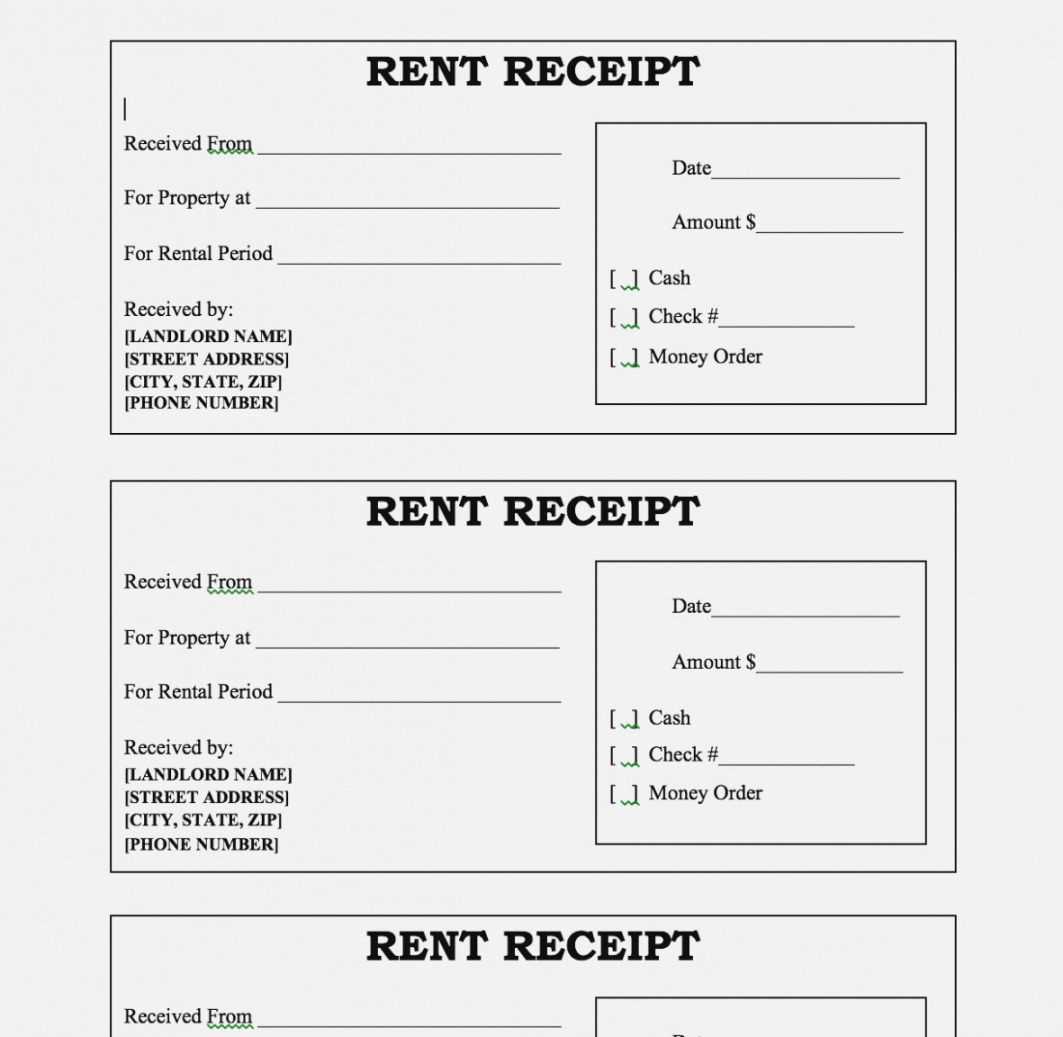

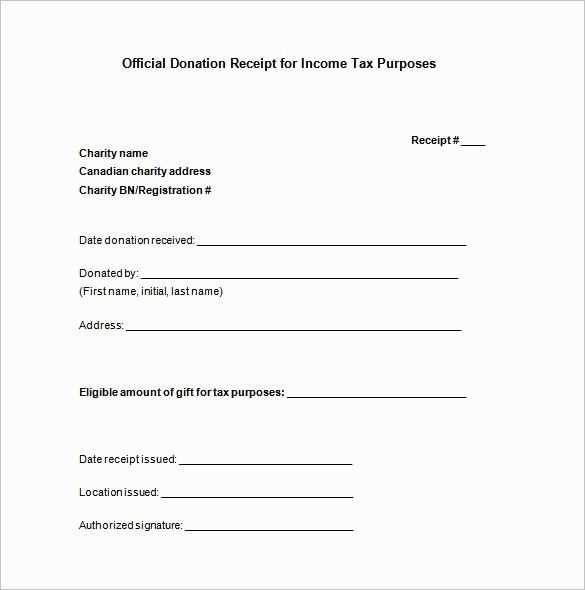

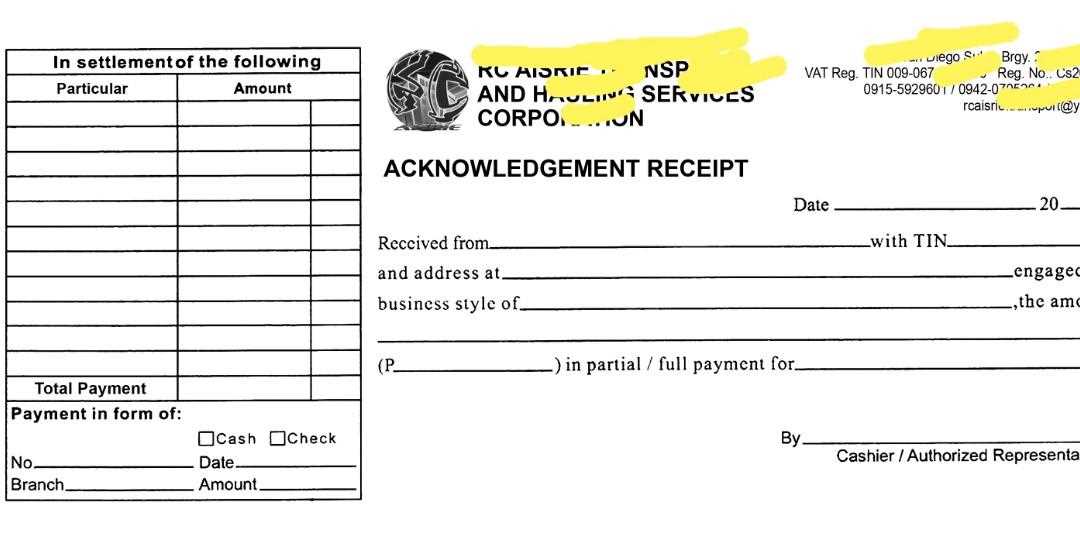

Download a structured and professional receipt template to simplify financial transactions. A well-formatted document ensures clarity in payments and serves as a crucial record for tax and accounting purposes. Whether issuing receipts for business sales or freelance services, a standardized layout minimizes disputes and enhances transparency.

Choose a template with editable fields to customize key details such as date, transaction amount, and payment method. Automated calculations and preformatted sections help eliminate errors and speed up processing. Ensure compliance with local financial regulations by including tax details and relevant disclaimers.

Opt for a design that matches your branding by adjusting fonts, colors, and company details. Many templates are available in fillable PDF format, allowing easy modification without additional software. Select an option that supports digital signatures for a seamless and paperless experience.

Before finalizing, double-check that all required elements are present, including payer and payee details, invoice reference, and an itemized breakdown of charges. A properly structured receipt not only enhances professionalism but also strengthens record-keeping efficiency.

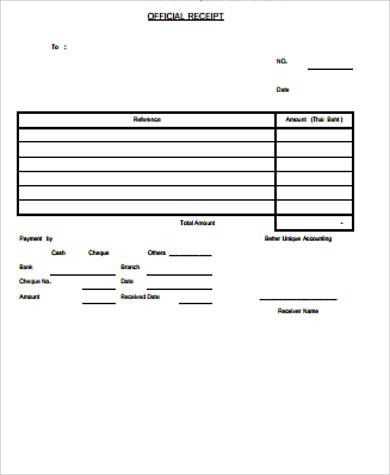

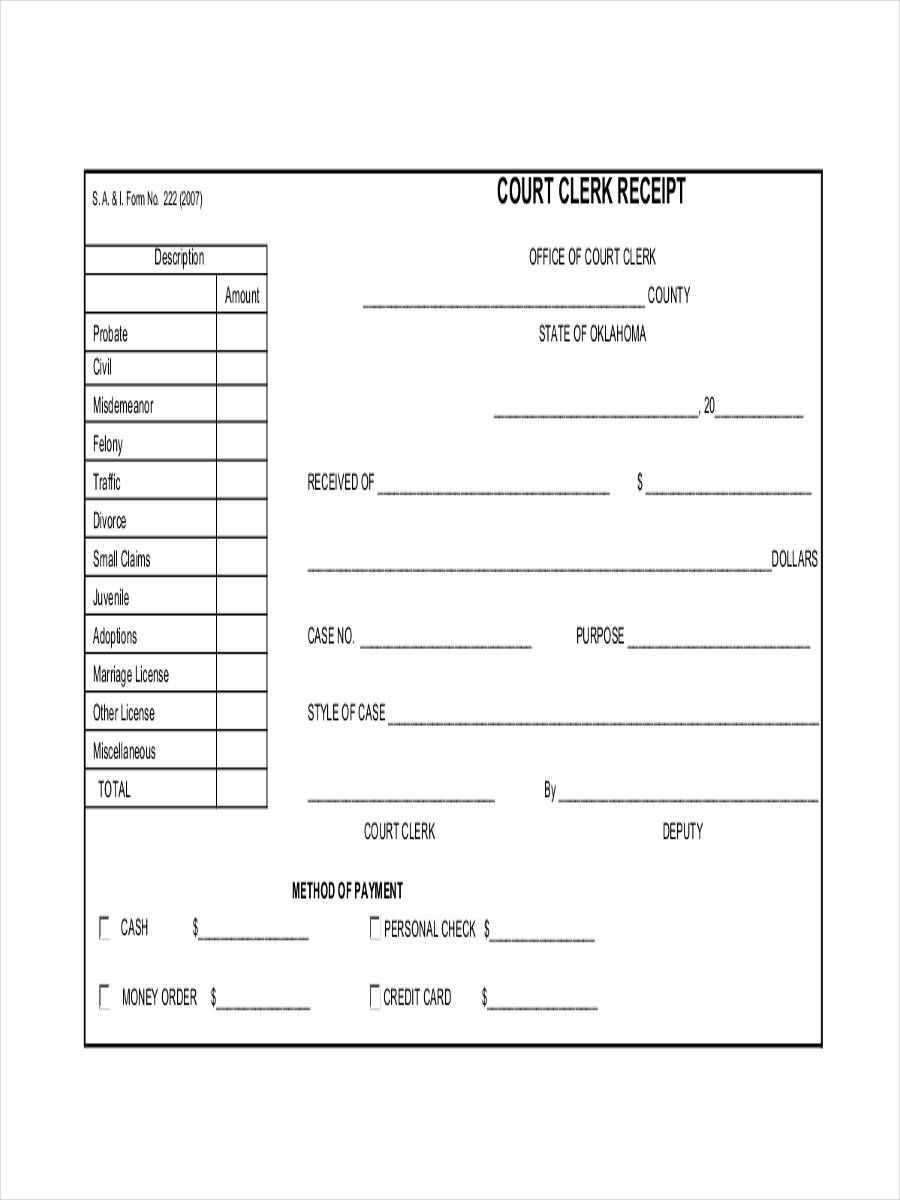

Optimized Official Receipt Template PDF

Ensure your receipt template includes the necessary details to maintain accuracy and compliance. Use clear sectioning to improve readability.

Key Elements to Include

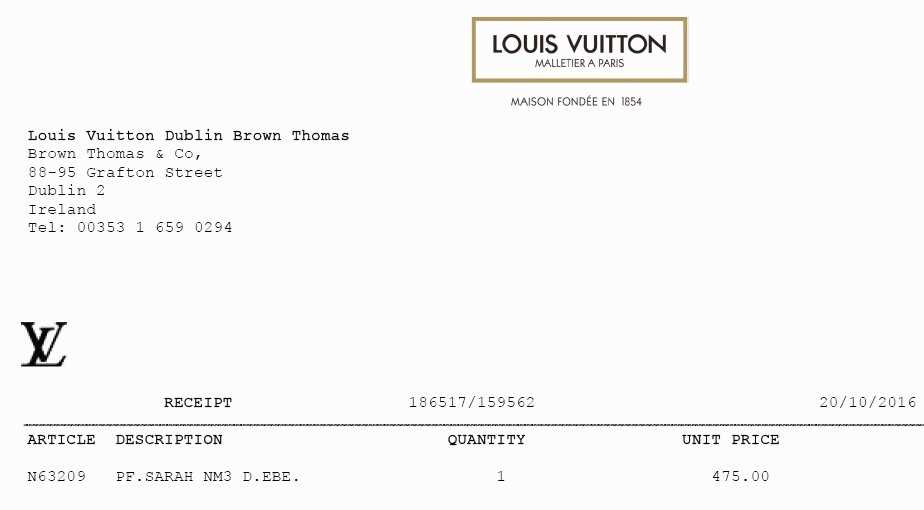

- Business Information: Name, address, and contact details.

- Receipt Number: Unique identifier for tracking.

- Date and Time: Exact moment of the transaction.

- Customer Details: Name and contact information (if applicable).

- Itemized List: Description, quantity, price, and total cost.

- Payment Method: Cash, card, or digital transfer.

- Authorized Signature: Validation from the seller.

Format and Optimization

Choose a structured layout with aligned sections to enhance readability. Use a standard font and avoid excessive styling. Save as a high-quality PDF to ensure clarity when printed or shared digitally.

Official Invoice Template PDF

Choose a structured and professional invoice template in PDF format to ensure clear documentation of transactions. A well-designed template should include all essential details, making financial tracking easier.

Key Elements to Include

- Business Information: Clearly display the company name, address, and contact details.

- Client Details: Include the recipient’s name, address, and any relevant identification numbers.

- Invoice Number: Use a unique identifier for easy reference.

- Itemized List: Outline products or services with descriptions, quantities, unit prices, and totals.

- Payment Terms: Specify due dates, accepted payment methods, and any applicable late fees.

- Taxes and Discounts: Clearly state any applicable charges or reductions.

- Notes Section: Provide additional details, such as return policies or personalized messages.

Advantages of Using a PDF Format

- Consistency: Formatting remains intact across different devices.

- Security: Protect sensitive information with encryption or password protection.

- Ease of Sharing: Easily send invoices via email or store them digitally.

- Professional Appearance: A clean layout enhances credibility.

Download a template that suits your business needs, customize it, and start using a reliable invoicing system today.

Business Information: Clearly display the company’s name, address, phone number, and tax identification details. This ensures legitimacy and compliance with financial regulations.

Client Details: Include the recipient’s name, address, and contact information. Accuracy here minimizes disputes and ensures smooth communication.

Invoice Number and Date

Assign a unique invoice number for tracking and reference. The issue date is equally critical for record-keeping and payment processing.

Breakdown of Charges

List products or services with descriptions, quantities, unit prices, and total costs. A structured format enhances transparency and prevents confusion.

Payment Terms: Specify due dates, accepted payment methods, and late fees if applicable. This encourages timely payments and avoids misunderstandings.

Taxes and Discounts: Clearly outline any applicable taxes and deductions. Proper calculation ensures compliance and accurate financial reporting.

Additional Notes: Provide any necessary instructions, terms, or personalized messages. This section can clarify policies and add a professional touch.

Choose a Flexible Template

Select a receipt format that allows modifications. Many platforms provide editable templates where you can adjust fonts, colors, and layout to align with your brand identity.

Include Your Business Information

Ensure the receipt displays your company name, logo, address, and contact details. This not only looks professional but also helps customers recognize and trust your business.

Modify Payment and Order Details

Customize fields to match your transaction type. Add item descriptions, taxes, discounts, and payment methods. If your system supports it, include a QR code for quick verification or reorders.

Personalize Customer Interaction

Enhance customer engagement by adding a thank-you message, return policy, or a unique discount code for future purchases. A well-crafted receipt can serve as a marketing tool while maintaining clarity and professionalism.

For precise and editable payment documents, consider these reliable tools:

Adobe Acrobat

Adobe Acrobat provides a powerful way to create, edit, and sign payment receipts in PDF format. It supports OCR for scanned receipts, batch processing for efficiency, and cloud integration for easy access across devices.

PandaDoc

PandaDoc streamlines document creation with customizable templates, automated calculations, and legally binding electronic signatures. The built-in analytics feature tracks document interactions for better financial oversight.

| Tool | Key Features | Best For |

|---|---|---|

| Adobe Acrobat | Advanced editing, OCR, cloud sync | Highly detailed PDF receipts |

| PandaDoc | Templates, automation, analytics | Business invoices and contracts |

| PDFescape | Online editing, form filling | Quick modifications without software |

| DocuSign | Secure e-signatures, compliance | Legally binding financial documents |

Choosing the right tool depends on whether you need advanced editing, automation, or compliance features. Each option offers unique strengths tailored to different payment documentation needs.

For creating an official receipt in PDF format, ensure that you include specific key elements for clarity and professionalism. Begin with the business or organization’s name and contact information at the top. Then, include the receipt number, date of transaction, and a brief description of the product or service provided.

Details to Include

- Receipt Number: A unique identifier for the transaction.

- Date: The exact date of the transaction.

- Item Description: Clear details about the product or service sold.

- Amount Paid: Clearly state the total amount paid, including taxes if applicable.

- Payment Method: Indicate how payment was made (e.g., credit card, cash, bank transfer).

- Company Information: Address, contact details, and possibly a logo for branding purposes.

Design Tips

Keep the layout clean and easy to read. Use clear headings and bullet points to structure the receipt. Avoid cluttering the space with unnecessary details. Make sure the font size is legible, and the text contrasts well with the background for readability.