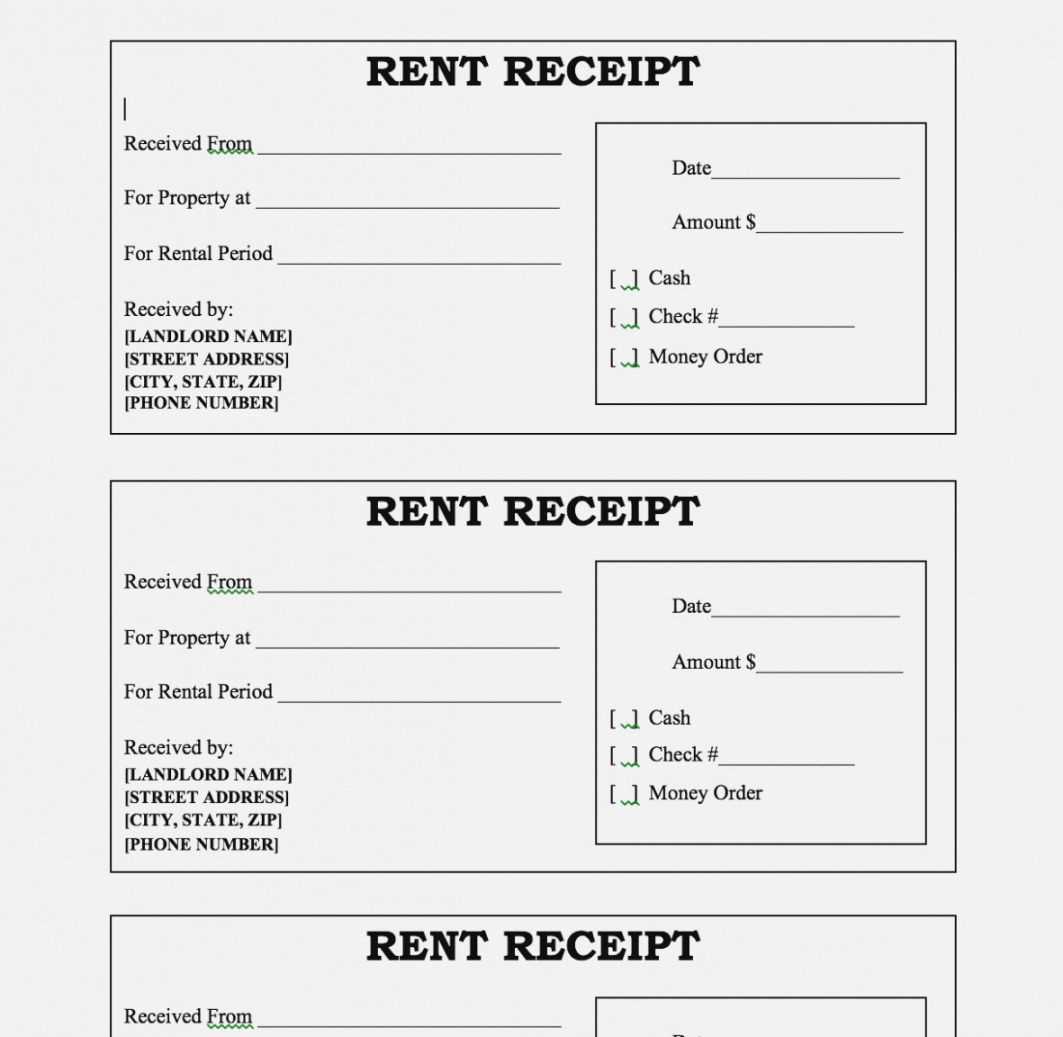

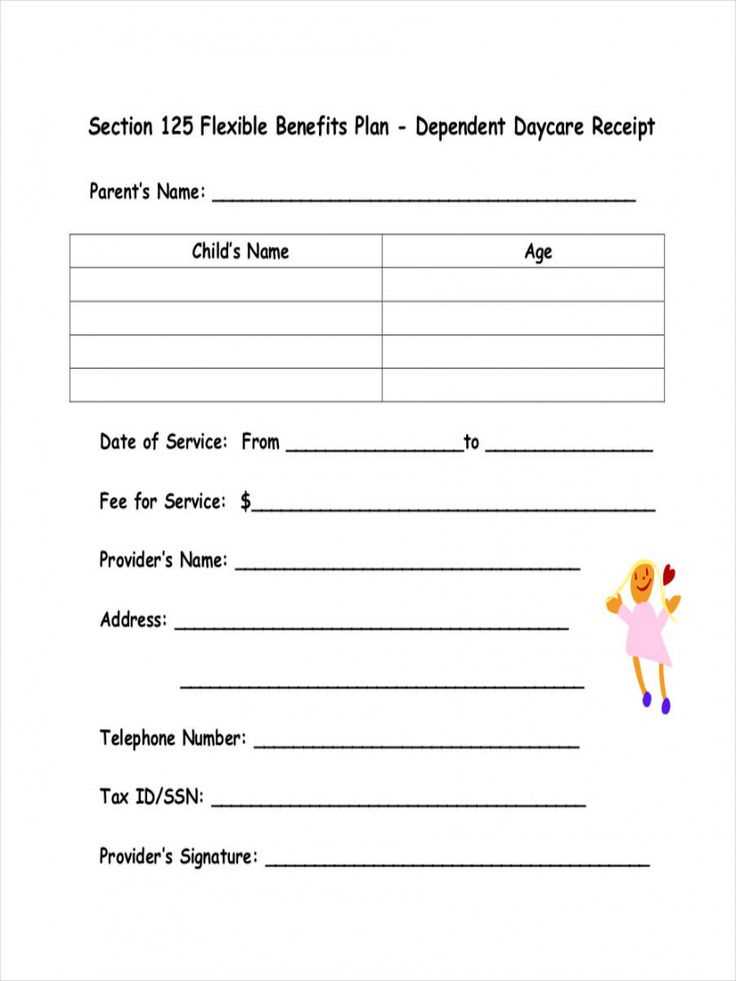

To simplify the process of claiming dependent care expenses, using a dependent care receipt template is a practical step. This template helps you organize and document all relevant information needed for reimbursements or tax deductions. Whether you’re submitting expenses to your employer or the IRS, a well-organized receipt ensures that everything is in order and easily accessible.

Start by filling in basic details such as the provider’s name, address, and the services provided. It’s crucial to include the dates and the amount paid for care services, along with any other necessary breakdowns like hours of care or types of services rendered. Using a PDF template streamlines this task, ensuring no information is missed, and makes it easy to print and submit the receipts when required.

Additionally, make sure the receipt includes the provider’s tax identification number (TIN) or Social Security number (SSN), as these are required for tax purposes. Providing accurate and complete information from the start can prevent delays or rejections of your claims. The dependent care receipt template is a reliable tool to keep everything in check, reducing the chance of errors during submission.

Here’s the revised version:

Fill out each section of the dependent care receipt template with accurate details. Ensure the provider’s name, address, and contact information are clearly stated. Provide the exact dates of care, including start and end times, and include a description of the care services offered. Keep receipts clear and concise, without unnecessary information.

Verify that the total amount charged is correct and matches the payment made. Any discounts or adjustments should be noted. Sign and date the receipt, confirming that the information is accurate. This step is essential for reimbursement or tax deduction purposes.

If you need multiple receipts for different care providers, make sure each one is properly formatted to avoid any confusion. Double-check all entries before submitting to ensure accuracy.

Dependent Care Receipt Template PDF: A Practical Guide

If you are looking for a simple and reliable way to manage dependent care receipts, using a template can streamline the process. A Dependent Care Receipt Template PDF helps you track and organize expenses for daycare, babysitting, or other caregiving services. This document is useful for tax reporting, particularly when applying for tax credits or reimbursements. The template typically includes key details such as the caregiver’s name, the amount paid, the dates of care, and the child’s name.

How to Use a Dependent Care Receipt Template

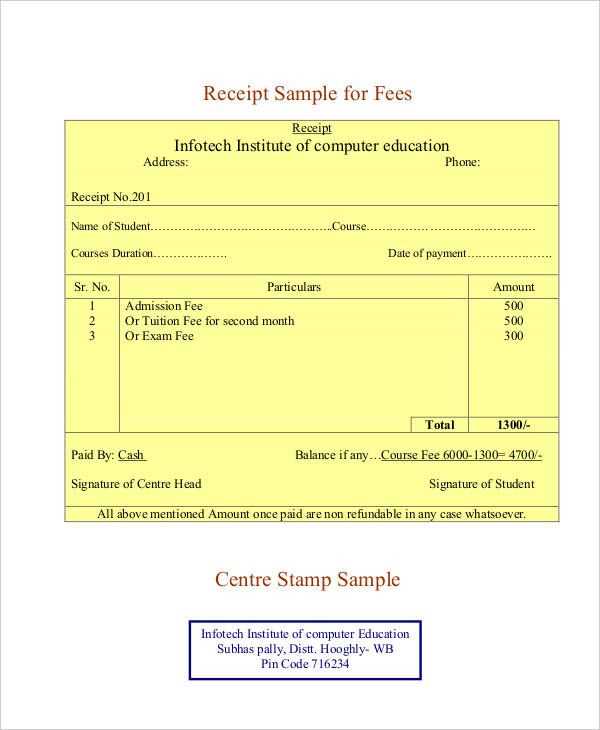

To begin, download a Dependent Care Receipt Template PDF that suits your needs. Many templates are available online, and you can customize them to fit your situation. Fill in the necessary details, ensuring accuracy in each section. It’s helpful to categorize payments by month, especially if you are submitting receipts for multiple months. Include the total amount paid for each caregiving service along with the specific dates of service, which can be important for tax filing purposes.

Key Details to Include in the Template

Make sure to include the following information in your receipt:

- Caregiver’s Name: The full name of the person or facility providing the care.

- Service Dates: Specify the start and end dates of the care period.

- Amount Paid: Record the exact payment made for each service.

- Child’s Name: Include the name of the child who received care.

- Caregiver’s Address and Tax ID: Some templates request this information, especially if the care provider is a business.

Once completed, save and print the document for your records. If submitting to an employer or tax authority, be sure to attach the appropriate supporting documentation, such as proof of payment or bank statements. Keeping everything organized will ensure smooth processing of your claims or reimbursements.

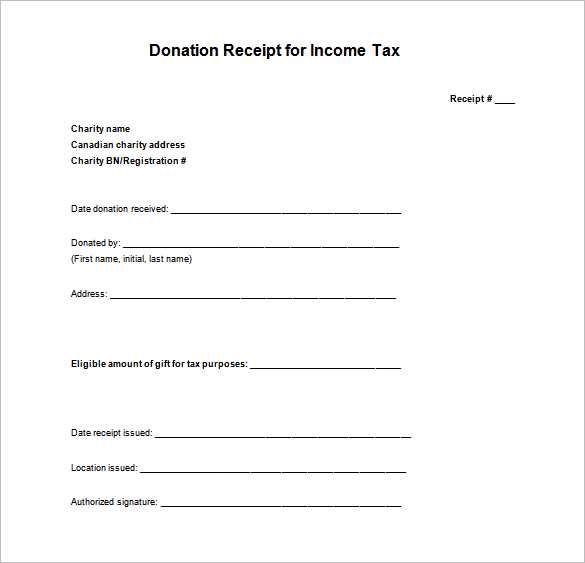

To customize your dependent care template for tax purposes, begin by ensuring all required fields are present, such as the dependent’s name, relationship to you, and their care provider’s details. Include columns for the total amount paid during the year, date(s) of service, and any other relevant expenses associated with the care. This makes the data easy to track and allows for accurate reporting.

Next, include a section where you can add the tax identification number (TIN) of the care provider, as it may be needed for claiming the dependent care credit. Without it, you could face delays or complications during tax filing.

Make sure to update the template regularly to reflect any changes in care costs or providers, especially if you switch providers or if there’s an increase in fees. Having a version-controlled document makes sure you keep everything in order year after year.

If you’re managing multiple dependents or care providers, organize the entries by dependent or provider name. This organization will save you time when entering the data on your tax forms. Using separate sections for each dependent can streamline your tax preparation process.

Finally, remember to review the template before submitting your tax documents to ensure that all required fields are completed. Errors or missing information could cause delays or trigger audits. Keep your template saved in both a digital format and a printed copy, so you always have a backup if needed.

A dependent care receipt must include clear, specific details to ensure its validity. The following items should always be present:

- Care Provider Information: Include the provider’s full name, address, and contact details.

- Dependent’s Name: Specify the name of the dependent who received care.

- Service Dates: Clearly list the dates when care was provided.

- Amount Paid: Document the total amount paid for the care provided, along with any breakdowns if applicable (e.g., daily rates or hourly fees).

- Payment Method: Note how payment was made (e.g., cash, check, or credit card).

- Care Type: Describe the type of care provided, such as daycare, after-school care, or eldercare.

- Provider’s Tax ID Number: If applicable, include the care provider’s Tax Identification Number (TIN) or Employer Identification Number (EIN) for tax purposes.

These details are critical for ensuring your dependent care receipt is both valid and useful for reimbursements or tax deductions.

Keep receipts organized in clearly labeled folders, both physical and digital. For digital records, scan or take clear photos of receipts immediately after receiving care services. Use a consistent naming convention, such as “Care_Provider_Name_Date,” to easily locate them later.

How to Store Care Receipts Efficiently

When storing care receipts digitally, consider cloud storage services like Google Drive or Dropbox. These platforms provide easy access and backup options. Create subfolders for each care provider or month to further streamline organization.

Submitting Receipts for Reimbursement or Tax Filing

Before submitting receipts, ensure all necessary information is included–such as provider name, service date, and cost. Check submission guidelines for format requirements. Some organizations prefer scanned PDFs, while others may accept JPEG or PNG images. Always follow the instructions to avoid delays.

| Receipt Format | Preferred Submission Method |

|---|---|

| Upload via web portal | |

| JPEG/PNG | Email or online portal upload |

| Paper | Mail with reimbursement form |

Double-check all details for accuracy before submitting. This prevents issues or delays in receiving reimbursement or tax deductions. Keeping an organized record of all receipts is key for smooth processing and peace of mind.

Use a clear and concise format when preparing a dependent care receipt for submission. Ensure it includes all required details such as the care provider’s name, address, and phone number. Specify the dates of service and the amount paid for each day or session. This level of clarity helps avoid confusion or delays in processing the receipt.

Details to Include

When filling out the dependent care receipt template, make sure the following information is listed:

- Care provider’s full name and contact details.

- Date(s) of service provided.

- Total amount paid for services rendered, broken down by session or date if applicable.

- Signature of the care provider, confirming the receipt of payment.

Keep a Copy

Retain a copy of the completed dependent care receipt for your records. This will be helpful for future reference, especially during tax season or if there are discrepancies about the services provided or amounts paid.