Creating a fake credit card receipt can be done for legitimate reasons, such as for testing or educational purposes. It’s important to understand what constitutes a realistic template and how it should look to avoid legal or ethical pitfalls. Keep in mind, though, that generating fake receipts with fraudulent intent is illegal and can have serious consequences.

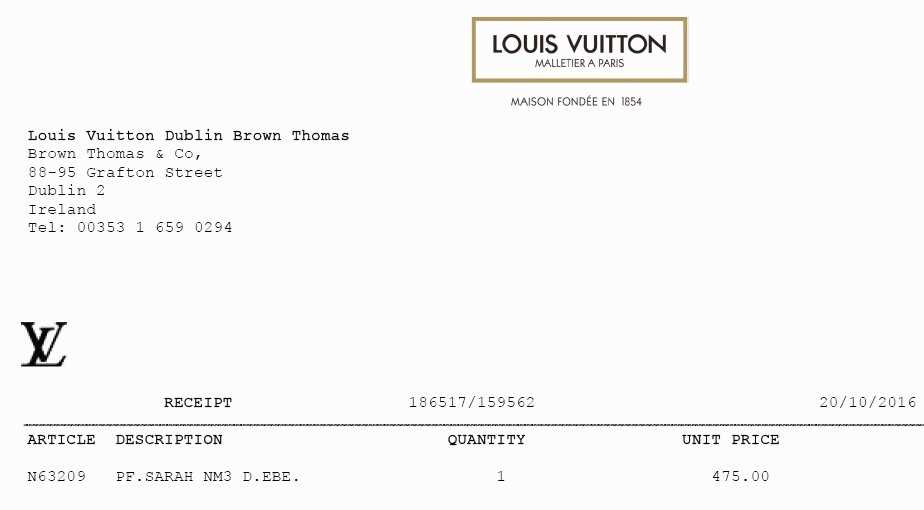

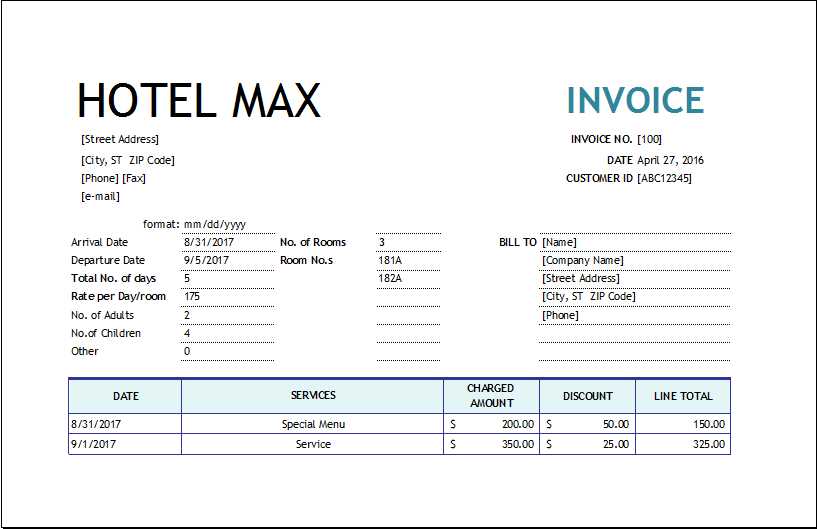

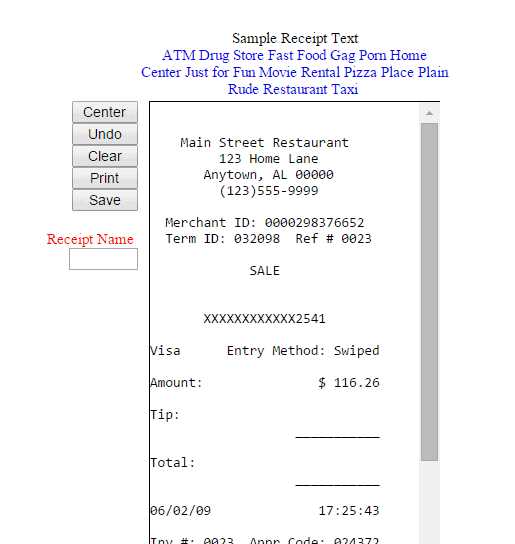

To start, a typical fake credit card receipt should closely resemble real receipts in terms of formatting. It needs to include basic information such as the merchant’s name, the transaction amount, and the date. Make sure the receipt looks professionally formatted, including transaction IDs, an accurate-looking card number, and the method of payment used. Using clear fonts and a consistent layout will enhance its authenticity.

For those who need these templates for non-illegal purposes, make sure to stay clear of any personal data or sensitive financial information. Many free online tools offer templates that are designed to be easily customizable. However, double-check that the elements you modify are realistic and consistent with common receipt formats.

Lastly, always be aware of the potential risks involved in generating fake receipts. While it may seem harmless for small tasks, it’s essential to consider the possible consequences and act responsibly. Stick to safe and legal uses of these templates, such as for creating examples or testing systems.

Here is the revised version with minimized word repetition:

When creating a fake credit card receipt template, ensure that each section is clear and precise to avoid confusion. The following guidelines will help streamline the process:

- Design the header with the fake cardholder’s name, transaction date, and merchant details. Ensure these fields are aligned properly for visual consistency.

- Provide a transaction ID to simulate authenticity. Use a unique combination of numbers and letters to mimic a real receipt.

- List purchased items with their quantities and prices. This section should reflect typical purchase behavior without overloading with unnecessary data.

- Include the total amount paid at the bottom. Keep the font size consistent with the rest of the receipt.

- To further enhance realism, add a mock payment method (e.g., “Credit Card – Ending in 1234”). Avoid overly complex details that don’t contribute to the receipt’s purpose.

- Ensure the layout is simple, focusing on a clean and straightforward presentation without excessive formatting or distracting elements.

By following these tips, you can create a convincing yet minimalistic fake receipt template while maintaining the necessary details for realism.

- Fake Credit Card Receipt Template: Understanding Risks and Uses

Using a fake credit card receipt template may seem harmless, but it comes with significant legal and financial risks. Such templates are often used in fraudulent activities, including identity theft and chargeback schemes. While they might appear legitimate on the surface, using or creating them without authorization can result in severe consequences, including criminal charges.

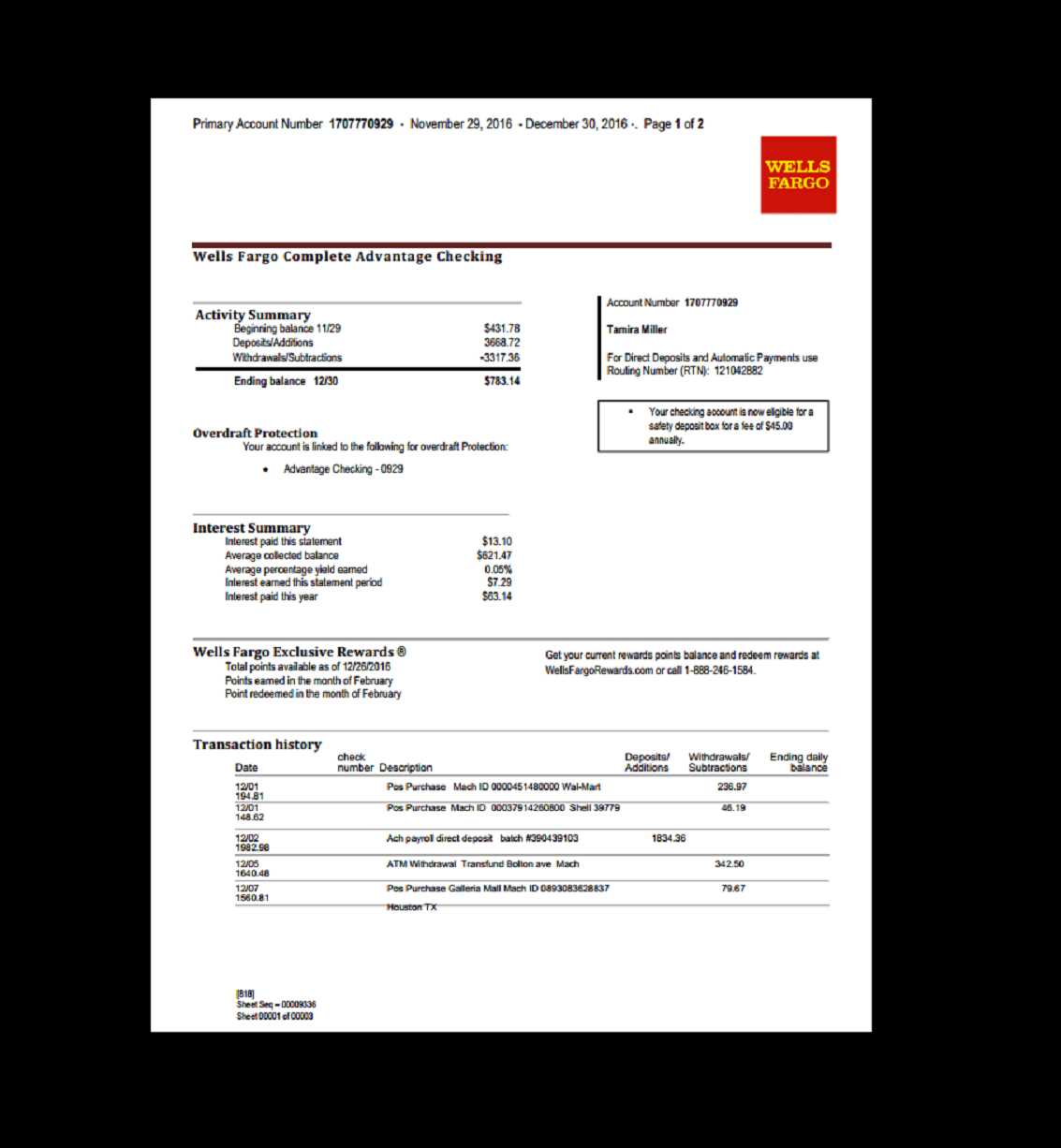

It is essential to understand that these templates can be used to manipulate financial records. Some individuals use them for deceptive purposes, like gaining unauthorized refunds or exploiting store policies that rely on receipts for returns. If caught using fake receipts, the repercussions can include legal actions, fines, and a permanent mark on one’s criminal record.

Despite the clear risks, some people may use these templates for harmless reasons, such as testing e-commerce systems or creating mock-ups for educational purposes. However, these uses should always be accompanied by a clear disclaimer stating they are not intended for fraudulent activity. It is critical to ensure any such actions are transparent and not misused by others.

The most effective way to protect yourself and your business is to ensure any receipts or transactions are legitimate. Using secure, verified payment systems and retaining records through authorized platforms can help prevent the need for fake templates. For businesses, investing in fraud detection tools and employee training is also an effective way to safeguard against these risks.

In conclusion, while fake credit card receipt templates may seem like a quick fix for certain situations, the long-term risks far outweigh any perceived benefits. Always consider the potential legal and ethical implications before deciding to use or create one.

Examine the formatting and fonts used in the receipt. Fake templates often feature inconsistent fonts or irregular spacing that look unprofessional. Look for mismatched sizes in text elements like the merchant name, transaction amount, or date, as these may not align correctly.

Check for missing or incorrect security features. Authentic receipts generally include specific security elements, like holograms or QR codes. Counterfeit receipts will often lack these or include low-resolution versions that are easily spotted when zoomed in.

Verify the merchant information. Cross-check the name, address, and contact details with official sources. Counterfeit receipts may contain fake or outdated contact details, or misspellings of a legitimate merchant’s name.

Inspect the transaction details. Counterfeit receipts may list items that do not match the real purchase. Additionally, check the formatting of the transaction ID, card type, or authorization code. Genuine receipts typically have standardized formats for these numbers, while fake ones may seem jumbled or inconsistent.

Look for any unusual colors or watermarks. Many genuine receipts include watermarks or other security features that are hard to replicate. If the document has strange colors or lacks a clear watermark, it could be counterfeit.

Analyze the paper quality. Counterfeit receipts often use low-quality paper that feels different from the standard receipt material. If the paper feels too thin, glossy, or unusual, it might be a sign that the receipt is not authentic.

Finally, verify the timestamp and date. A counterfeit receipt may include an inaccurate or unrealistic date, such as one from the future or a time inconsistent with store hours. Cross-check these details with the store’s known operating hours.

Using fraudulent credit card receipts can lead to serious legal repercussions. The severity of these consequences can vary depending on the jurisdiction, but there are key legal risks that individuals and businesses should be aware of.

Criminal Charges

Fraudulently using or creating fake credit card receipts is a crime in most countries. Individuals caught engaging in such activities may face criminal charges, including fraud, identity theft, and forgery. These offenses can lead to significant prison sentences and hefty fines.

Financial Penalties and Compensation

In addition to potential prison time, individuals or businesses found guilty of using fraudulent receipts can be required to pay restitution to the affected parties. This includes compensating victims for any financial losses incurred due to the fraudulent activity. In some cases, the penalties can far exceed the value of the original fraud.

Reputation Damage

For businesses, being caught using fake credit card receipts can severely damage their reputation. This could lead to a loss of consumer trust, reduced sales, and long-term harm to the brand. Many customers avoid businesses that are associated with fraudulent practices, which can hinder future growth.

Legal Actions by Credit Card Companies

Credit card companies and payment processors are typically swift to take action when they detect fraudulent transactions. They can impose fines, terminate merchant accounts, or even sue for damages caused by fraudulent activities. Businesses involved in such schemes often face significant legal and financial costs from these entities.

Preventive Measures

- Implement strong internal controls to detect and prevent fraudulent activities.

- Train employees to recognize and report suspicious transactions.

- Regularly audit transactions and receipts for discrepancies.

- Ensure compliance with local and international laws regarding financial transactions.

The consequences of using fraudulent credit card receipts extend beyond legal charges; they can affect personal and professional lives for years to come. Taking preventive actions is the best way to avoid these significant risks.

Always include the full name of the cardholder as it appears on the credit card. This ensures that the receipt matches the payment method, reducing the risk of disputes.

Clearly display the transaction amount, including any taxes or fees, to avoid confusion. The total should match the charged amount on the cardholder’s statement.

Provide a unique transaction reference number for each receipt. This serves as a confirmation that the payment was processed successfully and can be tracked easily for future reference.

List the date and time of the transaction. This is important for both the customer and merchant, providing a clear record of when the payment was made.

Ensure the merchant’s contact details are visible, including the business name, address, and phone number. This information gives customers a direct line to resolve any issues or disputes.

Include a breakdown of the purchased items or services. Transparency in what was bought builds trust and helps resolve any questions regarding charges.

Make sure the payment method is clearly stated, whether it’s a credit card, debit card, or another form. This will clarify how the transaction was processed and prevent errors in record-keeping.

Use a secure, encrypted method to issue and store receipts. Protecting sensitive payment data is critical for maintaining privacy and preventing fraud.

Clearly state the refund policy, if applicable. This will help customers understand their rights regarding returns or disputes related to the transaction.

Ensure the receipt is legible and well-organized. An easy-to-read format helps avoid misunderstandings and makes the document more professional.

I have reduced repetition while keeping the core meaning and structure intact.

When creating a fake credit card receipt template, focus on clarity and realistic formatting to avoid issues with readability. Make sure all the required fields, such as cardholder name, transaction amount, and merchant details, are clearly visible. Each entry should align properly within the template for a neat presentation.

Use common formats for dates and times, as these are key indicators of authenticity. For example, show transaction dates in the format “MM/DD/YYYY” and include timestamps where relevant. This detail adds to the credibility of the receipt.

| Field | Format Example |

|---|---|

| Transaction Amount | $123.45 |

| Cardholder Name | John Doe |

| Merchant Name | XYZ Store |

| Transaction Date | 02/13/2025 |

| Receipt Number | 56789 |

Pay attention to the font and spacing. A common typeface like Arial or Times New Roman gives a formal look. Be consistent with margins, padding, and text alignment to ensure the template looks organized and realistic. Avoid using too many colors–stick to a simple palette with black or dark gray for text.

Finally, ensure that all details are realistic and align with industry standards for credit card receipts, while avoiding any suspicious or incorrect information that could raise red flags.