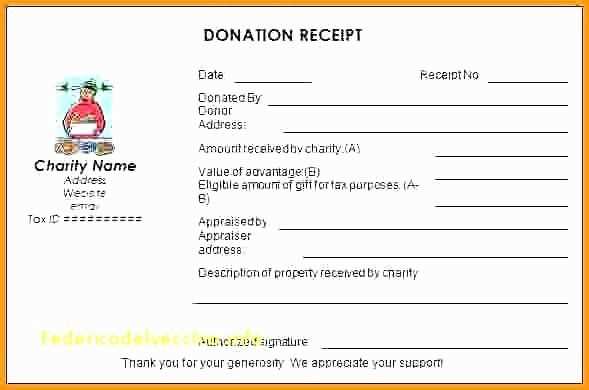

Creating a well-organized receipt for a fundraiser ensures transparency and trust between your organization and donors. A simple, clear template helps in maintaining accurate records for both tax purposes and donor acknowledgment. This receipt should include specific details like the donor’s name, date of the donation, amount contributed, and a statement confirming whether any goods or services were provided in exchange for the donation.

Keep it clear and concise: A fundraiser receipt template PDF should avoid unnecessary complexity. The essential fields–donor details, contribution amount, and any applicable disclaimers–should be easy to find. Your template should be structured so that the donor can easily reference the receipt when needed.

Customize for your needs: While a standard template provides a basic structure, make sure to adapt it to your specific fundraiser. Depending on the scale and nature of the event, you might want to add additional fields such as campaign name, donor tier, or event-specific messages. These small additions can enhance the personal touch and help track donations more effectively.

Here are the corrected lines without repetitions:

Ensure that the donor’s name, donation amount, and date are clearly visible on the receipt. Always include your organization’s name and tax identification number for verification purposes.

Structure of the Fundraiser Receipt:

Start with a header that clearly indicates it is a donation receipt. Provide the donor’s contact information and the specific purpose of the donation.

Additional Recommendations:

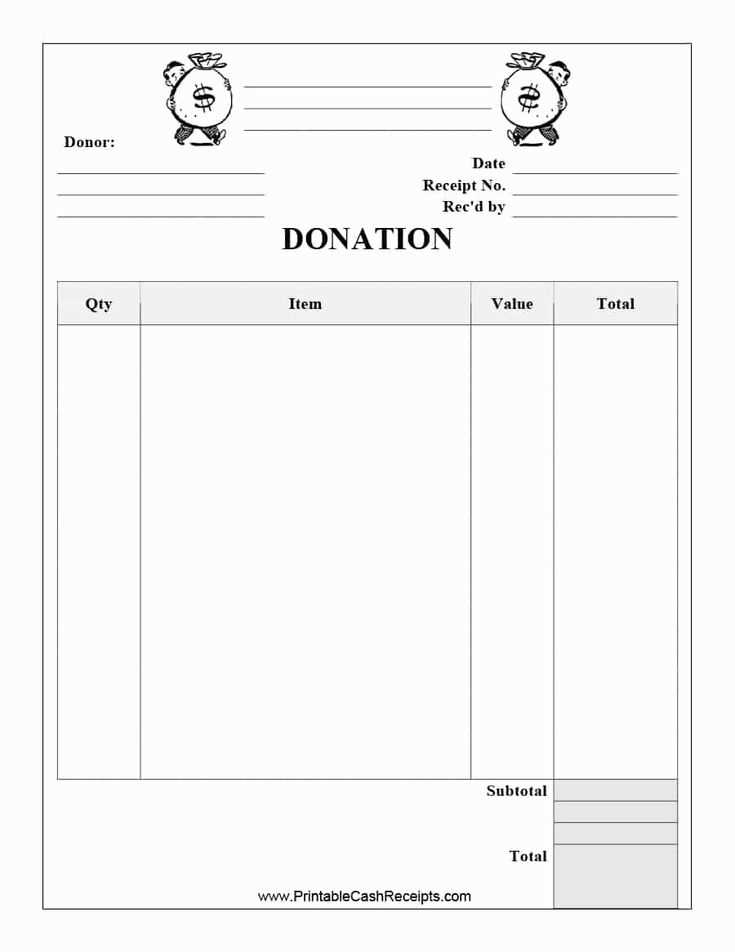

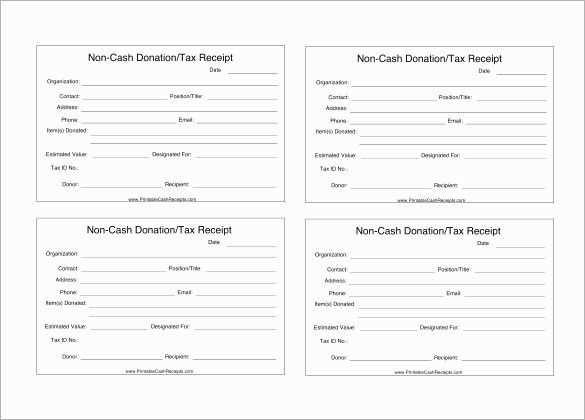

When detailing the donation, specify whether it is a monetary or in-kind contribution. For in-kind donations, include a brief description of the items received.

Make sure the donation receipt also includes a statement such as: “No goods or services were provided in exchange for this donation” if applicable. This is important for tax reporting.

- Fundraiser Receipt Template PDF Guide

To create a fundraiser receipt template in PDF format, begin by ensuring that the layout is clear and user-friendly. Include sections such as the donation date, donor name, amount donated, and the fundraising event name. It’s important to include a statement confirming that no goods or services were provided in exchange for the donation, especially if it’s tax-deductible. A digital signature from the event organizer or a stamped signature can add legitimacy.

Key Information to Include

Ensure the receipt includes the following details:

- Donor’s full name and address

- Amount donated, clearly marked

- Event or cause name

- Date of the donation

- Statement confirming the donation is tax-deductible (if applicable)

- Organizer’s name and contact information

Formatting Tips

Use a clean and simple design with enough white space to avoid clutter. It’s recommended to include the charity’s logo or branding at the top for a professional appearance. Ensure the text is legible and the font size is appropriate for easy reading.

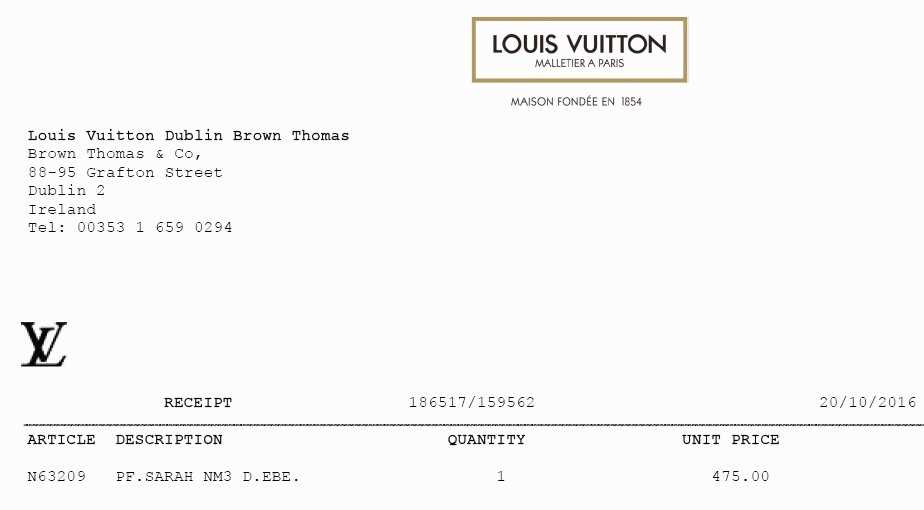

Design a fundraiser receipt template by including all necessary details for both the donor and your organization. Start with your organization’s name, address, and contact information at the top. This ensures the donor knows where their contribution went and how to reach you if needed.

Key Information to Include:

- Donor’s Information: Name, address, and contact details.

- Receipt Number: Create a unique identifier for each donation.

- Date of Donation: Ensure you record the exact date of the transaction.

- Amount Donated: List the exact donation amount in clear figures.

- Type of Donation: Specify if the donation is monetary, in-kind, or a pledge.

- Tax Deductibility Notice: Include a brief statement confirming that the donation may be tax-deductible if applicable.

Design Tips:

- Keep the layout simple and easy to read.

- Use clear, legible fonts to avoid any confusion.

- Incorporate your organization’s logo for a professional appearance.

Once all the necessary components are in place, ensure the receipt is saved as a PDF file for easy sharing and printing. This format is universally accessible and maintains the integrity of the layout when distributed electronically or physically.

Begin with a clear description of the donation amount, including the type of contribution, whether cash or in-kind. For cash donations, specify the exact dollar value, and for goods or services, provide a brief description and estimated market value. Ensure the donor knows no goods or services were exchanged for the donation if applicable.

Next, include the charity’s name, address, and tax identification number (TIN), which is necessary for tax purposes. This information allows the donor to claim any tax deductions on their contribution.

Always state the date of the donation. This helps both the donor and the organization maintain accurate records, especially for year-end tax filings.

Indicate if the donation is tax-deductible. If your organization is a registered nonprofit, affirming this status is vital for donors seeking to claim deductions.

| Element | Description |

|---|---|

| Donation Amount | Exact dollar value or description of in-kind contribution |

| Organization Details | Include name, address, and tax ID number (TIN) |

| Date of Donation | Exact date the donation was made |

| Tax-Deductible Status | Clarify if the donation is eligible for tax deduction |

Finally, offer a thank-you message or note of appreciation. A simple acknowledgment strengthens the donor’s connection with the cause.

For creating a fundraiser receipt, PDF is often the best format. It ensures consistency across devices, preventing formatting issues that can occur with other file types. PDFs are also universally accepted and easy to share via email or print, making them a reliable option for both donors and organizers.

If you’re working with other file formats like Word or Excel, consider converting them to PDF before sending or printing. This avoids complications with layout shifts or compatibility problems that might arise on different systems.

- PDF: Offers a fixed layout that looks the same on any device, making it ideal for maintaining document integrity.

- Word: Best for drafting and editing but should be converted to PDF for final distribution to ensure uniformity.

- Excel: Use for financial records but convert to PDF for receipt generation, as this format is more professional and accessible.

Choose the format based on the need for editing, sharing, and printing, but PDF will often be the most practical and reliable choice for final versions. It balances ease of use with professional presentation.

To make your fundraising receipts unique and professional, include your organization’s name, logo, and contact information at the top. Make sure the receipt template clearly states the purpose of the donation, including the specific fundraiser or event. Customize the wording to align with your mission and the donor’s contribution type (e.g., cash, check, or online). Add relevant tax information if needed, as well as a personalized thank-you message for the donor’s support.

| Field | Description |

|---|---|

| Organization Name | Include your full legal name to ensure transparency and trust. |

| Donation Amount | Clearly state the donation amount, making it easy for the donor to verify. |

| Donor’s Name | Personalize the receipt with the donor’s full name for recognition. |

| Thank You Message | A brief note of appreciation helps strengthen the relationship with the donor. |

| Tax Information | Include any relevant tax-deductible details if applicable. |

Ensure that the format is easy to read, with clear sections and enough space for each piece of information. Consistent font size and style will make the receipt professional and user-friendly. Provide a copy for the donor via email or printed version to acknowledge their support.

Donation receipts must meet specific legal criteria to ensure validity for tax purposes. The IRS requires that receipts for donations over $250 include the donor’s name, the amount donated, and a statement of whether any goods or services were provided in exchange for the donation.

For donations below $250, a simpler receipt is sufficient, but it must still include the donor’s name, the date of the donation, and the amount given. Additionally, non-cash donations must include a description of the item(s) donated. If the donor receives something in return (like a gift), the receipt must state the fair market value of that item.

Nonprofit organizations are required to provide receipts that clearly outline the value of any goods or services offered to the donor in exchange for the donation. The IRS specifically mandates that these details be included in receipts to maintain transparency and accountability.

Ensure all donations are properly documented, as failure to do so could lead to complications for both the donor and the organization in case of an audit.

Once fundraising receipts are issued, proper distribution and storage are key to maintaining organization and compliance. Start by ensuring that each donor receives their receipt immediately after the transaction, either via email or physical mail. This ensures donors have quick access for their records and tax purposes.

For digital distribution, consider sending receipts in PDF format. This makes it easy for recipients to store and retrieve the document. When mailing physical receipts, include a clear return address for any potential queries.

To store receipts, create a system that categorizes them by donor name or donation date. Whether using paper filing systems or digital storage, organization helps streamline future retrieval. For digital files, using cloud storage or encrypted file management systems can provide secure access.

- Ensure all receipts are labeled with identifiable information, such as donor name and donation amount.

- Keep digital backups of all physical receipts for security and compliance purposes.

- Maintain records for at least 7 years in case of tax audits or inquiries.

For added convenience, consider creating a standardized filing system, whether physical or digital, that allows for easy access in case a donor needs a replacement receipt or verification. Regularly review the storage system to ensure it remains efficient and compliant with relevant laws.

Replaced some words to reduce repetition while keeping the meaning intact.

When preparing a fundraiser receipt, adjust wording to avoid overuse of common terms. Use clear, direct language to ensure transparency. For example, instead of repeatedly saying “donation,” alternate with terms like “contribution” or “gift.” This enhances readability and maintains clarity.

Specific Word Changes

To keep the text fresh and engaging, swap out words without changing the message. Replace “received” with “accepted” or “acknowledged” where applicable. Also, vary the structure by using phrases like “amount donated” instead of “total donation.” Such modifications improve flow without losing meaning.

Consistency in Tone

Maintain a friendly and formal tone throughout the document. Adjust phrasing to ensure smooth transitions between sections. This approach enhances the document’s professionalism while keeping it approachable for readers.